Lab diamond conspiracy, happy elephants & more...

Hey folks!

In the natural order, there are a few predators that elephants fear, but their biggest biological threat is one they can’t see or fight. Baby elephants have battled a silent and deadly enemy: the Elephant Endotheliotropic Herpesvirus (EEHV). This virus primarily strikes Asian elephants, especially young calves between one and eight years old, although there is a growing threat to African elephants too.

Both species are already listed as ‘endangered’ on the IUCN Red List, making the virus an even graver concern. EEHV is a haemorrhagic disease, causing severe internal bleeding, and for calves with still-developing immune systems, survival chances are heartbreakingly slim. Just in South India alone, between 2013 and 2019, 13 young elephants lost their lives to this virus.

What makes EEHV especially dangerous is how unpredictable it is. No one knows exactly what causes the virus to activate or when it will strike. The infected calves in captivity, be it in zoos and elephant camps, have about 24 to 48 hours of time before it becomes fatal. Strangely, adult elephants carry the virus too, but without any harmful effects, allowing it to quietly persist within herds.

That grim pattern might finally be changing.

A recent vaccine trial has brought new hope. Until now, there was no cure or preventive treatment for EEHV: only emergency care that rarely worked once symptoms began. But that didn’t stop researchers looking for a solution.

A team from the University of Surrey and the UK’s Animal and Plant Health Agency (APHA) conducted the world’s first EEHV vaccine trial and tested it at Chester Zoo, which has lost seven calves to the virus in the past decade. They tested it on a sample of three elephants and closely monitored their progress, reaction and any changes before and after the jabs.

They made the vaccine work by using non-infectious proteins from the virus, introducing them safely to an elephant’s immune system, helping it learn to recognise and fight EEHV. When the team tested it, the results were promising: it successfully triggered the production of T-cells. These cells are the immune system’s frontline defenders that attack infected cells and build long-term resistance. What’s even better is that the elephants showed no negative side effects after vaccination. That makes it the first proof-of-concept for EEHV.

Currently the vaccine trials took four injections. If these early successes hold up in larger field trials, this breakthrough could protect the next generation of tuskers before the virus ever strikes and perhaps, with fewer jabs than expected. If all goes well, the next generation of calves might grow up trumpeting out of joy!

Here’s a soundtrack to put you in the mood 🎵

Main Hoon Zameen by Anand Bhaskar Collective

A big shoutout to our reader Akshay Naik for this great recommendation!

We’ve also received a bunch of brilliant song suggestions from many of you, so keep an eye on this space. Your name might just show up here next. And yes, keep the recs coming!

What caught our eye this week 👀

💎Are countries crashing lab-grown diamond prices on purpose?

Lab-grown diamond (LGD) prices have crashed like crazy! That’s not us saying it, but the World Gold Council, which reports that LGD prices have plummeted nearly 96% in wholesale prices for one-carat and two-carat stones since 2018.

The reason?

An immense oversupply of LGDs from India and China.

And that got us thinking, “Are countries part of a conspiracy to crash LGD prices to achieve something bigger?”

We know it sounds dramatic but hear us out.

Look, the natural diamond supply chain has always been controlled by a handful of powerful players. Russia’s Alrosa, De Beers and Rio Tinto together account for over 60% of global diamond mining. African nations like Botswana, the Democratic Republic of Congo, Angola and South Africa also play a massive role, while Canada ranks as the third-largest producer by volume. These countries control the source.

Meanwhile, countries like India, the UAE and Belgium dominate the polishing and trading business or the downstream part of the industry. But they don’t control diamond supply because they don’t have large natural reserves and rely on rough diamond imports, especially from Russia, to cut, polish and export finished stones.

But the rise of lab-grown diamonds changed everything. Suddenly, you didn’t need diamond mines to enter the industry. You just needed labs, where small diamond slices, called a seed, is placed inside a chamber with carbon-rich gas and exposed to heat and pressure, recreating how diamonds form underground. The result? A diamond with the same sparkle and structure as a natural one.

