What’s the shoe leather cost of ₹2000?

In today’s Finshots, we explore an economic theory that could be associated with the withdrawal of the ₹2,000 notes.

The Story

On Friday, the RBI set the cat amongst the pigeons. They said they were withdrawing the ₹2,000 note now that it had fulfilled its purpose*. And people panicked.

Because remember 2016?

Every ₹500 and ₹1,000 note was invalidated almost overnight. And people had to rush to banks and wait in queues to simply deposit this money.

But this announcement wasn’t really the same thing. You see, the RBI didn’t actually invalidate the ₹2,000 note. It didn’t ‘demonetise’ it. Rather, it was kind of a request, “Hey, we want you to stop using these notes. Could you visit your bank and deposit it or exchange it?”

The only key detail is that the request came with a deadline — the 30th of September. If you wanted to exchange your notes at the bank, you’d have to do it by this date. But in the same breath, the RBI also said the notes will remain legal tender even after this date.

So you should be able to use this in daily transactions. However, it’s anybody’s guess if people will continue to treat it as legal tender even though they are obligated to. In fact, even now most shops aren’t touching these notes with a barge pole. So if you have a ₹2,000 note, you’d have to deposit it into your account or exchange it soon enough. And that folks, creates something called the ‘shoe-leather’ cost to society.

And many folks have been critical of the policy citing this very detail.

But what exactly is the “shoe-leather” cost?

Well, it’s a theory closely associated with inflation. If people see a general rise in prices, they’ll likely defer their spending. And they may go to a bank and set aside this money in a savings account that fetches a decent interest rate. And if inflation keeps rising, they’ll make multiple trips to the bank. And they’ll wear out their shoes in this process.

Hence, the shoe leather cost.

And when people spend time and resources to try and beat inflation, the economy loses out. Because this wasted time translates to lost productivity.

And some people think this is what’s going to happen with the withdrawal of the ₹2,000 note. Yes, it’s not about fighting inflation, but you will be expected to make multiple trips to the bank to deposit or exchange the notes that you’ve stashed away safely at home. And each of these interactions will take time. There’s time spent at the bank. And the time spent getting there.

In fact, just look back to 2016 to see this theory in action. A few researchers conducted surveys in Delhi to figure out the actual costs involved. And this is what they found.

Before demonetisation, the average Delhi respondent used to visit a bank or ATM about 6 times a month. Since demonetisation, the average respondent has visited a bank or ATM 16 times. Taking the average respondents’ travel-time to a bank branch, which we found to be 23 minutes, and the average waiting time of 36 minutes in a queue, the people of Delhi appear to have spent an additional 10.5 hours of their life going to and waiting in banks since demonetisation.

That’s a lot of wasted hours. That’s one day’s worth of economic output.

So you can see why people are critical. However, this is only half the story. The other half of the story is that this is nothing like demonetisation. The central bank stopped printing these notes a long while back. Most ATMs haven’t been dispensing ₹2,000 notes and we even wrote an obituary mourning its death. In fact, these ₹2,000 notes only make up 11% of the cash in circulation today. Most people don’t have them lying around and even if they did, they are not going to the bank to get rid of it. Ask Zomato. Since Friday, 72% of cash on delivery orders on the platform have been paid for with ₹2,000 notes.

Even others are resorting to clever methods.

They are trying to push these notes to jewellers who currently seem to be charging a 10% premium while accepting these notes. Now some might look at this and say — “Oh look, there’s an added cost here.” But this stuff is happening only in the unorganised sector (due to strict KYC norms) and it’s likely that people are passing off these notes because they don’t want to deposit them with banks due to their dubious origins.

So while there’s truth to the fact that there is a “shoe leather cost” here, the actual quantum may be slightly exaggerated.

In any case, we hope that this is the end of the road for withdrawals and demonetisation.

Hopefully, we can all finally move on.

*Here’s one reason why the ₹2,000 note was introduced in the first place. In 2016, the government demonetised 86% of the available currency. And the RBI needed to replenish it quickly. Think about it this way, if the RBI wanted to push ₹10,000 into the ecosystem, they could print 5 notes and be done with it. But if they had to do it with notes of a ₹500 denomination, the printing presses would have to work 4 times harder. It would’ve been time-consuming. So a ₹2,000 note made sense.

