Weekly Wrapup: Tech stocks meltdown and the Mankind Pharma IPO

In this week's wrapup we talk about the tech stock meltdown and explain the Mankind Pharma's IPO

The Tech Stock Meltdown

Infosys is down ~12% in the last week. TCS is down nearly ~4%. Tech Mahindra is down 8%. And the Nifty IT Index is bleeding as we speak. So the big question is - What on earth is happening? And should investors be worried?

Well, we tried to answer that question in this video. Do watch!!!

Is Mankind Pharma worth $5 billion?

You don’t really see ads by pharma companies on TV. And that’s because the law doesn’t allow them to advertise drugs. Otherwise, who knows, you might have seen Micro Labs advertising Dolo everywhere.

But Mankind Pharma is an exception. Their ads often pop up during commercial breaks. But they don’t advertise drugs. They advertise sexual health — Manforce condoms, Prega News pregnancy kits, and Unwanted 72 emergency contraceptives. Their ads are everywhere.

Now you might be thinking, “Oh, so this is what the ‘pharma’ company sells.” But here’s the thing — these products are just 10% of Mankind’s business. Its real game lies in its massive prescription drugs. In fact, it’s the fourth largest in India today by domestic sales.

And it’s finally hitting the public markets with its IPO next week.

But to understand the Mankind Pharma IPO, we must first understand the company.

Now back in the day, pharma companies usually emerged from the minds of PhDs or doctors. But Mankind was different. Rajeev Juneja and his brother Ramesh Juneja were mere medical sales representatives in the 1990s. They weren’t the ones concocting drugs and formulas. So when they started Mankind in 1995 with ₹50 lakhs, they did things quite differently as well.

For instance, they didn’t set sales targets for their medical reps. They didn’t want a culture of, “Listen, if you don’t meet your target by the 30th, we’ll take away your briefcase.” They wanted to keep the reps happy and keep the attrition low. So the sales folks got a commission for everything they sold.

In fact, the eagle-eyed focus on sales meant that in the initial decade, Mankind did not even have its own manufacturing facilities. It outsourced the production, packaged it and simply got its reps to spread the word.

Now you’d imagine that this didn’t worry the biggies initially. They simply thought that Mankind was just a fly-by-night operator. That it wasn’t a serious threat because of its sales practices.

But Mankind kept its head down and simply focused on offering better prices.

For instance, in the 2000s, Mankind realized that erectile dysfunction was a problem plaguing over a third of men in India. And that back then, the most popular drug to treat it was Pfizer’s Viagra which sold at ₹350 a pop. Mankind jumped at the opportunity and sold their drugs at just ₹20. It was affordable for the masses. Soon, Mankind commanded a 30% share of this market.

It also sold its antibiotic Moxikind CV for ₹11 while others like GSK and Ranbaxy priced theirs at over ₹40.

We’re talking about drug prices in the 2000s, to be clear. And this low-price, value-for-money drug strategy seeped into its entire portfolio.

Mankind also did something else. They focused on smaller towns and cities that the others ignored. They went after the general physician and not the specialists. They wanted volumes and a bigger share of the prescription market. They needed doctors on their side because they couldn’t advertise the drugs on TV anyway. It worked.

But the true brand recognition and trust came in 2007. That’s when they aggressively began marketing their sexual health products on TV. The company’s sales skyrocketed. From a mere ₹350 crore in 2006 to a massive ₹4000 crore in 2016.

Mankind was soon the coolest kid on the block. And everyone wanted a piece of it.

In fact, even after PE firm ChrysCapital tripled its money and exited in 2015, it came back for more in 2018. It decided that Mankind’s potential was still intact. So it picked up another 10% and made an investment of about $300 million.

But the big question is — Will Mankind be able to replicate its success in the future?

After all, that’s what investors will be worried about when the company launches its IPO next week.

Well, here’s the thing. In the past year or so, Mankind is charting a new path. It’s shifting from drugs for acute illnesses such as the common cold and flu to chronic therapies such as diabetes and heart disease. While the acute therapy business contributed to 80% of its revenues in 2017, it has now dropped to 67%.

And it’s making this shift in a few ways. It’s acquiring companies such as Panacea Biotech that make cancer formulations and transplants. It’s also licensing molecules from other major pharma players to build its chronic therapy business.

On the face of it, it’s a good shift. Because acute therapies are primarily a pricing game when it comes to drug sales. On the other hand, chronic illnesses are on the rise due to lifestyle changes. And this segment not only gives them more pricing power but the revenues are also more predictable. Because once a patient is put on a drug for a chronic ailment, it’s likely to be a lifelong affair. These are repeat customers.

