The Groww IPO explained

In today’s Finshots, we break down Groww’s IPO, which opens for subscription today and closes on Friday (November 7th, 2025).

But before we begin, if you like stories that make business and finance actually make sense, then hit subscribe by clicking here. If you’re already a subscriber (or reading this on the app), just scroll down – today's story's a good one.

Also here’s a quick disclaimer. Groww is a direct competitor to Zerodha, and Zerodha, through its fund Rainmatter, is an investor in Finshots. Please don’t treat any part of this story as investment advice, and as always, make investment decisions only after conducting your own due diligence.

The Story

Most of our business stories begin with some unique backstory of how it all started and then shot up to glorious heights.

But Groww doesn’t come with that sort of flashy origin tale. Even its legal name, “Billionbrains Garage Ventures”, sounds like it should have an interesting story behind it. But it really doesn’t. It feels more like one of those names meant to capture the classic startup dream of humble beginnings and big ambitions. Groww began pretty much the same way and with one simple goal — to make investing easy, especially for everyday people like you and me.

When they started, this was a big deal. Because back then, around 2016, the National Stock Exchange (NSE) had only about 50 lakh active investors. Not because Indians didn’t care about growing their money, but because investing felt intimidating, complicated and expensive. And most folks didn’t really understand financial products the way they do now.

So four colleagues at Flipkart — Lalit Keshre, Harsh Jain, Ishan Bansal and Neeraj Singh, spotted that gap. They figured that investing shouldn’t feel like solving a puzzle and decided to fix it. And just like that, Groww was born.

Cut to today and the picture looks wildly different. The NSE now has upwards of 4.7 crore active investors. So you could say that’s a full-blown retail investing revolution. And a big chunk of that shift came from new-age discount brokers like Groww, who made markets accessible at the tap of a screen. If you’re wondering, ‘discount brokers’ simply let you buy and sell securities (self-directed trading) at low cost through an app, unlike full-service brokers such as Kotak Securities, HDFC Securities or ICICI Direct, who add services like wealth management, research reports and personalised advice to the bill.

But how exactly did Groww become a part of this growth story, you ask?

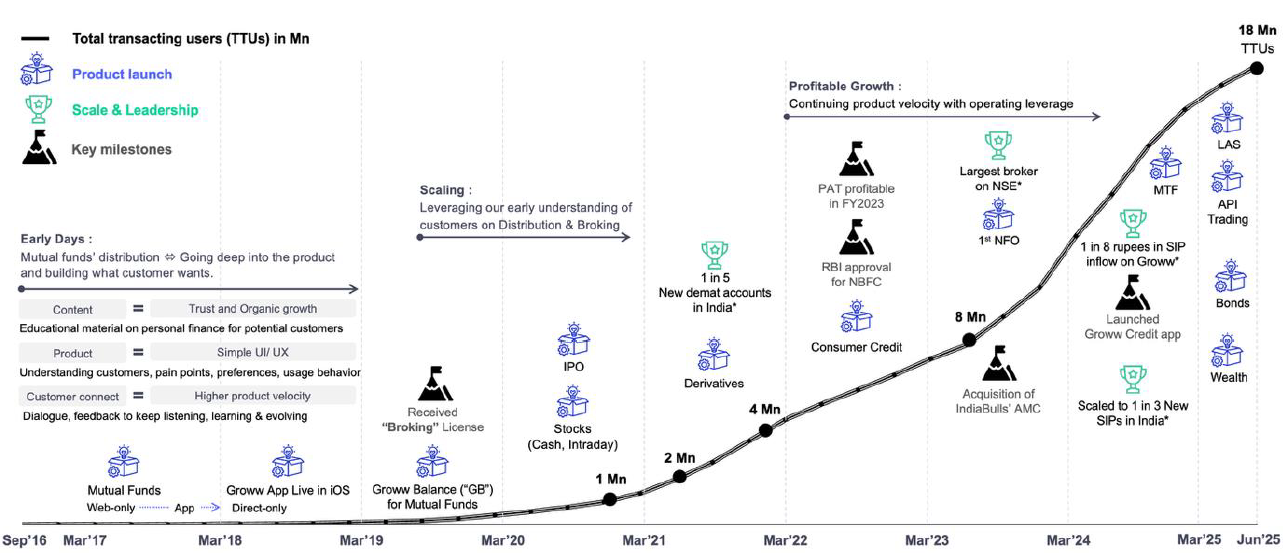

Turns out, Groww didn’t do anything wildly complicated. It began as a mutual fund distributor, and once it picked up a broking licence in 2020, it levelled up and became a stockbroker. And the timing couldn’t have been better. From there, things snowballed. It began letting users invest in IPOs, trade in derivatives, picked up an NBFC licence, started offering loans, and eventually climbed its way to becoming the largest broker on the NSE in terms of active clients. In fact, Groww now has over 1.2 crore active NSE clients. And if you look at total trading users, the number has gone from about 10 lakh to nearly 1.8 crore today. Not bad for a company that kept things simple.

