What SEBI’s new AIF rules mean

In today’s Finshots, we talk about SEBI’s latest consultation paper on Alternative Investment Funds (AIFs) and what the new changes could mean for investors and fund managers.

But here’s a quick sidenote before we begin. Finshots Idea Lab is back with season 2!

Compete in 3 rounds to solve real-world business problems and receive cash prizes worth ₹2.25 lakh, Pre-Placement Interviews, Exclusive Goodies and a lot more!

Click here to know more about the competition and apply.

Now, on to today’s story.

The Story

Mutual funds are easy to understand today. You pool your money with thousands of other investors into a themed fund — maybe focused on an industry or an asset class. And whether you invest ₹500 or ₹50,000, you earn returns in the same proportion. Everyone plays by the same rules, and everyone gets a fair deal.

But what if you’re an investor with crores lying idle, looking for something high-risk and high-reward? Then you start looking beyond your typical assets like bonds, equities, or real estate. The basic mutual funds don't impress you. And that’s where Alternative Investment Funds, or AIFs, come in.

Here, the entry bar is high, and fund managers operate by a different rulebook. You’re not buying listed shares or government securities anymore. It’s more like betting on startups, private companies, hedge strategies, or even exotic assets like art.

Because of this exclusivity, the rules in AIFs have always been... flexible. A ₹500 crore AIF could raise money from just a handful of investors, and some of them could negotiate special terms like early payouts or priority exits. Essentially, the bigger the cheque, the better the deal. And that didn’t sit well with SEBI. So the regulator decided to step in.

Back in December 2024, SEBI released a circular that said all investors in an AIF must have fair and equal rights when it comes to their undrawn commitments. And that fairness rested on two terms: pro-rata and pari-passu.

What does that mean?

Well, imagine you and your friend renting a house. You stay for 10 days, and your friend stays for 20. Now, if you divide the rent based on how long each of you stayed in, i.e. a 10:20 ratio, that’s pro-rata or paying in proportion to your share.

Now imagine that even though you stayed for 10 days and your friend stayed for 20, you both still pay the same rent, under the same agreement, and on the same day. That’s pari-passu, which is also known as equal footing or equal treatment.

The reason these two terms made it to the 2024 circular is because the regulator noticed that in some AIFs, equal treatment wasn’t seen across all investors. That meant two people in the same fund, investing in the same deal, could walk away with very different results. It went against the spirit of a pooled fund, where everyone’s money is supposed to share the same risk and reward.

But enforcing fairness in complex funds like AIFs is easier said than done.

That’s because, unlike mutual funds where all the money is invested upfront, AIFs don’t take your entire investment on day one. Fund managers call for capital in stages. Even then, it's only when they find a company or project worth investing in. The rest stays with the investor until it’s needed.

Say you commit ₹10 crore to an AIF. The manager might draw ₹6 crore immediately and call the remaining ₹4 crore later. That ₹4 crore is your “undrawn commitment” or money you’ve promised but not yet deployed. It’s still part of the total amount you’ve committed, but it’s just not invested yet.

And this is where confusion began.

Did SEBI’s fairness rule apply to the total commitment or only the undrawn part? How should existing schemes transition to the new system? Could fund managers stick to old agreements signed through Private Placement Memorandums (PPMs)?

Sidebar: Private Placement Memorandums are legal documents that are used for private securities. It tells potential investors about the risks, terms and opportunities of the investment.

All these uncertainties led to a difference in what the rules say and what’s practiced in real life. And it meant that fund managers were caught between breaching old contracts or violating the regulator’s circular.

Even the word ‘commitment’ didn’t necessarily have a clear meaning. Is it the total amount that an investor promised to the fund, or only the undrawn amount? Depending on which it is, an investor’s profit or loss could look very different.

Then came in structural confusion, particularly with close-ended schemes. You see, close-ended AIFs raise money and have it invested in levels or tranches so the rules seem pretty straightforward. But what if it’s an open-ended fund? Capital flows in and out every day, so following something like pro-rata becomes tricky.

But remember, at its core, though, SEBI’s goal was simple: fairness and protection. When some investors get preferential rights or early exits, it distorts the level playing field of pooled funds.

Because of all this, fund managers were left scratching their heads and thinking: can these issues be fixed without reopening old contracts? Nobody knew for sure.

That was until last week, when SEBI came out with a consultation paper on the new rules for AIFs. And where better to start, than defining what ‘commitment’ actually means.

