The crazy and puzzling story of Bisleri!!!

In today's Finshots we see how the iconic Bisleri came into being

The Story

Imagine sauntering across the hinterlands of India on a hot summer afternoon. The sun is beating down on you. You’re parched. And you’re almost out of water. Luckily for you, your best mate spots a small shack — a rundown store in the middle of nowhere. You look around and mumble — “Bisleri?”

The person nods and hands over a bottle.

It’s a story everybody relates to. We’ve all done it. Maybe not in the sweltering heat. But it’s happened at least once. And for most of us, Bisleri is synonymous with bottled water. You know you’ll find it anywhere. Even a tiny village store.

But what’s Bisleri’s history?

Well, that bit isn’t as straightforward as Bisleri’s iconic brand presence.

In fact, depending on who you ask, you may get a very different answer.

So let’s take it from the top. One thing we do know for sure is that the story starts in Italy in the 1800s. And it starts with alcohol.

A former Army General, Felice Bisleri set up the eponymous Felice Bisleri & Co to sell a type of liqueur — a herbal concoction of cinchona, herbs and iron salts that he called ‘Ferro-China Bisleri’. It was quite successful. And in the 1920s, the company set up plants in India to supply the ingredients for the ‘Ferro-China Bisleri’ tonic. That’s when the Bisleri-India connection began.

But things get a little murky after this.

Media reports suggest that Felice Bisleri died in 1921. Then the ownership passed to his family doctor — Dr Cesare Rossi. But we’re not too sure. Why’s that? Well, because another account from the famed auction house Sotheby’s portrays a very different narrative. In their version, Dr Cesare Rossi is a textile/fabric wizard who moved to India in 1953 and set up South India Viscose Ltd.

So why did a ‘family doctor’ turn into a textile wizard? No clue.

Did he move to India to look after the Bisleri plants? We don’t know.

Did Dr Rossi actually own Bisleri? Well…

The Sotheby’s article also points out that Felice Bisleri’s son-in-law General Cacceiandra was reviewing Bisleri factories after the second world war. And that’s when Dr Rossi and General Cacceiandra began discussing the prospect of selling bottled water.

So yeah, maybe Dr Rossi did own Bisleri and General Cacceiandra was simply his second in command. Maybe.

Anyway, the mystery thereafter is that no one talks about what happens over the next 12 years. Or what happened to General Cacceiandra?

After that, we move straight to 1965. And Dr Rossi is hellbent on selling bottled water by this point. He decides to partner with Khushroo Suntook, a lawyer with a rich Parsi business heritage to manufacture bottled water.

They realized that “the water quality back then was so bad in Bombay that people would get bad tummies…” They wanted to deliver clean, bottled water. So they set up a plant in Thane. They distilled water, added potassium and sodium and marketed it as mineral water. And they sold it to five-star hotels and restaurants.

Now comes another puzzle.

While some reports say that the business struggled because it didn’t reach the masses, Suntook says otherwise. According to him, business was booming. And they only sold Bisleri because of… superstition it seems. The Rossi family suffered an unfortunate tragedy back home and believed Bisleri was to blame for it somehow.

Yeah... So apparently they walked off, although you can’t be certain this is how it happened.

All we can say with certainty is that in 1969, Jayantilal Chauhan, owner of the Parle Group, took over. The group was looking to add a soda brand to its product portfolio and Bisleri seemed like the perfect fit. Parle bought Bisleri for about ₹4 lakhs.

Now here’s another riddle for you to solve.

See, according to BusinessToday, the current chairman of Bisleri Ramesh Chauhan said that Parle acquired Bisleri to get their hands on Bisleri Soda which was already popular. He said this in 2008.

But in an interview with Rediff in 2005, Ramesh Chauhan apparently said they simply used the Bisleri brand name and then launched Bisleri soda!

So, who actually launched the soda? Was it Bisleri or was it Parle? We don’t know.

Either way, it seems as though soda was the primary objective and not bottled water. After all, Parle was busy launching carbonated drinks such as Limca and Thums Up in the 1970s to beef up its portfolio that already included the popular Gold Spot. So it kind of made sense.

