Is RBI going to strangle UPI?

In today’s Finshots, we see why the RBI is mulling over an idea that could have an adverse impact on UPI transactions

Also, before we get into today’s story, one small announcement. If you’d like to receive our daily 3-min newsletter that breaks down news from the world of business & finance in plain English — click here!

The Story

Okay, let’s kill the suspense and answer the question right away — No, the RBI isn’t strangling UPI.

But they may be considering an idea that could have a massive impact on UPI’s popularity i.e. they are seeking feedback on a proposal that would allow banks and other institutions to impose a fee on certain UPI transactions.

But before we dive into this story, let’s rewind a bit to 2016 and understand how we got here.

At the time, digital payments weren’t exactly ubiquitous. People used cash more often than not. And debit or credit cards for high-value transactions. These were the obvious choices when people visited a grocery store for instance.

But then in 2016, UPI was born. All you needed was an Aadhar card and a mobile phone number linked to your bank account and you could send money seamlessly to your neighbourhood Kirana store.

Indians loved it. From a measly ₹38 lakhs worth of transactions in July 2016, UPI transactions soared to over ₹10 lakh crores in July 2022..

But why did UPI gain such popularity? Was it simply because of the added convenience? Or was there something else to it?

Well, UPI was free and that was a big deal for merchants accepting payments.

See, when you deal with credit and debit cards, financial intermediaries like banks take home a small cut (from the merchant) every time you made a transaction in their store. This is why you often see hand-written cardboard notes in small shops, with the merchants explicitly stating that they will only accept cards on high-value transactions (so the fee doesn’t eat into their margins).

This fee is called a Merchant Discount Rate (MDR).

But guess what? UPI doesn’t have an MDR. Everything is free. And merchants prefer it to other modes of payment.

But now, the status quo may be under threat.

On Wednesday evening, the RBI released a paper on India’s payment ecosystem — more specifically talking about the charges in the payment ecosystem. And after doing all the explaining, they sought feedback from the general public on the matter.

And they asked some very interesting questions when they got to the section on UPI.

- If there’s a fee on UPI, should it be a fixed fee or based on the value of the transaction?

- If there’s a charge, who determines it — the RBI or market forces?

- And if there’s no charge imposed, should the government subsidize it?

Now if you’re wondering where all this is coming from, well, you probably have to look at NPCI. And if you don’t know who that is, you probably need another quick detour.

See, the RBI didn’t create UPI. Instead, it’s the brainchild of another special entity — the National Payments Corporation of India (NPCI).

Back in the day, the RBI had a lot on its plate — like keeping banks in line, monitoring inflation, printing money, etc. So they went to a bunch of banks and said — “Hey, you guys should get together and create some sort of an umbrella organization that can innovate on transaction systems and make it easier for consumers to pay for stuff.”

And so the NPCI was born. 10 banks got together initially (many others joined later) and set up this entity as a not-for-profit. Sure, NPCI has ways of making money but this no-fee business on UPI didn’t sit well with them. After all, they had to deal with certain costs too. They’d spent money on setting up the business. And they needed to spend more money on upgrading it each year. They were also liable to pay other stakeholders in the payment chain and they weren’t entirely happy with the no-charge policy.

