RBL’s ticket to the big leagues

In today’s Finshots, we explore why Dubai’s Emirates NBD is placing a $3 billion bet on RBL Bank.

But before we begin, here's a quick note from our co-founder: "When we started Finshots, our aim was to make finance simple and accessible for everyone. Soon, we realized that understanding finance is just one of the challenges. Making smart decisions, especially around insurance, is a whole different ball game. That's why we built Ditto, a platform that makes insurance simple. No jargon, no spam, just honest advice from advisors who are only here to help you find the right plan."

So if you haven't already, go get your free, personalized insurance advice by clicking here.

Now, onto today's story...

The Story

A decade ago, few would’ve pegged RBL Bank as a serious contender in India’s cutthroat banking scene – whether as an investor or a customer. It didn’t have the size, brand muscle, or deep branch network of the industry’s big guns.

But it did have hustle. Being a smaller player, it took advantage of partnerships, co-branded cards and opportunities that its counterparts left behind. Take the 2016 tie-up with Bajaj Finance to issue credit cards, for example. The partnership changed how consumers spend using EMIs, and also how NBFCs (non-banking financial companies) and banks can partner up to maximise reach and revenues. By combining Bajaj’s massive customer base with RBL’s credit and capital, the duo scaled to around 5.2 million card holders, of which 3.4 million were through Bajaj Finance alone. It was a masterstroke, and some credit card metrics even put RBL’s market share in the mid-single-digits, which was a rare feat for a bank its size.

Then came microfinance. RBL expanded aggressively into rural towns and tier-2 India, onboarding millions of new customers and gaining recognition as a mid-sized retail bank. That helped it grow to a point, but things changed in November last year when the RBI cracked down on co-branded cards. New rules meant that NBFC partners could only distribute cards and not earn fees. And that fundamentally broke the RBL-Bajaj model, bringing a crucial growth chapter to a close. And RBL needed something new to continue.

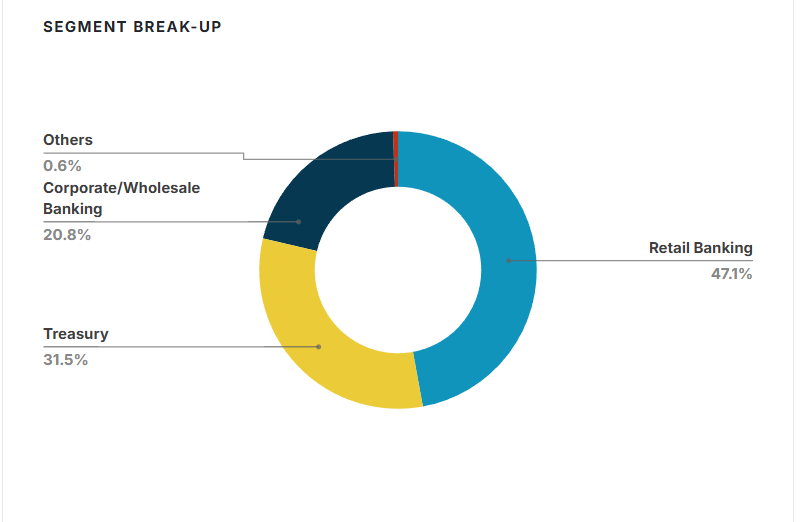

Because that stress wasn’t trivial. Nearly 47% of RBL’s revenues come from retail banking. The rest is split between treasury (31.5%) and corporate banking (20.8%). Meaning, retail was its core segment.

But it was also its biggest risk. Why, you ask?

Well, retail banking is a high-volume, low-margin game, and today’s retail banking market is brutal. Every offering from deposits, mutual funds to home loans and credit cards is a battlefield where the largest banks dominate. Even foreign banks have given up on retail in India, unable to overcome regulatory walls, competitive pricing, and rising acquisition costs. So domestic players obviously struggle if they don’t have scale.

And RBL has struggled. As per its Q2FY26 earnings call, net profit declined 20% year-on-year due to elevated slippages in its credit card portfolio (which accounted for nearly 70% of total slippages). For a bank with nearly half its business exposed to retail, that’s a red signal.

