Weekly Wrapup: The Rategain Story

Of late, everyone’s complaining about two things — that domestic airfares are through the roof and that hotel tariffs are sky high. And this got us thinking about dynamic pricing in the hospitality industry. You know, how these companies tweak their rates constantly in response to demand.

And there’s one company in particular that helps the industry do this — RateGain. So this week we thought we'd dive into the world of travel and pricing.

The Story

The way that an airline or hotel indulges in dynamic pricing is typically quite static. They know that people travel more during the holiday season. So they’ll bump up their prices then. Or they know that there’s a one-time big event happening in a city — say the cricket world cup finals in Mumbai, so they’ll ratchet up the prices again.

Also, despite the vast troves of data these folks have, their dynamic pricing isn’t really personalized to each and every traveller.

An airline might know that you prefer to travel on Thursday mornings. They know that you prefer to eat sandwiches in-flight. They know your preferred brand of perfume because you pick that often from the duty-free magazine. Meanwhile, the hotel knows that you prefer a room with a poolside view. They know that you crave tea at midnight and order via room service.

But no one shares the data with each other. They only know about your behavioural patterns when you travel or stay with them specifically. If you go to their competitors, they’ll have no clue what you’ve been up to.

But what if you could get someone to collate all these data points for you? See what your competitors are doing and help you set real-time prices? Maybe even help improve marketing efforts so that it’s more personalized and drives sales?

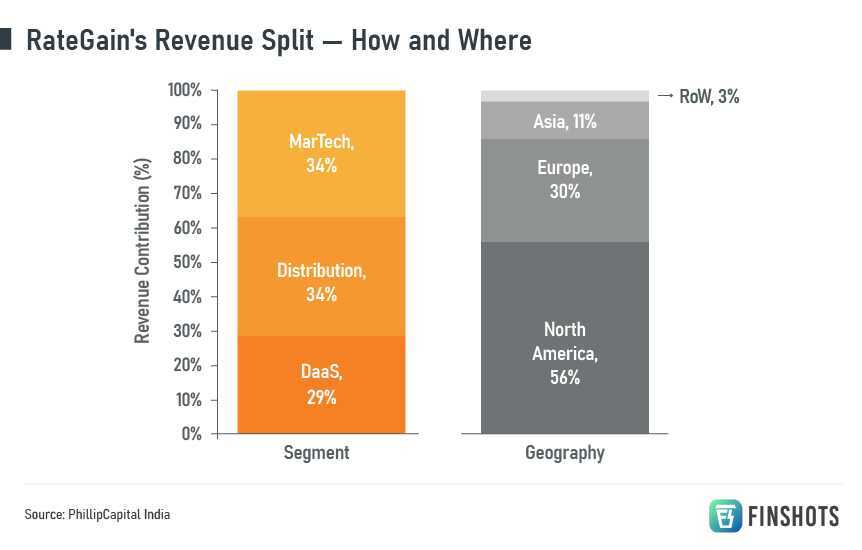

Well, that’s where this company called RateGain enters the picture. It’s a publicly listed company in India building solutions for the world. But as most Software-as-Service (Saas) companies do, they operate in the shadows. In this case, shadows of the hospitality industry. And if you break down RateGain’s business, 3 things emerge.

#1 Data as a Service (DaaS)

So RateGain pores through millions of consumer behaviour data points — 24 billion as per the company — and analyzes them for past patterns. And it’ll then try to predict what customers will do next. Such as how much will you be really willing to pay for that Thursday morning flight or the room with the pool view. It’ll look at what competitors are doing. And this will help the hotel or airline to set dynamic prices accordingly.

In fact, India’s newest low-cost carrier Akasa Air tied up with RateGain even before its launch. Just because it wanted to ensure that it was getting its pricing right from the start.

#2 Distribution

One of the biggest grouses for hotels is having to deal with updating prices, inventory, photos and content across multiple online travel agencies (OTA) and global distribution systems. It could be quite a cumbersome process. RateGain’s distribution features connect it all in one click. It’s a bridge between a third party and the hotel.

