The curious case of Aurionpro, new insurance rules & more...

In this week’s wrapup, we talk about the SpaceX IPO, why Mexico imposed tariffs on India, the new petroleum & natural gas regulations, the insurance bill 2025, and the new NPS rules.

Also, in this week’s Markets edition, we take a detailed look at why the company that powers India’s digital banking ecosystem isn’t doing well. You can read it here.

But before that, here’s a message to all the Breadwinners of their family.

You work hard, you provide and make sacrifices so your family can live comfortably. But imagine what it's like when you're not around. Would your family be okay financially? That’s the peace of mind term insurance brings. If you want to learn more, book a FREE consultation with a Ditto advisor today.

With that out of the way, let’s take a look back at what we wrote this week.

The $1.5 Trillion SpaceX IPO Explained

For decades, space was too expensive, too risky, and too political to be a real business. SpaceX changed that by slashing launch costs, dominating orbital capacity, and turning Starlink into a recurring-revenue machine in the sky.

Now, whispers of a $1.5 trillion IPO are rattling markets. If listed, it would be one of the largest in history and force investors to price something entirely new: a company that sits between infrastructure, defence, telecom, and science fiction.

But can public markets stomach exploding rockets, trillion-dollar ambitions, and a founder who hates short-term thinking?

Read the full story to find out.

Why Mexico wants to impose tariffs on India

Imagine you and two other friends are operating 3 separate food trucks. Two of them decide to buy ingredients from each other at cost, but since you’re not part of the deal, you’d have to pay an extra cost, solely because you didn’t have an agreement with them.

This is essentially how free trade agreements (FTAs) work and Mexico just announced tariffs on India, China, Thailand and a list of other Asian countries. If they don’t have an FTA in place with Mexico, then tariffs are enroute from 2026.

But why would Mexico, a developing country itself, and also one grappling with US tariffs, do the same to its trade partners?

The move has industry bodies and the government worried with 2026 just around the corner, and still no FTA in place. So why is Mexico doing this?

Find out in our Tuesday story here!

Why India’s new Petroleum and Natural Gas Rules matter

I live in a small town called Ashoknagar, near Kolkata that most people have never heard of. But in 2018, oil was discovered just ten minutes from my home. Big deal, right? Except… nothing happened for years. No drilling. No production. No money.

All because ONGC and the West Bengal government couldn’t agree on one deceptively boring question: how do you calculate stamp duty on an oil lease?

That tiny ambiguity ended up freezing a project worth ₹45,000 crore, hurting the state, ONGC, and even India’s oil imports. And Ashoknagar is just one example.

So in Wednesday’s newsletter we explained how outdated rules quietly choked India’s oil sector, and how a recent reform might finally fix it. You can read it here.

The Insurance Bill 2025 Explained

India is rewriting its insurance rulebook, but not in the loud, disruptive way telecom once did. Instead, the Insurance Bill 2025 is a calibrated reset. It gives IRDAI more flexibility, loosens rigid ownership norms, lowers reinsurance entry barriers, and makes it easier to deploy foreign capital, all while keeping policyholder protection front and center.

The goal is ambitious: to ensure every Indian has insurance by 2047. But insurance is a different kind of industry altogether. If an insurance company fails, it hurts households, not just shareholders.

So will these reforms unlock growth without weakening trust? Or expose cracks in a system built on long-term promises?

Read our Thursday story to find out.

An explainer on the new NPS rules

In about a week, it’ll be Christmas. A week after that, and 2026 will have started and surely we’ve all made plans for the year to come. But talk about retirement, and it sits at an odd spot where it’s important enough to matter, but quite far enough to postpone.

That’s where the National Pension System comes into play: a solution to help Indian citizens save for retirement and not outlive their savings.

But the catch is that NPS was quite strict on what you could do with your retirement money. Higher annuity, limited premature withdrawal options and few illnesses that fit the bill for withdrawal. All this was recognized and updated by the Pension Fund Regulatory and Development Authority (PFRDA), the regulator that oversees NPS. Higher age limits, lower mandatory annuities, formal rules for missing persons and more were introduced to bring NPS to the current day.

These changes meant a lot of freedom, but is that necessarily a good thing when it comes to a retirement fund? Find out in our Friday story here.

Finshots Weekly Quiz v2.0 🧠

Hey folks! A few months ago, we hit pause on the Finshots Weekly Quiz because we were cooking up something new. And this month, we finally unveiled the Finshots Weekly Quiz v2.0. If you missed out, don’t worry. Click here to check out the rules and set a reminder to participate consistently starting next month!

