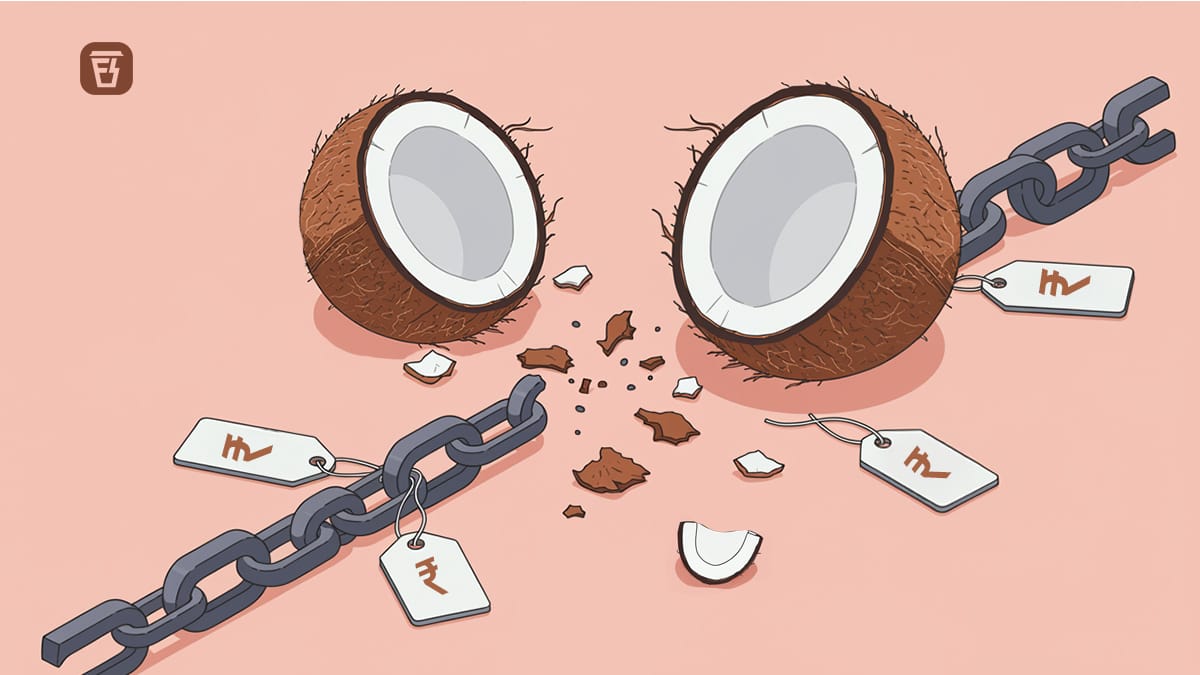

The curious case of rising coconut oil prices

In today’s Finshots, we tell you why coconut oil prices have suddenly shot through the roof.

But before we begin, if you love keeping up with the buzz in business and finance, make sure to subscribe and join the Finshots club, loved by over 5 lakh readers.

Already a subscriber or reading this on the app? You’re all set. Go ahead and enjoy the story!

The Story

About a year ago, you could walk into a store and grab a litre of coconut oil for about ₹160. But today that same bottle could burn a ₹500 hole in your wallet.

And if you’re from South India, or just someone who swears by coconut oil for cooking, skincare or your weekly champi (a traditional Indian head massage), this price spike probably feels outrageous.

So, what’s going on and why have coconut oil prices more than tripled in just a year, you ask?

Well, to understand that, you’ll need to know the basics of how coconut oil is made.

There are two main ways. One is the traditional route. You take mature coconuts, scoop out the white flesh, dry it into something called copra and then press it to draw out the oil. The other method is a bit more delicate. You make coconut milk by blending tender coconut with water, and then carefully separate the oil either by boiling it or chilling it down until the oil rises to the top.

But whichever route you take, one thing is essential: an ample supply of coconuts.

And that’s exactly where the problem begins. Because coconuts have been in short supply. For context, over the last two decades, India’s coconut consumption has shot up by 25%. Today, we use around 14–15 coconuts per capita (per person per year). And it’s not like everyone’s just sitting around munching on coconuts. That overall demand includes everything from industrial use, hair oils, skincare products to desserts, snacks and even temple offerings.

The thing is, coconuts are now the go-to for all things “healthy and natural”. The cosmetics and personal care industry has exploded in India, and coconut oil is a key ingredient. At the same time, more coconut-based products are entering the market. There’s desiccated coconut, coconut flour, coconut milk and even processed coconut water. That simply means that there are fewer coconuts going into oil production.

And it’s not just domestic demand. Indian coconut products have become hot exports too. Countries like the US, Europe and the Middle East are lapping up Indian desiccated coconut and coconut milk. So more of our coconuts are being diverted abroad, leaving less for regular home use.

Then comes another twist — tender coconuts.