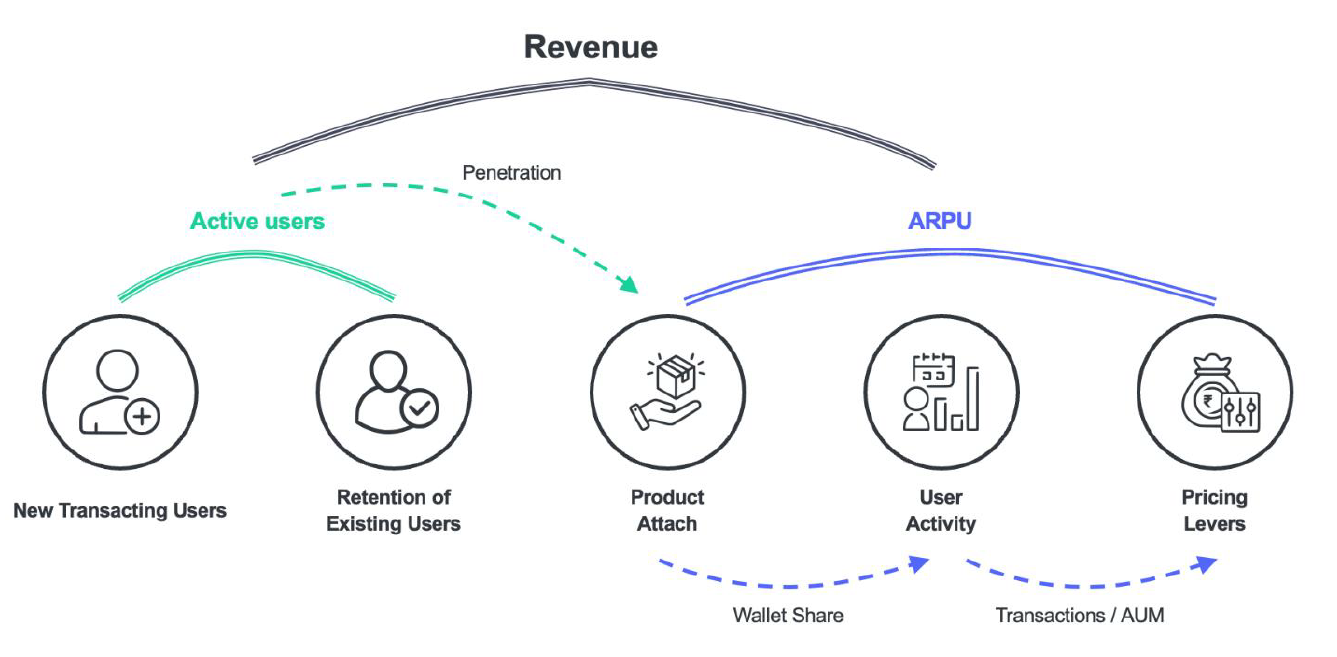

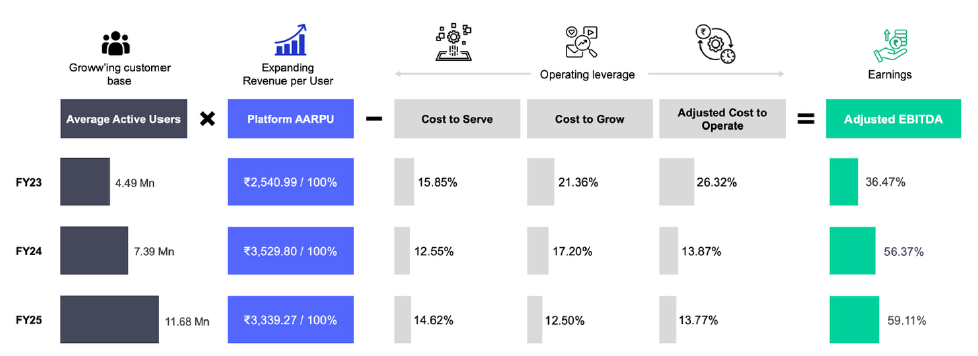

And staying simple wasn’t just about the product. It was the growth playbook too. Groww focused on getting people through the door first — maybe someone only came in to buy mutual funds or trade stocks. Once they were in, Groww kept them around with a clean, simple interface and a smooth experience. And then, slowly, it nudged them towards trying other products like using Groww UPI for payments, dabbling in derivatives, investing in bonds, and so on. The more products a user adopts, the more the company earns per person — or in finance speak, higher AARPU (annual average revenue per user), which has gone up from ₹2,540 in FY23 to ₹3,339 in FY25.

Content played its part too. Groww pushed out educational posts, videos, and newsletters to keep users engaged and confident about the markets. Those users then spread the word, more people signed up, and the cycle just kept repeating. The proof is in the pudding. Groww’s three-year user retention rate stands at about 78%. In other words, once people start investing on Groww, they tend to stick around for years. And that’s great for the brokerage business.

