In this week's Finshots Markets we explain how Delhivery’s diversifying its business in a bid to reach profitability

The Story

On Tuesday, the word on the street was that Delhivery, the logistics startup (can you still call it a startup if it’s 12 years old?), was going to snap up the 34-year-old logistics firm Gati.

On Wednesday, Delhivery denied this flat out. It called the reports ‘factually incorrect’. Gati dismissed the rumour too.

So we’re back to square one. And maybe there’s nothing brewing. Maybe some executive at Delhivery had a casual conversation with a Gati executive at a logistics mixer. And maybe a reporter got a whiff of this and spread the word. Or maybe there was a serious meeting in a conference room somewhere and numbers were discussed. But since it’s too early to say anything, the companies had to deny it. We don’t know.

Whatever the case may be, there’s a bit of deja vu in all of this.

And that’s because we’ve heard this rumour before. 4 years ago, Delhivery was in the news for the same reason. Apparently, they’d held talks with Gati back then.

So with the rumour popping up again after 4 years, it makes you wonder — Maybe Delhivery should just buy Gati?

Hear us out. Logistics is what greases the wheels of our economy. Those veggies you see at the supermarket. That car you test-drove last weekend. The clothes you are about to order online. They’re all ready and stocked up thanks to the modern marvel of logistics. It’s a $160 billion industry in India. And it’s only growing.

But not all logistics companies are made equal. They might have markedly different businesses. And these different businesses might have different profit margins.

Wondering what on earth we’re talking about?

Well, look at Delhivery. It started off in 2011 as the “delivery boy” for restaurants and then capitalized on an even bigger opportunity — India’s burgeoning e-commerce industry.

At the time, e-commerce companies like Flipkart and Snapdeal fulfilled orders using their own modest delivery arms or availed services of old-school courier companies — who were more attuned to delivering documents or shipping bulk orders. They were old and slow and did not live up to the Indian consumer’s high expectations. And these expectations required a different kind of focus.

You needed a network of warehouses, last-mile distribution and a robust tech platform to tie everything together. You also needed organised backend processes that could handle payments, particularly cash on delivery — which was a big thing back in the early 2010s. Delhivery went about building all this. And its dream of being the ‘third-party, last-mile logistics delivery firm’ (3PL) for e-commerce has been shaping up rather well since then.

According to a RedSeer report, ~20% of all e-commerce delivery volumes in India were found to be fulfilled via Delhivery. And with internet shopping still fairly underpenetrated in the country, there’s plenty of room to grow.

But here’s the thing — the margins on e-commerce delivery haven’t been anything to write home about. Delhivery just had a service level EBIT margin (earnings before interest, taxes, ESOPs and a few other costs) of 2.5% in FY19. That was when nearly 90% of its revenues came from the e-commerce sector.

