Is Byju’s hype machine stumbling?

In today's Finshots we see why everybody is talking about Byju's lacklustre performance

The Story

It took a while for Byju’s to put out the results for the financial year 2020–2021. But it has finally arrived now. And it’s not what people expected.

The company originally projected revenues worth ₹4,400 crores.

But in reality, revenues remained flat at around ₹2,500 crores and losses surged to a whopping ₹4,500 crores — 20 times higher when compared to FY20.

At this point, you could turn around and ask — How?

How did this happen? If the expectation was that Byju’s would post a higher top-line figure and better earnings figure, where did it go wrong?

Well, to understand this discrepancy, you have to first look at Byju’s income streams.

According to a report in the Ken, there are three ways in which Byju’s makes money:

- Course fee — income made from live tutoring. Session by session

- Streaming fees — revenue earned when students stream pre-recorded courses

- Revenue from tablets and SD cards — these involve offline course materials and tests. The target audience here is typically people from lower-income families who don’t have access to high-speed internet.

But here’s the thing — Byju’s makes most of its money selling hardware — the tablets that we spoke of. So they will contend that they’re a product-first company.

And revenue recognition here is rather straightforward. Companies record revenues when they ship a product or the customer accepts delivery. But the Byju's tablet isn’t worth all that much without the content inside and the content can be consumed over several years. So if you recognize the total revenue when the sale is made, it might be misleading, considering the service is rendered over a longer time frame.

What if the customers default or don’t pay up or cancel the course after making a down payment? What happens then?

Should you still recognize all the revenue upfront? Or should you take a less aggressive approach and recognise the revenue over a longer time frame?

Their auditor seems to have taken the more conservative approach and as a consequence Byju’s has had to defer or postpone recognising 40% of the revenue for FY21.

But they’re also some confusion on the expense side.

According to an article in the Morning Context, Byju’s has had a habit of “capitalizing” expenses.

What does that mean?

Well, think of it this way. If you spend a bunch of money marketing your service, you should ideally tally it all up on the expenses side. Then, deduct it from the top line and calculate earnings. But on some occasions, you could argue that these marketing spends create long-term benefits and the value accrues to you over time. And if you could support it with evidence, you could treat some of this expense as an intangible asset. An asset that creates long-term value.

And if you do that, you could cut down your marketing expense and redistribute it across multiple years. This would translate to a material improvement in profits for the current year. However, this practice is generally shunned and auditors are wary of capitalizing such expenses.

But some companies do it nonetheless.

For instance, “In March 2020, Byju’s total salary expenses was about Rs 900 crore. But the company transferred Rs 526 crore of this expense as intangible assets to the balance sheet, and eventually recorded only Rs 420 crore as expense in the profit and loss account. Basically, more than 60% of the expense was capitalized.”

This year, Deloitte hasn’t let the company capitalize a large part of its expense and it’s safe to say this probably has had an impact on the bottom line.

But that’s only just the tip of the iceberg.

Byju’s has many other issues.

For instance, there were rumours about a possible listing a while ago. The company had plans to go public in the US and raise money from investors in a bid to legitimize its claim as the world’s biggest ed-tech company. The company was expected to go public at a $40 billion valuation. But then, the funding winter arrived. There wasn’t enough money going around anymore and investor interest tapered. Byju’s probably decided to defer the listing plans considering the sentiment.

Needless to say, we haven’t heard much about the IPO since.

Then, there was the famous $300 million acquisition of WhiteHat Jr just 4 months into the pandemic. Byju’s paid a pretty penny for the company. But it seems that the acquisition hasn’t worked out all too well. 30% of Byju’s losses can be attributable directly to WhiteHat Jr.

That is harsh.

Also, the company’s investors seem to be asking more pointed questions. According to an article in the Livemint, it seems they are particularly concerned about the lack of a full-time CFO.

Especially for a company the size of Byju’s.

Finally, there’s some apprehension in the bond market as well. You see, the company borrowed some $1.2 billion in November by issuing bonds. However, according to a report in the Financial Times, the bonds are now available at a 30% discount (according to data collected last week).

So even the lenders aren’t all that enthused about Byju’s prospects it seems.

Bottom line — Byju’s has a tough road ahead of it. The complaints aren’t going away. Investor scepticism is on the rise. And the company’s financials don’t inspire a lot of confidence.

Can the enigmatic founder Byju Raveendran turn the ship around?

You tell us.

Until then...

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

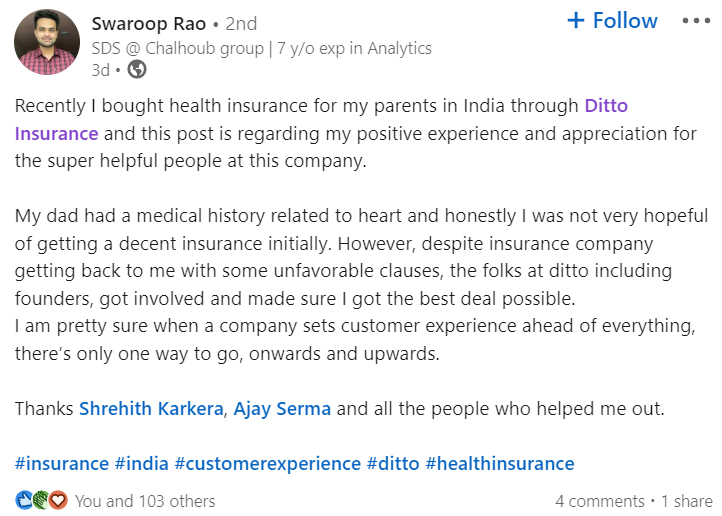

Ditto Case Study: Dealing with complicated cases

Most people think buying health insurance is a rather straightforward endeavour. However, that is only true for a small subset of people. If you have complicated health conditions, things can get very tricky.

Take for instance Swaroop — the gentleman who posted the very nice review we’ve attached at the top. He wanted to cover his parents and he was looking for a comprehensive option. However, we soon found out that the doctors had performed a benign heart procedure on his father a while back. And this immediately made things a lot more complicated.

For one, most insurers don’t consider applicants with heart issues, even if they’re in perfect working condition. So we had to pore through our database to see which insurer was likely to consider the application. But even with this knowledge, we soon found out that the insurer wasn’t willing to consider his proposal. Now, most people give up at this point. And rightfully so.

But the thing is — there’s always recourse.

We quickly reached out to the insurer to see if we could get additional clarity on the matter. We wanted to know why the policy was rejected. The insurer was kind enough to set up a call and explain to us the issue. And after some deliberation, we knew that we still had a chance if we could submit additional reports regarding his health condition. The insurer made no promises. But they were willing to reconsider. So our advisor put together a list of reports, made a compelling case and submitted these details to the insurance company. It took a while but the insurer came through extending a policy with some caveats, of course.

So here’s what you should do if you ever find yourself in such a situation. Always try and see if you can get the insurer to list out the actual reason for rejection. Then ask them if there’s any room for reconsideration. If they tell you that they would reconsider the case with additional documents, then you can promptly mail it to them and see if they change their mind.

Or you could simply talk to us at Ditto — our insurance advisory platform and we will fight for your cause.