Inside the theories that won the 2025 Economics Nobel

In today’s Finshots, we tell you why this year’s Nobel Prize in Economics went to Joel Mokyr, Philippe Aghion and Peter Howitt.

But here’s a quick sidenote before we begin. The Insurance Masterclass series starts tomorrow.

Tomorrow’s session focuses on life insurance - how to choose the right cover and avoid costly gaps. The following day is all about health insurance and what to look for in a good policy.

If you have been meaning to sort out your insurance, now is the time.

Only 40 seats remaining. 👉🏽 Click here to register now.

Now, on to today’s story.

The Story

If someone asked you how economists measure economic growth, your first instinct would probably be to say, “By looking at how much the total value of goods and services has increased over time.” In other words, by tracking how the Gross Domestic Product (GDP) has grown.

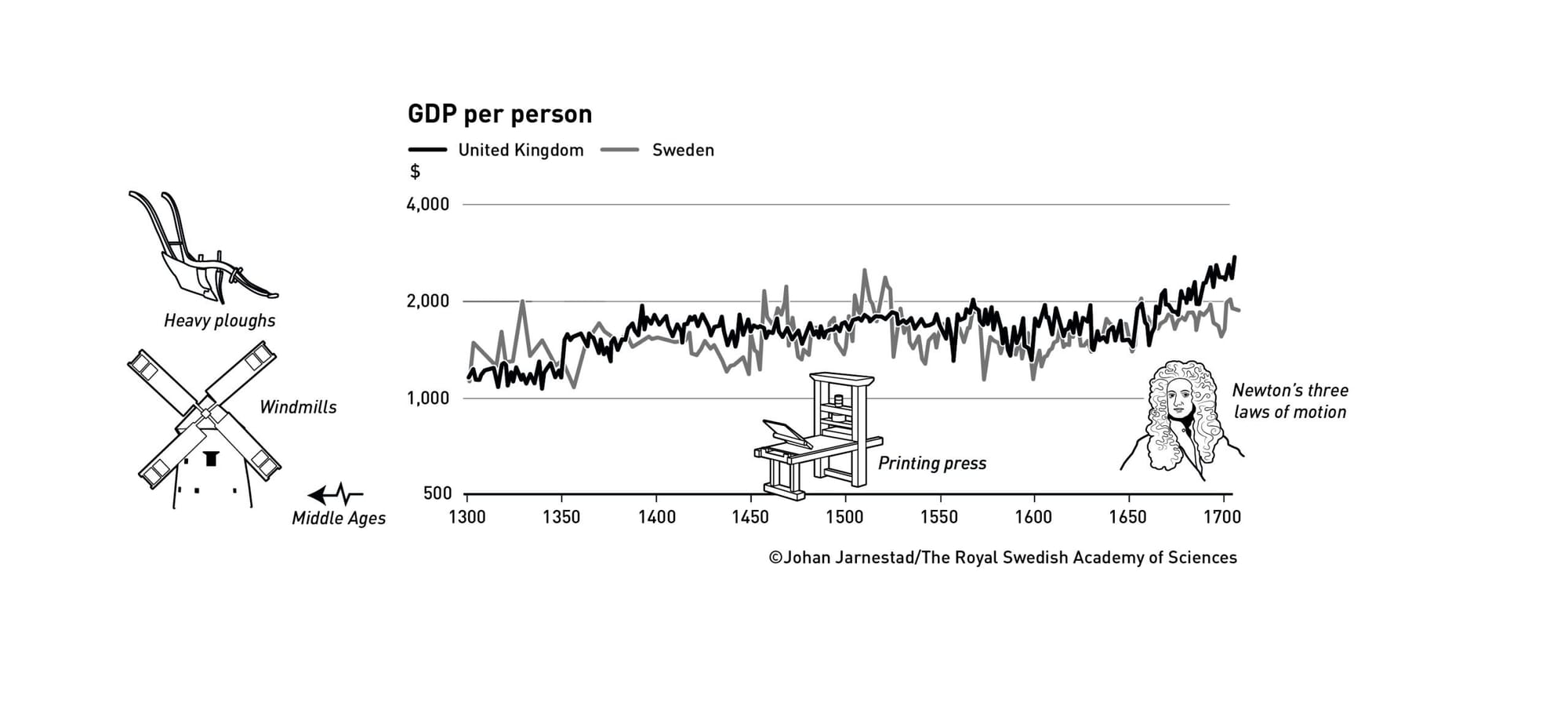

And that’s exactly what one of this year’s Economics Nobel Laureates, Joel Mokyr, was doing. He wanted to understand how economies grew before and after the Industrial Revolution in Europe. But along the way, he stumbled upon something rather odd.

