🍳Quake resistant real estate, Xania Monet and more...

Hey folks!

Xania Monet just became Billboard’s latest sensation, with a No. 1 R&B hit, over 44 million streams, 1,46,000 Instagram followers, and a multimillion-dollar record deal.

Sidebar: Billboard is a company that tracks music popularity, and R&B stands for Rhythm and Blues, a genre that blends blues, jazz, and gospel music.

All this, without ever stepping into a studio. Because Xania Monet isn’t real. She’s an AI-generated artist. Her vocals are created by Suno, an AI music platform that turns a few typed prompts into a full-blown R&B track.

Now, many singers and record labels aren’t exactly cheering. They’ve accused AI acts like Xania of building success on copyrighted material used to train these tools, without crediting anyone. In fact, Suno was sued by major record labels and the Recording Industry Association of America last year for that very reason.

So then, how are labels still signing deals with AI artists like her?

Well, Xania’s songs sound so real that fans can’t tell the difference. Her manager says it’s no different from how remixes of Michael Jackson’s or Prince’s songs keep releasing years after they passed away. And the human behind Xania, Telisha “Nikki” Jones, says she writes the lyrics for every track, only using AI to generate the vocals. In short, if the song hits the right chord, they don’t see a problem.

But that’s where things get tricky. Real artists now worry about being replaced by technology that can make endless content — fast. And with streaming services and record labels pouring millions into AI acts, visibility for human musicians could take a hit. Not just that. The Suno lawsuit we mentioned earlier was eventually settled out of court, with Universal Music Group, one of the plaintiffs, now partnering with AI music firms like Udio.

Looks like the industry that swore it would never dance with AI… is now moving to its beat.

Would you?

On that note, here’s a (non-AI 😁) soundtrack to put you in the mood 🎵

Salad Days by Jatayu

You can thank our reader, Sharang Sharma, for the rec.

Ready to roll?

What caught our eye this week 👀

Can earthquake resistant buildings be the future of Indian real estate?

This week, our team discussions have revolved a lot around climate change. And somehow, the conversation drifted to earthquakes.

We started wondering if climate change could actually make cities that weren’t too prone to quakes a little more vulnerable now. Think of Delhi NCR. It’s not sitting on a major fault line, but because it’s close to the Himalayas, it does feel the occasional tremor. Officially, it falls in Seismic Zone IV, the second-highest risk category in India.

And as we were reading and talking about all this, we stumbled upon something fascinating. Japan’s real estate market has long earned people’s trust, thanks to its incredibly strict building codes that make structures more resistant to earthquakes.

That got us thinking, “Could earthquake-resistant construction be the future of real estate in India too?”

But first, some context. Climate change doesn’t directly cause earthquakes. Those come from movements deep in the Earth’s crust. What it does do is change the stress on the crust in certain ways that can make earthquakes more likely.

Take melting glaciers, for instance. When they melt, it’s like removing a heavy weight that’s been pressing on the land for thousands of years. The crust beneath then slowly springs back, which can shift stress patterns and sometimes trigger earthquakes. That’s part of what’s happening in the Himalayan region, and by extension, cities like Delhi.

Even extreme rainfall can play a role. When rainwater seeps deep into the ground through cracks (called faults), it can increase pressure within those rocks, making them slip more easily. So after years of unusually heavy monsoons, cities like Mumbai, which sits in Seismic Zone III (moderately risky) could be more at risk than before, given its history of nearby faults like Thane Creek and Uran.

Then there’s another, slower kind of problem — land subsidence. It happens when too much groundwater is drawn out, causing what’s known as aquifer compaction. Think of an aquifer as a sponge full of water beneath the ground. When you extract too much water from it, say, for agriculture, industry, or city use, the sponge dries up. With less water inside, the soil and rocks above start to compress and sink a little. Over time, that adds up and causes the land above to subside.

But these problems aren’t impossible to manage. Japan’s a great example. After the devastating Great Kanto Earthquake of 1923, it made earthquake-resistant construction a priority. Building codes were introduced in 1924 and updated constantly since then. The results are stunning. Building collapse rates in Japan dropped from a staggering 76% before 1971 to just about 3% now.

And if we take a cue from Japan, cities can’t afford to ignore safety. In the long run, investing in safety pays off. After all, India has lost nearly $80 billion to climate-related disasters in just the last two decades. Rebuilding always costs more than preparing. And with major urban centres like NCR, Kolkata, Ahmedabad, and Mumbai sitting in high seismic zones, building earthquake-resistant structures isn’t optional anymore. It’s the foundation for sustainable urban growth.

But there’s a catch. Many big cities are also some of the oldest, which means retrofitting old buildings to make them safer is tough and often impractical in crowded areas.

Then there’s affordability. Take Mumbai, for instance. It’s already one of the least affordable cities in India, with average property prices around ₹26,900 per sq. ft. That’s nearly 14 times the average household’s annual income. Global standards suggest that housing should cost up to 5 times one’s income, but in Mumbai, even the top 5% of households would need over a century of savings to buy an average home. Delhi’s no better either. Homes cost over 10 times the average annual income, and nearly 28% of earnings go into EMIs.

