In today’s Finshots, we dive into shares with differential voting rights and Tata Motors’ decision to cancel them.

The Story

When a company issues equity shares, they’re trying to raise money. It could be to make an acquisition. It could be to finance day to day activities. Or companies may do it to repay existing loans and rid themselves of the burden of paying significant amounts of interest periodically. Equity money is pretty much perpetual in nature after all. They don’t have to ever return it.

But there’s a slight problem with equity shares. It dilutes ownership.

Say you own 1 out of 10 shares issued by a company. That’s 10% of the company in your pocket. If the company decides to issue 2 more shares and some third party laps it up, you now own less of the company — it drops to 8.3%.

And quite often, founders or promoters don’t like diluting their stake too much. They don’t like to cede control. Because once someone else owns a share, these folks usually have the right to vote too. The shareholders can choose to actively participate in management decisions. They can band together and scuttle the company’s plans to diversify or protest against increasing pay.

For instance, back in 2015, shareholders forced Maruti Suzuki to change its agreement with Suzuki Motor Company. The agreement chalked out details about setting up a new plant. Shareholders didn't like it and they voted against the proposal. In another case, shareholders voted to try and prevent Havells from paying a certain royalty to its promoter-owned groups. And a couple of years ago shareholders of Eicher Motors (Royal Enfield) voted against the reappointment of Siddhartha Lal as the MD too.

Yeah, that can happen if promoters give away ownership.

Which brings us to Tata Motors.

In 2008, Tata Motors desperately needed money. It had borrowed this sum to buy British luxury brands, Jaguar and Land Rover. And then it wanted to get rid of the loan. So it decided to tap the equity markets to raise over ₹4,000 crores and repay the loan.

But the promoters didn’t want to dilute their ownership. They wanted to keep control. So what did the automaker do?

Well, Tata Motors decided to issue a special kind of share — something called DVR share or differential voting rights share. The premise was simple. It wouldn’t offer the same voting rights as regular shares. It would carry only 1 vote for every 10 shares. And because it didn’t carry ‘equal’ rights, Tata Motors would sweeten the deal. The shares would come with an additional dividend. And it would also be issued at a discount to the regular shares. Back then shares of Tata Motors were trading at ₹340 a pop, but the DVRs were made available at ₹305.

So investors who didn’t care about voting rights but only cared about generating passive income through extra dividends swooped in. And Tata Motors raised crores without giving away too much control.

Sounds quite brilliant, no?

So they issued DVRs in 2008. And then some more in 2010 and 2015 too. The promoters raised money and didn’t have to dilute their own voting power.

And these types of shares have been quite popular in the US. Meta (Facebook), Alphabet (Google) and The New York Times have all issued differential shares or what they call Dual Class Shares (DCS). Heck, when social media firm Snap went public in 2017, all the new shares they issued carried absolutely no voting rights. Which meant only founders and private equity investors would have any say in how the company was run. The IPO still garnered a lot of attention and people flocked to invest.

But unlike the US, DVRs simply never caught on in India. Even though such shares were permitted since December 2000, just a handful of companies issued these shares. And maybe that was a problem. Maybe investors didn’t really understand what these shares were used for. So while typically these kinds of shares trade at a 5% discount to the main shares, Tata Motors' DVRs were almost always available at a 40–50% discount.

Now one reason could be that the big investors or the folks like mutual funds preferred to buy ones with voting rights. That way, they could intervene and vote if they felt the company was doing something foolish. And the retail folks simply didn’t understand what on earth was going on with DVRs. So most of them stayed away. Oh, and Tata Motors didn’t pay any dividends for a long time either so there was no added benefit here.

So the discount never vanished.

Either way, 15 years after first issuing these DVRs, Tata Motors has had enough. On Monday evening, it announced that it’s planning to cancel all these DVR shares. Yup, the company’s DVRs could stop trading within a year.

