Sunny Side Up 🍳: An obituary to the iPhone mini, pay-by-car and the trading high

Hey folks!

Restaurants seem to be angry with us. Because most customers in Bengaluru are overusing paper napkins just because they’re free. And we know you and I have both done this. That actually translates into 10 tonnes of paper napkins consumed daily by members of the Bengaluru Hotels Association alone.

This doesn’t just increase their costs but also increases the waste which restaurants have to deal with. So they’ve found a new way out of this problem. You’ll now get paper napkins in Bengaluru’s eateries only if you ask for them. You won’t find it waiting for you at the table when you sit.

Now the problem with this solution is that these napkins will still remain a freebie. So people may not hesitate to ask. We’re Indians after all. We don’t mind using stuff as long as we don’t have to pay for it. But come on! You don’t want restaurants to lock up the napkins in a pay per use dispenser. So we’ve got to make sure that their efforts work. Just use hand towels or your own handkerchiefs. It isn’t that hard really.

Here’s a soundtrack to put you in the mood 🎵

Tu Hai Pt. 01 by Indian Ocean

Thanks for this intense recommendation, Jayraj Khunti!

A couple of things caught our eye this week 👀

RIP iPhone mini

If you’re a compact phone + iPhone lover, there there. Because Apple just pulled the plug on its iPhone mini series this week. And although it's normal for it to discontinue old models when it releases new ones, this one hits differently because it’s almost like the end of an era.

You see, a lot of people love compact phones. They slip easily into your pockets. The edges of the screen are easier to reach. And they’re great for single handed use. So Apple obviously thought that the mini series would do well in the market. But it may have overestimated the sales that way.

Because over the years our phone screen times have only increased. A decade ago we spent an average of about 45 minutes on our phones daily. But now, we use it for close to 4 hours. We use our phones for work, play and entertainment. And that requires more power, so more battery too. And bigger batteries require more space, which means that phones have to get bigger as well. That’s exactly why although some people love compact phones, they can’t make do with them as energy requirements increase.

The result?

The mini didn’t sell so well. For instance, if you look back at data for the iPhone 12 from 2021, the mini only contributed to about 5-6% of the sales pie. Whereas nearly half of it was dominated by the bigger phones like the iPhone 12, Pro and Pro Max. So analysts were actually questioning whether Apple should even bother making a mini version of the iPhone 13. But it did, and that disappointed too.

So it actually began slashing production for the mini series and diverted some of their components to its big screen phones. And since chip shortage was a concern, it made sense to use all of its resources to mint maximum profits with products that did better in the market.

But looks like Apple has had enough. It has finally erased the iPhone mini from its website. And the only other smaller phone it now has is the SE. Now, SE is more like Apple’s budget offering so it’s not a perfect comparison or substitute to the mini.

Maybe small iPhone lovers will only have to keep theirs as a souvenir when the device stops working. Who knows? It could even fetch some money at a future ‘rare items’ auction!

***

Your car can be your wallet

The NPCI (National Payments Corporation of India) never fails to amaze. Since its inception in 2008, it has given the word innovation a real run for its money. UPI was obviously a game-changer in giving a massive boost to digital payment volumes. And it has taken multiple avatars over the years. You can link certain credit cards with UPI now. You can use it to set up recurring payment mandates. Heck! There’s also UPI now and pay later — an overdraft or loan facility.

And if that wasn’t enough, we now have the idea of pay-by-car. Coupled with tech from ToneTag, a fintech company, the NPCI has enabled pay-by-car across Bharat Petroleum fuel stations to run its pilot. All you have to do is tell your car’s infotainment system which fuel station you’d be heading to. After you refuel you enter the bill amount, which gets debited from the FASTag account linked to your UPI. And you’re done.

Of course, this tech is in its nascent stage at the moment. But soon this could open up opportunities for cars to order your food and pay as you go too. Or maybe unmanned drive-in fuel stations where you can refuel by yourself, pay by car and zoom away. Because the Internet of Things (IoT) market has only ballooned over the years. Between 2016 and 2020 alone the market boomed a whopping 330%. And today you can do more with your devices.

But yup. With great power comes great responsibility. So maybe protecting these devices from both physical and digital theft is something that needs to have a booming market as well. What do you think?

