The Rise and Fall of 8K Miles Software aka SecureKloud

In this week's Finshots Markets, we dive into how a company that was once the next big thing lost the plot. The arrest of two of its co-founders isn’t a good look, no?

The Story

Can a rebrand breathe new life into a company whose promoters are accused of fraud?

Temporarily, I guess. Because as Abraham Lincoln said, “You can fool all people some of the time and some people all the time. But you can never fool all people all the time.”

And maybe that’s the story of SecureKloud Technologies — a tech company trying to capture the cloud.

Now you may not have heard of this small-cap stock before. So let’s rewind a bit and maybe it’ll jog your memory. If you’ve been tracking stocks for at least half a decade or more, that is.

The year was 2008. And a tech entrepreneur named Suresh Venkatachari decided to try his hand at a new venture. He’d sold his previous business and he wanted to try something new. He thought the ‘Cloud’ would be the next big thing. Physical servers in every company would be a thing of the past. So he roped in two of his associates RS Ramani and Harish Ganesan. Amd together, they incubated a company called 8K Miles Software at the Indian Institute of Management Bangalore (IIMB).

The name?

Well, the earth’s diameter or the distance from one end to the other through the equator was roughly 8,000 miles. So yeah, Venkatachari wanted his cloud business to be global. And he picked this name.

The company even went public in just 3 years. Not through an IPO but through a reverse merger. Basically, they acquired a dormant company that was already listed on the exchange. It was a simple route to get a toehold in the market.

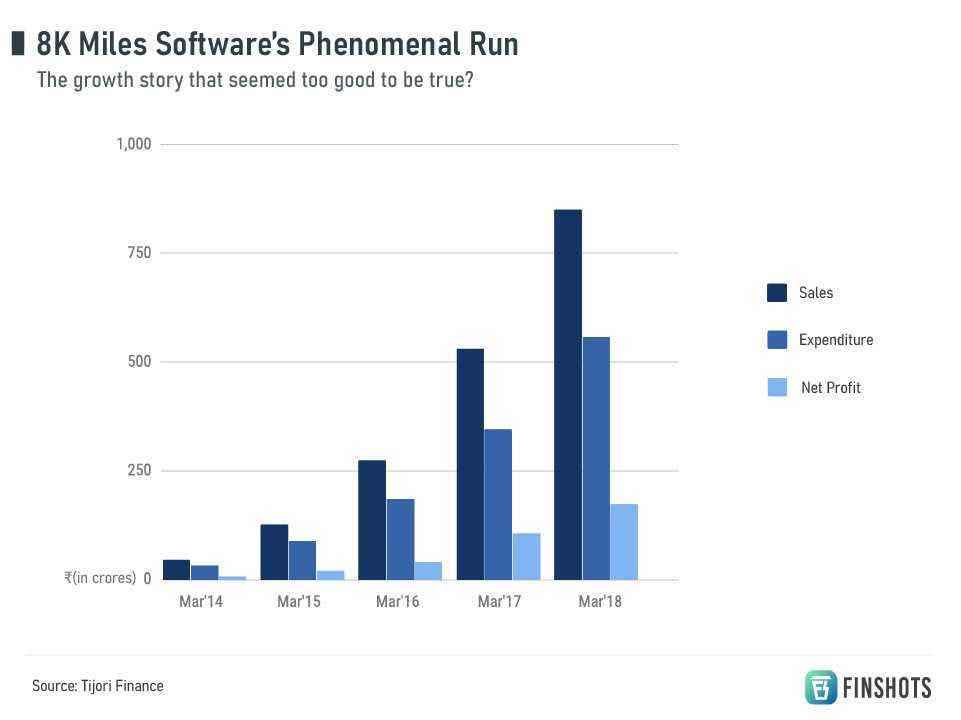

And pretty soon, investors were impressed by its financial results. The revenue grew by 130% annually from FY14 to FY17. Its net profits kept pace with it. And its stock price soared by nearly 1500% too.

Mutual funds companies such as DSP BlackRock bought a fairly significant 3.5% stake in the company. When Sandeep Tandon (who runs Quant Mutual Fund today) picked up a 6% stake, everyone’s ears perked up too. It showed that serious investors saw promise in the company.

And everyone pointed to one thing — how companies were moving to the cloud for their needs. That the migration was happening faster than anticipated. 8K Miles was supposed to be in a sweet spot to ride these tailwinds. And when the revenues soared, everyone put it down to the industry’s phenomenal performance. Microsoft even had a blog in 2016 calling 8K Miles a leader in the life sciences space for cloud IT security.

Everything seemed credible.

Until one fine day, its auditor Deloitte resigned in a shock move. It yelled ‘fraud’. And suddenly, everyone woke up. The share price crashed by 90%.

SEBI jumped in and began investigations. It appointed Grant Thornton to run a forensic audit and the skeletons came tumbling out.

When SEBI published its final order in December 2022, it said that 40% of 8K Miles’ revenues came from just 3 customers during 2018 and 2019. And that immediately after the forensic audit began, the revenues dropped like a rock. From ₹842 crores to just ₹382 crores in FY20. In fact, the businesses under the ‘international business’ segment basically evaporated into nothing.