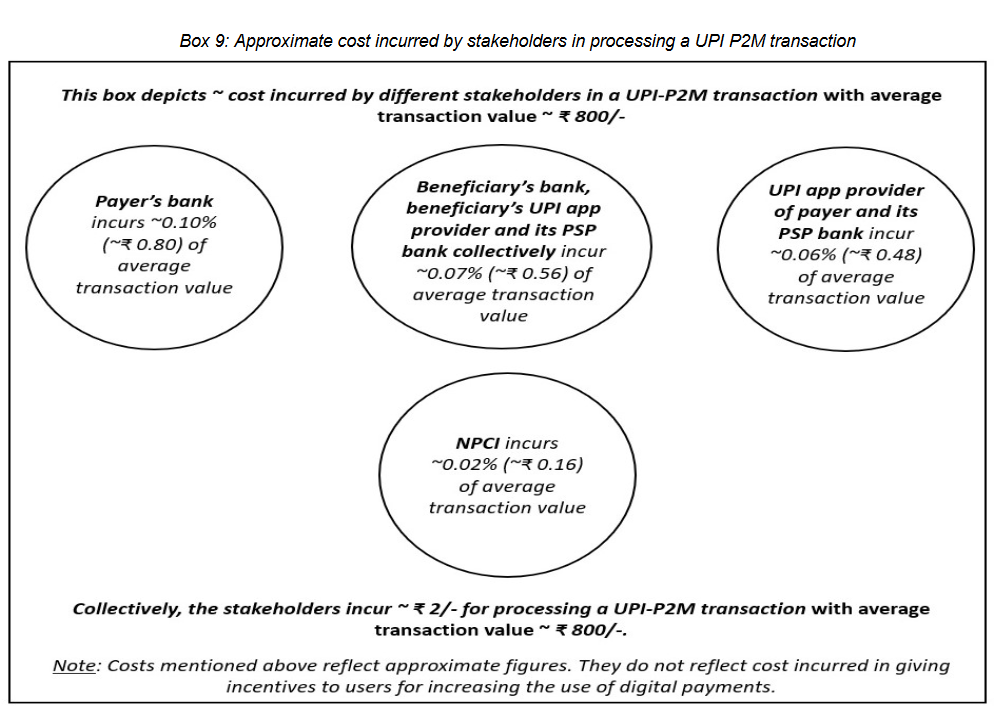

According to the RBI’s own calculations, if you’re making a payment of ₹800 via UPI to a shopkeeper, the stakeholders (banks, NPCI, and payment providers) will incur a charge of ₹2. So if you take into account the massive value of UPI transactions, it could add up to ₹1,250 crores every month*. That’s a lot of money. So, the many stakeholders facilitating this transaction have been lobbying hard.

Source: RBI

Which explains why the RBI wants feedback. They want to solicit public opinion so that they can understand how to go about this if they choose to impose a fee.

What impact will it have on you? Well, not a lot. If you’re sending money over to your friend, there will be no charge (most likely). But if you’re trying to buy a pack of biscuits using UPI, it’s possible merchants may put a board on top titled “UPI only for transactions above ₹100” or “Pay ₹1 extra on all UPI transactions.” Because otherwise, they may have to pay the charge.

Once again, the RBI has explicitly stated that they haven’t taken a call on the matter and this is simply an exercise in understanding public opinion some more. So maybe we will have to just wait and see what happens.

Until then...

*The monthly value of UPI transactions is a little over Rs 10 lakh crores. And approximately 50% of the transaction value is peer-to-merchants. Since the RBI’s calculation focus only on this P2M segment, we’ve calculated the ₹1,250 crores of monthly fees lost based on this.

Ditto Insights: Why Ditto?

The most common question we get here at Ditto is this — “Why should I talk to Ditto before buying insurance?” “Can’t I do it myself?”

Well, of course, you can. The basic tenets of a health insurance policy for instance are relatively straightforward. You pay a small fee (a premium) every year to cover all future medical expenses, subject to some reasonable restrictions of course.

However, despite the seeming simplicity here, there are infinitely many possibilities to consider. In fact, when you try to parse through these possibilities, you’ll begin seeing why people despise the prospect of buying health insurance at all. It’s a chore. A complicated mess of conditions and exclusions. A product that will abandon you when you need it the most.

What should have been a lifesaver is thought of as a needless distraction.

But perhaps it doesn’t have to be this way. Perhaps the reason why people feel let down by health insurance products is because they’re party to an unequal contract. Think about it. When you accept the health insurance proposal, you’re signing off on a contract that you probably haven’t even read fully. Most people can’t even name their insurance provider, let alone the nitty gritty of the contract.

The insurance companies meanwhile have spent countless hours poring through every single detail, every single word that features in the document.

They have lawyers drafting policies that give them an extra edge during payouts. You don’t have that.

They have dedicated teams working on fine-tuning benefits. You don’t have that either.

They have experience on their side. You have none.

So it should come as no surprise that you are at a disadvantage here.

Now some would suggest that the only alternative here is to draft a custom contract with the insurer — one where you get to dictate the terms and conditions.

But that is simply not feasible. Insurance contracts have to be standardized. It’s the only way insurance companies can sell policies to a large group of individuals. If you insist on a custom contract, they will simply turn their back on you. That means your only option then is to work within the confines of this standardized document. You have to find ways to come out of this transaction relatively unscathed even though the odds are stacked against you.

Which brings me to the — “Why Ditto” question.

Unlike other agents that try and simply shove a policy down your throat, we prepare you for what lies ahead. Instead of elaborating on the terms and conditions, we will explain the logic behind imposing them in the first place. It’s like a game of cat and mouse. When the gong strikes and the claim is made, you want to extract every single penny and the insurer wants to keep every single penny. The only problem — the insurer has a well-defined strategy to mitigate risk on their end, but you don’t have one.

So our job is to equip you with a blueprint. A blueprint that will walk you through the many ways in which insurers and their affiliates protect their own interests. A blueprint that will offer you a sneak peek into their minds so you know what to do when you have to make your purchase.

As the great military strategist Sun Tzu once said — The opportunity to secure ourselves against defeat lies in our own hands, but the opportunity of defeating the enemy is provided by the enemy himself.

And while insurance companies aren’t quite the enemies here, they are worthy adversaries who are not going to accept defeat lying down. They are prudent. They are diligent and most importantly, they are prepared.

So it’s time you do the same. Talk to Ditto.

Also, don't forget to share this article on WhatsApp, LinkedIn and Twitter