LGDs also came with a cleaner image. Producing a natural diamond usually means digging up land, moving nearly 250 tonnes of earth for just one carat and releasing close to 160 kilograms of greenhouse gases into the atmosphere. Mines leave behind massive pits and long-term ecological damage. But with LGDs, you skip all that environmental guilt.

And for countries like India and China, already strong in diamond polishing, this was a sparkling opportunity. They had factories, skilled labour and distribution networks in place. So scaling LGD production was easy. Also, the more they produced, the cheaper it became. For the first time, they could compete in the global luxury diamond market without owning a single extra mine.

Initially, it worked brilliantly. LGDs made diamonds feel accessible. People who once avoided diamond stores because of sky-high prices now walked in freely. New-age jewellery brands pushed LGDs, and soon traditional names joined them — Kalyan Jewellers through Candere, TBZ and Senco Gold & Diamonds all launched LGD collections.

But then came another twist. India and China produced so much that prices crashed. LGDs were already about 30% cheaper than natural diamonds, but oversupply dragged prices even lower. And once something becomes too cheap, people start questioning its value. So buyers drifted back to natural diamonds, not for logical reasons, but emotional ones. Natural diamonds still symbolise rarity and status. They’re a classic Veblen good, where demand goes up when prices stay high, because exclusivity matters.

But here’s the clever part. No matter which way customers go, brands remain in a win-win situation. For instance, if a premium brand like Kalyan chooses not to sell LGDs to maintain its luxury image, it still has Candere to serve mid-market buyers who want them. Tanishq, CaratLane and Mia don’t sell LGDs either, but Tata Group’s Trent launched Pome to tap into that exact space. So whether people choose real diamonds or lab-grown ones, the big jewellery brands win regardless.

And that’s why this whole thing feels like strategic reverse psychology. Countries like India seem to have deliberately pushed LGD production to flood the market, crash prices and slowly take a bigger share of the global natural diamond trade.

Sounds far-fetched, you might think, until you see what natural diamond producers are doing.

Diamond-producing governments from Angola, Botswana, the Democratic Republic of Congo, Namibia, Sierra Leone and South Africa, along with industry bodies like the Gem & Jewellery Export Promotion Council (GJEPC) (India’s apex body for gems and jewellery), the Antwerp World Diamond Centre (AWDC), the Dubai Multi Commodities Centre (DMCC) and De Beers, have recently signed the Luanda Accord, an agreement pledging 1% of annual diamond sales to promote natural diamonds.

But whether there’s a real conspiracy behind all this or not, it does seem to be having an effect. In India, interest in natural diamonds is slowly picking up again, partly because people are realising how much rarer they’re becoming.

But hey, maybe there’s no hidden agenda here at all. Maybe it’s just market forces doing their thing and we’re overthinking it. And maybe we just need to stop watching so many thriller films!

