Sunny Side Up 🍳: AI Music, Devil in your SIPs & Expensive Paintings

Hi friends,

Are you still reeling under all those Twitter threads and LinkedIn posts about how ChatGPT is going to take over the world? Everyone’s busy listing out the kinds of jobs that will be lost thanks to AI. Even us writers. 😟

But have you seen what Google has been up to with AI?

Last week, the tech giant quietly released something called MusicLM. It’s an AI that has been trained on 280,000 hours of music. And now, it can create some thumping music for you. Even from complex text prompts like this — “A rising synth is playing an arpeggio with a lot of reverb. It is backed by pads, sub bass line and soft drums. This song is full of synth sounds creating a soothing and adventurous atmosphere. It may be playing at a festival during two songs for a buildup.”

It really sounds too good to be true.

Now Google isn’t releasing MusicLM to the world just yet. But why’s that, you ask?

Apparently, there’s a bit of an ethical dilemma here. You see, MusicLM has this tendency to take original material created by artists and use it in its own music. It’s not that bad — only 1% of its music was plagiarised so to speak. But it’s still a problem. You don’t want to get sued by massive music production businesses for copyright infringement.

There’s also something else that lawyer Chris Mammen pointed out to The Verge. Let’s say you’re purchasing a song. Are you buying the rights to play the song or are you also buying the right to use it for training AI bots? Do you need the artist’s permission before you put it to use?

Lawyers aren’t quite sure what’s the right answer yet.

So yeah, you can see why Google’s keeping its public release on hold for now. But the way things are shaping up, it looks like even music producers are soon going to face the heat of AI!

Here’s a non-AI soundtrack to get you in the mood 🎵

Sukoon by Hassan & Roshaan ft Shae Gill

Listen to this non-AI generated song and tell us it doesn’t soothe you?! Hat tip to our reader Aakankshi Bothara for this lovely recommendation.

A couple of things caught our eye this week 👀

Meta’s big day is thanks to firing people

Meta’s (formerly Facebook) stock price jumped 20% on Friday. It was its biggest single-day jump in a decade. But guess what? It wasn’t some new buzzword like Metaverse that did the trick. It wasn’t even its latest earnings which was a bummer really — it fell a whopping 55% during Oct-Dec 2022 compared to the same period in 2021.

What did the trick?

Well, a couple of things.

See, investors only care about future profits. Meta’s slashed 13% of its workforce already. And it could just be the tip of the iceberg. More job cuts could be on the way. Free perks will be thrown out of the window. Heck, Meta’s CTO even published a blog post where he said how Facebook’s culture had changed — from initially saying no to charitable donation to then saying yes without thinking. And well, charitable donations don’t help a company’s core business.

Now he may not really have meant to say that charity at Facebook was a bad thing. But you get the drift. It’s all going to be about fiscal discipline in 2023. You can be sure that investors will rub their hands in glee when they hear of every cost-cutting measure. They’ll probably make more money in the future.

But the bigger thing is that Meta announced a $40 billion dollar buyback. What does that mean, you ask?

Well, Meta has some spare cash lying around. It’ll also pad up its coffers after all those layoffs. So what can it do with the money? Well, it could invest it into projects that will help it move the needle in a big way. But if there aren’t enough such ideas, it can return the cash back to investors. Meta will pay them a nice sum of money and simply buy the shares back from them.

So yeah, investors love layoffs and getting money into their pockets instead. Simple.

***

Apple Watches are creating havoc

Apple’s ads are brilliant. Let’s face it. Apple knows how to play to your emotions and sell product. And they don’t just tell you facts about the product. They’ll weave a story. Like the ad about privacy where a person is chased by a barista at a coffee shop, the banker, and everyone else for data.

But the most hard-hitting ad is probably one they made for the Apple Watch. It’s called 911 and it simply tells you the stories of real people who were stuck in real emergencies and called for help using their Apple Watch. The watch saved their lives. And the ad plays to the basest of human emotions — fear. Fear of dying.

It’s brilliant.

But there’s another feature of the Apple Watch — the fall detector. Now, when Apple launched this feature, this is what their website said.

“If Apple Watch SE or Apple Watch Series 4 or later detects a hard fall while you’re wearing your watch, it taps you on the wrist, sounds an alarm, and displays an alert. You can choose to contact emergency services or dismiss the alert by pressing the Digital Crown, tapping Close in the upper-left corner, or tapping “I’m OK.”

If your Apple Watch detects that you’re moving, it waits for you to respond to the alert and won’t automatically call emergency services. If your watch detects that you’ve been immobile for about a minute, it will make the call automatically.”

Sounds perfectly reasonable, right? If you’re fine and can respond, no harm done.

