Sunny Side Up 🍳: Buying moon land, a heartbreaking doggo fact & rental deposits

Hey folks!

Before we start today's story we have an amazing video for you on our YouTube channel. It's on the Chinese Real Estate crisis and it's one of the best videos we've done so far. So you may want to check it out. Link here.

If you've watched it already, let's talk about Apple. The tech company :)

Apple is doing something smart with its smartwatches. Apparently, it’s testing 3D printing technology on its Apple Watch 9. And that’s quite a cool thing to do.

You see, right now, Apple Watch chassis (the metal frames) are made by cutting metal slabs into their desired shape. But with this new experiment, Apple might just need to feed a design into a 3D printer and let it draw out the shape of the Watch parts by oozing out molten metal that solidifies later. At least that’s how 3D printing works for construction. So it would be safe to assume that 3D printing with metals might work almost similarly.

It’ll save production time and could also reduce costs. There’s less wastage too because it only uses the necessary amount of metal needed to create device parts. And if all goes well then Apple might use this technology across its other devices as well.

Could this mean we get cheaper Apple products?

Here’s a soundtrack to put you in the mood 🎵

Baadal by Sanjith Hegde

You can thank our reader Pranshu Chakraborty for this recommendation.

What caught our eye this week 👀

Owning a piece of the moon

If we asked you how much it would cost to buy an acre of land in any Indian metro, the first thing you’d probably say is “Crores of rupees”. But do you know how much it costs to buy that same stretch of land on the moon?

Just about ₹2,400 (or $29)!

Wait… What?

Yup. A Jammu based businessman recently purchased a property on the moon. And although many celebrities including Shah Rukh Khan, Tom Cruise and former presidents of the US are rumoured to have owned lunar properties at some point in time, the trend seems to be catching up now. Courtesy, the success of Chandrayaan-3. A firm called The Lunar Registry has even witnessed higher order volumes because of it.

Sounds pretty cool right?

Now, before you get too excited and think of investing in lunar real estate, take a breather. Because nobody can legally own property on the moon. Here’s why.

In 1967 the United Nations members signed an agreement called the Outer Space Treaty. It simply governs how countries go about their space explorations. They can’t use land in outer space for military activities. And certainly can’t claim any right on parts of celestial objects including the moon. The Moon Treaty of 1984 asserts this too.

But Dennis Hope, a former car salesman from the US, thought he could outsmart these laws by finding loopholes. He’s been a lunar land broker ever since the 1980s because he suggests that these treaties only apply to nations or governments. Nothing in them bars individuals from owning lunar land.

But here’s the thing. When you buy a property you always trace back its title or former ownership to check if everything’s clear. That way nobody can claim your property afterwards. And if you go back far enough to check who the first-ever owner of the property was, it would definitely have been owned by a sovereign of that land. The sovereign would have then passed it on to your ancestral owners before finally coming to you.

So, if no sovereign can claim ownership of the moon, then how could they pass it on to anybody else? Anybody selling you property should own it first. And if that isn’t the case, you know this is a practical joke. It definitely could be a possibility in the near future if specific regulations kick in. But not for now.

So what of all the people who’ve bought it already? Well, it could just be a gesture that makes you feel good. Or maybe gives you hope of living on the moon someday? We don’t know.

But if anyone tells you that the moon could be a great real estate investment, just share this story with them.