Then there’s the unsecured lending problem. Whether it’s a smartphone or a car, customer defaults hit hard. Repossessed assets rarely match the outstanding loan, and banks often take the hit. And RBL realised it couldn’t afford to stay stuck in this loop. To challenge SBI, HDFC Bank or ICICI, it needed more than clever partnerships… it needed capital.

That’s where the Emirates NBD deal comes in. The Dubai-based lender is investing $3 billion for a 60% stake in RBL Bank, making it the largest foreign direct investment in an Indian bank to date. The number alone made headlines. But it’s what this capital enables that’s more interesting.

Remember that retail capital problem that RBL Bank was facing? Well, one of the reasons for it was branch fatigue. Despite operating since 1943, the bank has grown to only 563 branches countrywide. That’s not enough to compete with the big players. And with most customers parking their money in the top 5 banks, RBL couldn’t rely on organic growth alone. As the CEO put it, “We are now a mid-size bank and our aspiration is to move into the league of big banks.” That wasn’t possible without a serious infusion of funds.

Apart from this, the deal could also give a boost to RBL’s capital adequacy ratio (CAR). In simple terms, this ratio tells how much capital or cushion a bank has compared to its risky assets. RBL Bank’s CAR stood at around 15.5% as of June 30, 2025 (for Common Equity Tier-I), slightly down from 16.18% in March 2024. Now, the RBI’s minimum threshold for CAR is 11.5%, so sure, RBL has some breathing room. But a 3% drop could change things quickly and put the entire bank at risk. With Emirates NBD’s capital, RBL can expand lending, tap into safer sectors like housing finance or corporate credit, and still stay well-capitalised. In other words, it can grow without gambling the house.

But capital isn’t the only benefit. Emirates NBD brings experience in markets foreign to RBL, which has been a domestic bank since inception. They would open up opportunities in Egypt, UAE, Türkiye, Singapore and some European regions like the UK and Germany as well. This could create a new revenue stream from Indian businesses and NRI accounts. And since RBL essentially becomes a subsidiary post-acquisition (pending regulatory approval), it may soon operate with a more global footprint.

Then there’s tech. Emirates NBD has invested over AED 1 billion on digital transformation, focusing on AI-driven credit systems, paperless onboarding, and advanced mobile banking platforms. For RBL, this means faster modernization of backend systems, improved risk analytics, and smoother integration across products. In short, RBL could leapfrog into the digital age by plugging into Emirates NBD’s tried-and-tested infrastructure.

For Emirates NBD, the value is equally clear. India is one of the fastest-growing banking markets in the world, with rising credit penetration, a young population, and deep digitisation. But breaking in organically is a nightmare since regulatory hurdles, licence restrictions, and stiff competition could make it a slow grind. With this deal, they get instant access to RBL’s 15 million customers, over 560 branches, and ready-made compliance clearances. It’s a shortcut most global banks can only dream of.

That said, not everyone is thrilled. RBL’s employee union has protested the takeover, calling it an “onslaught by international finance capital.” And their concern isn’t unwarranted. Earlier this year, Japanese lender SMBC took up a 24.99% stake in Yes Bank. Years earlier, Catholic Syrian Bank was taken over by Fairfax, a Canadian firm. In each case, capital came in, but so did control. And critics worry that foreign ownership in key financial institutions can dilute local accountability. Strategic decisions may soon be made in boardrooms halfway across the world. And employees fear restructuring, culture clashes, and layoffs.

There’s also the regulatory angle. While the RBI has slowly relaxed foreign investment rules, it remains cautious about granting full operational control to overseas players—especially in retail banking. The final approval process for this deal will likely be watched closely, and may even become a precedent for future foreign takeovers in the sector.

But for now, both sides seem to have found what they need: one gets the capital and expertise to grow, and the other gets an express entry into the Indian market. And whether this becomes a case study in smart globalization or a cautionary tale of overreach is something only time will tell.

Until then…

Sharing is caring. If you found this story useful, please do consider telling your friends about it. All you have to do is send it on WhatsApp, LinkedIn, or X and ask them to subscribe :)