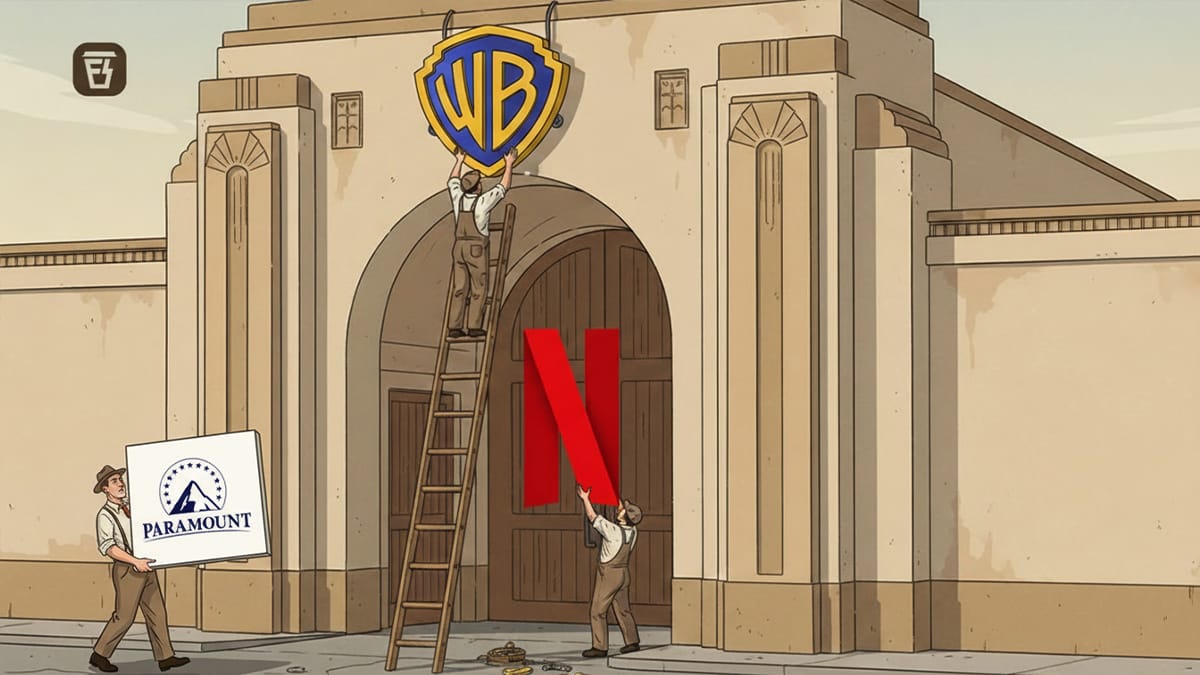

The Warner Bros–Netflix Saga Explained

In today’s Finshots, we unpack how one of Hollywood’s most iconic studios ended up on the auction block, why Netflix sprinted to buy it, and how Paramount suddenly crashed the party.

But here’s a quick side note before we begin - "I should’ve bought health insurance sooner."

That's what 85% of Indians who paid hospital bills from personal savings & debt ended up saying.

Medical emergencies don't come with a warning. They can strike anyone, anytime, causing years of savings to go down the drain.

So don't wait until a crisis hits you. At Ditto by Finshots, we make insurance simple. Our advisors explain all the policies in simple English and help you pick the right plan. Book a FREE 30-minute consultation today. No spam, no pressure.

The Story

For nearly a century, Warner Bros. has been one of Hollywood’s crown jewels. From DC superheroes to HBO’s prestige dramas, its catalogue shaped global pop culture. But the company that once set the tone for entertainment found itself stuck in a brutal financial bind.

You see, before Discovery, AT&T (the American telecom giant) owned Warner Bros. However, they wanted to sell it off as they were bleeding with debt from the Time Warner acquisition.

On top of this, AT&T wanted to focus on its core business, which was telecom and broadband. They thought the cash infusion from the sale would give them enough capital to reduce debt, upgrade their networks, and position themselves for the next wave of competition in 5G and high-speed broadband.

