What will happen if India gets a 500% tariff?

In today’s Finshots, we’re going over a hypothetical scenario where the US imposes 500% tariffs on India, and what we could do to counter this.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Just a few days ago, Trump approved a bill that would impose tariffs of up to 500% on countries that purchase oil from Russia. The bill was essentially framed as a way to pressure India and others to cut trade ties with Russia. But in effect, it sent an entirely different message that trade policy could be used as a blunt geopolitical weapon.

Now, a 500% tariff is unreal. If implemented, it would practically wipe out demand for Indian exports in the US. A pharmaceutical shipment worth ₹1 crore would cost ₹6 crore by the time it reached an American port. A t-shirt sold at Walmart for $10 would cost $60.

And even highly competitive Indian IT service contracts, already priced thinly, would become unaffordable overnight. No importer or procurement head in the US is going to pay six times the price for the same product or service. Instead, they’ll simply look elsewhere. And that's the core of the problem.

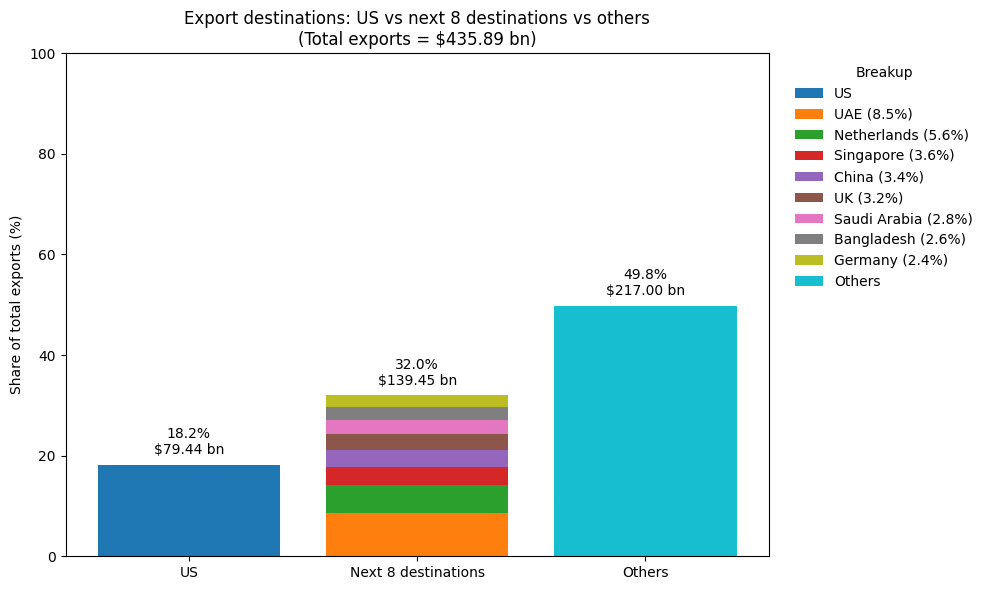

Because the US is our single largest export partner. For context, in 2024, 18% of all Indian exports (physical goods, not services) or roughly $80 billion, went to the US. That includes pharmaceuticals, engineering goods, chemicals, textiles, and even gems and jewellery.

So the real question is: if the US intentionally or otherwise blocks India from its market, how can India respond?

Do we retaliate? Do we shift trading partners? Can we sign new free trade agreements to replace the demand that the US once fulfilled? And if so, how many countries would it take to match up to what one market, the US, provides?

That’s the puzzle we hope to unpack in this edition of Finshots.

So, how many FTAs does India need to replace the US?

Let’s start with the math. In FY2024, India’s total exports (goods and services) stood at about $434 billion, of which the US accounted for nearly 18%. That’s $79 billion worth of demand. So, in theory, if India wanted to offset that entirely, it would need to find other countries willing to buy that worth of goods and services.

Now, let’s take a closer look at what we export to the US. There’s electronics, precious stones, pharmaceuticals, textiles, mineral fuel, and a lot more stuff.

But here’s the catch. Finding other buyers for these goods sounds achievable until you realise just how concentrated global trade is.

Take a look at the numbers:

The UAE is India’s 2nd largest export destination. However, it accounts for only 8.2% of India’s exports. The Netherlands comes next with 5.6%. Then comes Singapore (3.6%), China (3.5%), the UK (3.3%), Saudi Arabia (2.8%), Bangladesh (2.6%), and Germany (2.4%).

Collectively, these eight countries make up around 32% of our exports. That sounds like a lot, but remember the US alone accounts for more than half of that.

But let us assume that demand from the US will cease entirely post 500% tariffs. What happens then?

Well, we can go out and sign free trade agreements with the remaining top countries. And to be fair, India already has free trade agreements with some of these countries.

For instance:

- We have a CEPA (Comprehensive Economic Partnership Agreement) with the UAE, signed in 2022.

- We have a CECA (Comprehensive Economic Cooperation Agreement) with Singapore, which has been in effect since 2005.

- We also have a newly signed FTA with the UK, which kicked off in July 2025.