For close-ended AIFs, the regulator says that funds may calculate pro-rata rights either on the basis of an investor’s total commitment or on the undrawn commitment. But whichever method the fund chooses to follow, it must be clearly stated in the PPM and it can’t be changed later during the lifetime of the scheme. That takes out two birds in one stone: investors know the rules from the ground up, and fund managers don’t have to sway in confusion.

Next comes what funds can do with the undrawn commitment, which is basically idle funds. It clearly states that they cannot have it deployed elsewhere secretly. It keeps things fair, transparent and maintains the pro-rata rule.

And for funds already operating under old PPMs, there’s a transition phase. As long as they follow one of the approved drawdown methods and disclose it clearly, they won’t have to reopen contracts.

Now despite these rules, not all AIFs function the same way, and SEBI knows that. So open-ended category III funds, the type where anyone can enter and exit whenever they want, don’t have to follow the same rules as close-ended funds. So, SEBI says they don’t need to apply the pro-rata rule to drawdowns. Instead, they just need to make sure that profits are shared in proportion to the units each investor holds.

SEBI also made it clear that the new fairness rules won’t mess with how fund managers get paid. The profit share that managers or sponsors earn is called carried interest. But it is a reward for performance, not part of the investor pool. So it doesn’t fall under the pro-rata or pari-passu rule. This means managers can still earn their usual performance fees without breaking any regulations.

And lastly, SEBI also wants funds to keep better records. This means log every investor’s commitment in rupees, show clearly how pro-rata rights are applied, and make sure trustees verify it in their reports. Past deals (before December 2024) can stay as they are, but every new investment from here on must follow the updated pro-rata rules.

For now this is still a draft paper, open to public comment. But if it becomes regulation, India’s AIF ecosystem could finally strike the right balance between fairness and flexibility. Because in a market where big risks often chase big rewards, maybe fairness is the safest bet of them all, no?

Until then…

Don’t forget to share this story with your friends, family or even strangers on WhatsApp, LinkedIn, and X.

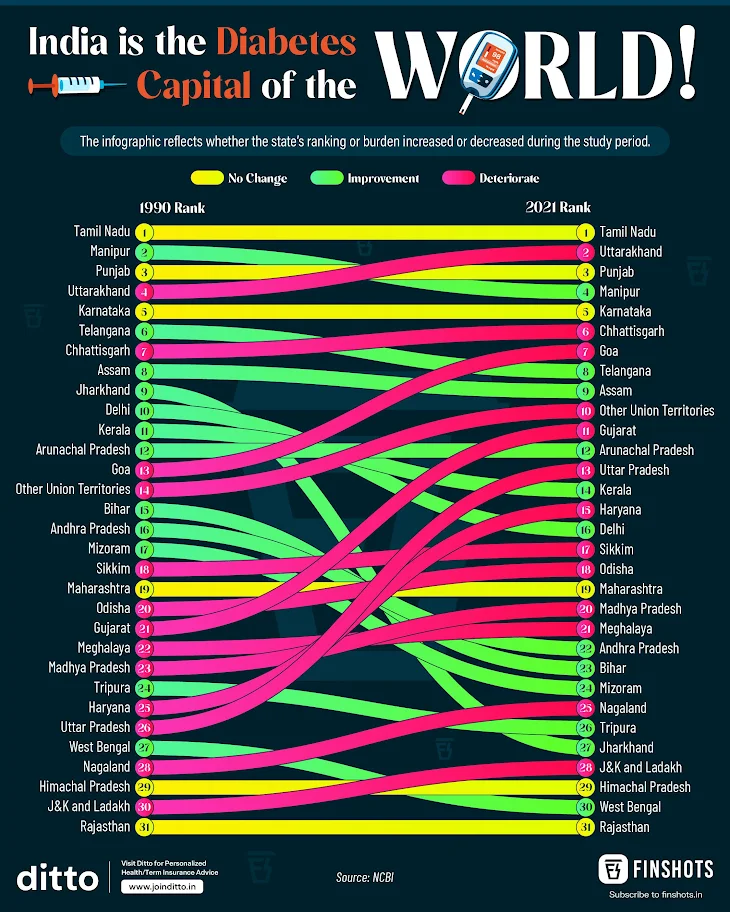

Did you know, India is the Diabetes Capital of the World!

Diabetes cases in India have surged over 30 years, and with it, the risk of long-term medical bills.

And if healthcare costs are rising faster than incomes, your best defence is early protection.

That’s precisely why a comprehensive insurance plan is extremely important. Speak to Ditto Insurance's IRDAI Certified advisors for free to figure out your insurance needs. Click here to book your call today!