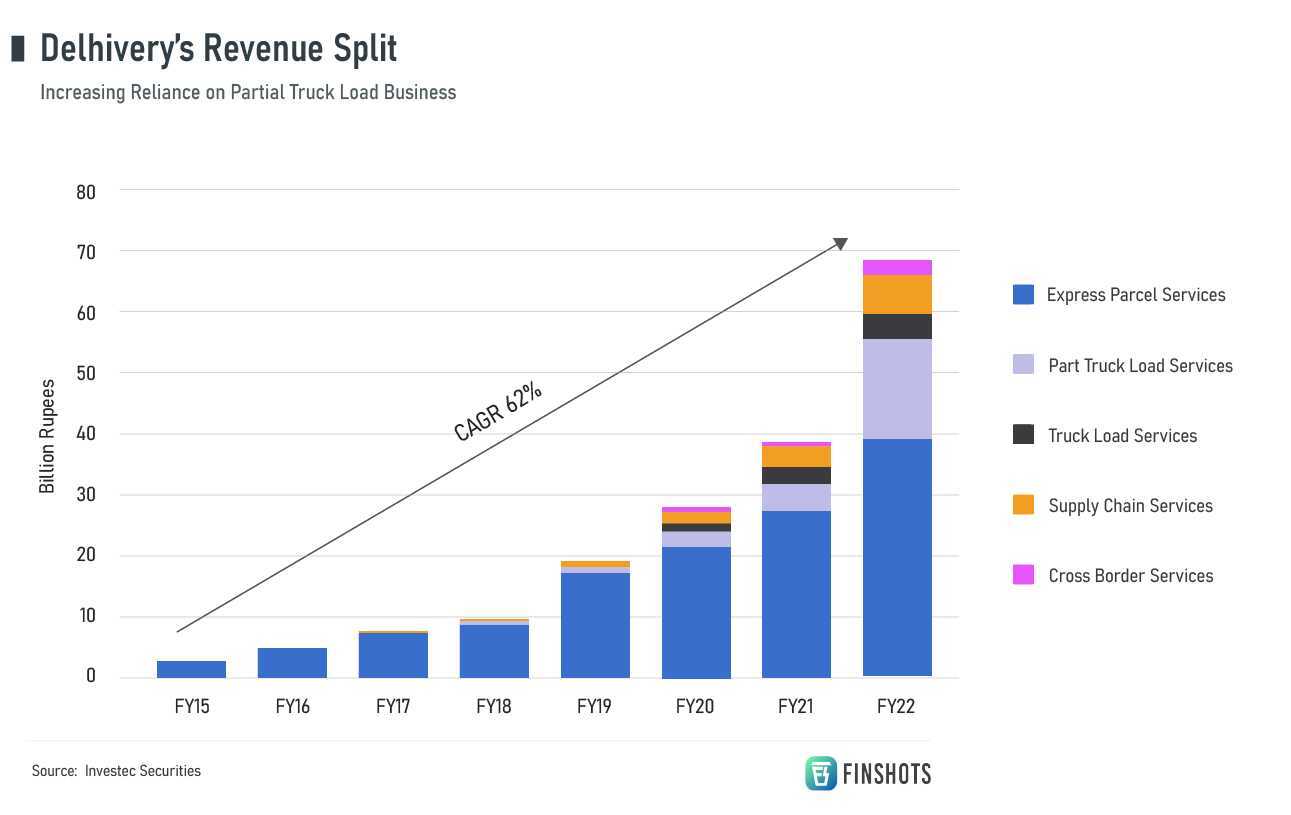

So Delhivery began to experiment. It began to build other revenue streams. It cut back its dependence on e-commerce — its share in the topline has fallen to just 60% now. And as per a report by Investec, those margins we spoke about have improved too. To 11%.

Now part of this could be simply because the time and money Delhivery spent over the past decade is finally bearing fruit. Maybe it is able to use its routes better. And maybe that has helped it to cut back on its transport costs. But it has also come at a time when Delhivery has slashed its pricing. It’s offering its services for cheaper in a bid to improve market share. So that means, the changing revenue mix is helping Delhivery’s margins too.

Especially the growth in the Partial Truck Load (PTL) service segment.

What’s PTL, you ask?

Well, imagine you’re a business that wants to transport a couple of things from one end of India to the other — a 20 kg pack of electric equipment and a 500 kg machine. Road transport via trucks is probably one of the easiest ways to get the deed done. But, hiring an entire 50-foot truck is going to be expensive. So you speak to the logistics providers and they tell you that you can share the truck with their other customers. They’ll consolidate your items with the others that are headed in the same direction. This way, you get a lower transportation cost and flexibility too.

That’s a Partial Truck Load service — a segment dominated by traditional players such as Gati, Safexpress, and TCI Express.

And the thing is, it’s not a B2C play like e-commerce. It’s not about delivering the new shoe to a customer’s door. Rather, it’s a B2B play dominated by direct relationships with manufacturing clients. That means the order values are higher, the pricing is higher, and ergo, the margins that logistics companies make are higher too.

In fact, just look at the EBIT margins that Bluedart, TCI Express, and Safexpress are able to deliver. It’s been in the 15% range for quite some time now. And that’s quite an enviable number.

