Is Apple's credit card coming to India?

The Apple rumour mill is churning. And the big news is that Apple has met with the top brass at HDFC Bank to launch a co-branded credit card in India. Yup, an Apple credit card!

Why’s this a big deal, you ask? In today’s Finshots, we explain Apple’s financial service ambitions.

But before we begin, if you're someone who loves to keep tabs on what's happening in the world of business and finance, then hit subscribe if you haven't already. We strip stories off the jargon and deliver crisp financial insights straight to your inbox. Just one mail every morning. Promise!

If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Apple’s credit card foray, which began in 2019, is limited to the US. There have been rumours about a European adventure. But it hasn’t materialized. That means if Apple does greenlight India, we get the number two spot in the tech giants credit card ambitions.

That’s a big signal of India’s potential, right?

But before we get into why India might be a preferred destination, we have to ask — why is Apple so interested in financial services in the first place?

Because here's the thing: the tech giant has its tentacles everywhere. It has Apple Pay which allows mobile payments and peer-to-peer transfers. It has the credit card. Goldman Sachs launched it. It has a high-yielding savings bank account — again with Goldman Sachs — that pays out an interest 10 times higher than the average in the US. And it also has a 'buy now pay later service'.

So yeah, it might not be a bank with all the licences in tow, but in the past 10 years it has built a solid financial ecosystem. Which explains why JPMorgan Chase’s CEO Jamie Dimon actually thinks of Apple as a rival now. He believes that Apple is walking and talking like a bank.

Now everyone has an opinion on why Apple is doing this. And the most common theory is that Apple isn’t actually trying to become a bank. It is simply trying to keep everyone locked into its ecosystem. See, if you’re in the US and want that high-yielding Apple savings account, you first need an Apple credit card. And that kind of means you need an iPhone to get started. And if you have all these, you’re not really going to shift from Apple to Android, right?

And let’s face it. Apple would probably rather deal with creating customer experiences. And leave the hard regulatory stuff and risk audits to the real banks. That kind of stuff is too mundane.

Or is it? Maybe Apple actually does harbour some banking intentions.

Because that BNPL service we mentioned? Well, that’s not in partnership with a bank. Apple’s using the billions of dollars of cash from its own balance sheet to facilitate lending. That’s crazy!

Also, Apple has a secret (not so secret anymore) internal project called Breakout. Apparently, the tech giant is working on stuff to handle interest calculations, rewards, and credit checks all on its own. It wants to shunt its partners to the side. It even bought a fintech startup in the UK that specializes in using alternate data to determine creditworthiness of potential borrowers.

All this makes it seem like Apple really wants to become a bank, no? After all, the financial services industry does make a boatload of money. It’s a way for Apple to reduce reliance on just selling products.

Now if you think about it, Apple’s in a sweet spot to disrupt the status quo in banking. It has built its reputation on trust and privacy — things that a bank has to espouse. And as journalist Rana Faroohar put it, “Consumer love of Apple is partly down to the intimacy of our relationship with the company. Studies show people are likely to touch their smartphone more than 2,600 times a day. That’s not a connection you get walking into a bank branch (if in fact you can find one).”

You can bet that the younger folks will probably trust an ‘Apple Bank’ more than an old traditional bank, maybe? Selling financial products in that case wouldn’t be that hard for Apple. Although you can bet that regulators will have a thing or two to say about a tech giant trying to become a financial services giant too.

So how does India fit into these plans?

To be honest, we’re not quite sure. India isn’t in Apple’s top three markets. And until a few years ago, Apple didn’t actually seem to care about us. The change of heart is quite new.

But the simple answer could be the massive potential. At the moment, Apple only has a 5% share of the smartphone market in India. Analysts think that India’s position is very similar to China’s 15–20 years ago where Apple has an 18% share today.

So as disposable incomes rise in India, Apple’s quite well placed to grab a higher share. It’s already seeing a nice bump in revenue from India. It topped $6 billion in FY23 and it was 50% more than the previous year. Mind you, this was before it launched its flagship stores in Mumbai and Delhi in April this year. So FY24 could end up being a heck of a lot brighter.

Now you’d imagine a good chunk of these purchases will be using credit cards, right? After all, Apple products don’t come cheap and people would prefer to buy them on EMIs instead. This also means that Apple loses a chunk of the money as fees when people swipe their regular cards in store. But that equation could change with a co-branded card in the mix. And Apple could see a bump in revenue.

Not to forget that Apple has actually stopped accepting payments via Indian debit and credit cards on its App Store. They asked people to add funds to their Apple ID instead. And this was all thanks to the RBI. The banking regulator tried to make card payments more ‘secure’ but instead made things quite convoluted. An Apple co-branded credit card could solve these problems too.

Also, rumours say that Apple wants to get into the UPI game. And the easy way to do that is to ditch Mastercard and Visa and get Rupay on board for the payment system. Since Rupay credit cards can be linked to UPI, it could give Apple a foot in this door as well.

