Sunny Side Up 🍳: All that glitters is not gold, Rhesus monkeys & calories, and Credit cards

Hey!

Are you feeling overworked? We’ve got something for you.

Samsung Korea has come up with a new concept mouse that runs away from the desk if you try to work too much. So if you’ve gone overboard with your work hours. This mouse will sense it and slip away from your hands! 😁

If you’re wondering why Samsung even came up with something like this, it’s because of work-life imbalance in Korea. Employed folks there hesitate to log out of work even post work hours it seems.

Sounds familiar?

Anyway…

Here’s a soundtrack to get you in the mood 🎵

My Only Swerving by El Ten Eleven

Shout out to our reader Ravishu Punia for this recommendation. It’s become one of my go-to tracks when writing the newsletters!

Now that you’re settled into your favourite couch, sipping a refreshing beverage, let’s get this Sunday started!

What caught our eye this week 👀

Gold in Platinum’s clothing

Ever heard of legal smuggling?

Confused? Don’t be. Because this is happening for real. Gold is being imported under the guise of platinum. Thanks to a loophole in our Customs Law.

You see, Indians love gold and we end up importing a lot of it to satiate our demand. Last (financial) year we spent a whopping $46 billion on importing 842 tonnes of gold. It was a 30% jump over what we imported the year before that.

Now the thing is when we keep importing more stuff than we export, it affects our trade balance. Also, we typically have to pay for gold imports in dollars. And when have to keep exchanging precious Rupees to buy Dollars for import purposes. It can devalue our currency.

All this worries people who manage the country’s finances.

So a while ago, the government thought ‘Let’s discourage gold imports by raising import tariffs!” And it did. It almost doubled the tariffs to 15%.

Now folks could still smuggle it illegally into the country as always. Some estimates state that about 300 tonnes of gold are smuggled into the country every year. And since it bypasses the official routes, the government loses ₹20,000 crores in annual revenues.

But not everyone can be a gold smuggler, right?

So yeah, this time, a few gold traders found quite a novel way to import gold legally. They figured out that our Customs Law states that if an alloy contains 2% or more of platinum, it’s considered to be platinum itself during import. So traders began to import alloys that contained 96% gold and 4% platinum!

Quite ingenious!

And since platinum alloys attract import duties of just 10.75% compared to the 15% for gold, they save money in the process too!

Quite a dapper move to hoodwink the government, eh?

But yeah, it’ll be just a matter of time before the authorities plug these leaks that cause losses to the government’s coffers.