But, people who partake in nefarious activities love high-value notes. They can store more value with fewer notes and transport it easily. That’s why Europe calls the €500 note the Bin Laden note.

So eventually, it made sense that the RBI would want to remove the high value ₹2,000 note. They stopped printing it in 2018–19. And when they finally saw that the fake notes of this variety were rising alarmingly, they probably pulled the plug.

Until then...

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Term life insurance prices are rising!

A prominent insurer is looking to increase their term insurance rates in the next few weeks.

For some context: when you buy a term life product, you pay a small fee every year to protect your downside. And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones.

The best part? When you buy early, you can lock in your premiums to ensure they're not affected by any future rate hikes.

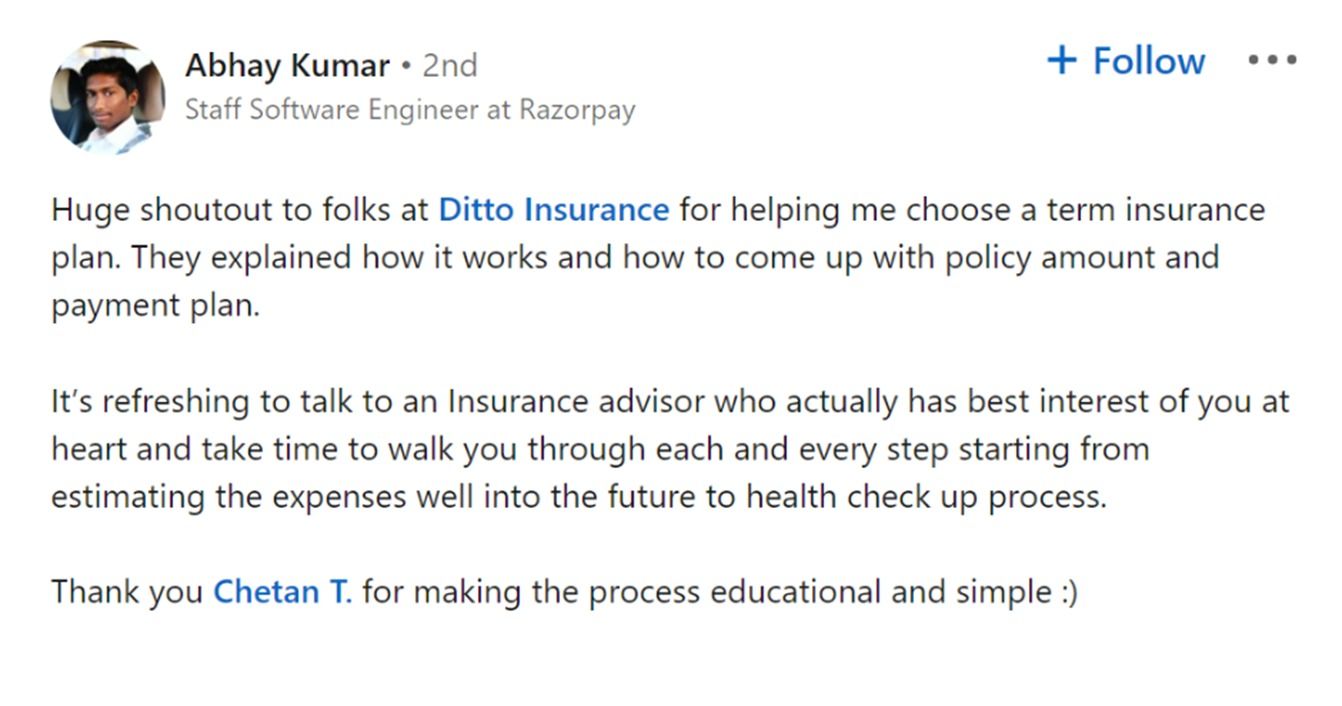

So, if you've been thinking of buying a term plan, now might be the best time to act on it. And to help you in the process, you can rely on our advisory team at Ditto.

Head to our website by clicking on the link here

Click on “Book a FREE call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!