When he looked at data from Sweden and Britain between the early 1300s and the early 1700s, he noticed that incomes sometimes went up and sometimes dipped. But overall, there was barely any long-term growth — even with big, disruptive innovations like the invention of the printing press.

If you were to plot this on a graph, the line representing economic growth between these years would look almost flat like a long plateau.

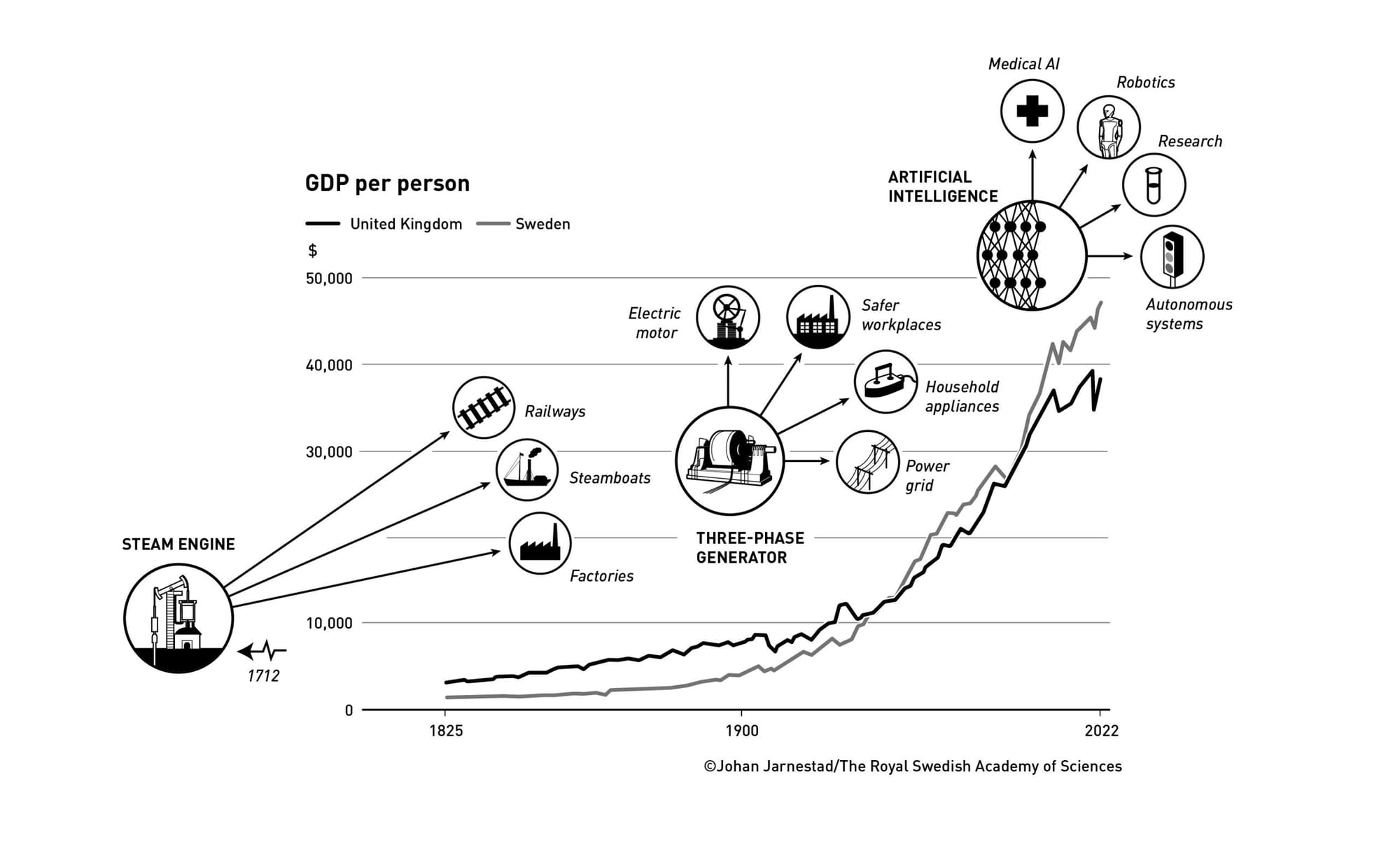

But then, the graph starts to look completely different from the early 19th century — right after the Industrial Revolution gathered steam.