- Bangladesh is covered under SAFTA, the South Asia Free Trade Agreement.

- We’ve signed a Trade and Economic Partnership Agreement (TEPA) with EFTA nations, like Iceland, Liechtenstein, Switzerland and Norway.

- We’re negotiating with the EU, which would cover Germany and the Netherlands. In fact, this might be finalised as soon as next week.

So, in theory, all these markets could help absorb some of the shortfall from a US pullback. But here’s the problem. Just because we sign an FTA doesn’t mean a country will suddenly double its imports from India. There are natural capacity limits. Every economy has a certain size and structure.

For example, the Netherlands can’t magically import more pharmaceuticals. Singapore isn’t going to replace the US as a buyer of engineering services, and Bangladesh won’t suddenly order billions in IT contracts. In practice, even after signing full-fledged trade agreements, exports take time to grow.

For instance, after the India–UAE CEPA was signed, exports to the UAE did increase, especially in sectors such as engineering goods, gems and jewellery, and electronics. But it wasn’t a $30 billion spike overnight. It was a measured, marginal increase spread across quarters.

And then there’s the issue of product-market fit. India exports high-end pharmaceuticals, custom machinery, engineering design, and software to the US. These are sectors that thrive on standards, IP protection, stable legal systems, and concentrated demand. You can’t simply shift that demand to a new country just because tariffs are lower there. The market has to exist. The companies have to want it. And more importantly, legal and compliance systems have to support it.

You could offer the same drug in five new countries, but if their regulators don’t approve it or their hospitals don’t need it at that scale, it won’t matter. So even if India signed ten new FTAs tomorrow, it would take years for companies to cultivate the same level of access they currently enjoy with American buyers.

That’s why it’s not just about finding new buyers. But about building new relationships and creating new demand pathways. And all of that takes time, money, and trust.

So what can India actually do, you ask?

Let’s be honest here. If the US ever goes through with a 500% tariff, India cannot replace that demand overnight, not with five FTAs, not even with ten. What it can do is lower the concentration risk over time. That means two things:

First, expand and deepen trade ties.

India needs to keep signing FTAs, but strategically.

We already have good agreements with the UAE, Singapore, the UK, and EFTA countries. Agreements with the EU, Brazil, Chile, and maybe even the US are in the works. These are important because they lower tariffs, but more importantly, they lower friction. That makes it easier for Indian goods and services to flow across borders, with fewer approvals, better recognition of standards, and more predictable rules.

But the real work begins only after the FTA is signed. Indian exporters have to actually go out and cultivate demand in these countries. That means building sales teams, navigating local laws, and being competitive on pricing and quality. Without that follow-through, the FTA is just a piece of paper.

Second, build demand at home.

If we can’t fully replace US demand abroad, we have to create more demand domestically.

That could mean:

- Boosting consumption through infrastructure and rural spending

- Encouraging import substitution in sectors like electronics and capital goods

- Helping MSMEs scale through better credit access and supply chain integration

- Expanding PLI (Production Linked Incentive) schemes to new sectors

- Supporting domestic champions in pharma, engineering, and chemicals

The idea is simple: if exports falter, the domestic economy should be strong enough to absorb some of that shock. And in recent years, India has made progress. We did reduce GST last year to offset the tariffs, which helped consumption. In fact, Private consumption in mid-2025 was growing at nearly 8% year-on-year. That’s a good sign. With the right fiscal push and policy support, India can continue growing even if global trade becomes more hostile.

So, can we afford to lose the US?

Not easily. And definitely not immediately.

The US is too large, too wealthy, and too deeply integrated into India’s export ecosystem to be replaced overnight. But that doesn’t mean we’re defenceless. If we treat FTAs as fireproofing rather than firefighting, we can gradually reduce our dependency on them. And if we build a strong, demand-driven domestic economy, we can withstand even the sharpest external shocks.

At the end of the day, trade isn’t just about tariffs. It’s about trust, consistency, and relationships. And while the US may be threatening to break that trust, India still has the tools to rebalance its trade future, if it starts early and moves smart.

But for now, the best bet is to negotiate. And negotiate hard.

Until then…

If you think this explainer helped you understand the current geopolitical situation slightly better, feel free to share this with your friends, family and even strangers on WhatsApp, LinkedIn, and X.

Insurance Masterclass Series: Claims made Simple!

A prominent insurer is set to raise term insurance rates in the next few days. Which makes this a good time to understand how life and health insurance actually work, beyond just premiums.

That’s why we’re hosting a free Claims Webinar Series, where we break down how claims are processed in the real world, why delays and rejections happen, and what truly makes a difference when it matters most.

📅 Saturday, 17th Jan | ⏰11:00 AM

Health Insurance Masterclass

How hospitals process claims, common deductions, the mistakes buyers often make, and how to choose a policy that won’t let you down when you need it most.

📅 Sunday, 18th Jan | ⏰11:00 AM

Life Insurance Masterclass

How to protect your family, choose the right cover amount, and understand what really matters during a term insurance claim.