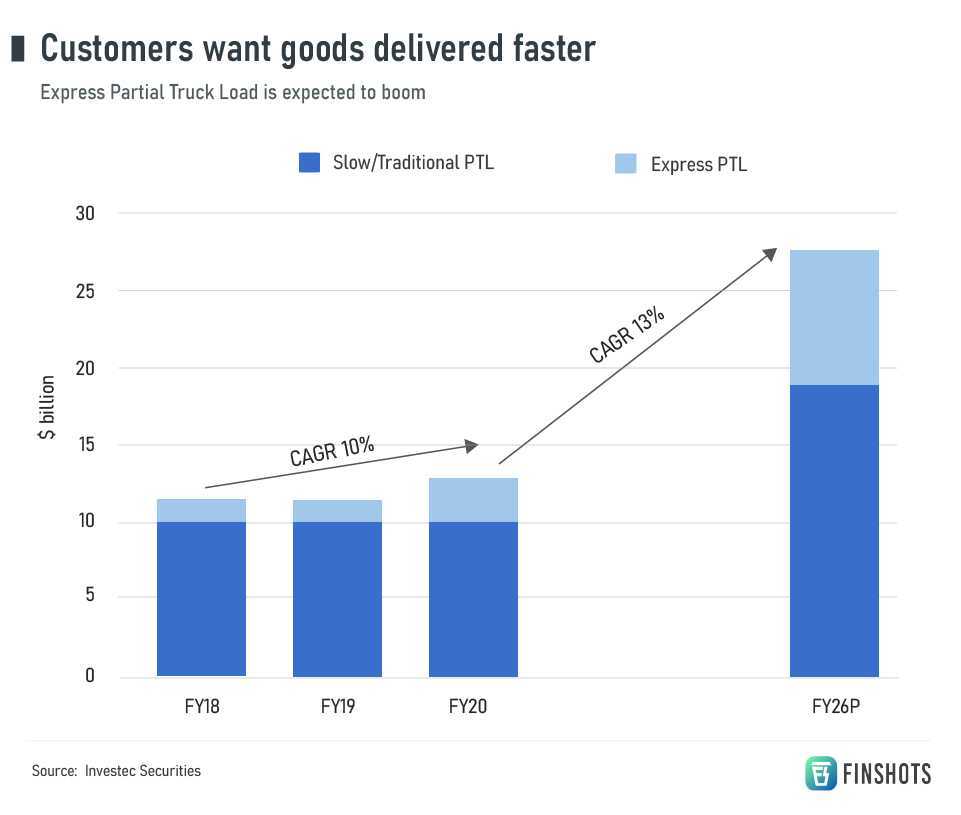

But here’s the thing. Even PTL is evolving. It’s becoming more ‘express’ in nature. Because gone are the days when companies would be fine waiting for a couple of weeks to get products from one place to another. They want faster deliveries to meet customer expectations. People are used to superfast e-commerce delivery and they want that for everything else too. So brands with both online and offline operations are trying to keep up with these times and that means the truckload business is becoming express as well.

So if Delhivery can combine its express delivery prowess with someone else’s PTL forte, it could be quite a force to contend with in the logistics industry. That’s what mergers and acquisitions are for at the end of the day, right? Either to double down on what you already have. Or to try and get better at a business segment that will be a major contributor in the future.

And maybe that’s where an established entity like Gati comes in. It has been around for 30-plus years. It started life by moving heavy shipments like air conditioners and even ATM machines. Yup, ATMs! And over time, it built a formidable presence in surface logistics or simply put — trucking. That’s where it gets almost all of its revenues from and it’s one of the top 5 players in the organized PTL space.

Sure, Gati’s gone through a bit of a rut of late. It has made some bad business decisions. There have been promoter troubles. The debt was rising. And all this eroded market share in the past 5 years. So even though its gross profit margins are in line with peers, its EBITDA margins have been quite dismal. It is in the low single digits.

So, if Delhivery does acquire Gati for its legacy, it’ll still have to put in the hard yards. Just to turn around its fortunes.

But there are just two problems with this theory of ours.

For starters, Delhivery already splashed some cash on another startup called Spoton Logistics a couple of years ago. It wanted to strengthen its position in this B2B express delivery and reduce the dependency on e-commerce. And it’s still struggling to integrate Spoton’s business with its own. So there’s really no reason for it to rush into another acquisition right now.

And that’s not even the elephant in the room.

What we have conveniently ignored until now is that Gati may actually not be up for sale! Why? Well, Allcargo Logistics got its hands on the company just a few years ago. It first picked up a 19% stake in 2019 and then upped it to 47% a couple of years ago. Allcargo wanted Gati’s PTL business too. And to turn it around, it has even hired a new CEO and is restructuring the business.

Why on earth would Allcargo exit a business that it’s spending time and money on to rebuild?

So yeah, it does seem like it’s just the rumour mill at work here.

But hey, hopefully, the story wasn’t for nothing. And if we did a decent job of explaining why the B2B express logistics business is crucial as the newly-listed ‘startup’ Delhivery charts a path towards profitability, we’d love to know!

Until then…

Don't forget to share this Finshots on Twitter and WhatsApp.