The Real Estate Bailout

In today's newsletter we talk about the 25,000 crore booster package offered to the Real Estate Industry

The Screw Up

The government is setting up a bailout fund for the real estate industry. Rs 25,000 crores will be pumped into housing projects in the affordable and mid-income categories. The hope is that this money can then be used to complete projects in the final stages of development so that homebuyers and Real Estate developers can breathe a sigh of relief.

But that’s not the real story.

The real story is the massive screw up here. How on earth did the Real Estate Industry get here in the first place? Where did they go wrong? Why does the industry need bailouts time and time again?

And to answer these questions, we need to go back in time.

Backstory

The problem can be traced back to the economic boom of the 2004–2008 era when GDP growth was constantly surging at 9–10% every year. In a bid to exploit the growth opportunities available, Real Estate Developers launched new projects worth lakhs of crores setting off the biggest investment boom in the country’s history. Until in 2008, the Global Financial Crisis (GFC) threatened to ravage the entire world economy.

India, however, emerged out of the GFC relatively unscathed. But growth rates moderated. The most affected were Real Estate companies who had overstretched themselves after having borrowed large sums of money to commission expensive projects. And by expensive, we don’t mean 50 Lakh expensive. we are talking about several crores expensive. And these projects weren’t selling.

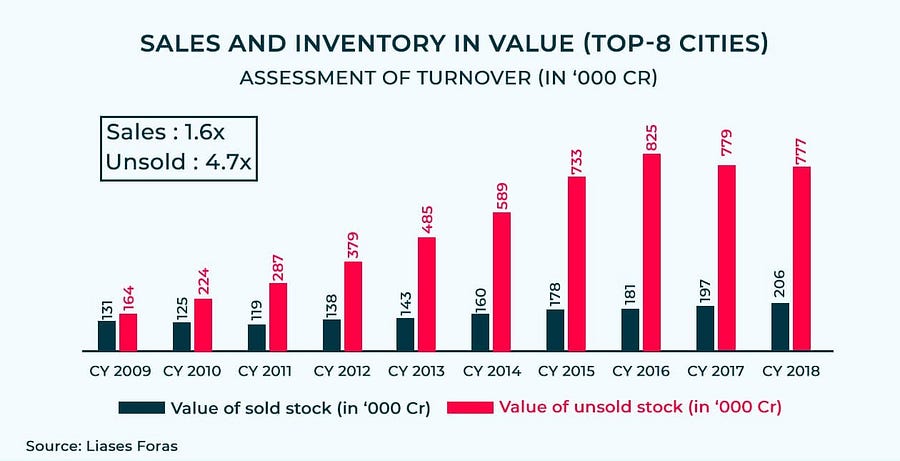

Think about it. You can’t expect a middle-income consumer to fork over 1 Crore for a 2 BHK property. It's preposterous. Also, as housing prices increase, rental yields on properties tumble. Rental Yield i.e. rent measured as a proportion of the total property value stood at about 6% back in 2008— meaning you could earn about Rs.6 in rent every year if you buy a house worth Rs. 100. But by 2015, rental yields had tumbled to 2%. This isn’t a worthwhile money-making opportunity when you are expected to pay close to 10% in home loan interest. So inevitably unsold homes started piling up.

And every time an unsold home piles up somewhere, there’s a Real Estate developer who is not getting paid. The best recourse here is to simply reduce prices. Once you sell properties at a discount, you can get rid of the unsold inventory and improve your prospects considerably.

So why not just do that? Why not cut prices?

Well, because they couldn’t.