But then, the 1990s rolled around. India had opened its doors to foreign players and Coca-Cola and Pepsi stormed back in. Parle felt the heat and decided that they couldn’t compete with the biggies. They sold their carbonated drinks business in 1993 to Coca-Cola. They only kept Bisleri water. They had no option but to innovate and grow the business.

Till then, they were focused on selling 20-litre cans to offices and other institutions. But in 1995, they launched the easy-to-carry and now ubiquitous 500ml bottle. It became accessible to a lot more people.

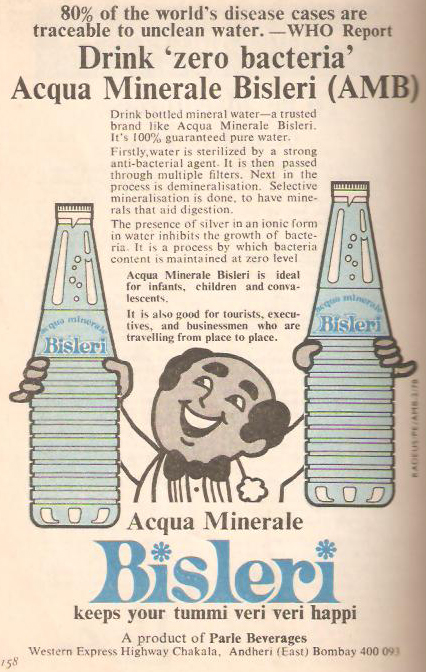

And they also launched their first print ad showing off their Italian heritage. They called it ‘Acqua Minerale Bisleri’ and also had a very foreign sounding and quirky caption — ‘keeps your tummi veri veri happi’. But the point of the ad was to market ‘clean’ water.

And the big game changer?

Bisleri realized that transporters didn’t find it viable to carry trucks loaded with cans of water across long distances. There wasn’t enough money in it. So, Bisleri set up its own trucking network and began to set up its distribution network to reach every nook and corner of India.

And since then, there’s been no looking back for the company. It galvanized a 30% market share in the organized bottled water market with 4,000 distributors and 5,000 trucks. And in FY20, it hit ₹1500 crores in revenues with ₹100 crores of profits.

Life’s good for Bisleri.

But the only constant in life is change, no?

With current chairman Ramesh Chauhan in his 80s and no family member to take over the business, the former Italian water brand is now set to welcome another set of owners to continue its legacy in India.

While rumour is rife that the Tata Group is the frontrunner in the show, the deed’s not done yet. And we’ll have to wait and watch how the future of Bisleri unfolds now. But at least you know its history now. Well, sort of!

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

PS: Don’t forget to let us know if you solve some of those mysteries!

Ditto Insights: Why Millennials should buy a term plan

According to a survey, only 17% of Indian millennials (25–35 yrs) have bought term insurance. The actual numbers are likely even lower.

And the more worrying fact is that 55% hadn’t even heard of term insurance!

So why is this happening?

One common misconception is the dependent conundrum. Most millennials we spoke to want to buy a term policy because they want to cover their spouse and kids. And this makes perfect sense. After all, in your absence you want your term policy to pay out a large sum of money to cover your family’s needs for the future. But these very same people don’t think of their parents as dependents even though they support them extensively. I remember the moment it hit me. I routinely send money back home, but I had never considered my parents as my dependents. And when a colleague spoke about his experience, I immediately put two and two together. They were dependent on my income and my absence would most certainly affect them financially. So a term plan was a no-brainer for me.

There’s another reason why millennials should probably consider looking at a term plan — Debt. Most people we spoke to have home loans, education loans and other personal loans with a considerable interest burden. In their absence, this burden would shift to their dependents. It’s not something most people think of, but it happens all the time.

Finally, you actually get a pretty good bargain on term insurance prices when you’re younger. The idea is to pay a nominal sum every year (something that won’t burn your pocket) to protect your dependents in the event of your untimely demise. And this fee is lowest when you’re young.

So if you’re a millennial and you’re reading this, maybe you should reconsider buying a term plan. And don’t forget to talk to us at Ditto while you're at it.

1. Just head to our website by clicking on the link here

2. Click on “Book a FREE call”

3. Select Term Insurance

4. Choose the date & time as per your convenience and RELAX!