But here’s the thing. Apple Watches seem to be on overdrive these days. Apple made the software more sensitive and it keeps making false automated calls now. Especially when people are skiing. Now if someone’s skiing, and there’s a false alert, they can’t just stop on the slope and hit ‘I’m OK’, right?

So emergency workers in the US have to respond to all these falls calls now. And they’re not happy about it. Because it could mean they suddenly put other calls on hold. Calls which are real emergencies.

And what do these emergency responders want?

Well, they think that Apple should maybe have its own call centre to deal with emergencies triggered by its feature

Money tips 💰

The devil in your SIP

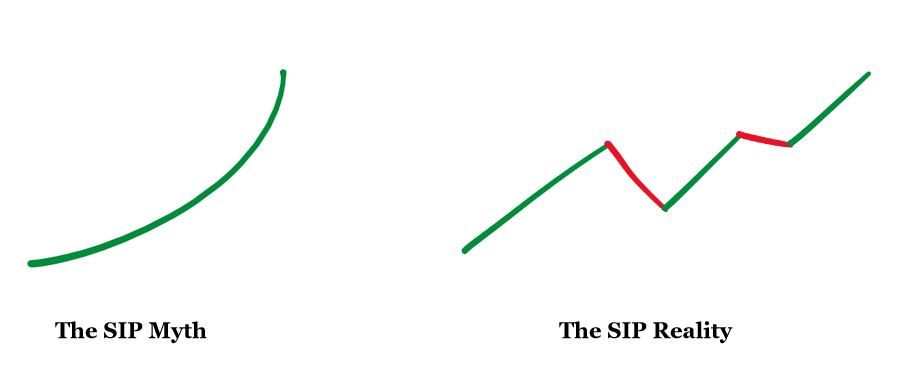

We’ll all been sold fairy tales of Systematic Investment Plans or SIPs. In case you’re wondering what on earth is an SIP — it’s just an automated monthly investment you make into a mutual fund. Everyone tells you that SIPs are the best way to build long-term wealth. That the magic of compounding will work in your favour.

And this is true. If you’re disciplined and invest money regularly, it truly does compound and create riches.

But sometimes, SIPs can shock you too. Because there’s something no one tells us — It’s never a one way ride to the top. And as the infamous lines go, “Even SIPs are subject to market risk.”

Yes, the calculators and charts show you values that simply go up and up and up. But no one shows the stock market crashes that occur in between all this.

Let me paint a picture.

Imagine you’ve diligently invested ₹10,000 every month through the fabled SIP route. The investment grows and after 5 years, it’s worth ₹8 lakhs. You’re happy. It’s exactly what all those charts promised.

But then, the stock market crashes by 30%. You look at the investment and it’s now worth only ₹5.6 lakhs. 5 years of investing goes down the drain. You wish you’d just put money into an FD instead. You curse everyone who ever uttered the word SIP.

You panic seeing this loss and withdraw the investment.

And I don’t blame you for that. It’s an evolutionary trait. If we see a snake today, we’ll quickly flee in the opposite direction. It’s a fight-or-flight response. Our brain has evolved to respond quickly to any risk it perceives. And that’s valid even if it’s the risk of the stock market. When we see red and everything crashing, we want to take our money and run away. We overreact.

That’s what happens all the time.

But slowly, the market recovers. It continues to march upwards. Investors who braved the uncertainty continue to make money. They even kept investing during the market crash. Which means that they kept buying at cheaper and cheaper levels. Smart!

You, on the other hand, are not gaining anything anymore. You already withdrew your money disappointed at what you thought were false promises of SIPs. If only someone had told you, “SIPs are not a magic wand. Be patient.”

At least now you know that you simply should’ve ignored the noise. You have a new mantra — ‘Just Keep Investing”.

Readers Recommend 🗒️

Quit: The Power of Knowing When To Walk Away by Annie Duke

This brilliant book was recommended by our reader Rishabh Jhol. Now he put quite a bit of effort into trying to explain what the book is about in a nutshell. But the gist of it can be captured in these few lines:

“It is important to quit not only because the path you are pursuing isn’t worthwhile anymore, but also because you are less likely to put your time, money, and intention in exploring other opportunities due to myopic path dependency

….

When we are on a path, we tie our identity to it. We suffer from sunk cost fallacy as we believe we’ve invested too much into it and it would be foolish to move away. It potentially prevents us from having a bigger outcome in life.”

And if you’re not a reader, he says that the audiobook is a great companion for walks too.

So read it, listen to it, and let us know what you think.

***

Anyway, that’s it from us today. Have you read or listened to any exciting stuff this week? Or binge-watched some sharp business TV shows? Share it with us and we’ll feature it in the newsletter. Just hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).

Have a restful Sunday. Take care!