Farmers have started pivoting towards selling tender coconuts because they fetch quicker and higher profits. And that’s no surprise because urban Indians, especially in cities like Bengaluru and Pune, love tender coconut water as a natural summer cooler. But the more tender coconuts that hit the market, fewer mature coconuts are left behind for copra production, the backbone of traditional coconut oil.

Sure, this year’s early monsoon onset might have cooled the demand for tender coconuts. But that’s not necessarily good news because the early rains shortened the summer, which is the peak harvesting season for coconuts. And if that wasn’t enough, 2024 also had prolonged droughts and recurring heatwaves in key coconut-growing regions like Tamil Nadu, Kerala and Karnataka.

Put all of this together and you’ll see why there’s a 30–35% drop in coconut and copra availability.

That’s massive, especially for people in South India, for whom this is more than just a price hike. It’s about habit, tradition and taste. Coconut oil is part of their everyday life. But at ₹500 a litre, it’s hard to justify. So people start switching to cheaper alternatives like sunflower, palm, or soybean oil. And once they move on, it’s difficult to win them back.

That’s not just speculation. We’ve seen this story before.

A few decades ago, indigenous oils like groundnut oil were elbowed out by cheaper vegetable oils. Even today, regaining that lost market has been a struggle, no matter how superior or traditional the original oil is.

That’s why the Solvent Extractors Association (SEA), the body representing the vegetable oil industry, has been pushing the government to temporarily ease its no-import policy on coconut oil and copra.

You see, India has long banned the import of coconuts and their products. The idea was to protect local farmers and safeguard domestic livelihoods. But now, that very policy is backfiring. High prices are driving consumers away, and without any way to cushion supply, we might lose coconut oil’s spot on the kitchen shelf.

So SEA wants the government to allow imports for just about 6 to 12 months. Not to flood the market. Just enough to manage this demand-supply imbalance.

And that’s a possibility. Countries like the Philippines and Indonesia are coconut oil giants. In 2025, the Philippines produced about 16 lakh tonnes, while Indonesia managed 10 lakh tonnes (as compared to India’s 5.7 lakh tonnes). And roughly 65–70% of that oil was exported. Their production costs are lower, and even with import duties, prices could match what we’re paying now, but with a steadier supply. That might be just enough to cool off the price panic.

And while we don’t know if the government will actually go ahead with the import plan, short-term imports won’t fix everything. There are deeper problems that need the government’s attention.

Like pests.

Yup, something we didn’t tell you earlier is that pests like the whitefly are quietly wreaking havoc on coconut farms, especially in Karnataka and Tamil Nadu. These little things develop pesticide resistance pretty quickly, which makes them particularly tricky to deal with. But here’s where the government can step in and help by making farmers aware of a simple workaround — introducing natural predator insects that protect coconut palms and the soil while keeping whiteflies in check.

Also, it’s not just about mature trees. Whiteflies can infest seedlings too. If they’re not checked early, they spread like wildfire once planted. That’s why experts recommend monitoring right from the seedling stage by destroying infested batches, avoiding the movement of infected plants and using yellow sticky traps. These are simple yellow sheets coated with glue that attract pests because of their bright yellow colour and help catch early signs of trouble.

Another issue that the government needs to manage is adulteration.

As coconut oil becomes expensive, there’s a growing temptation to mix it with cheaper oils and pass it off as pure. This not only poses health risks but also erodes consumer trust. Once people feel they’ve been cheated, they’re more likely to ditch coconut oil altogether. And that again chips away at long-term demand.

So even if prices cool off tomorrow, the damage to perception and trust might linger.

So yeah, the way forward needs a mix of quick fixes and long-term solutions. Maybe even a few awareness campaigns to help farmers and consumers make informed decisions.

Because coconut oil isn’t just another product. It’s part of daily life for many Indian homes. And losing it, even temporarily, to a supply crunch would be unfortunate.

For now though, until prices come back to earth, your next bottle of coconut oil may just have to be used a little more sparingly.

Until then…

If this story helped you wrap your head around why coconut oil is getting unbearably expensive, don’t forget to share it with your friends, mums, dads and even strangers on WhatsApp, LinkedIn and X, to help them make sense of it too.

🔊Introducing Pitch Perfect 2025!

If you've been following us for a while, you know our story didn't begin in a corporate boardroom. It started in a college dorm room with 3 broke students who chose to skip placements and chase something bigger.

That something was Finshots.

Today, Finshots reaches over 500,000 readers, and through Ditto, we've empowered 800,000+ Indians to make smarter insurance decisions.

Now, we're looking for the next game-changing idea to back.

Introducing Pitch Perfect 2025 – a flagship startup pitch challenge powered by Zerodha.

So, if you've got a BIG idea that could help Indians get better with money, pitch it to us!

What's at stake:

✅₹10,00,000 in prizes

✅Potential funding from Zerodha Rainmatter

✅All-expenses-paid trip to Bangalore to pitch directly to Nithin Kamath and industry veterans

Ready? 👉Apply Now!