Taylor Swift and the Baumol Effect

In today’s Finshots, we explain why concert ticket prices might seem to be getting more and more expensive each year.

The Story

We’re all just living in Taylor Swift’s world.

She announces a concert in a new city and fans go berserk. Tickets are sold out in seconds. And then it’s the turn of cities to pull out all stops to woo her fans. For instance, the city of Glendale in Arizona wrote a proclamation or a love letter to Taylor Swift. It even renamed itself ‘Swift City’ for a couple of days.

It might sound weird and crazy. But it does make sense as to why cities are so excited. Because, in just the US, her tour could generate economic activity worth a whopping $5 billion. It took her concert in Vegas to bring tourism finally back to pre-pandemic levels. So yeah, you’d imagine that cities want to ensure that the fans really splash cash when they attend the concert. It’ll give the local economy a nice little boost amidst all the economic worry.

But we don’t want to talk about just Taylor Swift’s magnetic pull here. We have a more interesting question — why the heck are concert tickets so expensive?

Wall Street Journal is calling 2023 ‘the year of the $1,000 concert ticket’. And if you try and compare the prices of Taylor Swift’s tickets for her tour to Australia in 2018 versus the one scheduled for 2024, you’ll see that ticket price inflation has outpaced general inflation. Even if you account for the relationship between the US and the Australian dollar. And just to be clear, we’re talking about primary ticket prices here. Not the insane prices of resale tickets being sold by scalpers.

So, why is this happening?

Well, the simple answer would be that it’s the demand and supply equation.

For instance, Ticketmaster, the online platform responsible for selling these tickets made quite a startling revelation in November. Back when Taylor Swift’s concert tickets just went on sale. The volume of traffic on their platform was so massive that they said that Taylor Swift would have to perform a stadium show (that could probably pack 50,000 people) every single night for the next 1,000 days just to meet this demand.

And that’s just not humanly possible, right?

So that means folks like Taylor Swift can bump up the prices if they want to. Fans will still flock to the shows. No questions asked.

But here’s something else you should know. It isn’t just Taylor Swift’s concert tickets that are increasingly pricey. Price inflation for live performance has outpaced general inflation for decades. In fact, according to the economist Alan Krueger who authored a book called Rockonomics, the cost of an average concert ticket increased from $12 in 1981 to a whopping $64 in 2017.

Now if prices had stayed in line with general inflation, those concert tickets should’ve been only about $32.

So how on earth do we explain this variance?

Well, in the 1960s, an economist named William J. Baumol came up with a theory about productivity. It’s called Baumol’s Effect or Baumol’s Cost Disease.

Imagine a Swiss craftsman producing a watch a couple of hundred years ago. He’d painstakingly produce just 12 watches in a year. But people developed machines to improve productivity. And that changed the game. Soon, the craftsman could produce 1,200 watches a year with the same labour. He was more productive.

That meant the factory could sell more watches in a year and pocket more money. But the factory could also pass along some of these gains — they could cut prices of the watches for customers and also increase wages for the workers. Everyone would win.

Now let’s look at live music. And this is an example from an economic report titled “Why are the prices so damn high”:

In 1826, when Beethoven’s String Quartet №14 was first played, it took four people 40 minutes to produce a performance. In 2010, it still took four people 40 minutes to produce a performance.

Basically, in those 200 years, the productivity of a string quartet didn’t change It stayed the same. And that’s just how things are when it comes to live performances. Taylor Swift still needs the same amount of time to perform a set of 10 songs in 2023 than she did during her first tour in 2009. The only marginal productivity comes in terms of better microphones.

But does that mean that the musicians won’t see a rise in their wages?

Of course not. If their wages didn’t rise, musicians would quit. They’d go and work in manufacturing instead to make better money. So the industry has no option but to keep wages in line with everything else.

Put simply, Taylor Swift will have to keep paying her band and crew higher wages even though they aren’t getting more productive. Otherwise they’d leave. So that definitely feeds into the higher ticket prices.

And if you think about what inflation really is — it’s simply the average price rise (or fall) of a whole bunch of things consumed in a country. So if manufactured goods have a higher weight in this inflation calculation, it can keep the overall figure low. And that means, it’ll always seem like prices for live performances are getting more and more expensive every year when compared to the price of watches. Or compared to general inflation.

That’s the Baumol Effect for you.

So yeah, if you’re planning to save up for a Taylor Swift concert in the future, now you know how to go about it. You’ll have to factor in the allure of Taylor Swift’s brand, the demand vs supply equation, and even the Baumol Effect.

Until then…here’s an image of the Glendale Proclamation or the city’s love letter to Taylor Swift.

And don’t forget to share this article on WhatsApp, LinkedIn, and Twitter.

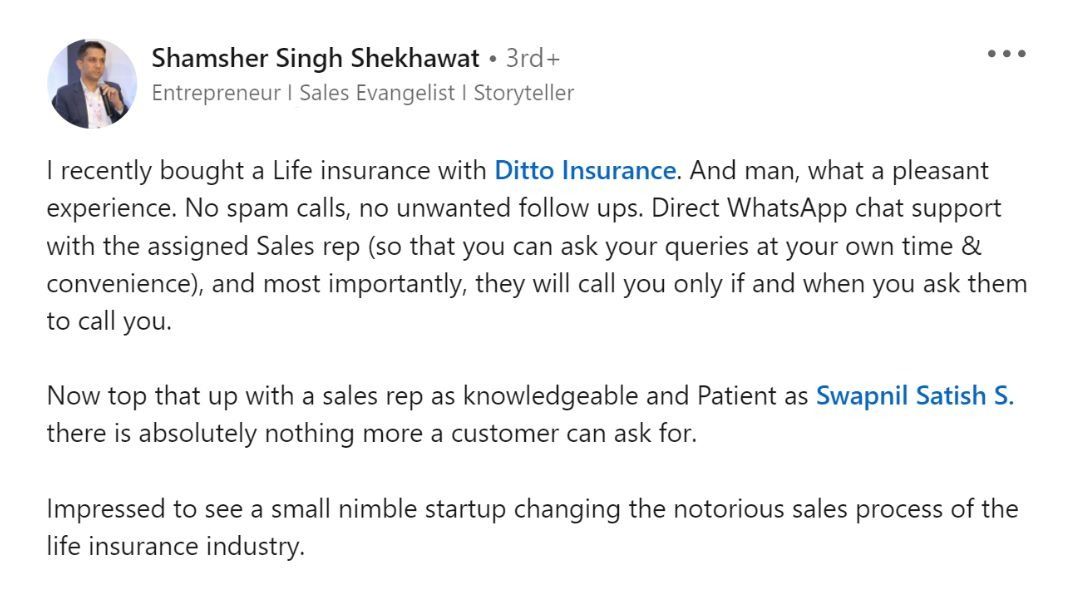

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here