The Tata Trusts saga explained

In today’s Finshots, we break down the unfolding saga at Tata Trusts where legacy, leadership, and power are all being tested.

But here’s a quick side note before we begin. Trust Finshots for Finance? You’ll love Ditto for insurance.

Built by the same four friends behind Finshots, Ditto is here to make insurance simple. No spam, only honest advice to help people make smart insurance decisions.

✅Backed by Zerodha

✅Rated 4.9 on Google (13,000+ reviews)

✅7 lakh+ customers advised

Click here to talk to an IRDAI-Certified advisor for FREE.

Now on to today’s story.

The Story

A little over a year ago, India lost a titan who changed what power could look like – Ratan Tata. When he passed away on October 9th, 2024, the country mourned as if we’d lost that one teacher who quietly kept us going.

But that grief came with a strange mix of nostalgia and uncertainty. Because while the world was still remembering the man, the Tata empire was learning how to move forward without him. And that’s where the story begins, inside the boardroom of Tata Trusts, where unity and legacy were about to face their toughest test yet.

Two days after Ratan Tata’s passing, the board would make his half-brother, Noel Tata, the new chairman of Tata Trusts, making him one of the most powerful heads of the Tata Empire.

What makes this seat so special, you ask?

To understand that, you need to know the hierarchy. Picture the Tata ecosystem and you might see cars on roads, Titan watches in stores, Westside or Zudio outlets, maybe even your morning Starbucks cup that says “A Tata Alliance.”

All these companies and more ultimately roll up to Tata Sons, the holding company of the multi-billion dollar conglomerate. And sitting even above that, quietly controlling the empire, is Tata Trusts.

So when Noel Tata took charge, it wasn’t just another corporate transition but a shift at the top of the pyramid. And soon after the appointment, the Trusts held its first board meeting without Ratan Tata, and it would be the firestarter of the saga. On paper, it was just another session at Bombay House. But this one carried a different air since the patriarch’s chair was empty, and every decision now had to be made without his quiet nod of approval.

And among the resolutions discussed, one stood out. The board decided that when a trustee’s tenure expires and they’re reappointed, it would now be for life.

And here’s where things got tricky. If any board member opposed another trustee’s reappointment, they’d be considered ‘unfit’ to sit on the board – effectively forcing everyone to agree, or risk losing their own seat. Even more interestingly, if there was disagreement on reappointment, all decisions made in that meeting could be called into question.

Simply put, they either agreed on everything, or nothing at all.

This was a power move if there ever was one, because it effectively meant that trustees couldn’t selectively agree to some decisions and disregard the others later. A rule designed to preserve unity had, perhaps unintentionally, tightened control.

And while the boardroom appeared calm on the surface, a silent countdown had already begun elsewhere – The Tata Sons listing!

The Reserve Bank of India had set a firm deadline: September 30th, 2025. Back in 2022, the RBI had classified Tata Sons as an “Upper Layer NBFC”, which meant it needed to list within three years. And probably nobody had as much to gain from the listing as the Shapoorji Pallonji (SP) Group – the 2nd largest shareholder in Tata Sons, owning about 18%. That stake alone was worth nearly ₹3 lakh crore!

From the 1930s, the SP Group had been the quiet partner in the Tata legacy, helping build homes, bridges, and landmarks across India. But by 2025, its own empire was saddled with over ₹55,000 crore in debt and staring at a $1.2 billion repayment due in December.

Liquidity had become the difference between survival and collapse. And the listing of Tata Sons could’ve been their lifeline to unlock the massive value of their holding. They had already sold the Gopalpur port for about ₹2,000 crores and issued a $3.25 billion bond with an eye-watering 19.75% yield rate to stay afloat.

But as the September 30th deadline for IPO approached, the much-anticipated listing never came. No merchant bankers were hired, no prospectus was filed. Instead, Tata Sons quietly wrote to the RBI, requesting a review of its “Upper Layer NBFC” classification – essentially seeking to avoid the listing.

Because for Tata Trusts, this was about protection.

You see, the Trusts depend on dividends from Tata Sons to fund charitable work. And a public listing would expose them to market volatility and stricter regulations. Risks that could limit their autonomy and philanthropy.

But internal tensions were starting to bubble.

A bloc of four trustees within Tata Trusts — Mehli Mistry, Pramit Jhaveri, Darius Khambata, and Jehangir H.C. Jehangir – opposed the re-appointment of Vijay Singh as the Trusts’ nominee to the Tata Sons board. The reasons cited for this weren’t fully clear, although multiple sources point to a growing power struggle over senior roles.

Vijay Singh wasn’t just another trustee. He was a defense secretary and a close confidante of the late Ratan Tata. And his unexpected removal was the first sign of a fracture. (Vijay Singh eventually resigned from the Tata Sons board but remained a trustee.)

Now a power vacuum rarely stays empty for long, and soon after, there was an attempt to propose Mehli Mistry’s induction to the Tata Sons board. Except this time, Noel Tata and Venu Srinivasan pushed back and blocked it.

