Is Indian craft beer fizzing out?

In today’s Finshots, we explore what’s going on with India’s craft beer brewers.

But before we begin, if you're a daily reader and want to stick to the habit then here's a link to the Finshots Weekly Quiz. We pick a winner at random and announce their name in our weekend Sunny Side Up editions. So, what are you waiting for? Answer all the questions correctly and stand a chance to win exclusive Finshots merchandise!

The Story

There’s beer. And then there’s craft beer. It's not like the mass-produced beers that you find on most store shelves — like Kingfisher. Craft beers are brewed in small batches. They’re like limited edition items. And they often incorporate interesting flavours like mango.

And the posterchild of the Indian craft beer scene has been Bira91. Launched in 2015, it quickly became a viral sensation. In its first year, it sold just 150,000 cases of beer. In the second year, they claim to have sold 700,000 cases. The demand was unprecedented and their beer was almost always out of stock.

Sidenote: All reports say ‘cases’. Now cases usually pack 12 or 24 bottles but none of the media reports really make a clarification.

They even got the venture capital firm Sequoia to make an investment. Yup, a firm known for its tech bets was dipping its toes in unfamiliar territory - beet. Here’s what Sequoia (now Peak XV Partners) wrote in 2018 in a note about their Bira91 investment:

The success of micro-breweries [think pubs] in Bangalore and Gurgaon, which made and sold craft beer, were clear indications that consumers were loving the craft category. But the micro-brewing business model is difficult to scale. Ankur [the founder of Bira91] had a plan that could scale up rapidly.

And maybe all this hype prompted others to follow suit. Everyone wanted to get into the craft beer business and brands mushroomed left, right and centre. Industry reports flooded in using the same peg — under penetration. Reports back then pointed out that India’s per capita beer consumption was just 4.6 litres when compared to an Asian average of 57 litres. Everyone expected this to rise.

But here’s the deal. While some folks say that craft beer sales are growing by 20% annually, not everyone seems to think so. Others say that the packaged craft beer industry only sells a few million cases every year and the market share continues to remain in the low single digits.

Now we can’t be sure what's the truth here. Because we haven't seen comprehensive reports about the craft beer industry. But it does seem that brands are pulling back slowly. LiveMint says that brands like Witlinger, White Owl, Kati Patang, and White Rhino have either shut down or scaled down their operations.

So the question is — how did the once vaunted craft beer industry lose its way?

For starters, maybe people just overestimated the market for craft beer in the first place. Even after so many years, it still accounts for a measly 2-3% of overall beer sales. And maybe that’s to do with the fact that most people in the country still prefer beers that are stronger in nature. Even Bira91 realised that a few years ago and launched a stronger variant in the lineup.

And not to forget that it’s definitely a money-guzzler. Setting up everything can set you back by ₹70 crores. Then you have to spend massive amounts on brand campaigns too. Since you can’t directly advertise alcohol, you have to find other ways to get people’s attention. Maybe by sponsoring festivals and stuff. And it just doesn’t seem to end. Take Bira for instance. The brewer has been around for almost a decade. And yet, in FY22 while the revenues from operations grew by 1.7 times over the previous year, its expenses rose by a similar amount too.

Then there’s the headache of going pan-India.

Because taxes are a state affair. And it can vary tremendously across the length and breadth of the country. The red tape around licences can be chaotic. On top of that, there’s the matter of beer being taxed based on volume. Not on alcohol content. So a beer with 5% alcohol content is taxed at the same rate as Indian Made Foreign Liquor (IMFL) with over 40% alcohol. You can see why people prefer hard liquor then, don’t you?

So beyond a point, it becomes a tough proposition for craft beer makers to really lower the price.

And then came the pandemic and the subsequent liquor ban. Most craft brewers were small players trying to find their footing. And a couple of washout summers meant that it was game over for most of them.

And those who survived are now battling inflation.

Because as soon as the Russia-Ukraine conflict kicked off, prices of key materials like barley and glass jumped 30-45%. And apparently, liquor companies cannot easily hike prices because pricing is actually dependent on what the state prescribes.

So yeah, put all these together and you’ll see why a large section of the craft beer market is struggling. Maybe barring Bira91 which continues to find backing from foreign investors.

But wait…maybe there’s still some light at the end of this tunnel. Because we’ve just talked about packaged craft beer so far. It seems that microbreweries, the OG of pouring fresh craft beer from the tap, are still gaining popularity. And while Sequoia might’ve not seen microbreweries as a scalable investment, we’re seeing more of these local pubs brewing craft beers in-house. So maybe being and staying local is the advantage everyone wants today.

And we’ll have to see who emerges on top over the next few years.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter.

PS: It appears that the UK craft beer industry is going through a crisis of its own too. More than 100 small brewers have shut shop in the past year or so. And they're blaming Brexit, the pandemic, and rising costs. Were we in a craft beer bubble, folks?

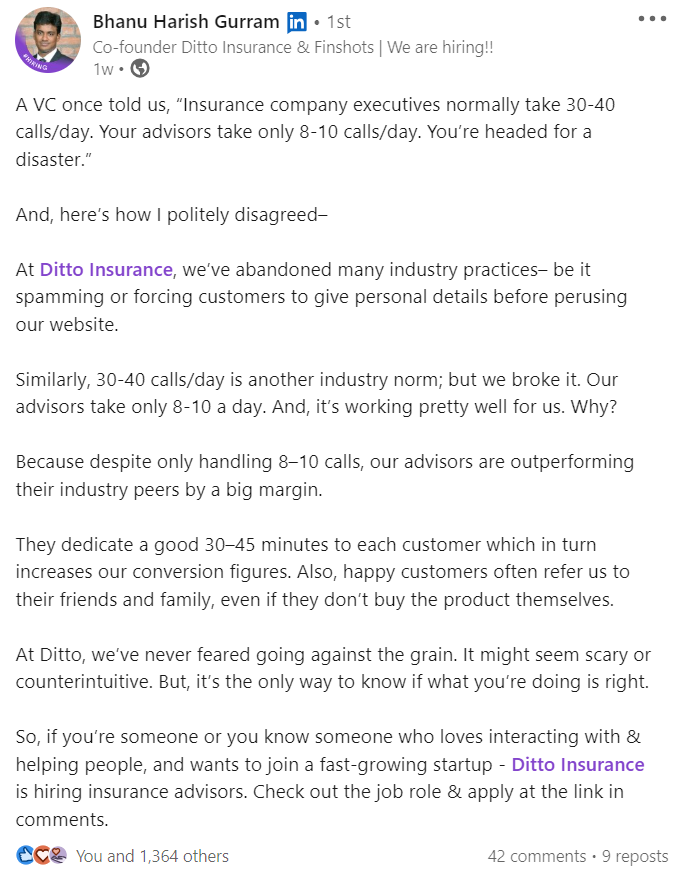

We are hiring!!!

Our team at Ditto (by Finshots) is looking to recruit 'Insurance Advisors'. If you crave an exhilarating journey that challenges you, rewards your drive, and gives you the platform to build exciting initiatives, this is the perfect opportunity for you. Apply now.