To tip or not to tip, that is the question!

In today's Finshots we talk about service charges and all the debate surrounding it

Also, a quick sidenote before we begin the story. At Finshots we have strived to keep the newsletter free for everyone. And we’ve managed to do it in large parts thanks to Ditto — our insurance advisory service where we simplify health and term insurance and make it easy for people to purchase the product. So if you want to keep supporting us, please check out the website and maybe tell your friends about it too. It will go a long way in keeping the lights on here :)

The Story

16th century England was a real jolly place. Apart from the occasional witch hunt, people congregated in coffeehouses and salons to discuss trade and current affairs. And if you were someone who wanted “To Insure Promptitude (TIP)”, you’d drop a coin into a brass box placed out in the front. It was an advance payment of sorts to grease the wheels of service. It’s what you’d do if you wanted to have a server at your beck and call. And it kind of worked.

By the 18th century, the brass boxes had given way to colourful bowls and people were dropping tips as they sipped on tea and munched on some pie.

Tipping had finally taken off.

But cut to 21st century India and you’ll see that voluntary tips have now become all but mandatory. It stands out in your bill front and centre, with the title “service charge.” And it’s creating a bit of a stir, especially back at the Department of Consumer Affairs (DoCA). A couple of weeks ago, they shot off a letter to the National Restaurant Association of India (NRAI) and accused restaurants of forcing customers to pay exorbitant service charges. They wanted an explanation — “Why were restaurants charging this sum without informing customers that it was a mandatory feature? Also, why were restaurants hell-bent on embarrassing customers who sought to exclude it altogether?”

So they set up a meeting on June 2 to discuss the matter.

And once they had some time to deliberate on the matter, they decided to do….nothing.

At least for now. The government’s position hasn’t changed much. They believe that there is no reason for customers to pay a service charge unless they explicitly consented to pay this sum. But they can’t punish restaurants for mandating a service charge either, because they aren’t entirely sure if they have the legal authority to do so. In fact, the only thing that came out of the meeting was a promise. A promise to introduce an official law to weed out the service charge altogether.

But NRAI is still busy tweeting out clarifications with the hashtag ServiceChargeIsLegal. So it’s anyone’s guess what happens now.

This is also a throwback to 2017 — when the same debate took centre stage. DoCA actually published guidelines explicitly stating that the service charge was a voluntary matter and restaurants couldn’t force it upon diners. It called it a “restrictive trade practice under the Consumer Protection Act” and noted,

“that entry of a customer in a restaurant cannot be itself be construed as a consent to pay service charge. And placing of an order by a customer amount to his/her agreement to pay the prices displayed on the menu card along with the applicable taxes. Charging for anything other than the afore-mentioned. without express consent of the customer. would amount to unfair trade practice as defined under the Act."

Everyone breathed a sigh of relief and hoped that things would change for the better. But, it didn’t. Nothing changed.

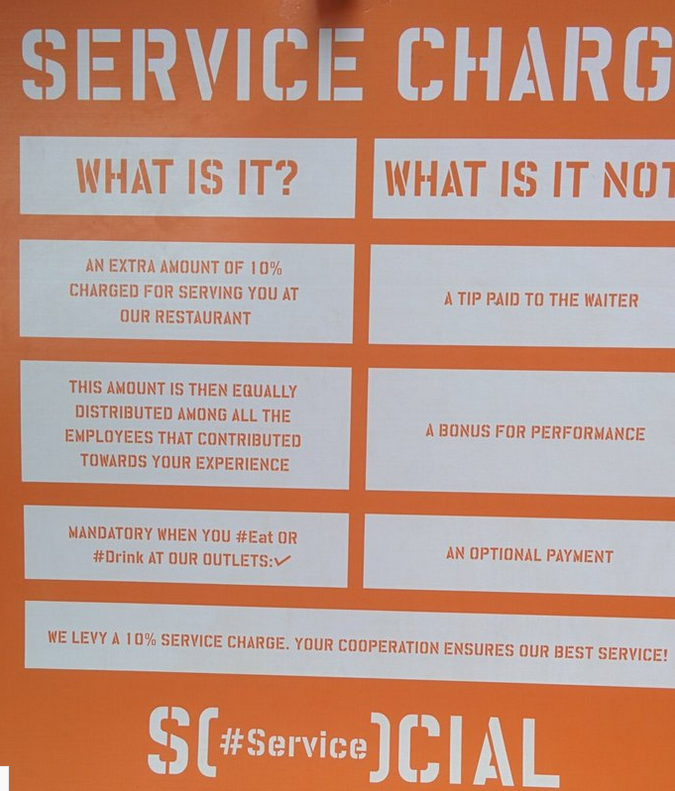

NRAI even went on to say that if customers didn’t want to pay a service charge, they shouldn’t eat at restaurants. Meanwhile, popular gastropubs like Social put up boards outside their establishments clearly stating that the service charge was mandatory — and that it was not a “tip” to the server

So what was the point of the guidelines then?