So the same bloc that had once resisted Vijay Singh’s reappointment now found itself on the opposite side of Noel Tata’s leadership. By mid-2025, the board had split into two clear camps — Noel Tata, Venu Srinivasan, and Vijay Singh on one side… and Mehli Mistry, Darius Khambata, Pramit Jhaveri, and Jehangir Jehangir on the other.

For the first time since Ratan Tata’s era, the Trusts looked divided.

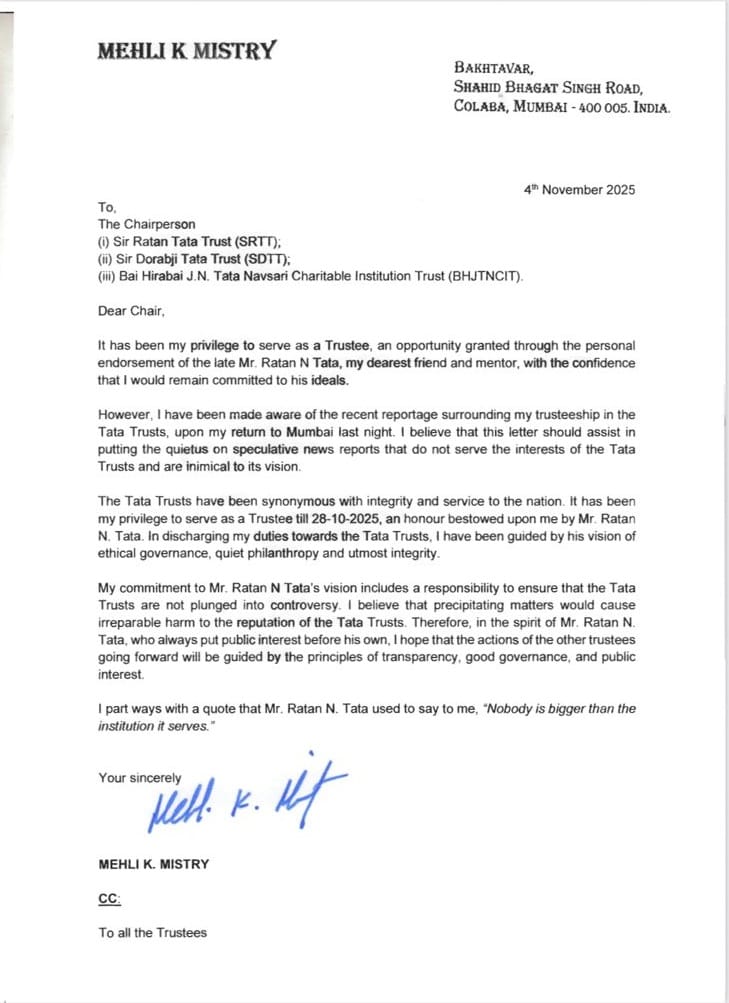

The breaking point came in September 2025. Mehli Mistry, who was the executor of Ratan Tata’s will, proposed his own nomination to the Tata Sons board.

This move was seen by Noel’s side as self-serving, especially amid an already tense governance debate. And when the vote was called, the board was split 3-3 (three in favor, three against). And Noel, as chairman, cast the deciding vote against Mistry.

Days later, when Mistry’s three-year term came up for renewal, the vote again tied 3-3. Once again, Noel’s vote decided the outcome – Mehli Mistry was out.

Of course, that exit wasn’t without flair and drama. Within a week, Mistry filed a legal caveat, signaling a possible court challenge. His exit sent ripples through the group, not just because of who he was, but because of what he represented: it symbolised the fading of Ratan Tata’s old guard.

Around the same time, the SP Group publicly renewed its call for the Tata Sons listing, urging “transparency and governance accountability.”

For the government, this wasn’t just another corporate dispute anymore but more of a confidence issue for the Indian economy. Because the Tata Group isn’t just another business house. It’s one of the oldest, largest and reputed conglomerates in the world. And at a time when foreign investors are pulling out of Indian markets left and right, Bombay House couldn’t appear divided.

So in early October, Noel Tata, Venu Srinivasan, and Darius Khambata were summoned to Delhi for a closed-door meeting with Home Minister Amit Shah and Finance Minister Nirmala Sitharaman. The message was clear: the country couldn’t afford uncertainty at the top of one of its most trusted business institutions. Stability was now a national interest.

When the delegation returned to Mumbai, the mood had shifted. Within weeks, Mehli Mistry withdrew his legal caveat. On November 4, he formally resigned from Tata Trusts, writing that he “did not wish to be a source of discord.” His letter closed with a line Ratan Tata often repeated: “Nobody is bigger than the institution it serves.”

It was a poetic exit, but one that marked the end of an era.

The board was back under Noel Tata’s control, but the cost of that control was unmistakable. The Trusts had survived the crisis, but for the first time, they no longer looked unbreakable.

And after a year, the real test begins now. Keeping the house united and the trust unshaken.

Until then…

If this story helped you make sense of the Tata Trusts saga, share it with a friend, family member or even strangers on WhatsApp, LinkedIn and X. And tell them to subscribe to Finshots too.