Social media trading?, a GI for kulcha and more...

Hey folks!

If you’ve ever been to Punjab or Delhi, chances are you’ve tasted one of the most addictive street foods around — the humble kulcha. Golden, flaky and best enjoyed with chole (chickpea curry), a dollop of butter, some curd and tangy achar (pickle) on the side, it’s the kind of dish that keeps you going back for more.

Now, there are plenty of stories about how this delicacy came to be. One version takes us back to Maharaja Ranjit Singh’s court in pre-partition Punjab. His cook, Ram Das, is said to have experimented with dough kneaded using fermented chickpea water, fennel and a dash of a secret masala. The king loved it so much that kulchas soon became a royal breakfast staple.

But some other stories claim that kulchas are simply a desi cousin of the naan, adapted and perfected in Punjab. Some even say colonial kitchens borrowed French layering techniques, giving kulchas their signature flakiness.

Whatever the truth, it’s clear that the dish has deep Punjabi roots.

And now, Punjab is looking to give it a modern stamp of identity — a GI tag. If you’re wondering, that’s a “Geographical Indication” certification, the same kind that protects Darjeeling Tea or Kashmiri saffron. It basically ensures that when you say “Amritsari kulcha”, it really is from Amritsar, and not some generic imitation.

Which makes you ask, why get a GI tag for something as simple as a kulcha?

Well, you see, the kulcha isn’t just Amritsar’s pride. It’s woven into the food culture of Bihar, Lucknow, Delhi, Jammu, Kashmir and even Lahore. Everyone has their own version, and it’s close to people’s hearts wherever you go.

But that’s where the confusion begins, and Punjab wants to avoid that because kulchas aren’t just food in Amritsar — they’re a livelihood. A single kulcha shop can rake in tens of thousands of rupees a day, selling plates for ₹30–70. It’s a business that sustains street vendors, bakers, flour suppliers and even rickshaw drivers ferrying hungry tourists straight to the stalls. And those tourists don’t just come from across India. Many travel from abroad just to savour an authentic kulcha.

A GI tag could protect these small businesses from cheap imitations and open new doors. Think premium branding, exports to specialty markets or maybe even more franchised kulcha chains or packaged kulchas on supermarket shelves. With exports already hit hard — reportedly down 40% last year thanks to global trade disruptions, the timing couldn’t be better.

So, the next time you’re digging into a buttery, crispy kulcha in Amritsar, remember — it might soon carry an official GI stamp of pride. But no matter the label, its humility and charm will always lie in that soft, comforting bite.

Here’s a soundtrack to put you in the mood 🎵

Sadiyantra by Gauley Bhai

Ready to roll?

What caught our eye this week 👀

Social media + trading = 👍?

Imagine you open your trading app and instead of boring candlesticks and overwhelming tickers, you’re scrolling through something that looks suspiciously like Instagram. A glossy feed full of likes and comments… except there are no sunsets or avocado toasts here. It’s your friend flexing his Tesla shares. Or a hedge fund manager sliding in with a big Apple buy. Or maybe even a politician adding Nvidia to their portfolio.

Well, that’s Robinhood’s newest experiment.

The US brokerage is rolling out something called “Robinhood Social.” Think X or Reddit, but every post is backed by a real trade. The pitch is simple too. Small investors often feel shut out of the information loops that swirl around Wall Street insiders. This, Robinhood says, beams the action right into your feed.

And it’s not just stocks. Robinhood’s weaving in prediction markets too. So, you could scroll past bets on elections, football finals, or even reality TV finales. It’s more like finance, speculation, and memes all served in one app.

Sounds exciting? Absolutely.

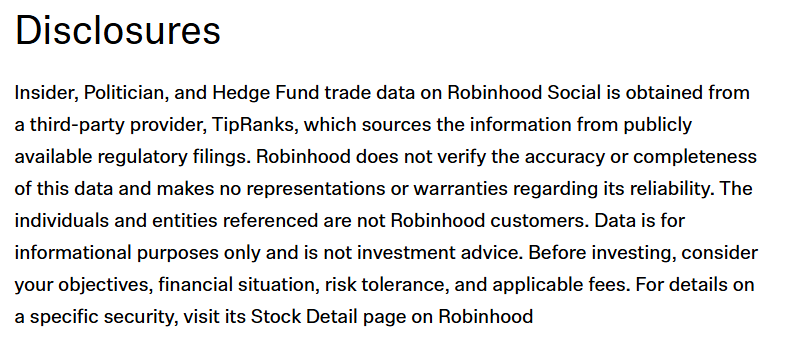

But here’s the thing. When trades double as content, investing can risk turning into performance art. A flashy screenshot can set off a meme rally. And those who hyped it up can cash out just as quietly, without posting their exits. Robinhood knows this too—it slaps a neat little disclaimer on the feed.

Which, loosely translated, means: you’re on your own, buddy!

And if history is any guide, that’s not reassuring. Remember India’s fantasy trading apps that blurred into gambling before regulators pulled the plug? Or the GameStop saga where viral posts sent prices to the moon before retail investors crashed back to earth? It all tells us that when finance turns into entertainment, the comedown is usually fast and costly.

All of this just proves how thin the line between money and memes has become. Memes aren’t just the commentary anymore, they’re often the message.