From that point on, things changed dramatically. Apart from a few major hiccups, like the Great Depression in the 1930s and a handful of other crises, growth replaced stagnation as the new normal. Economies began expanding steadily, decade after decade, right up to the present day.

And this wasn’t just a British or Swedish story. Many industrialised countries followed the same pattern, growing at a consistent pace of around 1.5% a year. Now, that might not sound like a lot on paper, but when you think about it, steady growth at that rate can double a person’s income over their working lifetime.

And that made Mokyr curious. Why on earth would this difference in growth happen?

Turns out, the answer boiled down to three surprisingly simple things.

For starters, before the Industrial Revolution, innovation was built on what he called “prescriptive knowledge”. That means people knew how to do something, but not why it worked.

Take a blacksmith, for instance. He might’ve known that heating and hammering metal in a certain way made it stronger. But he had no clue about atoms, heat transfer, or any of the science behind it.

Then there was “propositional knowledge” — the kind that explains the why and how behind things. And back then, this theoretical knowledge had very little to do with actual invention. Basically, the people who made things weren’t talking to the people who studied why things worked.

And because of that separation, innovation was often random or misguided. For example, many were obsessed with building perpetual motion machines or devices that could supposedly run forever without needing any external energy source.

But the problem is, the laws of thermodynamics tell us that energy can’t be created from nothing. Every machine loses energy through heat, friction, or resistance. So perpetual motion is physically impossible.

And because of this, innovation before the Industrial Revolution often looked like guesswork, where people had their eureka moments purely by accident.

That began to change during the 16th and 17th centuries, when Europe went through what we now call the Scientific Revolution — a period that transformed how people thought about the world. It was part of evidence-based thinking that started replacing superstition and blind tradition.

Scientists began insisting on new standards for how knowledge should be created. In short, they came up with three basic rules:

- Don’t just say that something works. Measure it accurately.

- Test one factor at a time so that you can isolate what’s really causing an effect.

- And finally, if someone repeats your experiment, they should get the same result.

These practices made science more reliable and more connected to practical work.

And that’s precisely how the marriage of theory and practice led to bigger, deliberate inventions rather than accidental ones.

But just knowing the theory and the practice wasn’t enough. You also needed technical skill and commercial support. Because without those, even the most brilliant ideas would remain just that… ideas on paper.

