Why Google Pay and PhonePe will have to limit operations?

In today's Finshots, we talk about NPCI's latest ruling and how it might affect payment applications like Google Pay.

The Story

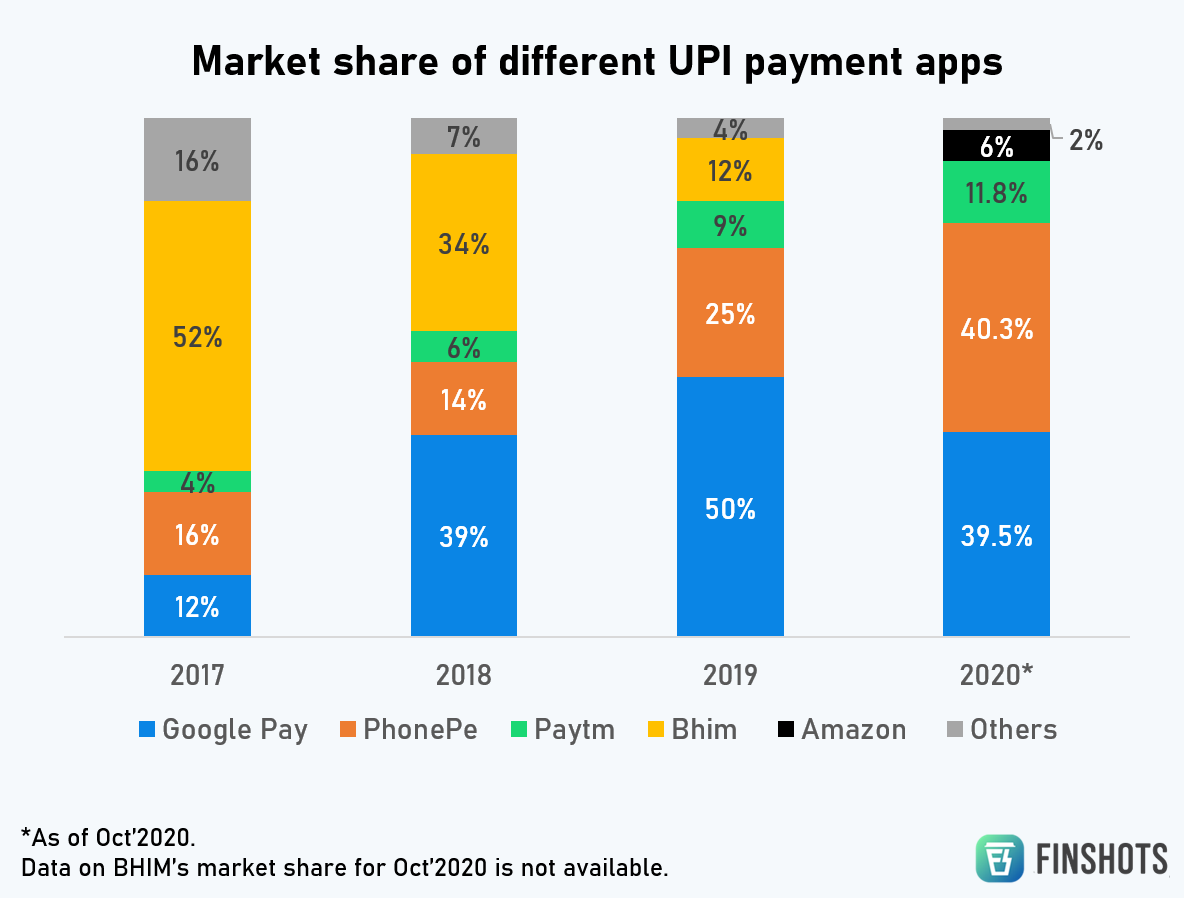

In a statement on Thursday, NPCI announced that third-party applications or TPAs like Google Pay and PhonePe — companies providing payment services via UPI can process a maximum of 30% of the transaction volumes starting Jan. 1, 2021. And this is a problem since PhonePe and Google Pay currently hold about 40% of the market, each. Meaning, they have to limit their operations soon enough or there will be consequences. And while there’s a lot to unpack here, it’s perhaps prudent to take it from the top.