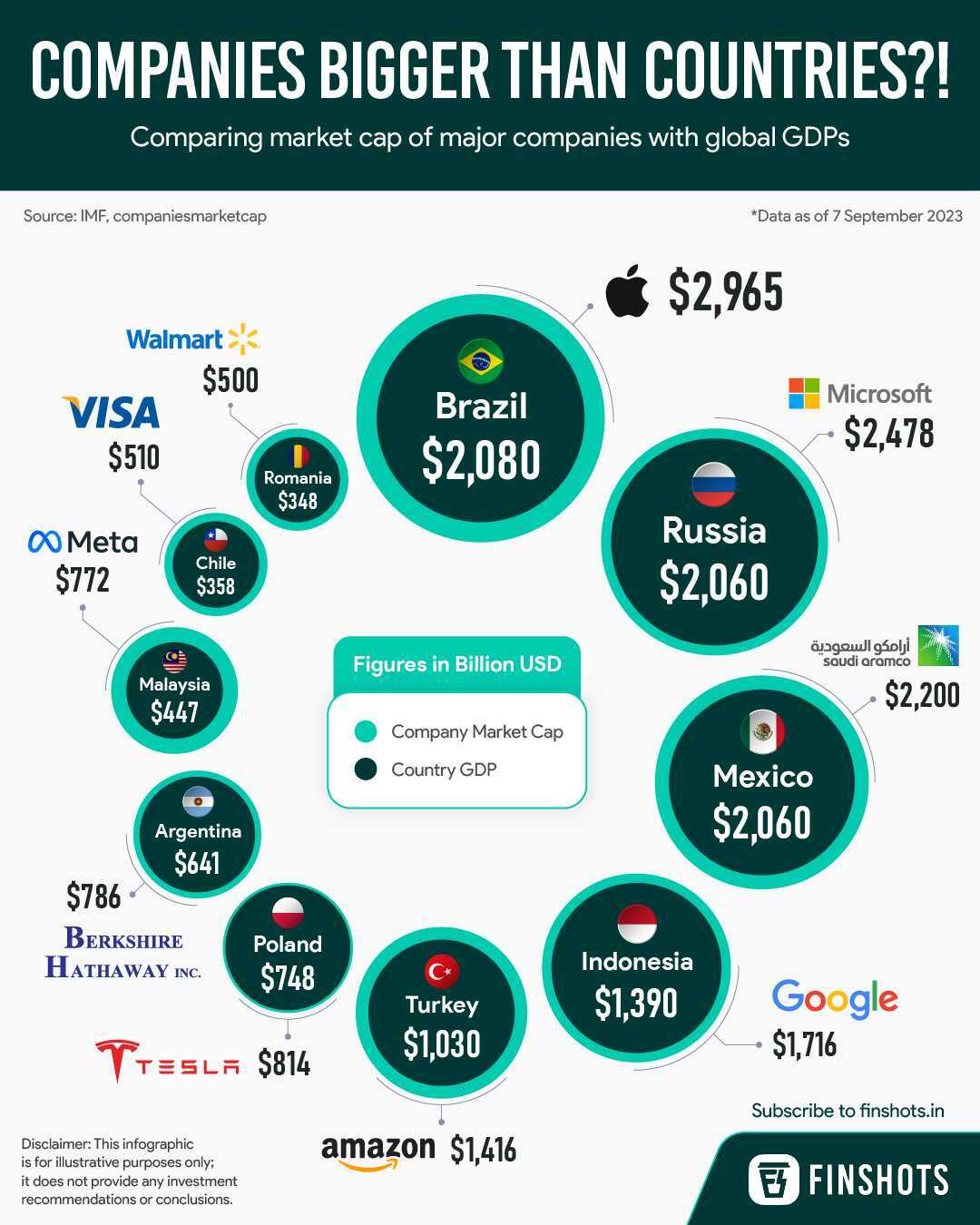

Infographic 📊

Money tips 💰

Trading can be addictive

You know that this header screams the truth if you trade in stocks. Because trading is fun. You make a gain today and you want more tomorrow. But if you make a loss, you still want to try your luck the next day to see if you can recover it. And this doesn’t just happen to beginners. We’re talking about experienced folks too. For example, SEBI says that 9 out of 10 F&O (futures and options) traders lose money. So, why does this happen?

You see, your brain has a part that acts like a pleasure centre when you do things that make you feel good. It could be reading your payday SMS, munching on a bar of chocolate or even scrolling through reels on your phone. Every such activity releases a feel good substance called dopamine as a reward. And trading can give you that dopamine high too, making it addictive.

So you end up over trading and see your losses piling. What’s the solution then?

Well, Zerodha* founder Nithin Kamath describes this quite interestingly. He says,

“Controlling your impulse to trade is like a person with a sweet tooth going on a sugar-free diet—assume that you'll do something stupid. The goal should be to limit the damage. With diet, it is to have fruits & sugar-free alternatives; with trading, it is bet sizing. A simple bet sizing strategy is to trade with as little quantity as possible most of the time. Increase it only when you have conviction and are trading well. This way, even if overtrading, the risk, and the trading & impact costs don't compound quickly.”

As long as you understand this and don’t let the trading impulse get to you, you’re good to go.

*Zerodha, through its Rainmatter Fund, is an investor in Finshots

Readers Recommend 🗒️

Our reader Krishna Hariharan has a very interesting recommendation for us today. It’s a YouTube video called “BOOKSTORES”, which talks about reading more in the golden age of content. Yes, a video talking about reading is quite ironic, we know!

But Krishna says and we quote, “Now you guys post a lot of book recommendations on your Sunday newsletters, but I’m sure the readers who read this are having a difficult time juggling between their daily life and reading. So here’s a video to help them out. It not [only] tells you how to read more but also talks about beautiful libraries from around the world. It also [has] interviews with some knowledgeable people like Tim Urban (Wait But Why blogger and TedX speaker), Eric Barker (author of Barking Up The Wrong Tree) and a few more. Add to that the dynamic editing style of Max Joseph and the video hooks you instantly.”

Thanks for this lovely recommendation, Krishna!

Finshots Referral Raffle 🏆

And the winner is…🥁... Ayush Jain!

Congratulations Ayush! We'll get in touch with you soon to send over your Finshots merch. For the rest of you, fret not. There'll many more raffles and giveaways coming up soon! On that note, look what we’re back with…

Finshots Weekly Quiz 🧩

Here’s your chance to win some exciting new Finshots merch. All you’ve got to do is click on this 👉🏽 link, answer all the questions correctly and tune in next week to check if you won.

Until then, don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).

See you next Sunday🖖🏽!

Don't forget to share this edition on WhatsApp, LinkedIn and X (formerly Twitter).