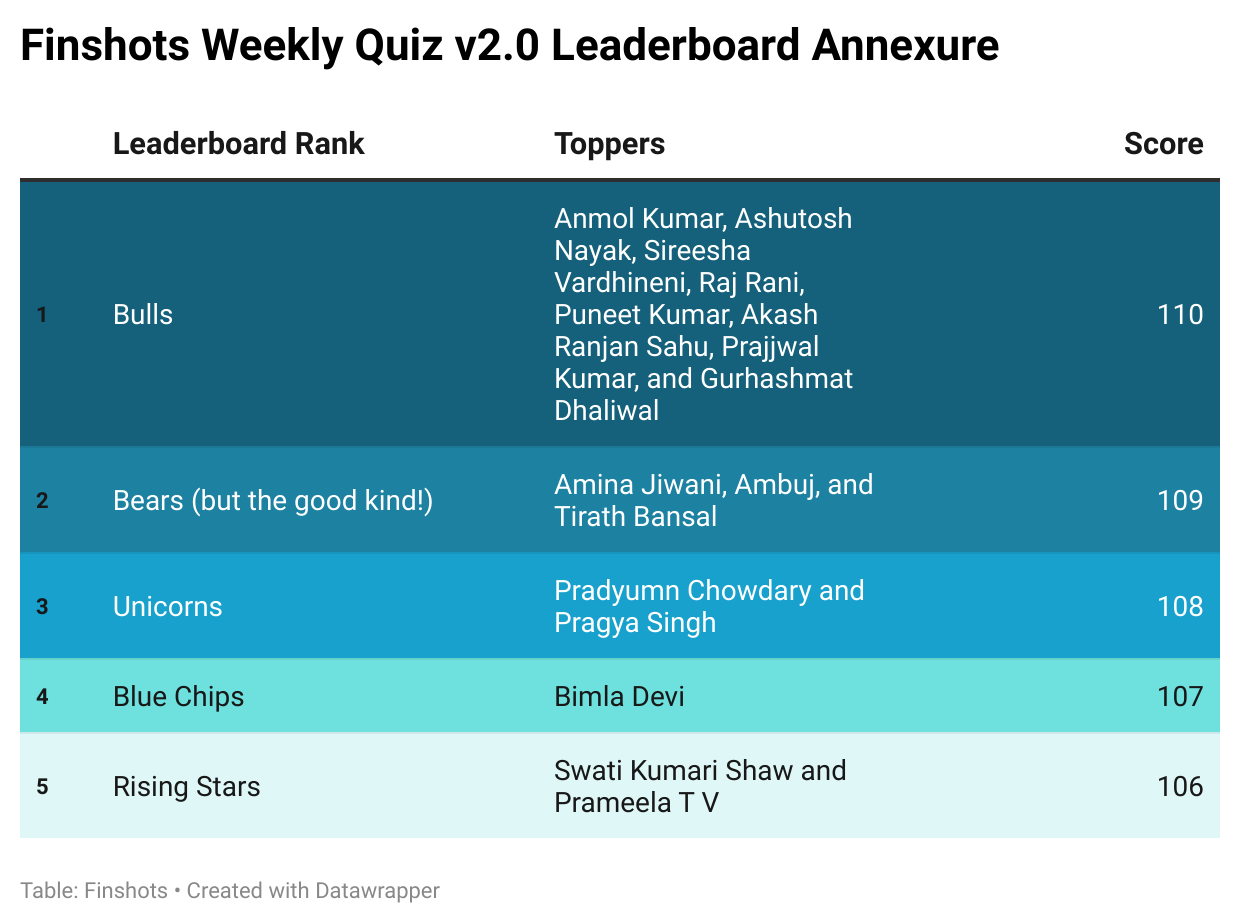

But for now, it’s time to announce the top scorers of our previous weekly quiz. There were a whole bunch of you who participated, and many of you ended up with the same scores. So we’re calling you Bulls, Bears, Unicorns, Blue Chips, and Rising Stars. Here’s how the leaderboard looks right now:

If your name has been featured on the leaderboard, then congratulations! If not, don’t lose hope. If you attempted last week’s quiz, keep at it and answer all the weekly quizzes this month. You never know when the turntables! Click on this link to take this week’s quiz, which is open till 12 noon, Friday, 26th of December, 2025. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We’ll publish it every Saturday in the Weekly Wrapup. And the first winner will be announced in the first week of January.

Liked this week’s wrapup?

Don’t forget to share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X. And subscribe to Finshots, if you haven’t already. Plis!