What is Modern Portfolio Theory?

Last week, Harry Markowitz died at the age of 95. He was a Nobel prize winner and the brains behind a famous economic (mathematical?) theory that explains how to diversify one’s investment portfolio.

So we thought we’d take a look back at his famous theory and see whether it still holds good today.

The Story

Imagine it’s the 1950s. Someone comes up to you and asks, “How would you build a portfolio of stocks?”

And you may something like this “I’ll look at the stocks with the most potential and buy them.”

But how do you determine potential?

Well, one way to do that is to try and forecast which stocks would generate consistently high cashflows (dividends) in the future. So then you’d calculate what all the future income would be worth in today’s value just to see if there’s any merit in buying the stock right now. There’s a bit of math involved.

But then, Harry Markowitz comes along.

He was studying economics at the University of Chicago and needed a topic for his PhD. And a random conversation with a broker got him interested in the stock markets. So he picked up books and started scouring them for ideas. And when he read about this approach in the book The Theory of Investment Value, Markowitz felt that something was amiss.

He felt that if people only cared about the returns from stocks, they’d simply buy the one stock that had the most potential. That’s what any ‘rational’ investor would do anyway.

But he realized that’s not what people did. Investors actually diversified and bought a whole bunch of stocks. They all believed in the adage “Don’t put your eggs in one basket.” They were trying to reduce their risk. People were risk-averse.

Also, there was one fatal flaw in how most people constructed portfolios.

For instance, you could buy 10 stocks just looking at the highest expected dividends. And you’d think you were diversified. You had 10 stocks after all. But what if all these high-dividend stocks were from the same sector — say banking? So if something spoilt the party for the banking industry, your entire portfolio would suffer in tandem. There’s really not much diversification here.

Instead, you needed portfolio diversification that included a mix of uncorelated assets. Or as Investopedia pithily put it, “Consider a portfolio that holds two risky stocks: one that pays off when it rains and another that pays off when it doesn’t rain. A portfolio that contains both assets will always pay off, regardless of whether it rains or shines.”

That’s a unique portfolio.

And just think about the overall risk in such a portfolio. It would be less risky than a portfolio created by simply adding up the risks of individual stocks.

While that makes intuitive sense, the weird part is that there wasn’t a mathematical model to create something like this back then. So, Markowitz decided to change that. He looked at how the historic prices of a group of stocks behaved in relation to each other. Did they behave in the same manner? Or did they behave like polar opposites?