But here’s what Tata also did. It looked at the price differential between its two classes of shares — it was over 40%. And it said, “Look, we know you bought the shares hoping that the price differential would narrow. It hasn’t. So we want to do something about that. We’ll give you a 20% premium on the share price. We’ll give you 7 regular shares of Tata Motors for every 10 DVR shares you hold. It’s a sweet deal.”

Investors are happy.

But also, Tata Motors can smile too.

For starters, they won’t have the headache of managing two classes of shares now. And they won’t have to answer questions as to why there’s always a discount between the two. Also, since everyone will now trade only the main Tata Motors shares, it’ll improve liquidity. People won’t be confused as to which one to buy.

But it also does something else. A key metric that investors track will improve — we’re talking about the earnings per share (EPS).

Why, you wonder?

Think about it this way. Assume a company makes profits of ₹100. And the company has 10 DVRs and 10 regular shares available for people to buy. In this case, the total number of shares is 20. And the EPS is ₹5 (₹100/20).

But now, those DVRs will be exchanged for the regular shares. All 10 of them will disappear and get converted into 7 regular shares. That means the total number of shares will fall to 17. Meanwhile, the profit is still ₹100. And ergo, the EPS improves to ₹5.90 and looks optically better.

That could attract more people to invest in Tata Motors. And the demand could push up the stock price too.

So yeah, that’s all there is to it. And now you know about these Differential Voting Rights shares as well.

The only thing we don’t know is — “why now”. What prompted Tata Motors to act on this out of the blue? And if you have an answer to that, you know where to find us.

Until then…

Don’t forget to share this article on WhatsApp, LinkedIn, and Twitter.

PS: Just because of this news, investors lapped up the DVR shares of another company Jain Irrigation today. It jumped by 20%! Investors are quite irrational, no?

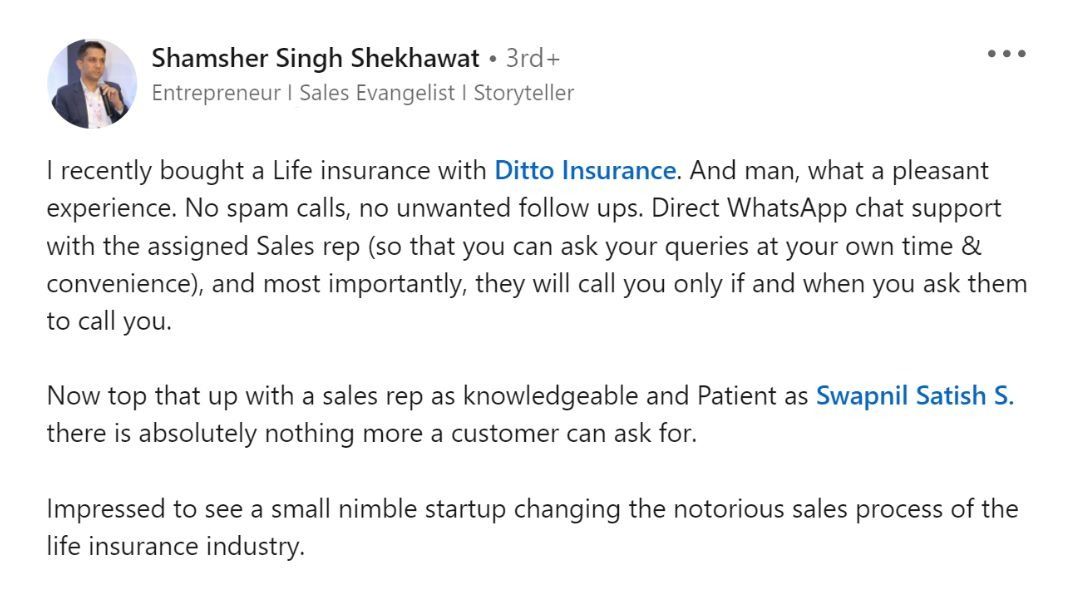

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here