Weekly Wrapup: The story of a wagon stock

In this week's wrapup, we tell you why investors are excited about a railway stock.

The Story

India is ramping up its railways. This year alone, we plan to spend ₹2.4 lakh crores to modernize everything — It’s the highest outlay ever!

And it’s part of an ambitious plan for the Indian railways to regain what has been lost — its share of freight traffic. See, people aren’t transporting stuff by railway like they used to. The market share of rail freight has literally halved from 52% to 27% in the past 15 years.

Some of it is to do with the poor network connectivity. The last-mile transport is quite difficult and there’s often an arduous road journey even after the goods have been offloaded at a railway station. So even though road transport doesn’t come cheap, people made the shift.

The other part is because of a shortage of wagons. If you’re left in the queue just to move your goods, the delays could impact your business. You’ll waste precious time.

So the government has been trying to fix this. They’re laying out new lines. They’re upgrading existing ones. There’s a Dedicated Freight Corridor crisscrossing the country just to service the transport of cargo. There’s a National Rail Plan (NRP) to create a ‘future ready’ railway system within this decade. And to keep itself ready for a boom in freight traffic, the government wants more wagons. In fact, as per some estimates, it’s probably going to demand 30,000 wagons annually for the next 8 years. To put this in perspective, the typical order size is just 10,000 wagons a year. So it’s pretty massive.

Now guess who’s a winner in all of this?

The protagonist of our story, of course — Titagarh Wagons. This 26-year-old Kolkata-based company has a 25% market share in the wagon-making business. In fact, it’s the largest in India now.

And if you had the foresight to see this massive rail expansion happening, you might have been laughing your way to the bank now instead of reading this…because Titagarh Wagons has had a rip-roaring 3 years.

The stock has delivered a staggering 850% return! It’s insane.

Now Titagarh Wagons isn’t really an overnight success. The group began operations in the early 1980s. And it started off by manufacturing railways-related stuff that was at the bottom of the value chain — things such as bogies which are like chassis and couplers that connected wagons. Back in those days, the company was called Titagarh Steels.

Fun Fact: If you’re scratching your head thinking aren’t bogies the same as railway coaches? Well, in India, yes. We somehow started referring to coaches as bogies. In the rest of the world, bogies are simply a part of the wheel system.

And for nearly 15 years, this business trudged along. But in 1997, the founder JP Chowdhary decided to add a bit more value to his propositions. He ventured into making entire wagons that would be used for freight. The railways transported a lot of goods across the country back then and he felt the opportunity was ripe. So he set up Titagarh Wagons which had a tiny production capacity of just 180 wagons a year.

And that was just the beginning.

Over the years, the wagon-making opportunity grew and rather than set up everything from scratch, Titagarh Wagons went the inorganic route. It acquired companies with synergy. In 2010, it bought a French company that specialized in freight wagons. And in 2015, it bought a wagon manufacturer in Rajasthan which already had the capacity to make 2,400 units a year.

Its wagon-making capacity was rising each year.

But then, Titagarh Wagons also thought, “Why should we stop at just wagons?”

After all, it had moved from bogies and couplers to freight wagons.

So it began to put in place its diversification plan. It struck an international deal — the acquisition of an Italian company Firema in 2015. And this was the boost Titagarh needed to foray into the passenger rail segments.

Firstly, it bid for Pune’s metro in 2019 and it won an order for delivering 102 metro coaches. Then it tapped Bengaluru. And it bid for Chennai and Ahmedabad as well. But the best may be yet to come because the NRP says that every city with a population of more than 20 lakh people will get a metro. The opportunity size could be quite massive here — nearly 7,000 coaches that each cost around ₹10 crores.

And hey, if metros are looking at not just function but aesthetics, then Titagarh Wagons could be a clear winner. Apparently, it’s the only one in India that can manufacture both aluminium and stainless steel coaches.

Not to forget the massive interest in the Vande Bharat trains. You’ve seen the crowds at railways stations trying to click pictures of the new-age semi-high speed trains with pointy noses, no? And the government wants 1000 Vande Bharat trains for its flagship railway project in the next 5–7 years. Titagarh Wagons has already teamed up with BHEL and secured the rights to manufacture 80 trains for now. And there could be more on the way.

Also, its role doesn’t end with manufacturing. It still needs to ensure train maintenance for the next 35 years. And that’s a nice chunk of recurring revenue for Titagarh Wagons too.

With this Titagarh’s passenger-related business has finally started contributing to its revenues. From a mere 0.5% in FY20 to about 20% so far this year.

And it’s not stopping. It’s thinking, “Alright, wagons and coaches are cool. But what’s next?”

The answer — wheels. See, India has mostly been dependent on China to get wheels for its trains. But it wants more localized production. And Titagarh collaborated with R K Forgings to set up a joint venture to manufacture wheelsets. They’ve already won a bid to supply 1.5 million forged wheels to the Indian Railways over a 20-year period.