Let’s start with NPCI.

Until 2008, the Reserve Bank of India managed payment and settlement systems all over the country. But then, the sheer volume of online transactions pushed RBI to the brink because you know, they also do other stuff — like keeping banks in line, monitoring inflation, printing money, etc. So they went to a bunch of banks and said — hey, you guys should get together and create some sort of an umbrella organization that can manage all these transactions. You can also develop systems that make it easier for consumers to pay for stuff. Won’t that be fun?

Lo and behold, the NPCI was born. It’s a not-for-profit organization responsible for operating retail payments and settlement systems in India and is now run by a consortium of 10 banks. They’re also responsible for UPI — the ubiquitous payment solution that has revolutionized the entire industry—Excerpts from an article on Finshots

Bottom line — NPCI isn’t a public organization. And it most certainly isn’t run by the government. But nonetheless, they are the de-facto regulators and they have the authority to limit the volume of transactions the likes of Google Pay and PhonePe can process at the moment.

Now obviously, existing players aren’t thrilled with the announcement. Their contention is simple. The financial ecosystem in India is still in its infancy. There are millions of people who still haven’t adopted UPI and it’s in everybody’s best interest to bring them to the fold. However, by imposing such a crippling rule, NPCI is forcing incumbents to hit the brakes on future acquisitions. Granted there might be some new player who might further this cause, but the impact will be limited since many incumbents will be forced to watch from the sidelines rather than compete. This, in theory, could scuttle the pace of UPI adoption and also hamper India’s lofty ambitions surrounding financial inclusion.

Their second argument is that such restrictions are wholly unnecessary. After all, customers switch between products all the time. Only three years ago, Google Pay had no presence. Yet today, it's one of the market leaders. You could extend the same argument and suggest that WhatsApp Pay will do the same thing Google did and claw its way up to the top. It’s what happens when you have an open market with few restrictions.

But NPCI will argue otherwise. What if this does not happen? What if the concentration of power only increases from here on in?

You could argue that these TPAs could have too much power, too much data and too much influence at some point in the future. And in the event this equation persists, regulators will have to figure out how to limit their influence one way or another. After all, monopolies are eminently undesirable. They stifle innovation and allow a single player or a small group of players to dictate rules and act as gatekeepers. It’s the reason why the US justice department is now pursuing Big Tech companies with such vigour. So even if this 30% restriction is a crude solution, it should prevent the unlikely scenario where a couple of companies rule the roster.

But what about the implementation problem? How would you enforce such a rule? And how would existing players comply with it?

Will transactions start failing when they breach a certain threshold? Will NPCI impose harsh penalties in the event any TPA does not comply? Will there be utter chaos when the rule is enforced?

Well, that’s unlikely.

Existing TPAs have until 2023 to comply with the rule. Meaning, they still have three years to figure something out. In all likelihood, the likes of Google Pay and PhonePe will now have to enforce speed-breakers on their acquisition strategy. Between now and 2023, they will have to self regulate their growth and pretend that the actual market is only 30% of the UPI universe. So maybe they’ll relook at some of their promotional spends. Fewer incentives for customers to transact would automatically stymie growth in transactions. Or maybe they’ll look at their integration strategy and stop offering their payment solution on certain apps like Zomato. That would drastically cut market share. But really, no TPA would ever risk doing that. Maybe they’ll look at smaller apps that drive little volume. That would be an option. But never somebody like a Zomato. That’s just going nuclear.

And oh, we haven’t yet talked about enforcement yet. For instance, how will NPCI know that somebody isn’t complying with its diktat?

The story goes that banks that enable these transactions will now report to NPCI each month and tell them who’s driving how much volume. Once NPCI tabulates the numbers, they can perhaps issue warnings or penalties depending on the scale of each transgression.

Anyway, it’s all speculation at the moment. And hopefully, we will have more clarity over the next few days.

Until then…

Share this Finshots on WhatsApp, Twitter, or LinkedIn.

Also don't forget to check our daily brief. In today's issue we talk about WhatsApp Pay's approval to roll out its services in India, why people buy more cosmetics during a pandemic, what the FASTag system is about. Do read the full draft here.