The LG Electronics India IPO

In today’s Finshots, we break down the LG Electronics India IPO, which opens for subscription today and closes on October 9th.

But before we begin, if you love keeping up with the buzz in business and finance, make sure to subscribe and join the Finshots club, loved by over 5 lakh readers.

Already a subscriber or reading this on the app? You’re all set. Let's get started with the story!

The Story

You’re probably thinking, “Another IPO? Haven’t we had enough already?” Fair point. But this one’s not your regular market debut. It’s the biggest listing of the year after Tata Capital, and it comes from a company that’s probably sitting right in your living room.

Because if you grew up in an Indian home in the 2000s, you already know LG. The maroon logo with a smiley on your fridge, or your TV, or the washing machine humming in the corner. It wasn’t just another brand but a part of many Indians’ daily life. And now, that same company wants to sit not just in your living room but in your portfolio.

LG Electronics, the Korean parent, is taking its Indian arm public. The offer size is ₹11,607 crores, and not a rupee of it will go to the company. It’s a pure offer-for-sale (OFS) where the parent is simply cashing out a slice of its stake after nearly three decades in India.

Which begs the question – why list something that doesn’t need the money? Well, because LG India has quietly grown into a heavyweight that deserves its own valuation tag. And India’s electronics market is a good example of why.

Air conditioners have more than doubled in size, from ₹1.55 lakh crore in 2019 to ₹3.2 lakh crore in 2024. Home entertainment systems have expanded 2.5x in the same period, from ₹37,000 crore to ₹89,500 crore. But despite this boom, India still lags far behind other nations. Refrigerators reach only 35% of Indian homes, compared to 99% in China and 80% in the US. Washing machines? Just 22%. And microwaves? Barely 4%, versus 80% in the US and 20% in China. And come to think of it, that’s more of a potential runway for growth than a problem. And that’s the bet LG wants to own.

The growth potential it is looking for is the untouched markets. The metros are saturated. The next frontier is Tier-2 and Tier-3 India, where rising incomes are meeting rising aspirations, and where appliances are still status symbols. So for LG India, that’s the new battleground. And with decades of trust and a massive presence, it could start with an upper hand.

Its business today is split across two pillars: home applications and air solutions, and home entertainment. The first covers washing machines, refrigerators, and air-conditioners; the second includes TVs and audio systems. Together, they’ve built India’s largest consumer electronics distribution network with over 35,000 retail (B2C) touchpoints spanning metros and small towns alike. And it doesn’t stop there. LG also runs the country’s biggest after-sales service network with 1,000+ service centres and over 13,000 service engineers.

On the manufacturing side, its two plants — in Pune and Noida — can churn out 14.5 million products a year. That makes LG the largest in-house manufacturer of appliances in India. More importantly, the plants are designed for flexibility: a single assembly line can handle multiple products. And over half of LG’s raw materials (about 54%) now come from Indian suppliers, thanks to local vendor tie-ups. That means faster production, lower import bills, and stronger “Make in India” credentials.

This scale and integration have made LG a market leader across four key categories — washing machines, refrigerators, TVs, and inverter ACs.

In FY25, its home appliances and air solutions division brought in ₹18,267 crores, or 75% of total revenue. Home entertainment added the remaining 25% with ₹5,672 crores. And that took the overall revenue to ₹24,366 crores, a steady rise from ₹21,352 crores a year earlier.

Profits follow a similar pattern. LG India’s profit after tax (PAT), or the money left after paying all expenses and taxes, has risen steadily from ₹1,348 crores in FY23 to ₹1,511 crores in FY24, and ₹2,203 crores in FY25. Its return on equity (ROE), which measures how much profit a company generates for every rupee of shareholder money, improved from 27% in FY23 to 45% in FY25, while return on capital employed (ROCE) rose from 39% to 47% during the same period, showing just how efficiently LG uses its assets.

So yeah, those are strong numbers for a 28-year old business. Which also answers our first question as to why the IPO isn’t about fundraising but signalling. That LG India is now big, profitable, and mature enough to stand on its own. The parent company is trying to unlock shareholder value, and prices LG’s India operations based on its individual performance.

And it’s not an empty claim. Revenues have grown at 10.7% compounded annual growth rate (CAGR) between FY23 and FY25. The company also plans to deepen localisation further and may even set up a third plant in Andhra Pradesh. So even though the IPO proceeds won’t flow into India operations, listing visibility itself could strengthen partnerships and supplier confidence.

