The Devyani- Sapphire Foods merger, Microfinance apps, Indian cardamom and more…

In this week’s wrapup, we talk about the downsides of the renewable energy transition, why the world is looking back at Indian cardamom, Sapphire Foods’ merger with Devyani International, how microfinance became so prevalent in India and SEBI’s paper on norms for sharing and usage of price data for educational purposes.

Also, in this week’s Markets edition, we break down the Bharat Coking Coal IPO. You can read it here.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The dark side of the sun

Solar energy is often sold as the cleanest way to fix our energy problem. It produces no smoke, requires no fuel, and emits no emissions.

However, as solar power scales up, something odd is happening in the background. Demand for metals such as silver and copper is surging because they are used as raw materials for solar panels. Grids are also struggling to cope with the power difference during peak supply and demand.

The result is a transition that looks clean at the surface, but hides real costs beneath it.

So is solar really a silver bullet, or just the start of a new set of trade-offs?

Read the full story to find out.

Why the world is turning back to Indian cardamom

After a long,hard day at work, sometimes the best solution is just a nice hot cup of elaichi tea.

That one green spice makes a world of difference and tea lovers would know it all too well.

Little did people know that it sits at the heart of one of the world’s most fragile spice markets. Native to the Western Ghats, it was once India’s pride and a globally prized export for nearly 4,000 years. But over the past century, Guatemala overtook India to become the world’s largest producer, thanks to year-round harvesting and large plantations that lowered production risks and costs.

India’s smallholder-led model, short harvesting window, and disease vulnerability prevented similar scaling. But that restraint unexpectedly paid off. In our Tuesday story, we covered how this shift is happening, why Indian cardamom is back on the global scale and how it tipped in our favour.

The Devyani-Sapphire Foods merger explained

Imagine walking into a mall and seeing KFC and Pizza Hut side by side… run by the same company. That’s exactly what’s about to happen across India.

Sapphire Foods is merging into Devyani International, bringing over 3,000 Yum! Brands outlets under one roof. Now on paper, this looks like scale. But underneath, it’s really about weak store-level growth, overlapping outlets, rising costs, and post-pandemic consumers eating out less.

So why did Yum push for this now?

We broke this down in Wednesday's story. You can check it out here.

Why is every app trying to become a microfinance app?

A decade ago, consumer apps competed on discounts and delivery speed. Today, they want to help you invest, make payments, and manage your money. Amazon offers investments, WhatsApp handles payments, Ola gives loans, and Airtel runs a payments bank.

This is because selling goods is a thin-margin business that creates revenue just once. But financial products, on the other hand, create a recurring revenue, lock users in for years, and monetise data far better than e-commerce ever could.

But when borrowing becomes invisible and frictionless, risks also build up. So is embedded finance expanding inclusion, or normalising debt without discipline?

Read our Thursday story to find out.

Why SEBI wants trading academies to step back from live data

The internet-era has made everything accessible at the swipe of a finger, one app away and just one quick transaction. But that quick gratification behaviour has transferred to quick gains from the stock market.

With that ease, more and more people are turning to online stock gurus to learn how to trade in the first place. Which is the best brokerage to use? How much money do you even need to start? These are all questions every new trader asks when they first step into the market.

These gurus came in to exploit the people genuinely interested in trading and operating as advisory firms, but marketed as academies.

That’s why SEBI stepped in and released a paper last week to put a curb on what use-case of live data counts as teaching, and what counts as illicit advisory without the certificate. To find out what the changes were, read our Friday story here.

Finshots Weekly Quiz v2.0 🧠

Hey folks! A few months ago, we hit pause on the Finshots Weekly Quiz because we were cooking up something new. And last month, we finally unveiled the Finshots Weekly Quiz v2.0. If you missed out, don’t worry. Click here to check out the rules and start participating in the quiz today to stand a chance of making it to this month’s leaderboard, and maybe even winning some merch!

