Why are India’s cities in such a mess?

In today’s Finshots, we dive into a report by the RBI to explain why municipal corporations need to be given more power

The Story

“Damn, have you seen what the roads look like? It was just a little rain and it’s flooded already. And the potholes! I give up! I can’t continue living in this city!”

If you live in Bengaluru or Mumbai, I bet you’ve been a part of such a conversation.

And who do we blame for the shoddy state of affairs?

Usually, the municipality. In Bengaluru, that’s the Bruhat Bengaluru Mahanagara Palike (BBMP) and in Mumbai, it’s the Brihanmumbai Municipal Corporation (BMC). They’re responsible for maintaining the roads and the drainage systems.

Sidenote: Municipal corporations are typically large civic bodies in charge of bigger cities. Municipalities are in charge of smaller regions and towns. For simplicity, we’re clubbing them together.

But have we ever stopped to think about how these municipal corporations actually work? How do they get the money to set things right in the first place?

Well, thanks to the RBI, we now have some answers. A couple of weeks ago, they published the first-ever report on India’s municipal corporations after analyzing 201 corporations across the country.

And what did they find?

That municipal corporations are struggling!

Let us explain.

In 1992, we amended the constitution to offer municipal corporations more authority. These local bodies have been around for a long time but we only formally recognised their role in the governance hierarchy after 1992. So with the amendment, we had the centre, the state and the local bodies. And with it we had more decentralization, Municipal corporations could finally understand local issues and fix them. They had funds, functions and functionaries.

Unfortunately, they just didn’t have enough financial power.

See, there are 18 functions handed over to municipal corporations. They have to take care of things such as urban planning, roads, water supply, street lights, sewage etc. But to do that, they also need money, no? So they can generate revenue through taxes, fees, fines and charges. But in most cases, they don’t have the provision to tax people directly. Instead, the state and centre government handles taxation and transfers some of the proceeds to municipal corporations.

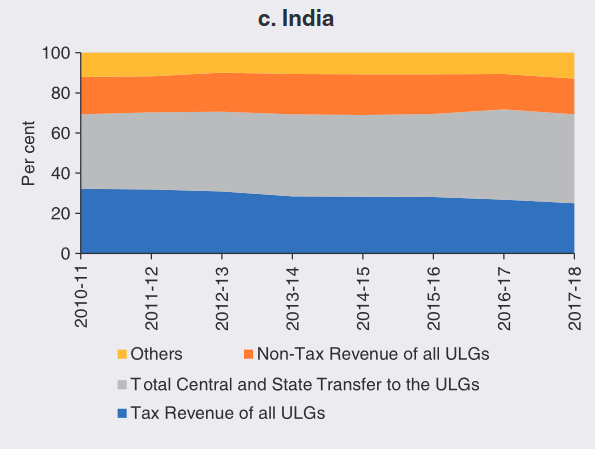

And it seems their dependence on such transfers is rising— 40% of municipal revenue now comes from central and state governments.

Sidenote: ULG's here mean Urban Local Governments/Bodies

And guess what? According to the RBI, this financial dependence makes our municipal system one of the weakest globally. Just compare it to our peers. In India, municipal revenue is just 1% of our GDP. Whereas in Brazil and Africa, it’s at 7.4% and 6% of GDP respectively.

That’s a problem because cities contribute 70% to India’s GDP. But if they don’t have enough control over the money needed to improve their infrastructure, it affects the migration of talent. Cities could collapse. And well, we’re left crying about the flooded roads and potholes!

But you know what makes things worse?

Delays — The bane of the system!

You see, the state governments have to set up a State Finance Commission every 5 years. That’s the body in charge of determining how to allocate funds to municipal corporations. But in many states, SFCs have not been set up on time. For instance, while Rajasthan has set up 6 SFCs over the years, Gujarat has set up only 3. And that’s definitely not a good sign.