When AT&T went looking for a way out, Discovery Networks became the most viable buyer. David Zaslav, Discovery’s CEO, had been advocating for scale in the streaming era. A merger with Warner Media offered Discovery the scale, prestige brands, and global footprint that Discovery alone could never achieve.

However, when WarnerMedia merged with Discovery in 2022, the combined company walked straight into a perfect storm. Revenue from legacy cable TV was collapsing, and losses from HBO Max and Discovery Plus ballooned. And the merger left the company with close to $40 billion in debt.

This is when investors panicked, and the board members eventually confronted the one truth nobody wanted to say out loud: To survive, Warner Bros. may have to sell itself.

By late 2025, Warner quietly went up for sale. However, the surprise wasn’t that. It was that Netflix stepped up to buy it for $83 billion.

But why?

Before we answer that question, let’s understand why WB is even put up for sale. In 2022, AT&T sold WB to Discovery, and as part of the deal, Discovery would take on much of its debt. However, Discovery hasn't pulled off a miracle, so it still has a tremendous amount of debt, on top of the mounting losses from cable TV.

For the last 3 years (since Discovery acquired WB), they have been continuously losing money. So WB wasn’t selling because it wanted to. It was selling because it had no choice.

Which brings us back to the question: Why would Netflix buy a struggling studio when its whole brand was built on killing studios?

Simple. Netflix has a weakness.

Netflix dominates streaming, but it doesn’t own enduring franchises. Disney has Marvel and Star Wars. Universal has Jurassic Park and Fast & Furious. Warner, on the other hand, has Harry Potter, The Lord of the Rings, the DC Universe, and HBO’s entire library. All while Netflix has a few hits, but few timeless titles.

Add to this, the streaming wars are entering a new phase. Growth is slowing, and competition is intensifying. Netflix can no longer rely on endlessly pumping out new originals. What it needs are assets — stories with decades of brand value. And Warner Bros. offers exactly that.

Owning Warner Bros. would make Netflix a full-fledged Hollywood power, complete with theatrical releases, theme-park-level IP, and a moat no competitor could cheaply replicate. All while they have the biggest moat that is distribution.

But just as the industry was still digesting the news, Paramount–Skydance also suddenly submitted a $108 billion all-cash offer higher than Netflix’s bid. And unlike Netflix, it wanted the entire company, including the loss-making cable division.

But why would anyone voluntarily take on cable TV in 2025?

Because for Paramount, cable is the backbone of its business. CBS, MTV, Comedy Central, Nickelodeon, local sports networks, and hundreds of affiliate stations keep its ecosystem alive.

Adding WBD’s networks could give it enormous leverage in advertising, sports rights negotiations, and distribution partnerships. And on top of that, if they own WBD (Warner Bros. Discovery), they would also own CNN – one of the largest cable news channels in the US.

However, if Paramount wins the bidding, it triggers a $2.8 billion breakup fee that WB must pay to Netflix.

Now, this brings us to the bigger question. Currently, Netflix is the frontrunner in the bidding process. So, can Netflix actually revive Warner Bros., or will it just asset-strip it like a PE firm buying a legacy business?

And this is not easy to answer.

Integrating a century-old studio with legacy workflows, complicated guild structures, and a famously chaotic creative culture is no small task. Netflix excels at speed and scale. None of which describes how studios traditionally operate.

Paramount, on the other hand, would face a different problem: adding Warner might give it scale, but scale also magnifies losses if the cable decline continues. Sure, Paramount does not have a mounting debt problem like WB, but purchasing the business does mean that they should clean up the mess left by its predecessors.

Meanwhile, Warner just wants someone who can stabilise its finances, protect its IP, and stop the bleeding.

So, where does this leave Hollywood?

For Netflix, this acquisition is about adding titles. For Skydance Paramount, it's about expanding its cable TV portfolio. And for Warner itself, it wants an exit that finally stops the bleeding and finds a worthy home for its most valuable titles.

But one thing is clear: whichever bid wins, it would mark the most significant shift in Hollywood in decades, and quite possibly the direction of global entertainment itself.

Will it be a good thing or a bad thing?

Only time will tell.

Until then…

If this story helped you make sense of the drama currently going on in Hollywood, feel free to share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X.