Sunny Side Up 🍳: Oscars, Swiggy’s cloud kitchen exit & a sweet financial habit

Hey, folks!

The Oscars are happening tomorrow.

So, we wanted to tell you a shocking fact about the awards. And when we say awards we literally mean the stunning Oscar statuettes.

It seems these statuettes aren’t even worth a dollar despite being the most revered award in the American film industry. If you’re shocked, but still scratching your head, here’s the reasoning behind it.

Winners can make great bucks by selling off their awards if they’re pricey. And even though an Oscar award derives greater value from just winning it, according to the regulations you can’t really auction or sell it off without first offering to sell it to the Academy of Motion Picture Arts and Sciences (which gives out the Oscars) for $1.

And these rules apply to the winners’ heirs too.

What a lost opportunity!

Here’s a soundtrack to put you in the mood 🎵

Need I Say More? by Karthick Iyer

Thanks for the lovely rec Santhoshi Andalam.

Let’s dive in now?

A couple of things caught our eye this week 👀

Swiggy hasn’t really parted with its cloud kitchen

Come the pandemic, there was one sizzling business model in the food industry ― the cloud kitchen.

A cloud kitchen, virtual kitchen or ghost kitchen (call it whatever you like) is a space where multiple restaurants cook together. There’s an infrastructure-as-a-service provider like Swiggy or Zomato that lets out a huge well-equipped area divided into kitchens. And that’s what some restaurant partners use.

A common space not only means lower rents for restaurants but also easier access to customers and faster deliveries since they can be planted in a bunch of areas depending on consumer demand. On the other hand, service providers also benefit from more eateries partnering with them.

This was a great business model even in the post-COVID world since people were sceptical about eating out. Even today cloud kitchens are considered to be more lucrative and hassle-free as compared to setting up restaurants where people dine out. In fact, by 2025 the cloud kitchen market size is expected to be close to $3 billion.

A few days ago though, Swiggy exited Swiggy Access, its cloud kitchen service by selling it off to Kitchens@. But if the business prospects are promising, then why is Swiggy letting it go?

You see, Swiggy isn’t actually breaking up with cloud kitchens. It’s only taking a step back from managing the business directly since it has agreed to accept Kitchens@’s shares instead of cash for the deal. This means that Swiggy will remain invested in it.

Why, you ask?

Well, Swiggy’s trying to rationalise costs as much as possible. Despite revenues increasing by 125% in FY22 over the previous year, its losses ballooned by almost the same percentage. While it initially planned on cutting down only indirect costs like infrastructure and office facilities, its food delivery growth rate didn’t meet expectations. So they had to compromise on other overall costs too.

And the proof lies in its latest layoff round, in which Swiggy showed the door to 380 of its employees.

So it’s more like an “it’s not you, it’s me” kinda situation between Swiggy and cloud kitchens.

But who knows? It could just do a backflip in the long run if things get better because cloud kitchens aren’t a dying business model any time soon.

***

Why are India’s credit card bills soaring?

Credit cards have been a hot topic this week.

It seems the credit card outstanding amounts have risen nearly 30% in January to reach a whopping ₹1.87 lakh crore as compared to just a 10% jump in the same month last year.

So, why are people’s credit card bills getting longer?

Well, two things.

- Co-branded cards

We’re talking about the popular Amazon Pay ICICI Bank, Flipkart Axis Bank, Indigo 6E Rewards HDFC Bank and other similar credit cards. Apparently, people are loving these. For instance, BankBazaar has co-branding tie-ups with YES Bank and RBL Bank. And applications for reward cards on BankBazaar rose 48% year-on-year.

With cards like these, consumers not only spend but feel like they’re saving or getting rewarded through cash backs or reward points. This way banks get to widen their reach too. So more brands are keen on launching co-branded cards this year to cater to digitally savvy consumers.

2. Financial awareness

Finfluencers are often looked at cautiously. But there’s one thing they’ve helped young folks with ― taking a keen interest in finance.

Fresh graduates, who’re just bagging jobs are more financially aware it seems. They’re actively trying to build their credit scores to be able to easily access bigger loans and beneficial interest rates in the future. Fintechs building a presence online and sharing information is helping youngsters make informed credit card choices and purchases according to V Swaminathan, Executive Chairman of Andromeda Loans.

Besides, letting RuPay credit cards fly on UPI’s back has also helped consumers become more comfortable with credit cards as a QR code is all it takes to pay.

Do you feel that your credit card spending growth has also added to this growth? Let us know.

