Why Ford just can’t let go of India

In today’s Finshots, we explain why Ford Motor Company wants to return to India four years after its exit.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

When I look at the roads today, and hear car enthusiasts praise the brilliance of sub-four-metre SUVs, I can’t help but wonder if anyone remembers who really started this revolution. Because like every big idea, it began with one pioneer. And one of the first players to bring this model to India was Ford Motors.

Their Ecosport, launched in 2013, was among the first and most successful “compact” SUVs in the country. Before that, your choices were simple: you could either buy a hatchback, a sedan, or a full-size SUV. There was no middle ground.

And that “middle ground” wasn’t an accident but policy-driven. India’s 2006 Budget introduced lower excise duty for cars shorter than 4 metres with small engines, while the 2013 Budget raised taxes on longer SUVs. And that change created the perfect opening for compact SUVs that EcoSport capitalised on.

That’s mostly why, today, that once niche-segment has become India’s hottest car category. Every major carmaker now has a compact SUV in its lineup, often its best-selling model. But ironically, Ford Motor is nowhere in sight.

So what happened, you ask?

You see, Ford entered India in 1995 and over the next two decades poured nearly $2 billion into its local operations. It built two large manufacturing plants: one in Sanand, Gujarat, and another in Chennai, Tamil Nadu. And it even turned profitable after a few rocky years. But as the car market changed, sustaining growth became harder than simply building cars. Rising competition and shifting consumer preferences toward compact and affordable vehicles meant that even a global brand with deep pockets struggled to carve out a meaningful share.

By 2021, the numbers no longer made sense. Its market share had slipped to just 1.75%, and it had racked up more than $2 billion in cumulative losses. The math didn’t add up and so it faced a hard choice: either keep burning cash to keep the plants running or shut shop and move on. Eventually, it picked the latter, and by FY23, it completed its exit by closing its last plant and leaving behind two decades of legacy on Indian roads.

It was this when many assumed the end of Ford’s story in India. Their American dream, as it turned out, stayed American. But that wasn’t quite it.

Because when foreign manufacturers leave, they usually sell their assets. In Ford’s case, that meant those two massive factories. So Ford did sell the Sanand plant to Tata Motors in early 2023: land, machinery, and workforce included. It was capable of producing 3 lakh cars a year but running well below capacity due to lesser demand.

And that left the Maraimalai Nagar plant in Chennai. Everyone expected Ford would sell that too, and they nearly did. The JSW Group, fresh from acquiring a stake in MG Motor India and China’s SAIC, was in advanced talks to buy it. But in a surprise twist, Ford backed out.

And that’s when the rumours began: maybe Ford wasn’t done with India after all. Because why would a carmaker hold on to an idle factory unless there were plans brewing, no?

By mid-2024, those rumours gained weight. Reports suggested Ford was planning to revamp its Chennai plant to export engines to Asia and Africa. The company even signed a letter of intent with the Tamil Nadu government to restart the plant for exports. And it all sounded like a sensible strategy until a new variable entered the picture: Tariffs!

Now, we know what you’re thinking. Wouldn’t Ford actually benefit from tariffs since it’s an American company? Well, yes and no.

Yes, because it’s based in the US, but no, because it also means it’s affected by Washington’s ever evolving trade policies, which discourage outsourcing to low-cost destinations like India. So Ford’s executives in Michigan are now stuck deciding whether restarting production in Tamil Nadu makes financial sense under these new trade headwinds.

And honestly, you can see why Ford is cautious. When it operated both Indian plants, it had a combined capacity of 4.4 lakh cars a year but used only about 25% of it. Despite being one of the world’s biggest automakers, it captured a measly share of the Indian market and lost billions.

One big reason for this was its joint venture with Mahindra & Mahindra. It was meant to develop low-cost platforms for Indian buyers but it fell apart in 2020. And when that collapsed, Ford lost its best shot at localisation and affordability.

And this wasn’t a one-off problem because American automakers have long struggled in India. For instance, I remember convincing my parents to buy a Chevrolet back in 2011, confident that the brand would stick around. But just six years later, General Motors, Chevy’s parent company, also exited India in 2017. From GM to Ford, and even Harley-Davidson in the two-wheeler space, US manufacturers have all faced the same issue here: a value-obsessed audience, razor-thin margins, and a market dominated by Maruti Suzuki and Hyundai that understand the Indian psyche.

From a buyer’s point of view, that kind of uncertainty hurts. A brand’s shaky presence means limited service centres, pricier parts, and fewer third-party options. When they sense that instability, they naturally go vocal for local. Especially, when it’s a luxury, long-term purchase worth lakhs.