Retail investors may find this empowering. But it can just as easily tip into a slippery slope where one wild speculation fuels the next—something that regulators are bound to find terrifying. And Robinhood? Well, for them it’s a full circle moment. The company began in 2013 looking more like a social app than a broker. And a decade, a meme-stock saga, and a few bruises later, it’s once again betting that markets and memes belong together.

So what do you think? Is Robinhood reinventing the markets or just giving them a like button? And should India get something similar too?

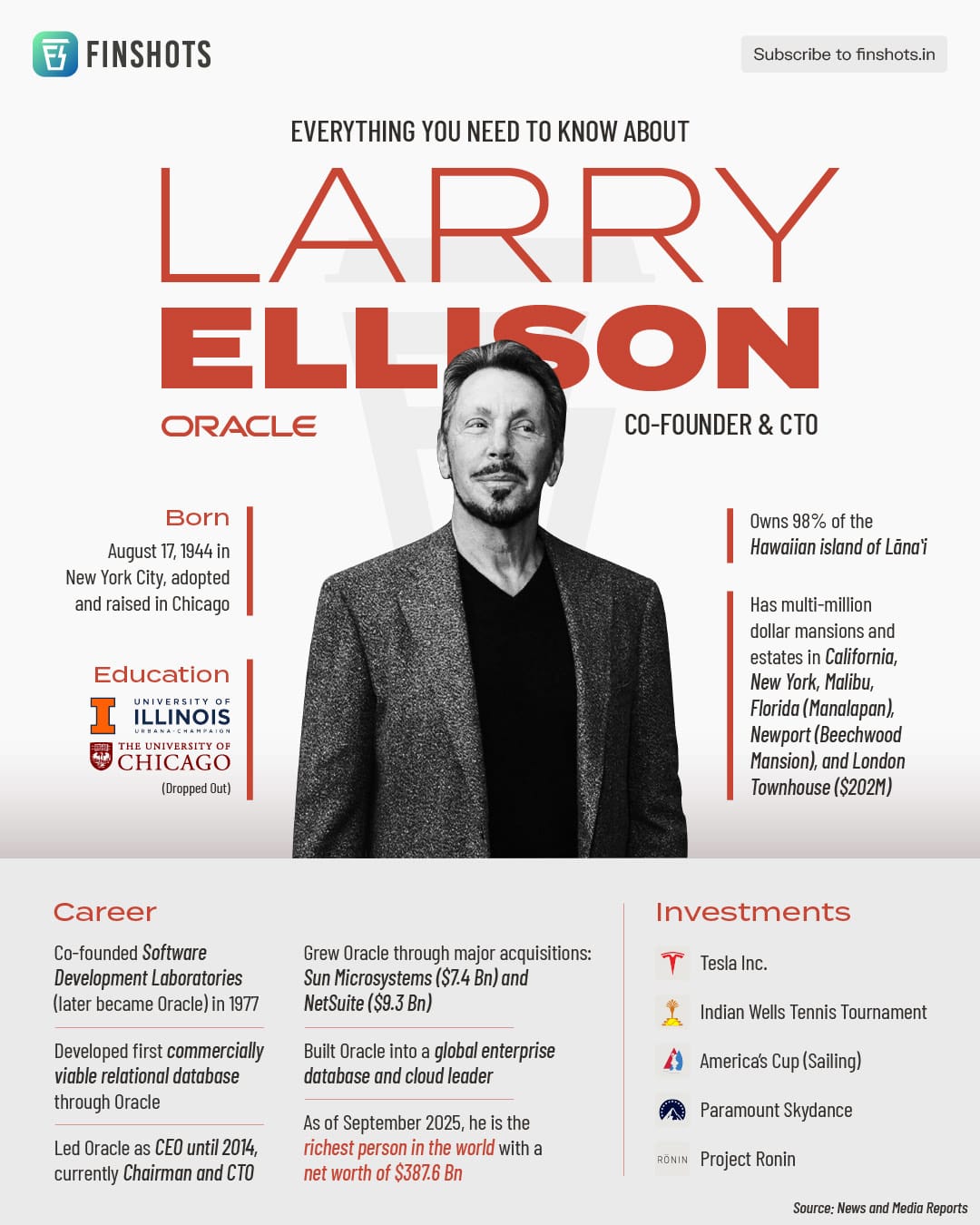

Infographic 📊

Readers Recommend 🗒️

This week, our reader Bhratesh Agrawal, recommends reading Apple in China: The Capture of the World’s Greatest Company by Patrick McGee.

He says,

This book is all about hardware and how China has mastered manufacturing (thanks to Apple). The book offers extraordinary insights into scale and the inner workings of the manufacturing business in China.

It also shows how far behind not just our beloved country, but the rest of the world is when it comes to manufacturing.

Thanks for the rec, Bhratesh!

Finshots Weekly Quiz 🧠

It’s time to announce the winner of our previous weekly quiz. And the winner is…🥁

Zahira Firdous Munshi! Congratulations. Keep an eye on your inbox and we’ll get in touch with you soon to send over your Finshots merch.

Also, a quick announcement before we go, we’re hitting pause on the weekly quiz for a bit as we’re looking to experiment with a new format. But don’t worry, we’ll be back soon.

That’s it from us this week. We’ll see you next Sunday!

Until then, send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Also, don’t forget to tell us what you thought of today's edition. Just hit reply to this email (or if you’re reading this on the web, drop us a message at morning@finshots.in).

🖖🏽

Don’t forget to share this edition on WhatsApp, LinkedIn and X.