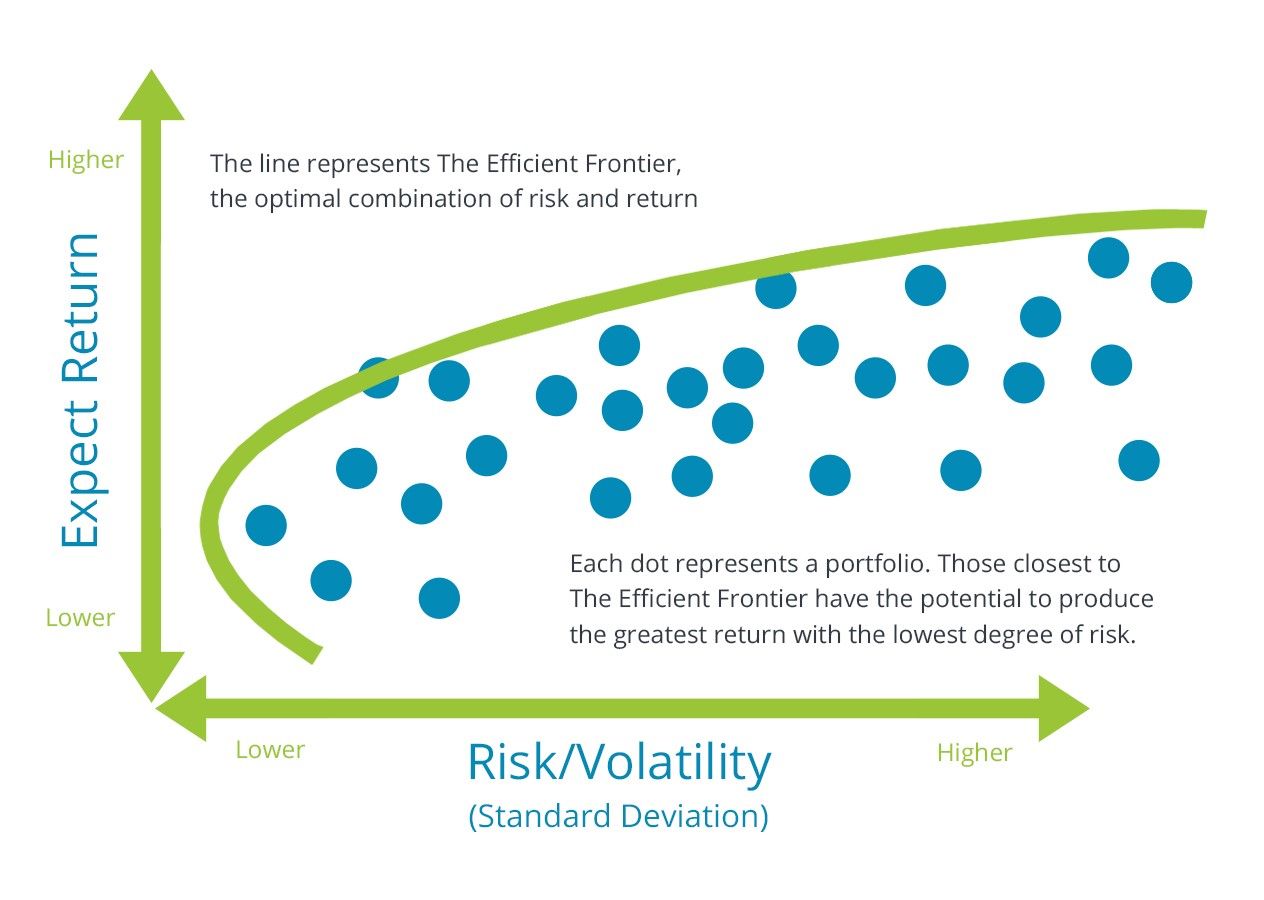

He then attempted to plot the relationship between risk and reward on a chart. His goal was to create an “efficient portfolio”. One that would help investors maximize their returns with the least amount of risk they were willing to stomach.

And just to be clear, when Markowitz spoke about risk, he meant the ups and downs in the stock price. Or what’s known as volatility.

Now it was the first time someone had actually quantified risk and reward in a portfolio this way. And let’s just say that it didn’t go down too well with the folks who were reviewing his dissertation. They said that the theory was “not economics, not mathematics, not business administration, and not literature.” Apparently, they felt Markowitz seemed to care more about the algorithms that could help build the portfolio. He wasn’t focusing on the economic theory that underpinned it.

But it was still quite a brilliant dissertation. And Markowitz was awarded the PhD.

Now sure, his dissertation became quite popular. But it was primarily restricted to academic circles. It was when he finally made it into a book in 1959 that the theory really gained prominence. Suddenly, wealth managers began to employ this Modern Portfolio Theory or MPT to create portfolios for their clients — maximize return and minimize risk.

And four decades later, in 1990, Markowitz won the Nobel Prize in Economics.

So, there’s only one question that remains — is the theory still valid today?

Well, there have been criticisms of MPT. Some folks say that while it might theoretically make sense, the changes in the relationship between stocks keep changing. And even a small change in this relationship can call for a complete revamp of stocks in the portfolio. That doesn’t bode well practically for long term investors. Others say that the way the risk is calculated isn’t quite right and that it needs to be updated. And folks like the author and trader Nassim Nicholas Taleb have blamed people like Markowitz for devising simplistic equations that fooled common investors into believing that stocks were less risky than in reality.

But despite all this, people still use versions of MPT even today. Heck, you’ll still find online investment portals that proudly proclaim that they use Modern Portfolio Theory in their models.

And earlier this year, Goldman Sachs came out in defense of the iconic 60:40 portfolio that emerged out of MPT. For uninitiated, think of it like this — if you had ₹100 rupees and wanted a portfolio that was adequately diversified and favourable from a risk-reward perspective, you’d put ₹60 in stocks and ₹40 in bonds. Simple.

So yeah, Harry Markowitz may have bid us farewell, but it certainly looks like his MPT legacy will live on.

Until then…

Don’t forget to share this article on WhatsApp, LinkedIn, and Twitter.

Term life insurance prices are rising!

A prominent insurer is looking to increase their term insurance rates in the next few weeks.

For some context: when you buy a term life product, you pay a small fee every year to protect your downside. And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones.

The best part? When you buy early, you can lock in your premiums to ensure they're not affected by any future rate hikes.

So, if you've been thinking of buying a term plan, now might be the best time to act on it. And to help you in the process, you can rely on our advisory team at Ditto.

Head to our website by clicking on the link here

Click on “Book a FREE call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!