And it’s not like these customers were prompt with their payments either. Only 26% of the money due was actually received. And 37% was written off as bad debts. Yet, 8K Miles continued to deal with them.

Fishy, no?

Then there was the vendor — an entity named Nationstar IT Services that was based out of Dubai. Nearly 35% of expenses were attributed towards ‘consultancy’ services for this firm.

Now when Grant Thornton asked 8K Miles for details of these deals, they found that there was nothing on email. The company claimed that only specific employees interacted with these entities. And since they’d all left the company, their emails were wiped out.

Now that’s always a suspicious excuse.

But here’s the craziest part.

See, Grant Thornton found out that the authorized signatory for NSIT was someone named Ms Gayatri Ramaswamy Nurani Iyer. And when they couldn’t find too many details about her, they actually found someone who ‘looked like her’ when they scoured LinkedIn. And this Ms Iyer was employed by a Tamil FM radio station in Dubai.

Now guess who was the MD and CFO of this radio station for a while?

Why, one of the co-founders — RS Ramani, of course.

And Grant Thornton believed that those 3 important customers of 8K Miles and this 1 vendor were all linked to each other. And that all those sales and salaries that were recorded in the books were cooked up. Fictitious. Fake. Fraudulent.

So when people looked at the revenue growth and went “wow”, they were being fooled by the company. And SEBI wasn’t too happy about it. In December, it barred Suresh Venkatachari and RS Ramani from the markets and imposed a fine on them And asked the company to cough up over ₹10 crores too.

But while SEBI’s investigation was in progress, Venkatachari wasn’t sitting idly. He tried to put the demons to rest. The company went through a complete overhaul — and called itself SecureKloud in January 2021.

And for a while, people seemed to have forgotten that serious allegations of fraud were levelled against this company. It witnessed a 2x jump in its price. Even as Vekatachari continued to run the business as the CEO. Ramani had exited his role as the CFO by then even though he continued as a promoter of the new company.

But the good times didn’t last. The shares dropped by 80% over the past 1.5 years. And now, both Venkatachari and Ramani have been arrested by the Enforcement Directorate. The allegation — some form of money laundering.

Now you have to ask — when you have a company that’s mired in deep controversy, why would anyone invest in it?

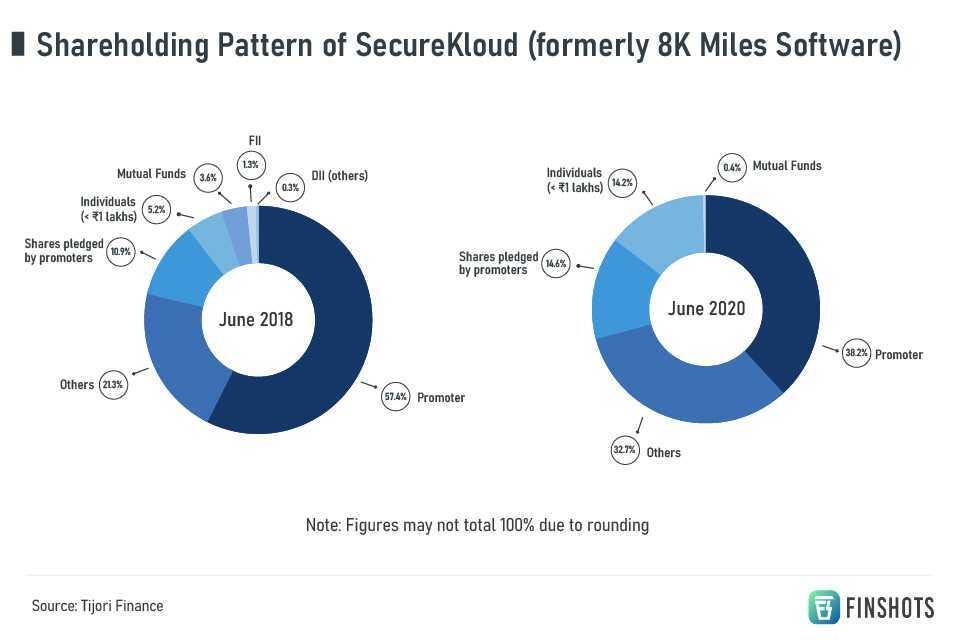

Just look at the shareholding pattern. In June 2018, retail folks who’d invested less than ₹1 lakhs owned 5% of the company. But by June 2020, they owned almost 33%. They were being suckered into buying more of the company. And they continue to hold on.

And if the rebrand with the same CEO should’ve been a warning sign that they were trying to wash off the sins of the past, no one cared. Sure, the big institutional names stayed away. The mutual funds learnt their lesson. But the retail investors held on in the hope that the company would regain some of its former glory.

8K Miles or SecureKloud looks to be just another company that maybe got a little too greedy. In trying to be a cloud company for the future, they seem to have forgotten that the long game is won by people who pay heed to corporate governance. And it’s a lesson that investors will do well to remember the next time they try to cash in on stock in the middle of a purple patch that’s ‘too good to be true.’

For today’s SecureKloud, the sins of the past keep coming back to haunt it. Can it work its magic now and come back stronger? Or is it game over? What do you think?

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you’re at it. We only have a limited number of slots everyday, so make sure you book your appointment at the earliest:

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!