The Cost Problem

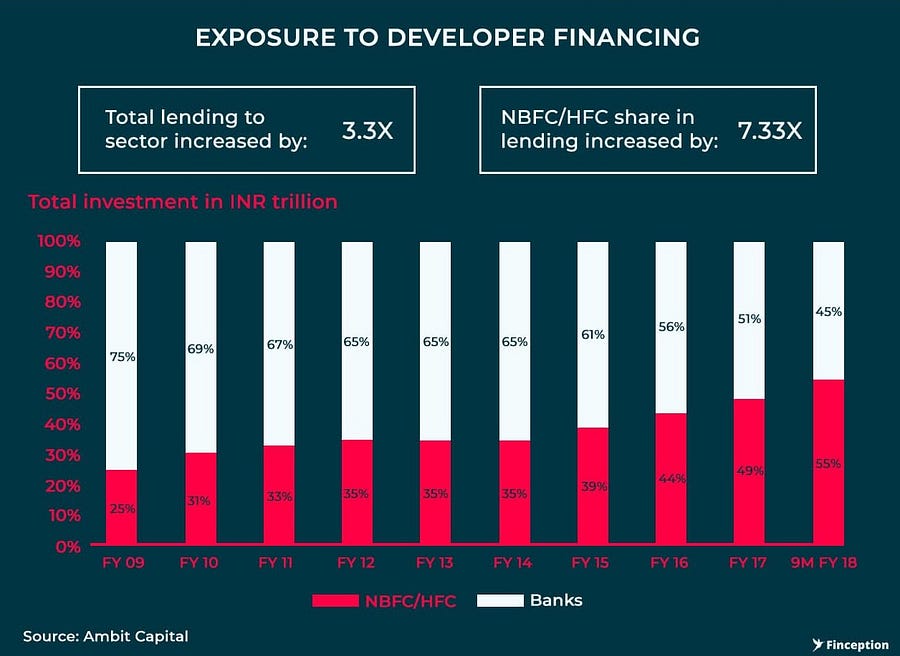

By now, banks were becoming increasingly wary of financing risky projects after the Reserve Bank of India forced them to take stock of the NPA problem. They had already loaned out millions to dodgy corporates and the likelihood of retrieving this money was slim. So why loan more money to Real Estate players, when you know they’re already suffering.

So most banks refused. Even the ones that did offer loans sought higher interest rates. Inevitably, development costs soared. So with profit margins declining, real estate developers were slowly running out of room to cut prices. Any further erosion in price would mean selling properties at a loss — a surefire way to bankruptcy. And that was a big no-no. In addition to this, there was another more sinister reason lurking in the shadows.

When you bring down prices, you have to revalue other properties you own. So the next time you go asking for a loan, the banks will want to look at your collateral i.e. the said properties you own. If this collateral is worth 50 lakhs, banks won’t lend you a lot of money. If the collateral is worth a fortune, say 2 Cr., you can still have a shot at borrowing large sums. So there was no real incentive to cut prices. On the contrary, there was every reason for them to sell properties at even higher prices.

The End Game

By 2016, banks had handed over the baton to Non-Banking Financial Corporations. And the NBFCs had a point to prove. They had always played second fiddle to large public/private sector banks. But now the time was ripe. There was money lying on the table and they weren’t willing to say no. Many NBFCs pursued dodgy real estate developers and financed some very risky projects. Although this inevitably propelled growth it came at a very steep price. When the NBFC crisis took center stage last October, they realised that they were walking on thin ice. And soon enough they cut funding to the Real Estate Industry.

Add to this the unfavourable Regulations, Black Money Act, Demonetisation, GST, and the Real Estate Industry was on the verge of collapse. Their greed and extravagance had finally given way to misery.

The cycle was now complete.

At this point, you’re probably thinking its best to let them be. The Real Estate Industry has no business asking for a bailout. So why help them at all. Right? Unfortunately, it's not that simple. Amidst all this, hundreds and thousands of homebuyers are left stranded because many of these developers have no money left to fulfill their obligations. It’s not the developers that need the lifeline. It's the homebuyers that need them the most.

Then there is the contention that some of these developers might mend their way if offered a lifeline. That they might finally stick to being prudent and clean up this mess. we are not sure about this assessment but we think the government figures that if this plan doesn’t work out, Real Estate in this country is going to the dumps.

Either way, we hope there's a silver lining here and things start improving soon.

Share this article on Whatsapp.

Update: Also yesterday, we hit 50,000 subscribers on Finshots. And throughout this journey, your support has been immense. So we can't thank you enough for spreading the word. We are forever indebted :)