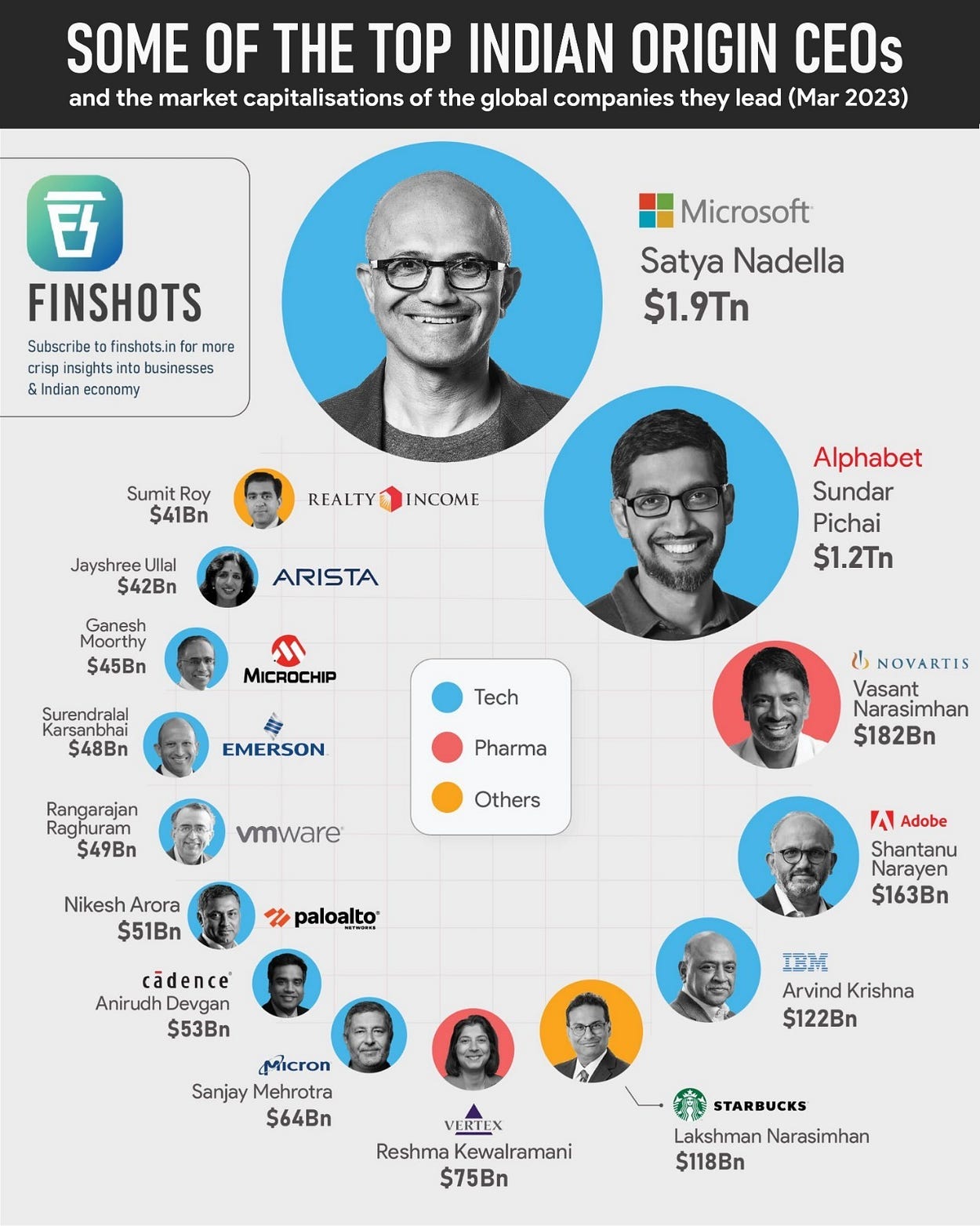

Infographic 📊

Money tips 💰

You’ve failed at managing your money if you haven’t done this

Imagine that you’re a good financial planner. You’ve got your family and yourself covered with term and health insurance. You’ve wisely diversified your investments across various asset categories. You have a ready emergency fund for unforeseen situations.

Hell! You even regularly estimate how much tax you’ll need to pay and plan your investments accordingly to reduce your tax burden!

But you don’t really share this information with your dependents. And you don’t have any documentation of it either. If you think that you’re too young to have dependents, think again.

You could have younger siblings. Also, you have your parents.

And it’s no good being a good money manager if you haven’t safely kept a record of your investments and insurance.

We know that everything is digital today. But it’s always good to be transparent about your savings, insurance buys, investments, loans and credit cards with your family. And keep relevant documents like policies, investment certificates, nomination forms, tax returns and loan statements neatly stacked in a damage-proof physical folder.

And this doesn’t just apply to monetary investments. You should do this with your fixed asset purchase bills too. That can save you a lot of time and money when you want to make a warranty claim.

If you’re confident that your family can retrieve it from a storage device like a pen drive or cloud storage, you could keep your documents safe in there too. Just make sure they’re not password protected. And that your family knows where it’s stored.

That way your folks will always be financially secure in your absence. And that’s when your status will change from just ‘good’ to ‘great’ money manager!

Readers Recommend 🗒️

12 Rules for Life by Jordan Peterson

This week we have a book recommendation from our reader Mohini Khandelwal. It provides life advice through essays on abstract ethical principles. Like why skateboarding boys and girls must be left alone, what terrible fate awaits those who criticize too easily, and why you should always pet a cat when you meet one on the street!

Sounds weirdly catchy no? Thanks for recommending this Mohini. We hope our readers pick it up.

Finshots Weekly Quiz 🧩

Thousands of you took part in our first-ever Weekly Quiz last Sunday. And we have a winner!

Congratulations Mayuri Govil! You’re the first-ever quiz winner. We’ll be in touch with you to send you that sweet merch we promised. 🙂

To everyone else — let’s try winning again, eh? Answer all 5 questions in today’s quiz correctly and you stand a chance to win some cool prizes.

Ready? Get your thinking caps on! Good luck.

Click here to access the Google form and take the quiz.

And with this, it’s wrap-up time. We’ll see you next Sunday.

Until then, don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).