The PhysicsWallah IPO explained

In today’s Finshots, we break down the PhysicsWallah IPO which opens for subscription today and closes on November 13th, 2025.

But before we begin, here's a quick announcement: Finshots Idea Lab is back!

After the massive love and excitement of Season 1 of our national-level case competition, we’re back with an even bigger challenge!

Compete in 3 rounds to solve real-world business problems and receive cash prizes worth ₹2.25 Lakh, Pre-Placement Interviews, exclusive goodies and a lot more!

Know more about the competition and click here to apply!

Now on to today’s story...

The Story

When we talk about revolutions in Indian education, we often point to the 1990s… liberalisation, private universities, and the IT boom. But the real transformation came later, quietly, through the lens of a camera. Teachers who once filled cramped classrooms suddenly had an infinite audience. Lessons that cost ₹50,000 were now free on YouTube. And in this world a small YouTube channel called PhysicsWallah quietly changed the rules. Because what was started by a young physics tutor named Alakh Pandey, is now a unicorn. It’s a ₹2,800-crore-revenue company, backed by marquee investors, running thousands of classrooms, and now, it’s gearing up for a ₹3,480 crore IPO this week.

But to understand PhysicsWallah, we need to zoom out to the business of education itself.

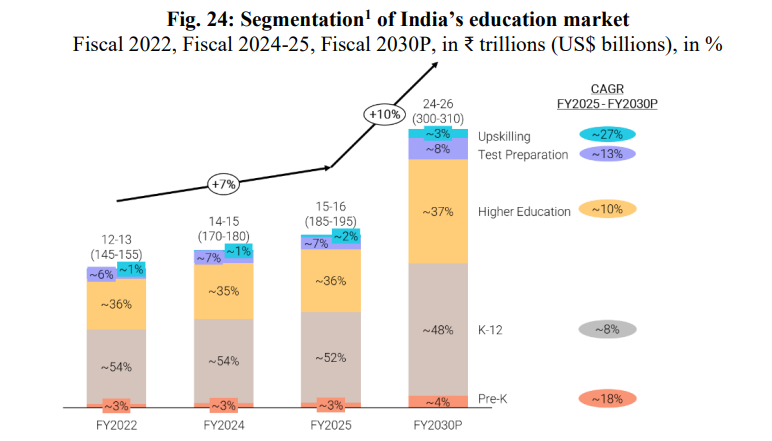

India’s education market, worth roughly ₹15 lakh crore, isn’t a single monolith. It’s a collection of overlapping ecosystems. The biggest piece is K–12 schooling where over 25-28 crore children enrol every year and spend their early years. Then comes higher education with 1,000-plus universities and over 45,000 colleges. And beyond that lies the “shadow system” i.e. test preparation, which exists parallel to the formal structure but is arguably more influential. It’s where millions of aspirants prepare for IITs, medical exams, UPSC, banking, and other competitive or government job exams. And increasingly, there’s a fourth segment — upskilling, with short courses and certifications for professionals chasing better opportunities.

Of these, test prep has become the most commercially explosive. It’s estimated to be a ₹1 lakh crore market, growing at a double-digit pace. Until a few years ago, it was highly fragmented from small local coaching centres, a handful of brand-name hubs, and word-of-mouth reputations built around star teachers. But edtech startups changed that dynamic. They saw an opportunity to standardise quality, scale content, and use technology to make one great teacher accessible to millions. And that’s exactly the thesis on which PhysicsWallah was built.

You see, the story began in Allahabad (now Prayagraj) around 2016. Pandey, who’d dropped out of an engineering college, started teaching physics to small batches of students. Then he began uploading his lectures on YouTube which were free, simple, and in Hinglish, for students who couldn’t afford expensive coaching. And his teaching struck a chord. Within months, those videos were racking up millions of views. So by 2020, PhysicsWallah launched its own app and website, turning into a structured edtech business. And it now had courses beyond physics from chemistry and maths to biology with a growing community that trusted the brand.

But what made it stand out was affordability. While Byju’s sold packages costing tens of thousands, PhysicsWallah’s courses were often priced under ₹1,000! The idea was to democratise access, not maximise margin. And that positioning of mass-market, low-cost, credible teachers built extraordinary goodwill. As the pandemic turbocharged online learning, it became a national phenomenon. And by 2022, it raised $100 million from investors like WestBridge and GSV Ventures, joining the unicorn club with a valuation of $1.1 billion!

But the founders knew the online boom wouldn’t last forever. Once physical classrooms reopened, students wanted face-to-face learning again. And that’s when PhysicsWallah pivoted fast. It expanded into offline centres and built what it now calls a “hybrid ecosystem”. The company’s strategy became simple: attract students online through its free content, then convert them into paying users in offline or hybrid classrooms. That’s why about 95% of its 46 million students first engage online, and around 70% of those who join offline centres are repeat users from the app or YouTube. It’s a funnel that turns attention into enrolment at minimal marketing cost.

And this offline push has been aggressive. How aggressive, you ask?

Well, PhysicsWallah launched “Vidyapeeth” centres — large-format coaching hubs in metros and tier-1 cities, and “Paathshaala” centres in smaller towns. Today, it has about 198 centres across 109 cities.