Oh, and there are the propulsion systems too — the electronic and mechanical parts that are needed to power the trains forward and control brakes. Titagarh is trying to build its expertise in this domain because it doesn’t want to leave this lucrative ₹5,000 crores annual market to others. So a few months ago, it launched its prototype of a traction motor — that’s the motor that helps rotate the wheels of the train.

By controlling one more piece in the railway cog, the company can bring down its costs even further. It can improve its margins significantly.

And to do all this, Titagarh Wagons is splashing the cash to expand capacity in the next 2–3 years.

It’s spending ₹100 crores on increasing its annual manufacturing capacity for wagons from 8,400 units to 12,000 units. It’s setting aside ₹200 crores to help it increase coach manufacturing from 250 to 850 per year. This facility will be dual use — both for the Vande Bharat line of trains and for metros too. And of course, another ₹200 crores on the factory for wheels.

The kicker — all this growth is without much debt on its books.

It’s diversifying, it’s growing and it wants us to know that. Last month, the company even proposed a change in name — from Titagarh Wagons to Titagarh Rail Systems. To tell investors that it’s not just a wagon maker anymore.

Looks like the 26-year-young company is just getting started on its ambitions, eh?

But will this dream run continue?

Well, we don’t know. Because there are a few risks. For one thing, its biggest customer is the Indian railways. Sure, there are private players like Tata Steel which use wagons too but that’s less than 20% of Titagarh Wagons’ business. And since the Indian Railway is dependent on the Union government’s plans, you can see why a change in political climate and direction could easily flip the switch for the company.

Also, while Titagarh Wagons might command a good piece of the market, it isn’t a walk in the park. You see, these railway deals happen through the bidding system. And sure, Titagarh’s experience and track record are what determine how many orders are given to it. But, if its rivals decide to indulge in some predatory pricing just to snag a deal or two, Titagarh Wagon will have no choice but to lower its price and match the lowest bidder. That means the company really doesn’t have much pricing power. And this results in its net profit margins remaining in the low single digits.

The other thing is, investors react to the growth in the company’s order book. If it bags an order for 100 trains, it doesn’t mean the money hits Titagarh Wagons’ account on day one. It comes in bits and pieces over the next few years. As and when it executes and delivers. But investors see this visibility of revenues for the near future and bake it into the current price.

So even if you see a rise in revenues in the next few years, you may not see a big jump in share price. That’s going to happen only if this healthy order book keeps growing. That’s the important metric here to indicate what comes next. And much of the recent jump in share price is thanks to these expectations than actual results. The stock isn’t cheap.

Anyway, we’ve laid out the facts for you. It’s now up to you whether you want to ride the Titagarh ‘band’wagon or stay clear of it.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

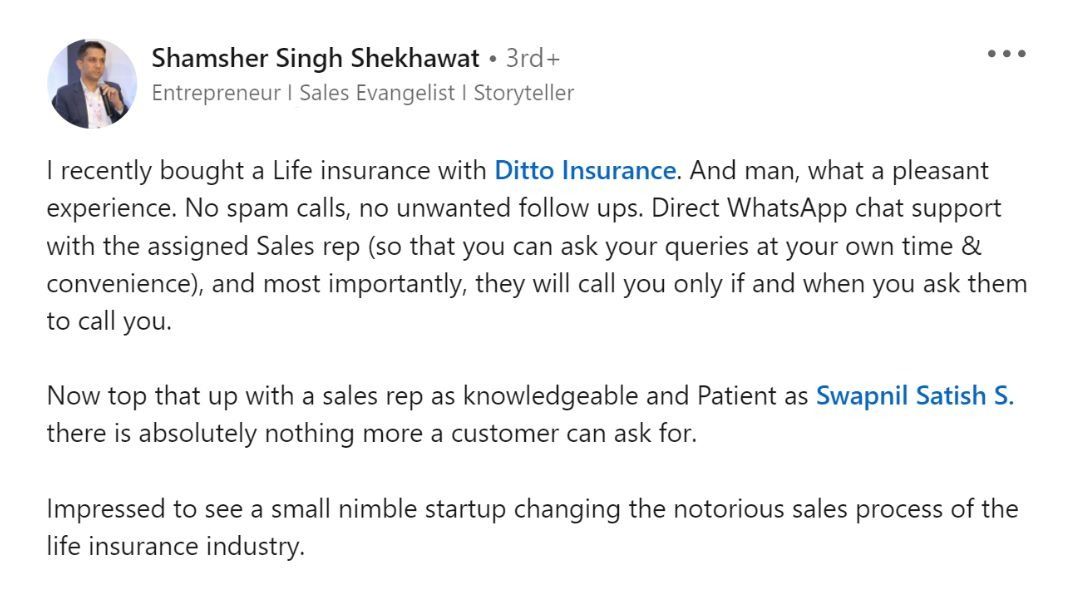

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here