Besides, many also point out that it wasn’t just about price sensitivity. The tax structure itself rewarded compact cars, local supplier integration was shallow, and American brands lacked the dealer and financing networks that Indian buyers rely on.

Ford, however, did try to soften that blow. Even after its first exit, it retained over 90% of its service network and committed to long-term parts support, a move that kept owner trust alive.

Still, walking away completely isn’t easy. Because India is no longer just another emerging market – it’s now the third-largest automobile market globally. In the first half of FY25, it exported over 25 lakh vehicles, up 14% year-on-year.

What began as a small export hub and bridge between Western automakers and developing countries has turned India into the world’s fourth-largest car manufacturer. Every global brand here uses the same playbook: Hyundai ships from Chennai to 80+ countries, Kia exports from Andhra Pradesh, and Maruti Suzuki alone accounts for 42% of all car exports.

So for Ford, the temptation to return is understandable. If others can turn India into a profitable export base, why can’t it? Even if it’s just to make and ship engines, their Chennai plant could serve as a gateway to global markets.

And Tamil Nadu gives Ford an advantage few markets can match: a dense supplier ecosystem (Renault-Nissan, Hyundai, BMW, and scores of Tier-1 vendors) plus direct port access via Ennore and Kattupalli. It even used Chennai earlier to export the EcoSport to multiple countries (and at one point, even to the US) proving the model works.

But timing matters. Ford has already committed $1 billion to an EV plant in Cologne, Germany, a bet that isn’t going as planned. Last month, it announced 1,000 job cuts there due to weak demand. So, it makes sense that Ford might look again at India, where manufacturing is still competitive and export-friendly.

If it does return, it’ll need to avoid past mistakes. Turning the Chennai plant into an export-only facility could help, since that model doesn’t rely on domestic sales.

And success could very well depend on three things: higher plant utilisation, more localisation, and smooth supplier payments. Because those are the same metrics driving India’s booming auto-component export market, which hit $21 billion in FY24. Plus, it will need a clear backup plan too, since tariffs and trade policies can shift overnight.

So yeah, Ford’s journey in India has always been about bold beginnings, abrupt exits, and the lingering question of return. Whether it revives the Tamil Nadu plant or writes it off will depend on how well it balances trade uncertainty with India’s growing export potential.

In that sense, Ford’s India story remains unfinished, not a failure, but a chapter waiting to be rewritten.

Until then…

Share this story with someone who wants to see Ford back in India on WhatsApp, LinkedIn, and X.

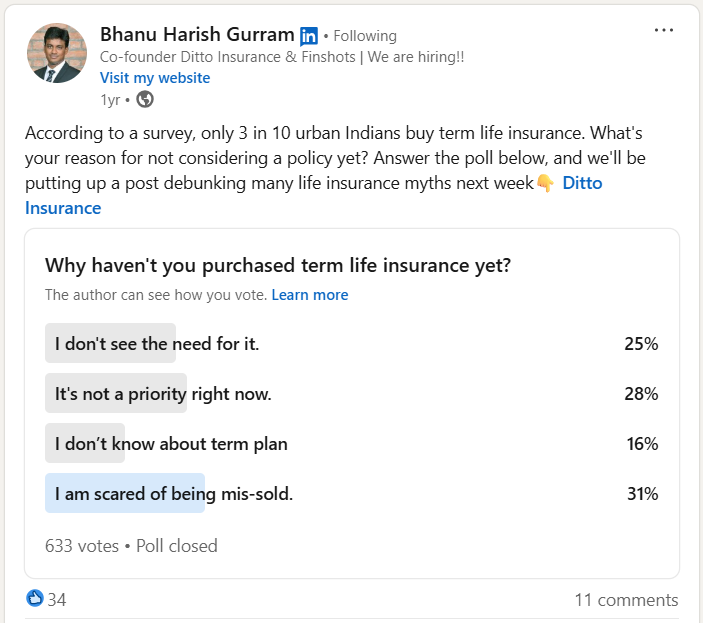

Our Co-founder Asked People Why They Avoid Term Insurance. The Top Reason? Right Here. 👇

31% said their biggest fear is being mis-sold. Many worry that agents may push costly plans or add confusing extras without full transparency.

That's a valid concern. After all, how can you trust something you don’t completely understand?

That’s why Ditto, a product of Finshots, has pioneered India’s #1 Spam-Free insurance platform. Our IRDAI-Certified advisors offer honest advice and help you find the right plan. Book a FREE consultation today.