But it’s still not an easy shift to make.

Because in order to make a mark in chronic therapies, Mankind needs a different sales strategy than what it employed in its first two decades. They need to tap the top specialist doctors in the country and not general physicians. Go top down instead of bottom up. Because once you get the top specialist doctors in the country to sing your praises, the others will follow.

But the sales force that can execute this might need a different skillset and approach. The question is — does Mankind have the ability to make that shift?

And not to forget that Mankind hasn’t made a name for itself as a big spender in Research and Development (R&D). Naturally, you’d assume that R&D is the bread and butter for pharma companies. They need to constantly innovate. And in the past three years, Mankind has only spent roughly 2.5% of its revenues on R&D. It’s lagging behind its peers. Alkem has spent nearly 5% and Torrent sets aside 6.5% of revenues for this purpose.

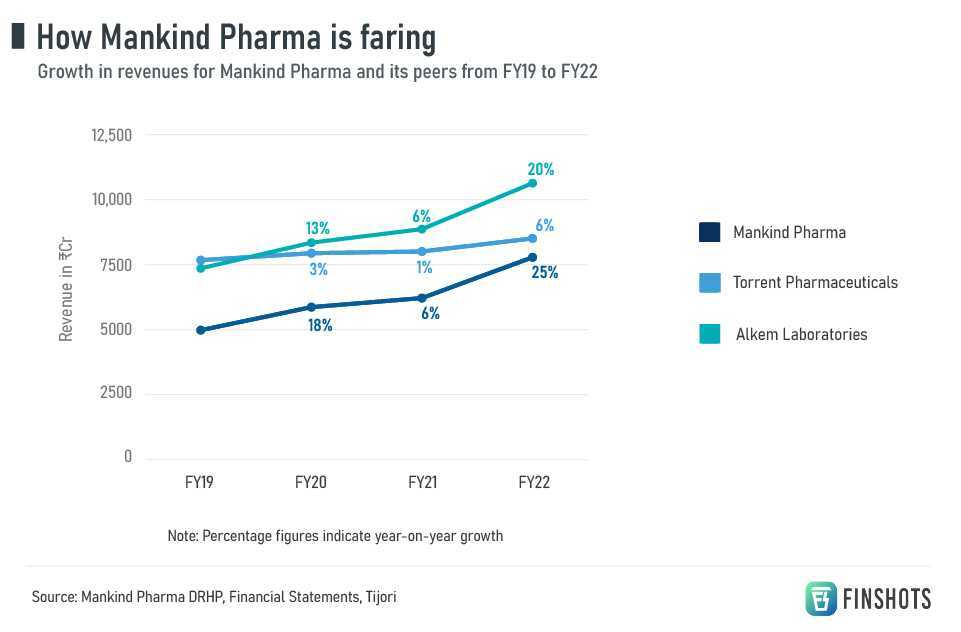

Despite this, Mankind seems to be holding its own. In the past 3 years, the shift towards selling in Metro cities seems to be playing out well. Its sales in these regions have grown at a faster clip when compared to 9 of its competitors — at 22% annually.

And it’s even doing some really quirky stuff to build its brand and image. In 2022, it actually launched an OTT service called Docflix for doctors that would have a bunch of medical content created by experts. How often do you see a pharma company do that, eh?

Alright then, what about the valuations, you ask?

Well, let’s just say that it doesn’t seem obscene. While analysts expected Mankind to aim for a valuation of nearly $7 billion, it’s 25% lower than that. And this means the price-to-earnings (PE) multiple is roughly 27.

Its peers on the other hand seem to be priced much higher. Alkem Laboratories is trading at 40 times its earnings. And Torrent Pharmaceuticals is trading at a significantly higher PE of 65 times.

The only problem seems to be that analysts think there’s information missing in Mankind’s DRHP.

For instance, Aequitas Research thinks that the only way to figure out what earnings multiple to give the company is to get more information on its business — on how its recent acquisitions are growing and also, if the consumer brands (condoms, pregnancy kits etc) are growing faster than their drug business. But the split seems to be missing.

It’s a sentiment echoed by Yes Securities too. The analysts are wondering about Mankind’s high gross margins — Because while it seems to be doing better than its peers Alkem and IPCA, they are not sure if it is due to the consumer brands or the drugs.

There’s also the fact that the company isn’t raising fresh money for growth. Instead, it’s the promoters (the Juneja family) and the private equity investors who are looking to cash out a bit.

And that’s usually a red flag for many investors.

Anyway, will the decades of consistent success lead to people lining up for the IPO? Or will Mankind’s shifting strategy make investors pause and wonder?

We’ll know next week.

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.