And finally, what’s in it for the partner bank? Say HDFC? Because the thing is if you were looking at the US, you might question the sanity of any bank that enters into a partnership with Apple. Goldman Sachs apparently spent $350 in the first year to acquire new customers for Apple Card and lost over $1 billion in getting this partnership up and running.

So going by this precedent, you wouldn’t think that anyone would want to partner with Apple.

But the thing is, we can’t really compare India to the US in this case. Because Goldman Sachs wasn’t really a consumer bank. It was an investment bank catering to mergers and acquisitions and esoteric stuff like that. Goldman Sachs didn’t care about dealing with people like you and me. That meant they had to splash the dough to get people to change their perspective. To get them to believe in Goldman Sachs, the consumer bank. And they even doled out credit cards to borrowers with low credit scores — the ‘sub-prime’ kind — who defaulted and created even more losses for the bank.

But a bank like HDFC won’t have any of those problems. It is the largest private-sector bank in the country. And despite the hiccup when it was barred from issuing new credit cards for nearly 9 months in 2022, it’s still the leader in the credit card space. It’s fairly conservative in its lending practices so won’t have to worry about going the Goldman Sachs way. And it doesn’t need to build a consumer brand from scratch. It’s already the behemoth.

Instead, it benefits from access to Apple’s ‘affluent’ customers. That’s a win, right?

Anyway, this is all speculation right now. And we don’t know how this will actually pan out. Apple may choose to ignore India completely and look elsewhere. But if it does launch credit cards in India, you can always come back and read this story again.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn, and Twitter.

Term life insurance prices are rising!

A prominent insurer is looking to increase their term insurance rates in the next few weeks.

For some context: when you buy a term life product, you pay a small fee every year to protect your downside. And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones.

The best part? When you buy early, you can lock in your premiums to ensure they're not affected by any future rate hikes.

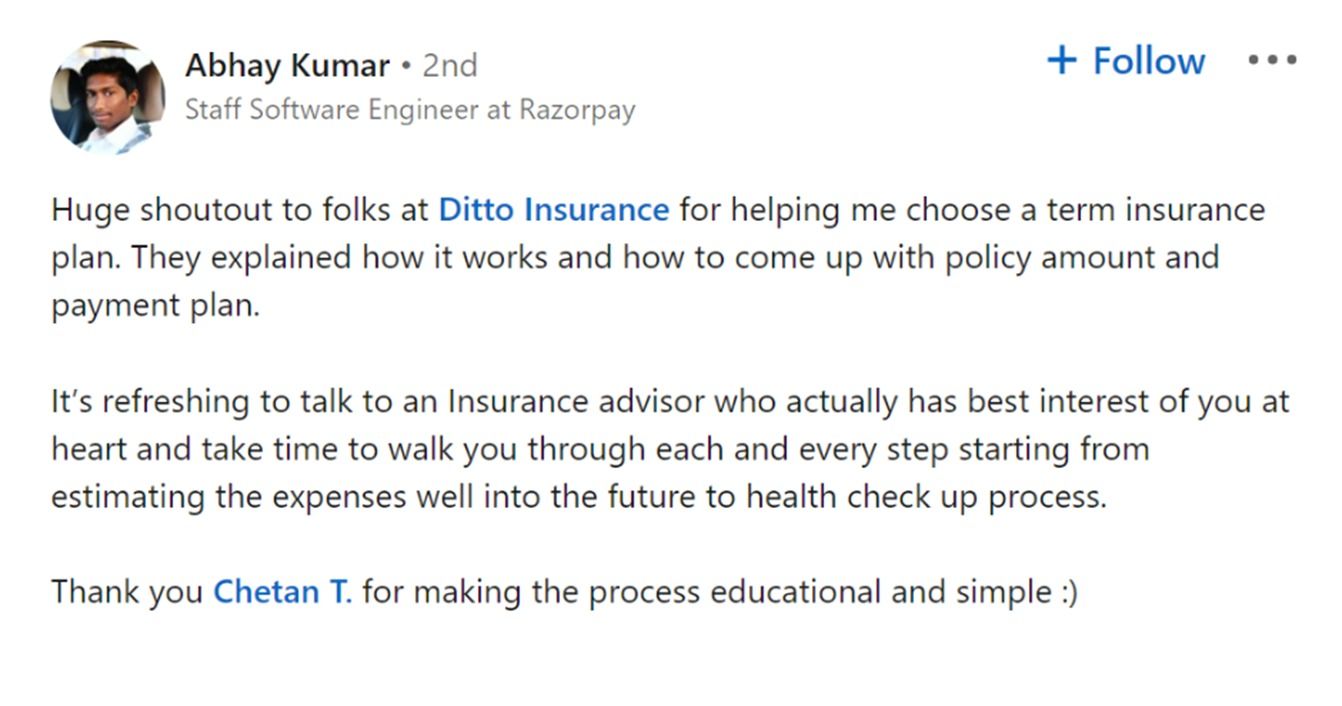

So, if you've been thinking of buying a term plan, now might be the best time to act on it. And to help you in the process, you can rely on our advisory team at Ditto.

Head to our website by clicking on the link here

Click on “Book a FREE call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!