And all this effort has clearly translated into numbers. Groww’s total income has jumped from around ₹1,260 crore in FY23 to nearly ₹4,060 crore in FY25. Its revenue from operations (which excludes other income), roughly ₹3,900 crore, has been growing at a sweet 85% CAGR over the same period.

Now, just for context, if you stack this up against two of its largest listed domestic peers (not necessarily new-age brokers, just listed brokers) — Motilal Oswal Financial Services pulled in ₹8,339 crore (growing at 40% CAGR), and Angel One earned ₹5,238 crore (with a little over 30% CAGR).

So yeah, Groww’s revenue growth has been eye-catching. And close to 85% of that comes from broking services alone. That’s basically the brokerage fee it earns when users buy and sell securities on its platform. The remaining chunk comes from things like the Margin Trading Facility or MTF (where users can borrow to buy stocks instead of paying the full amount upfront), interest income on loans, and fees from its own mutual fund business through the AMC (Asset Management Company) arm.

But revenue isn't the only way to measure how fast Groww has scaled.

If you look at active users, they’ve shot up from 50 lakh in FY23 to nearly 1.4 crore by FY25. Net profit has climbed too, from ₹457 crore to about ₹1,824 crore over the same period, although there was a blip in FY24, when it reported an ₹805 crore loss thanks to a one-time tax payment for shifting its parent entity from the US to India. Operating profit margin growth has been solid as well, jumping from 36% to 59%. For comparison, Motilal Oswal and Angel One’s margins in FY25 were 55% and 32%, respectively.

What makes this even more interesting is that Groww builds most of its tech in-house instead of outsourcing. That means no waiting around for external vendors to fix bugs or roll out updates. If investors suddenly ask for a new feature, or SEBI drops a rule change overnight, Groww can tweak things quickly and keep the platform running without hiccups. It also helps the app stay fast, reliable and ready for massive trading spikes without crashing. You can actually see that commitment in the numbers. Their software, server and tech expenses jumped 67% to ₹440 crore in FY25 compared to the year before.

And out of the ₹6,632 crore IPO, a small portion or ₹1,060 crore, is a fresh issue, out of which ₹152 crore will go solely towards improving Groww’s cloud infrastructure. The rest of the money will go into marketing and expanding its lending products like MTF and loans.

But this also highlights a downside that a big chunk of the IPO is an offer for sale (OFS), which basically means most of the proceeds go directly to existing shareholders cashing out rather than the company itself.

So how do you decide whether this IPO is worth betting on?

Well, you’ve seen Groww’s strengths. Now it helps to flip the coin and look at the risks too.

For starters, Groww still earns most of its money from brokerage services, as we’ve mentioned earlier. And when you're heavily dependent on one revenue stream, things can get shaky. If market sentiment turns sour and users pull back from trading, activity drops. And when activity drops, so does revenue.

Then there’s the regulatory angle. Any sudden change from SEBI, RBI or the stock exchanges could throw a spanner in the works. We actually saw something similar unfold in 2024 when SEBI tightened rules around the derivatives market to protect retail investors. It made it harder for small traders to participate by increasing the minimum amount needed to trade in derivatives and traders had fewer short-term trading windows each week. And the impact was immediate. Notional turnover (the total value of all futures and options trades as if traders paid full price, even though they only put up a margin) fell nearly 38% between Q1 FY25 and Q1 FY26, and individual investor participation dropped around 36%. At the same time, SEBI also capped how much brokers could charge relative to exchange fees, which forced Groww to tweak its pricing. As a result, its income from fees and commissions slid from ₹883 crore to ₹728 crore during that period.

And of course, this is a tech-first business. So if something breaks on the backend, the platform can go down, and outages are never great for user trust or stickiness.

Now coming to valuations, Groww was valued at around ₹58,500 crore in July 2025 and is currently sitting at roughly ₹61,735 crore (at the upper price band of ₹100). That works out to about 16 times its revenue and 31 times its earnings per share (i.e. a price to earnings or P/E ratio of 31x). On the face of it, that doesn’t look too bad when the industry average P/E sits around 40. But remember, its larger listed peers Motilal Oswal and Angel One are trading at P/Es of 24 and 19 respectively. So yeah, compared to them, Groww looks a bit pricey.

But maybe that premium is the market’s way of acknowledging what Groww has built — a platform that has pulled millions of first-time investors into the markets using slick tech, financial education, and a clear push beyond just stock broking.

Will these financially savvy users hit the subscribe button for Groww’s IPO and carry that growth forward, though?

That’s something we’ll have to wait and see. Until then…

If this story helped you understand Groww’s business and made it easier to decide whether you should bet on it or not, share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X.

Message to all the breadwinners

You work hard, you provide, and make sacrifices so your family can live comfortably. But imagine when you're not around. Would your family be okay financially? That’s the peace of mind term insurance brings. If you want to learn more, book a FREE consultation with a Ditto advisor today.