Even in cases where SFCs are up and about, they’re in no hurry to get on with work either. SFCs take 32 months on average to submit a report. And that results in delays of 16 months. And then State governments take their own sweet time of around 11 months to table their reports in the state assembly.

In the meanwhile, municipal corporations are waiting for the money and their hands are tied.

And to make things worse, municipal corporations are required by law to maintain a balanced or surplus budget. Meaning their revenue has to at least match their expenditure. They can’t really spend more than they earn citing the rich cause of infrastructure development.

Now this is quite unlike central and state governments. These folks can run a budget deficit — meaning they can spend more than they earn and quite easily borrow money to finance the shortfall.

When municipal corporations need to borrow money, they have to jump through various hoops. And it could take ages before they get the green light from their state governments too.

And what do they do instead?

Well, if you’re cash-strapped like the BBMP (Bengaluru), you mortgage your prime property!

For instance, in 2011, the municipal corporation handed over 11 of its properties to banks — this included the famous K R Market and the Public Utility Building. And a couple of years later, it used the beautiful Town Hall building as collateral for funds too.

So yeah, it doesn’t paint a pretty picture of the state of municipal finances in the country.

A third of our population now lives in towns and cities. And over the next decade or so, 17 of the 20 fastest-growing cities in the world will be in India! This rapid influx of people will put massive pressure on our urban infrastructure. And if we’re not prepared, the results could be quite catastrophic!

Hopefully, this RBI report will wake the system up. And we can fix the problems plaguing our municipal corporations. Maybe we’ll go back in time. To the 1960s when municipal corporations controlled their own destiny — and 89% of their revenues came from taxes and fees they levied.

That’s true decentralisation.

But will it happen?

We don’t know. Maybe.

In the meanwhile, now that we know the problem plaguing the system, maybe we shouldn’t be so hard on the folks at BBMP and BMC?!

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Why you should buy insurance with your first salary?

As a young individual, insurance might be the last thing on your mind — you probably think of it as something for the future, something that doesn’t need to be thought of right now.

But that’s where you’re wrong. And here’s why:

1) Super-low premiums: You get insanely low premiums when you’re young and healthy — and this goes for both life and health insurance! This is often because the younger you are, the less risky you are for the insurer.

2) Cover your family: So you don’t have a spouse or kids — but hey, what about your parents? Most youngsters forget that these are the people who spent their entire life making yours better. Which is why, you should consider adding term insurance to your financial toolkit. So in the event that you pass away, leave them with something they can hold on to after you’re gone.

3) Tax saving benefits.: Under section 80C & 80D, you can reduce your taxable income by the premiums paid for life & health insurance respectively. And what’s better than saving taxes from early on in your career?

4) Protect your wealth: As a young person full of ambition, you’re probably more attracted to wealth-generating investments. You want to make as much money as fast as possible. But building wealth takes time. And the last thing you want is for all your hard work to go to waste due to unforeseen circumstances like critical illnesses or untimely demise.

So first — make sure you and your family’s future is secure with health & term insurance.

5) Waiting Periods: You cross the waiting period for illnesses well in advance by buying health insurance early. That means that you can fully avail the benefits if the need arises and you don’t have to worry about hospital bills eating into your savings!

And hey, the world of insurance is quite tricky out there. But don’t worry — Ditto is here to help!

1. Go to Ditto’s website — Link here

2. Click on “Book a FREE call”

3. Select Health Insurance or Term Insurance

4. Choose the date & time as per your convenience and RELAX!

And our advisors will take it from there!

Finshots Giveaway alert

Oh, and before you go…is Finshots a part of your morning routine? Well, what’s a better way to enjoy your daily stories than with a steaming cup of coffee in your own exclusive Finshots mug?

We’re giving away our classic Finshots Mug to 5 lucky winners!

To enter the giveaway and get a chance to win, all you have to do is follow 2 simple steps!

It’s as easy as that :)

So what are you waiting for? Grab your chance now!