Now, add higher safety standards to this, like better materials, stricter codes, improved engineering, and costs climb further. That could easily make safety a luxury.

So yeah, earthquake-resistant buildings should be the future, but only if we figure out how to make safety affordable and enforce building standards effectively. And maybe that’s the irony. Our own actions are making the ground beneath us shake, and now we’re struggling to afford the safety to withstand it.

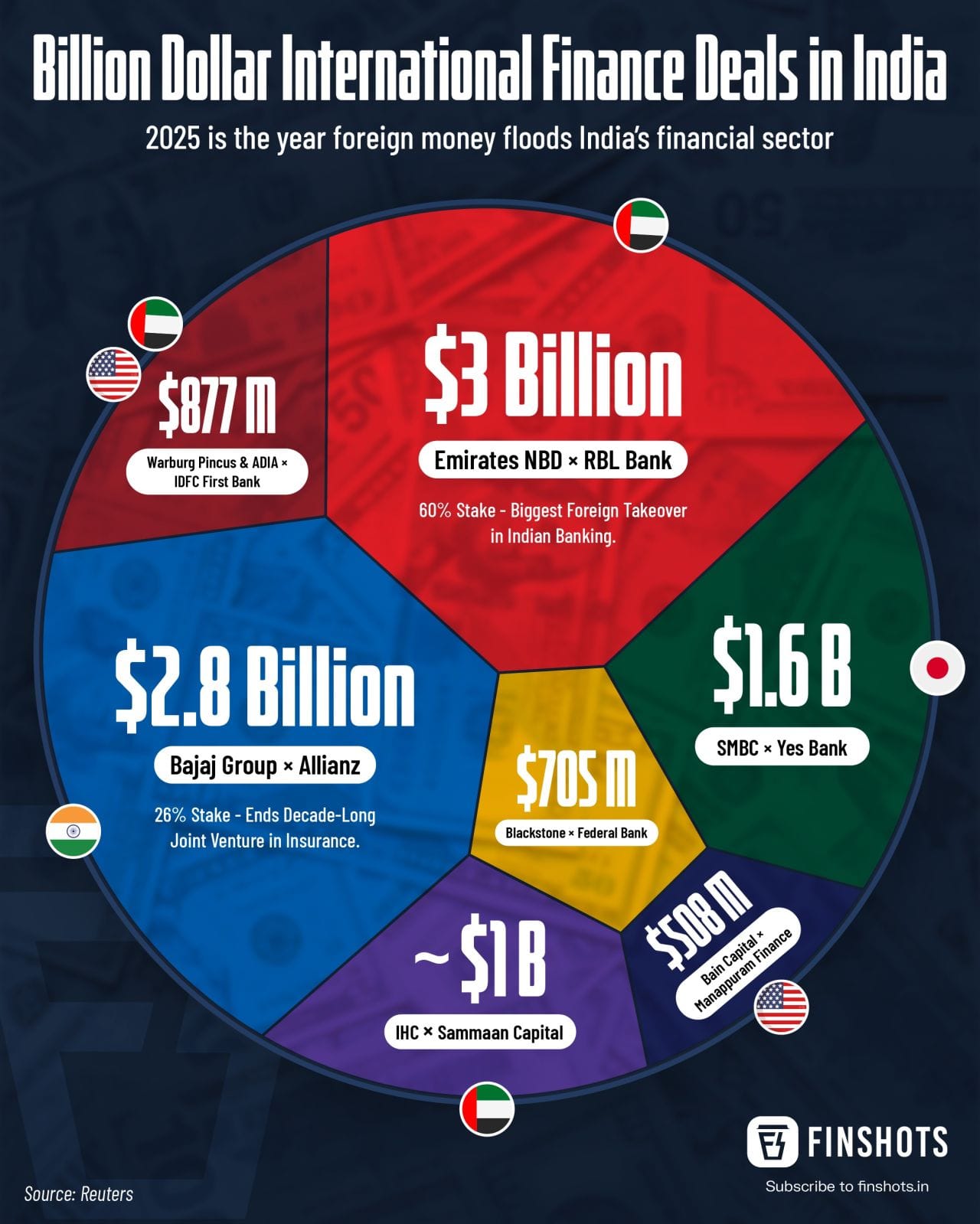

Infographic 📊

Readers Recommend 🗒️

This week, our reader, Sakshi Sonawane, recommends reading The Tipping Point by Malcolm Gladwell.

The book explains how small actions or ideas can trigger big social changes and become wildly popular.

Thanks for the rec, Sakshi!

That’s it from us this week. We’ll see you next Sunday!

Until then, send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Also, don’t forget to tell us what you thought of today's edition. Just hit reply to this email (or if you’re reading this on the web, drop us a message at morning@finshots.in).

🖖🏽

Don’t forget to share this edition on WhatsApp, LinkedIn and X.