Well, customers do have the provision to take their grievances to consumer court. However, that is a bit of a hassle since nobody has the time and patience to haggle over a few hundred rupees. In fact, only a measly 81 people took to court during the whole of 2020! But when they do, they have been rewarded — like a case from 2021 when the District Consumer Disputes Redressal Commission in Hyderabad ordered the AnTeRa restaurant to refund the service charge and compensate the customer with ₹3,000.

However, there is another side to the story.

What if the service charge is clearly printed on the menu for all to see and the consumer still refuses to pay? What happens then?

Well, it’s a bit tricky.

Take for instance this case from 1999. Mrs S.S. Ahuja, a resident of Mumbai, dined at the Pizza Express in New Delhi only to find out that the restaurant had imposed a 9% service charge. She believed this was patently unfair and took the matter to court. But the restaurant was having none of it. Their argument was simple — “All charges were clearly mentioned on the menu card and that they were in full compliance with the law.” After some back and forth, the Monopolies and Restrictive Practices Commission agreed with the restaurant’s version. In a December 2001 decision, they noted that there was no provision deeming the service charge illegal, and thus we arrive at another crossroads.

There are judicial orders describing service charge as "not illegal", and it kind of explains why NRAI has been tweeting about the “legality” of the “service charge.”

Perhaps the only thing that will add clarity is a “legal framework.” A framework that the government has promised to introduce, soon. So honestly, we will probably have to wait and see what that will contain.

At this point however, you could go — “If the service charge is so contentious, why do restaurants even bother outlining it as such? Why not simply inflate the cost of food and beverages to compensate for this? Isn’t that a more prudent alternative? Won’t that set aside the confusion entirely?”

Well, restaurants could do that. But there is a distinct advantage in outlining the service charge separately. When you’re ordering food, you are subconsciously keeping a tab on the total cost. If it reaches a certain threshold, you’ll likely prune your spending alongside it.

Now imagine a menu with an inflated price (accounting for the service charge). You’ll hit the threshold sooner and likely adjust your total spend. But if the service charge were added separately, you’ll only know about it when you receive the cheque. Most people will simply overlook this aspect entirely even if it’s printed on the menu. And some speculate that this is one reason why the service charge is added separately. It’s a surprise package — one that optimizes outcomes for restaurants.

The second question here is this — “If the service charge were in fact a tip, meant to improve the welfare of staff, shouldn't it be mandatory for restaurants to distribute the proceeds to these people?”

Well, not quite. Some restaurants swear that they distribute the proceeds diligently to the staff members. But others aren’t as prompt. They may simply pocket a sizeable chunk of this themselves without extending the benefit to those who are on the actual grind.

This is perhaps what bothers most people. The fact that they can never fully know what happened to the money.

Finally, there’s one other matter we need to discuss — GST on service charges!

If you’ve dined out recently, try to pull out an old bill and parse through it once again. You’ll probably see that there’s an added tax on the service charge. Is that a problem? Technically, no. GST is typically charged on the total bill. But, the point of contention here is that if a “service charge” is in fact voluntary, can you still impose a tax on it?

Well, the Hindu BusinessLine tried to find an answer 3 years ago and here’s what they found. One official from the Finance Ministry argued that GST had to be levied on the service charge. But, another senior official disagreed stating that “service charge is not taxable.”

Even the officials are confused it seems!

So if you’re the kind that thrives participating in a good old verbal engagement maybe you can battle it out with the restaurant manager the next time you see service charges printed on your bill. Or if you don't like confrontation, maybe you could simply wait for that legal framework before you take a firm stand on the matter. Until then let us know if you’ve ever had a debate on the service charge with a restaurant manager. Tweet at us and don't forget to share this article on WhatsApp, Twitter and LinkedIn...