#3 Marketing Technology (MarTech)

Up until a few years ago, people relied on travel agents to do their travel bookings. But not anymore. Online reviews and price comparisons have taken over. People are even going directly onto the website of hotels and scouring social media to find what they’re looking for. But most hotels haven’t kept up with these changes and have a sparse digital presence. They need handholding with digital marketing efforts that can use millions of consumer behaviour data points, and that’s what RateGain promises to provide.

Long story short, RateGain feeds real-time consumer insights into its software, packages it and sells it as a subscription to airlines, hotels, and online travel agents. It’s a SaaS company. That’s all there is to the business really.

Now here’s the thing that makes RateGain quite special. All the analyst reports that we read claim one thing — that RateGain doesn’t seem to have a single direct competitor, globally.

You see, the travel industry is quite fragmented and SaaS companies stick to their niche. They might just focus on data and pricing for instance. Or they might be the one that does social media marketing. It’s usually an ‘either or’ affair.

But RateGain has expanded its wings by really doubling down on acquisitions in the past few years. And because companies operate within a limited scope of work, RateGain has been able to step in and buy them out for relatively cheap too.

For instance, its foray into MarTech happened only in 2019 when it acquired a company called BCV Social for 2.3x its revenues. And earlier this year, it bought a Silicon Valley headquartered company called Adara for just 0.6x its revenue. And since Adara’s focus is on trying to find ways to measure the actual travel intent of a customer, it feeds nicely into RateGain’s existing strength of dynamic pricing too.

It seems like the strategy is working out for the company. Because it says that it’s not done acquiring its competitors yet. And it apparently has 185 companies on its target acquisition list. It’s trying to make sure that no one else has the all-round capability that it has.

Maybe the customers believe this too. Because RateGain’s got almost everyone in the industry in its pocket. 25 of the top 30 OTAs and 23 of the top 30 hotel chains in the world are its customers. And a bunch of international carriers like Lufthansa and Singapore Airlines too. In fact, it has nearly 3,000 customers and its gross revenue retention has been consistently over 90%. That’s insanely high and it just goes to show that existing customers keep renewing the business every year without fail.

So if there’s nothing else that’s quite like RateGain, it’ll be raking in the money, won’t it?

Well, it kind of is. Its revenues have indeed been growing at a fast clip.

But, there’s something analysts call the Rule of 40 when it comes to evaluating SaaS companies. And this rule simply checks if the sum of the revenue growth rate and the margins is greater than 40%.

And how do you read this, you ask?

Let’s take an example of a SaaS company with a revenue growth rate of 50% and margins at very low single digits. While its score would be close to 50, it may mean that the company is spending heavily on customer acquisition, retention strategies, and R&D in order to remain relevant and keep the top line moving. The growth is coming at the expense of profitability.

On the other hand, if say the growth is around 20% and the profit margin is 20% too, the company still meets the Rule of 40, but in a much more balanced manner. It shows that the management is able to balance both growth and profitability together. And that’s great news for any investor.

So, does RateGain meet the Rule of 40?

Well, on the face of it, RateGain checks the boxes. Barring FY21 which was a washout year for the hospitality industry due to Covid, it has consistently been able to keep this number above 50%. But if you dissect the numbers you’ll see that the margins on most occasions are in the single digits. And that means that RateGain has had to spend quite heavily on sales, marketing, and developing new products to achieve this sort of growth rate. For instance, it even has an in-house Artificial Intelligence lab now with nearly 40 employees to keep innovating.

So yeah, that’s something to keep in mind if you’re trying to understand the company a little better. Because everyone’s hoping that after years of building and innovating, the margins will finally expand. But what if it doesn’t? What if it can’t afford to curtail its expenses as it tries to remain on top?

And not to forget, by virtue of its monopoly status, people have been willing to accord quite a bit of a premium to the company too. It trades at a fairly high P/E of 62 times. And that could give new investors something to think about before they dip their toes into the space.

Anyway, the next time you see prices for the airline or hotel dynamically adjusting, or you receive some personalized marketing communication from them, you know that it’s RateGain that is probably behind it all.

Until then…