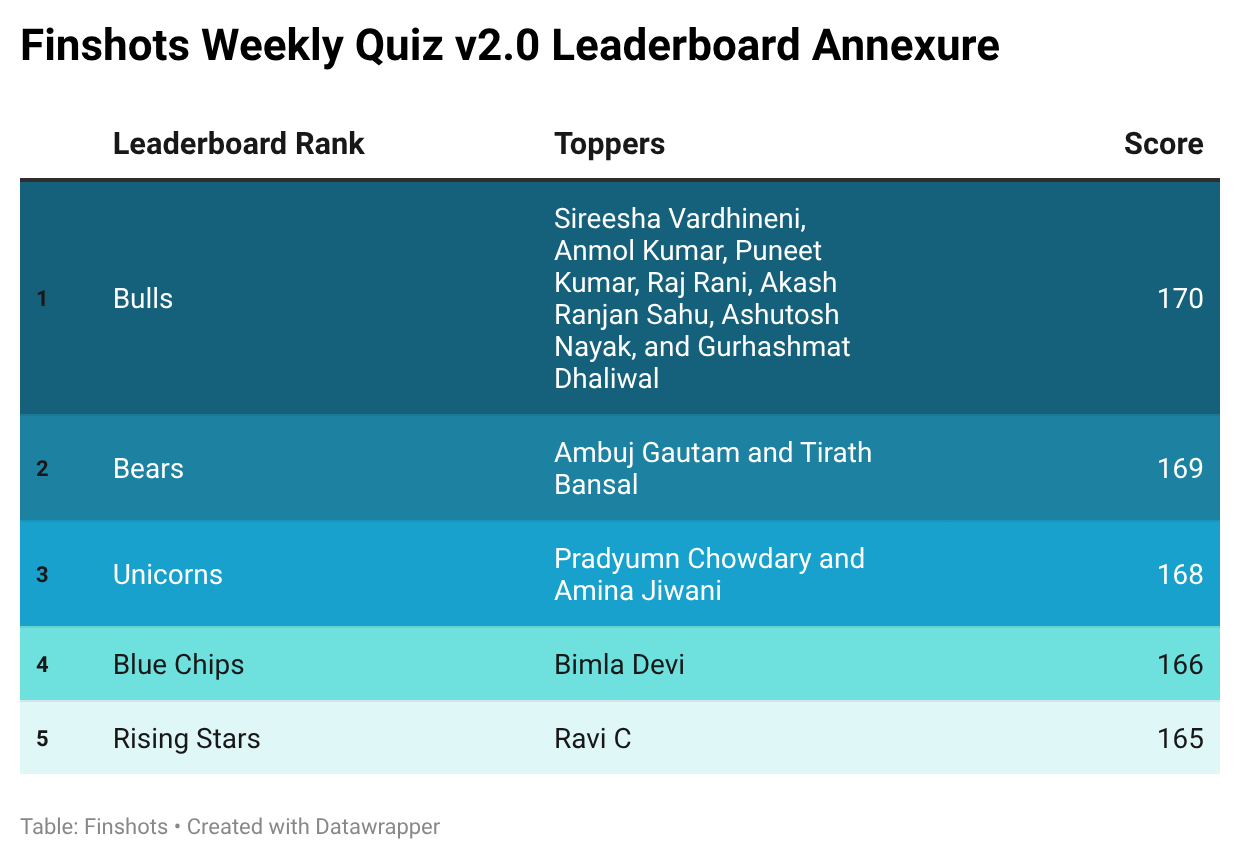

But for now, it’s time to announce the top scorers of our previous weekly quiz. There were a whole bunch of you who participated, and many of you ended up with the same scores. So we’re calling you Bulls, Bears, Unicorns, Blue Chips, and Rising Stars. Here’s how the leaderboard looks right now:

Check out the annexure below 👇🏽 to see the names of the top scorers

As you can see, we have seven top scores fighting for the merch. But unfortunately, there’s just one merch box to be won every month.

So to break the tie, we’ll be sending a tie-breaker question to all the “Bulls” via email. Keep an eye on your inbox! The one who gets it right the fastest wins the exclusive Finshots merch for December 2025, and we’ll reveal the winner’s name next week.

And to the rest of you whose names made it to the leaderboard, congratulations! You may not have won the merch this time, but you showed up consistently and earned a spot on Finshots’ weekly leaderboard. That’s pretty cool.

So don’t lose hope. Hit the reset button this month and keep answering all the weekly quizzes. Who knows? You might just be the winner this time around.

Click on this link to take this week’s quiz, which is open till 12 noon, Friday, 16th of January, 2026. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We’ll publish it every Saturday in the Weekly Wrapup. And the winner will be announced in the first week of February.

Liked this wrap-up? Don’t forget to share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X. And subscribe to Finshots, if you haven’t already. Plis!