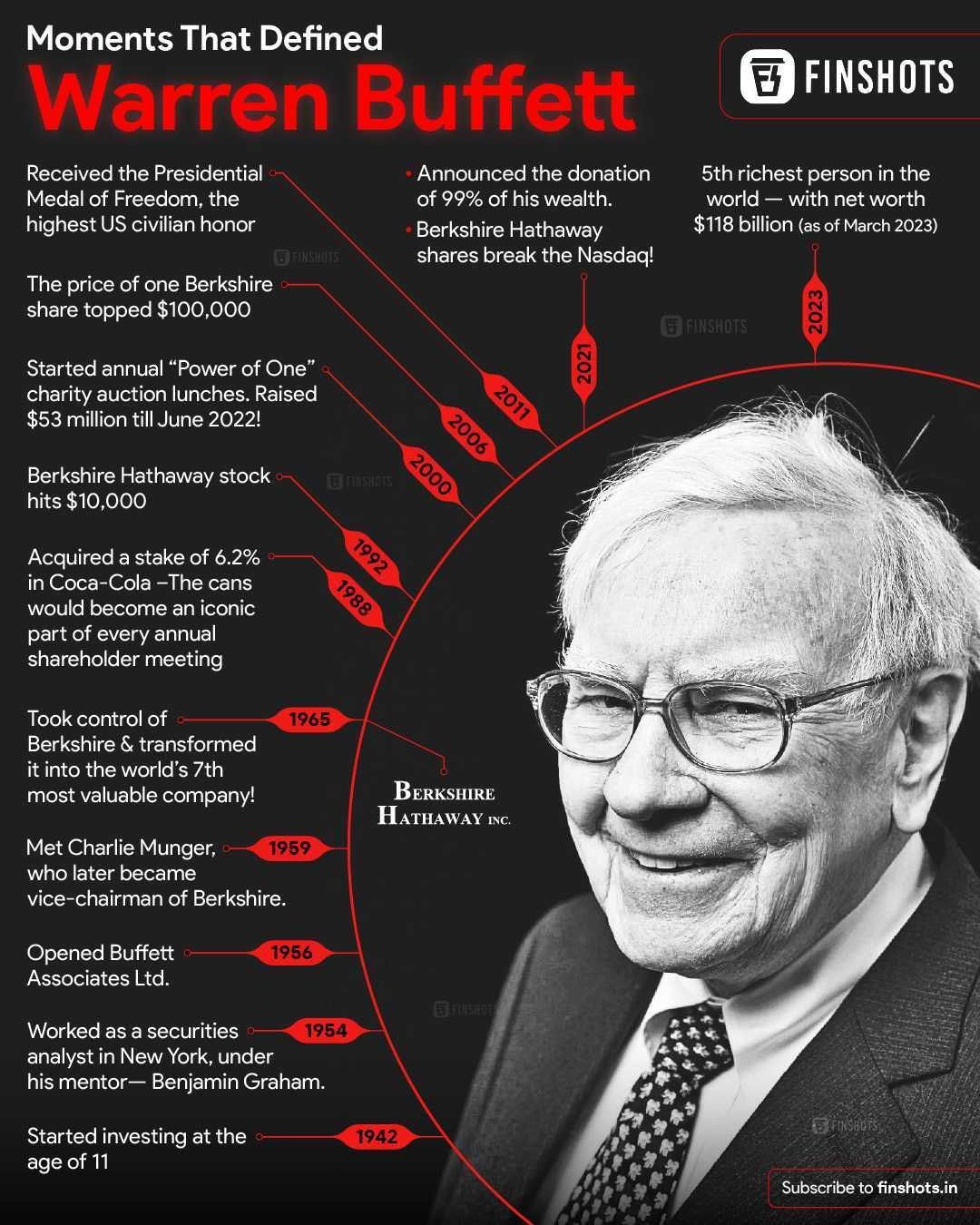

Infographic 📊

This didn’t make the cut ✂️

On Friday, we wrote about the economics of protecting endangered species. And here’s an interesting bit we came across. Protecting man’s best friend ― the dog, may not actually be worth it. Yup, we know dogs are not endangered species. But they still have a connection. Pet pawrents globally spend a lot of money to take care of their doggos.

There are now over 1 billion domestic dogs across the globe. These include strays and pets. And increasing dog populations also mean increased risks of losing more endangered species. Because apparently, dogs are the third most damaging mammal after cats and rodents. They may have even been responsible for the extinction of at least 11 species, including the Hawaiian Rail and the Tonga Ground Skink.

But we care for them nevertheless. This actually also finds a place in Andrew Metrick and Martin Weitzman’s economic theory too. They say that humans tend to have certain emotional bonds with certain animal species. So they might want to keep them alive despite throwing the cost-benefit scale out of balance. That’s why it could be hard to choose the ecosystem over dogs.

Don’t you agree? We know all dog lovers are nodding already.

Money tips 💰

Things you ignore about rental deposits

House hunting can be hard. Even finding the perfect space can leave you feeling anxious. The reason?

Hefty rental deposits. At times, landlords want you to put 6 months worth of rent on the table in advance just so they have some security when they rent out their house. And that’s when you could be making two common mistakes.

#1 Rental Deposit Loans

Arranging huge sums of money for rent deposits is a headache. So you could be lured by the charm of rental deposit loans that financial institutions offer. And an article in Moneycontrol (from 2019) tells us why.

Some of these loans come with a one time bullet repayment of the principal. This means that you just go on paying interest until the end of the loan term while paying the entire principal at once when your rental agreement expires.

But they could be minting more interest out of you than regular personal loans. And it’s not because the interest rates are higher. In a regular personal loan, you keep paying interest on the reducing balance of the money you borrowed. It’s called the outstanding principal. But since your principal doesn’t reduce over time in a rental deposit loan, you keep paying a fixed amount of interest every month. And that may make you feel like it’s lighter on your pocket.

#2 The wrong perception of getting back your entire rental deposit

This happens with most of us. When we vacate a rented space, we assume that we’ll get our entire deposit back. But you could be surprised when your landlord tells you that they’ve deducted maintenance or damages. And if you draw out a budget based on this assumption, it could shake your entire plan.

What you should do instead is read your rent agreement carefully before signing it, so you know exactly what part of your deposit will come back. And even if there’s no exact amount mentioned, don’t include this money in your monthly budget. You can decide how to use it when you actually receive it later.

Now you know what not to do when you sign a rental agreement.

Readers Recommend 🗒️

The Maverick Effect by Harish Mehta

Our reader Parth Shah recommends a book that narrates the inside story of India’s IT revolution. It talks about the transformation of India, a nation with an amateur understanding of tech into a $200 billion industry today. While also changing the lens through which the world looked at India.

Sounds like an interesting read. Thank you for the recommendation Parth!

With this, it’s time to say goodbye. We hope you unroll a fun day ahead. We’ll see you next weekend.

Until then, don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).

🖖🏽!

Don't forget to share this edition on WhatsApp, LinkedIn and Twitter.