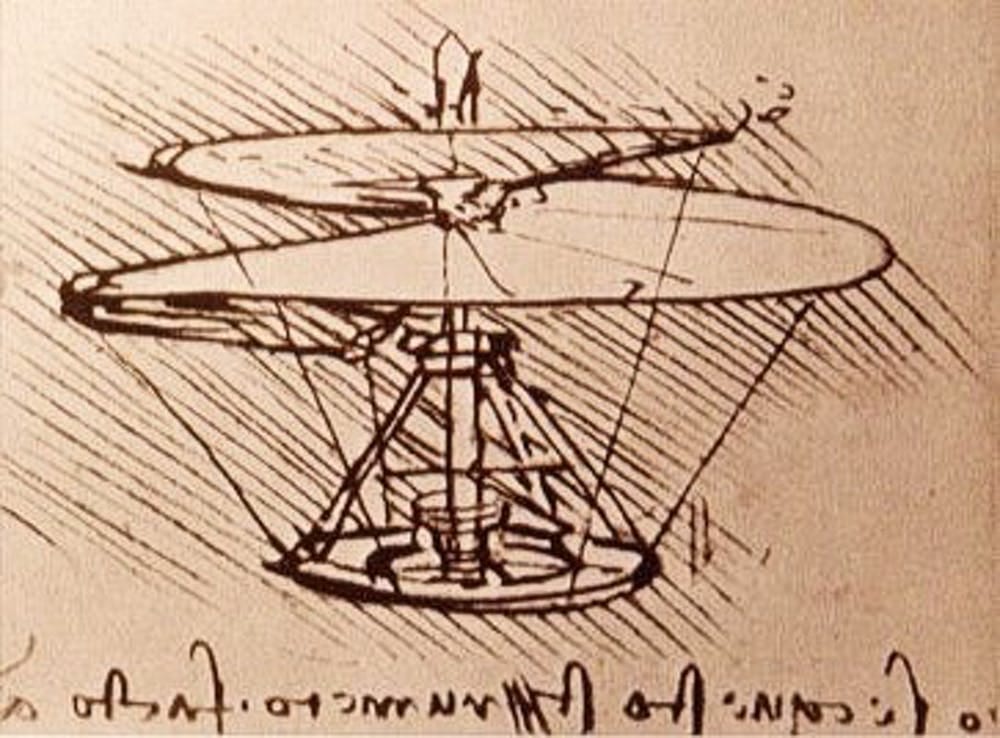

Take Leonardo da Vinci. He lived nearly 300 years before the Industrial Revolution and wasn’t just a painter. He was an inventor, engineer, and scientist too. He sketched out flying machines, parachutes, diving suits, and even an early version of a helicopter which he called the “aerial screw”. It looked like a giant linen-and-reed screw that, in theory, could spin upward through the air. But in reality, it couldn’t fly.

That’s because da Vinci didn’t have the right materials. Wood and canvas were too heavy. His power sources, mostly human hands, weren’t strong enough. And no one understood aerodynamics. So while he and the people of his time were brilliant thinkers, they couldn’t turn imagination into invention.

Britain, by contrast, had that perfect mix when the Industrial Revolution rolled in: skilled workers who could read blueprints, engineers who could experiment and improve, and entrepreneurs who could fund production and scale it up.

But there was one more ingredient. For growth to last, society had to be open to change, even when that change was uncomfortable.

Because you see, every new technology creates winners and losers. For instance, machines replaced manual labourers, computers replaced typewriters, and today, AI is rewriting job roles. The same thing happened back then with the steam engine and mechanised looms. Efficiency rose, but jobs were lost.

Naturally, those who lost out resisted. But it wasn’t easy because earlier, during monarchies and feudal systems, a small elite of nobles, landlords, or clergy could easily block any change that threatened their power. But by the time of the Industrial Revolution, though, things were different. Political power had spread. Parliament now included not just aristocrats, but merchants and industrialists too. That made it harder for any one group to hold back progress. And as society began valuing reason and evidence over tradition, change was no longer considered something to fear.

That explained why the growth spike happened.

But it led to another question. If new inventions constantly replaced old ones, wiping out companies or even entire industries in the process, how did the economy keep growing?

That’s where this year’s other two Nobel laureates, Philippe Aghion and Peter Howitt, enter the story.

They built a model to explain how technological change sustains growth in the modern world. And for that they began with a simple question — in a perfectly free market, would companies invest the right amount in research and development (R&D) to keep the economy growing?

This model showed that two opposing forces shape innovation:

- Too little R&D, where companies know their breakthroughs won’t stay profitable forever and that someone else will invent something better and take their place. That discourages investment. But from society’s point of view, every old idea still adds value because it becomes the foundation for the next one. So, overall, firms tend to underinvest in R&D, which is why governments often step in with support or subsidies.

- Too much R&D. When one company launches a new product, it can drive another out of business. They call this “business stealing”, similar to creative destruction. Sometimes, the new product is only slightly better, yet it captures big profits. That means too many resources can end up chasing small improvements, making innovation inefficient.

And this understanding helped policymakers strike a balance in knowing when to push innovation and when to pace it.

It also laid the groundwork for understanding competition. They figured that too few companies or monopolies can stifle innovation. But too many can make profits so thin that firms stop innovating altogether. So the sweet spot was to have enough competition to keep ideas flowing, but not so much that it kills long-term investment.

And while we’ve talked about how innovation affects companies, you can’t ignore that it affects people too. That’s why Aghion and Howitt argue that governments shouldn’t protect jobs, but workers — by helping people retrain and move into new roles. They call it flexicurity — a portmanteau (a word made by combining two others) of flexibility for firms and security for workers.

But there’s a catch. Sustained growth isn’t the same as sustainable growth. Progress often brings side effects like pollution, climate change, inequality, and resource depletion. And that could mean growth could stall again. But Mokyr believed these very challenges could spark new innovations or that technology could correct itself. But that only happens when guided by smart public policy such as climate action, healthcare, and fair distribution of wealth.

Because economic growth isn’t guaranteed.

After all, for most of human history, stagnation was the norm. And if we ignore the risks that come with innovation, we could slip back into that pattern.

But if we pay attention to the lessons from Mokyr, Aghion, and Howitt — staying open to ideas, encouraging innovation, and managing its side effects wisely, we can keep the engine of progress running for generations to come. And maybe, just maybe, we’ll keep that growth curve from flattening again.

Until then…

Note: An earlier version of this story mentioned “creative disruption” when we meant “creative destruction”. We’ve now corrected it.

Don’t forget to share this story on WhatsApp, LinkedIn, and X.