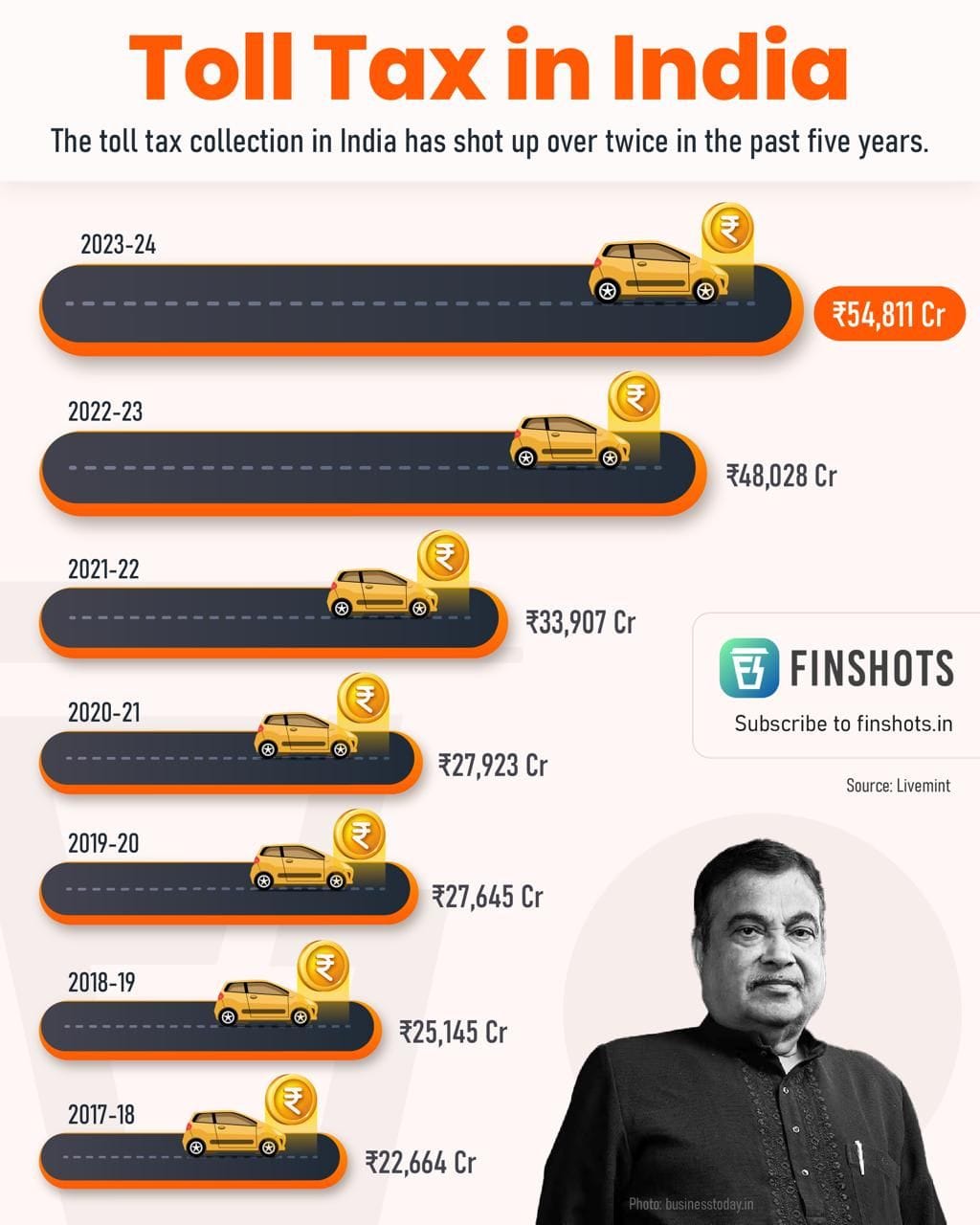

Infographic 📊

📺What experts aren’t telling you about the hidden power of gold

Gold prices are hitting all-time highs, but it’s not inflation driving this surge.

So in this episode of Finshots TV, we break down the real reasons behind gold’s meteoric rise, and whether it’s becoming the world’s safest bet right now.

The answer is something far beyond traditional market factors. Click here to check it out.

Readers Recommend 🗒️

This week, our reader, Shaleen Kachhara recommends reading The Siege: 68 Hours Inside The Taj Hotel by Adrian Levy and Cathy Scott-Clark.

As you’ve probably guessed from the title, it’s a gripping account of the 26/11 Mumbai attacks, when Lashkar-e-Toiba terrorists targeted multiple locations across the city, including the Taj Mahal Palace Hotel. The authors, both British journalists, spent years researching the incident and spoke to hundreds of people, including hotel staff and guests who lived through those terrifying hours inside the Taj.

Thanks for the rec, Shaleen!

That’s it from us this week. We’ll see you next Sunday!

Until then, send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Also, don’t forget to tell us what you thought of today's edition. Just hit reply to this email (or if you’re reading this on the web, drop us a message at morning@finshots.in).

🖖🏽

Don’t forget to share this edition on WhatsApp, LinkedIn and X.