All of which brings us to valuations of the IPO.

The IPO price band is set at ₹1,080–₹1,140, implying a price to earnings (P/E) multiple of roughly 33–35x and a market cap of ₹77,000 crores. That’s lower than the industry average of 43x and puts LG India just below Havells (₹93,000 crore) in market valuations. Sure, there are other domestic peers like Voltas, Whirlpool, Blue Star, but they are smaller and less diversified. And since global rivals like Samsung, Sony, and Haier aren’t listed here, LG’s IPO stands out as India’s first true consumer-electronics giant on Dalal Street.

But every legacy also has its cracks and you could see some for LG Electronics India too.

Nearly 75% of LG India’s revenue in FY25 went into raw material costs, and 46% of those materials are imported from China, Korea, and Singapore. That leaves it vulnerable to currency swings and supply disruptions. It’s why the company has been actively working to localise more of its supply network and reduce import dependence.

Competition in urban markets also remains brutal. So the next phase of growth depends on expanding deeper into India’s hinterland, where affordability and service reliability could decide who wins.

Then there’s the dependency risk. LG India operates under a licensing agreement with the Korean parent, paying royalties of 2.3–2.4% (depending on the product) of sales for using its brand and technology. That’s fine when relations are steady. But if the parent tweaks terms or withdraws access, the Indian arm could lose the very identity that built its success. The parent company also owns another Indian subsidiary, Hi-M Solutek, which handles maintenance for LG’s air-conditioners. For now, it works exclusively with LG India — but the contract isn’t binding. Any shift there could disrupt its massive service backbone.

And there’s also a ₹4,717 crore tax dispute hanging over the company, which is nearly 73% of its current net worth. If the verdict doesn’t go its way, it could dent future profits.

Still, despite those risks, this isn’t a company selling a dream. It’s selling a record. It’s not asking for money to build something new; it’s inviting investors to value what’s already built.

And only time will tell whether that ‘Lucky Goldstar’ turns out to be lucky for investors too.

Until then…

If this story gave you a quick breakdown of the LG Electronics India IPO, do us a favour and tell your friends, family, or even strangers about us on WhatsApp, LinkedIn, and X.

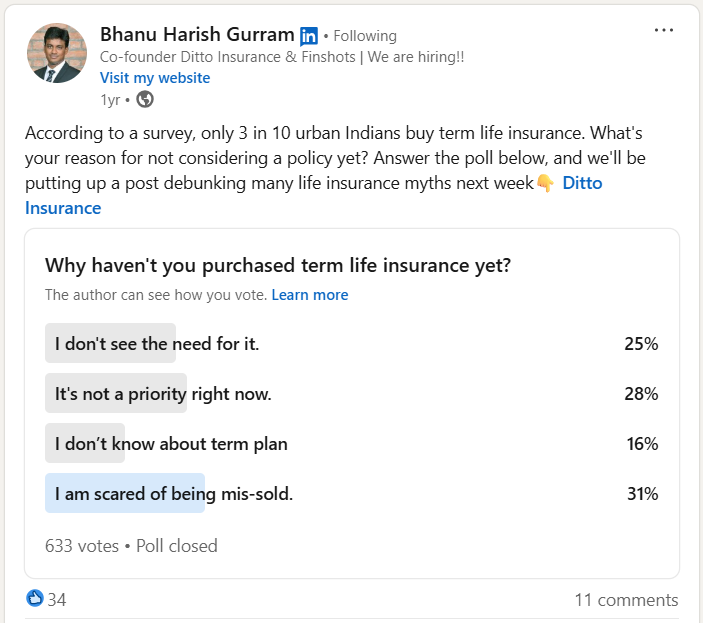

Our Co-founder Asked People Why They Avoid Term Insurance. The Top Reason? Right Here. 👇

31% said their biggest fear is being mis-sold. Many worry that agents may push costly plans or add confusing extras without full transparency.

That's a valid concern. After all, how can you trust something you don’t completely understand?

That’s why Ditto, a product of Finshots, has pioneered India’s #1 Spam-Free insurance platform. Our IRDAI-Certified advisors offer honest advice and help you find the right plan. Book a FREE consultation today.