It’s also been busy acquiring regional players to localise its reach: OnlyIAS for civil services prep, Xylem Learning in Kerala to capture southern markets, and Utkarsh Classes in Rajasthan to tap into vernacular content. In short, PhysicsWallah is doing to coaching what national restaurant chains did to regional eateries: consolidating a scattered market through scale, standardisation, and brand trust.

Financially, the strategy has paid off in growth. In FY23, the company reported ₹772 crore in revenue. By FY25, it had crossed that to ₹3,039 crore. That’s a two-year compounded annual growth rate (CAGR) of roughly 100%. The offline business has been the key driver, shooting up from ₹281 crore to ₹1,352 crore during that period. Online still provides massive reach with millions of students paying smaller fees, but offline centres bring higher average revenue per user (ARPU) and better monetisation.

However, the same shift that drives growth also drives costs.

Because see, running classrooms isn’t cheap. You need to figure out teacher salaries, rent, and operating costs which can pile up quickly. PhysicsWallah’s employee expenses alone rose 21% to ₹1,401 crore in FY25, while marketing and publicity costs jumped 41% to ₹276 crore. So despite its reputation for thrift, this is a business where human capital is the real product. Teachers account for over half of total costs, and teacher churn is an existential risk. The company sees 25–30% attrition each year, and some of its top JEE and GATE faculty have left to launch rivals.

Yet, PhysicsWallah has managed to stay relatively disciplined.

Losses, which ballooned to ₹1,131 crore in FY24 (largely due to goodwill write-offs and one-off non-cash accounting charges), narrowed sharply to ₹243 crore in FY25. And on a normalised basis, the core business is inching toward breakeven. For context, Byju’s was losing roughly ₹4,500 crore a year at a similar scale of revenue. PhysicsWallah’s relatively lean cost structure, partly because of its strong organic marketing, gives it a fighting chance at profitability.

So we could see the IPO as a test of whether investors buy that story.

Of the ₹3,480 crore the company plans to raise, ₹3,100 crore will come from a fresh issue and ₹380 crore from an offer for sale (OFS), under which founders Alakh Pandey and Prateek Maheshwari will each sell shares, while institutional investors like WestBridge, Lightspeed, and GSV are staying put. That’s a good signal as it shows that long-term capital isn’t rushing for the exit. And where will the fresh funds be used? Mainly to fuel offline growth. About ₹460 crore will go into opening new centres, ₹548 crore for leasing and facility costs, ₹710 crore for marketing initiatives, and ₹200 crore to upgrade technology infrastructure. And a smaller portion, roughly ₹48 crore, will be invested into subsidiaries like Xylem and Utkarsh for lease related payments.

Which brings us to the valuations of this IPO.

At the upper end of the ₹109 price band, the company would be valued at around ₹31,000 crore — about 10 times its revenue. For comparison, listed education firms like Veranda Learning trade around 4x revenue, while older coaching players like Career Point trade below 2x. But PhysicsWallah’s valuation reflects its scale, brand, and hybrid model. Plus, it has a 10 crore-strong digital community that few peers can match. Nevertheless, the valuations might seem high for a brand that is still struggling to see profitability.

And there are other risks as well. For one, expansion is capital-hungry. Each new centre takes nearly two years to break even, and scaling too fast could stretch management bandwidth. Second, the test-prep market itself is cyclical and sensitive to regulation. Any policy changes in major exams like NEET or JEE can alter demand overnight. Third, this is a teacher-driven business. If high-profile educators leave, students often follow. And as rivals like Unacademy and Aakash (now part of Byju’s) fight to regain ground, retaining faculty will remain a constant battle.

But despite these risks, the opportunity is enormous. India’s test-prep industry is still only partly organised. Tier-2 and Tier-3 cities, where incomes are rising and aspirations are exploding, are PhysicsWallah’s strongest hunting ground. With its low-cost pricing, strong community engagement, and expanding offline footprint, it has a real shot at dominating this middle-market segment.

The timing is symbolic too. Just three years ago, edtech was the darling of venture capital and today, it’s viewed with deep suspicion. Byju’s is mired in lawsuits, Unacademy has shrunk dramatically, and investors have largely written off the sector. So if PhysicsWallah keeps ticking the right boxes, and starts delivering even modest profits, it could restore some credibility to India’s education startups.

In that sense, this IPO isn’t just a financial event but a referendum on the entire edtech model. Can education be scaled responsibly without losing its soul? Can an enterprise built on free YouTube lectures sustain itself under public scrutiny? And can a teacher-turned-entrepreneur from Allahabad convince Dalal Street that education, done right, can be both meaningful and profitable? These are the questions investors need to ask themselves.

PhysicsWallah has already passed the hardest exam of capturing the imagination of millions of Indian students. Now, it faces a new test of winning over investors. And this time, the report card won’t be written on a blackboard.

Until then…

If this story helped you understand PhysicsWallah's IPO, share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X.

Message to all the breadwinners

You work hard, you provide, and make sacrifices so your family can live comfortably. But imagine when you're not around. Would your family be okay financially? That’s the peace of mind term insurance brings. If you want to learn more, book a FREE consultation with a Ditto advisor today.