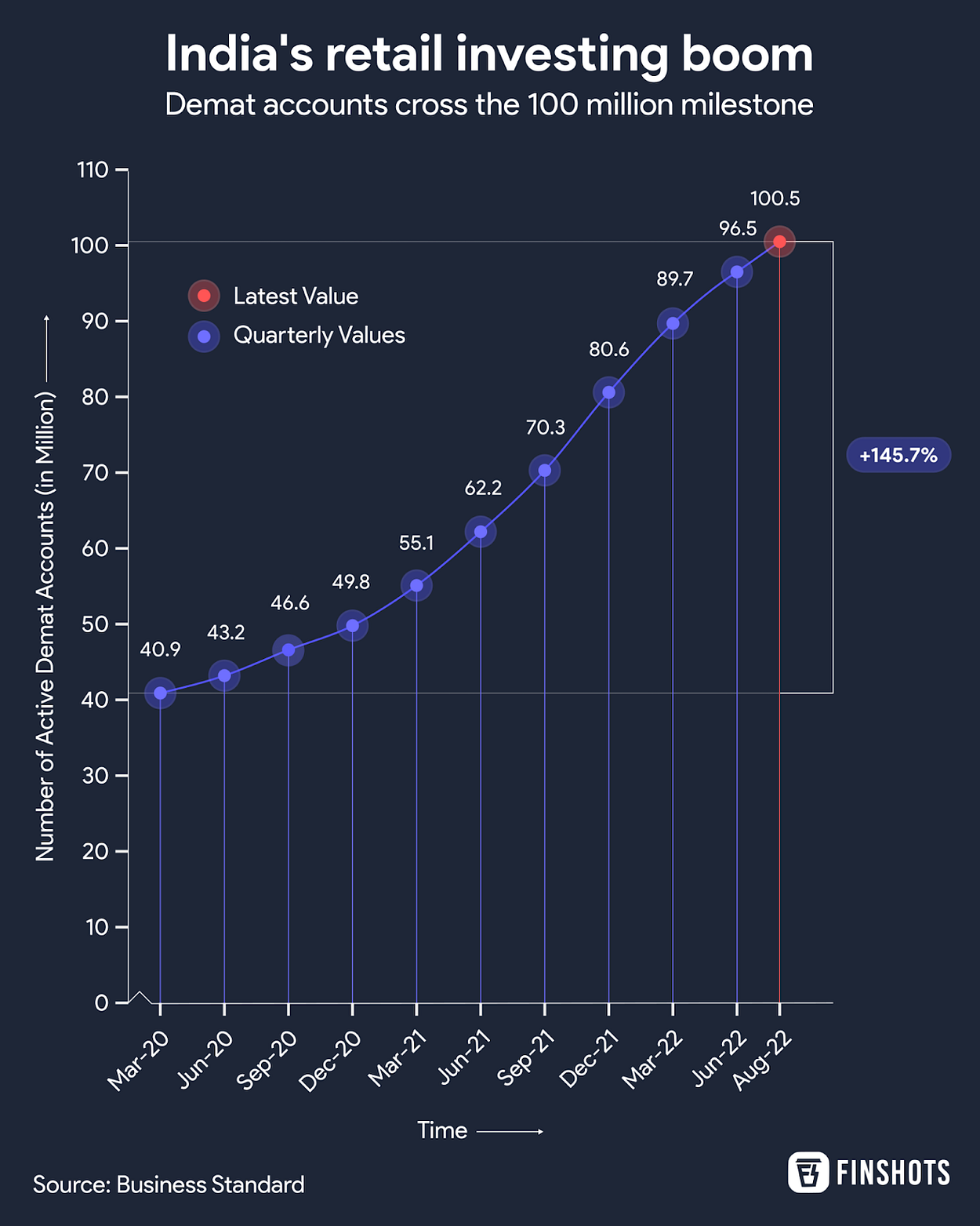

Infographic 📊

This didn’t make the cut ✂️

Can you beat ageing through your calorie intake?

On Friday, we explored whether including calorie details on restaurant menus can get people to eat less and battle the obesity epidemic. But this got us thinking — does cutting back on calories have other benefits?

Well, scientists are actually studying if we can defy ageing by controlling our calories.

In the late 1980s, a couple of studies were set up to understand how calories affected ageing in Rhesus monkeys. Why Rhesus monkeys? Well, we share 93% of our DNA with these primates. So if we want to understand human bodies, these monkeys are quite a close replication.

What did they find?

Well, CR monkeys looked younger (more hair and fewer greys), cancer was reduced by over 50%, the risk of heart diseases halved, and blood glucose levels were remarkably healthy.

Quite spectacular, no?

And while we definitely aren’t nutritionists who can recommend a change in diet based on this study, it’s worth diving deeper into, don’t you think?

Money tips 💰

Don’t let your credit card screw you over

Ever observed your savings rate drop when you use a credit card when compared to when you pay cash?

Maybe you haven’t paid so much attention. But you should!

Imagine you’re carrying a crisp ₹2,000 note to spend on your favourite snacks at a store. You have to ensure that every item you buy fits your budget. You can’t run over the budget simply because you don’t have a penny more to splash.

But now, look at the scenario with a credit card in hand.

You have a credit limit that’s almost always triple your monthly income. This can trick you into believing that you can indulge in slightly walking over your initial budget because you have a backup.

Moreover, the money doesn’t immediately disappear from your wallet or bank account. And this psychologically cheers you into spending more, even if it’s a few hundred rupees.

Add these up, and you’ll quickly realise how your plastic spending trespass on your savings or spending goals.

Is there a way to escape this trap?

Well, the best way to really do it is to avoid credit cards till you work in some discipline in your savings habit.

Stick to cash. Or even a debit card that instantly debits your bank account. That way, you’ll get an SMS that reminds you of a falling balance and you’ll wake up to reality quickly.

Maybe those “credit card reward points” can wait or simply aren’t worth it if it impairs your spending judgement.

Readers Recommend 🗒️

Everyone talks about the startup success stories and what we can learn from them. What about startup failures? Don’t they contain even more nuggets of wisdom?

Well, our reader Neil Parekh recommended a book called The Biography of a Failed Venture By Prashant Desai.

Here’s a synopsis of the book:

“In April 2017, Prashant Desai founded a venture to build the first truly Indian sports brand — D:FY. In six months, Rajiv Mehta, who started Puma India and led it for seven years, joined him as a partner. They opened seventeen stores in seven cities, riding on great aspirations and confidence. The business lost Rs 30 crore in thirty months, virtually wiping out all that Prashant had earned for nearly thirty years.

The Biography of a Failed Venture provides a brutally honest account of why D:FY failed and how entrepreneurs can avoid these pitfalls to make their business ventures successful.”

Keep your recommendations coming, folks. We love going through it all!

Anyway, hope you’ve enjoyed this edition! If you did, we’d love to hear from you. And if you didn’t, do send us your feedback. Hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in) and let us know.

As always, don’t forget to tell your friends and family about us.

See you next Sunday!

==========================================================