India's oil trick just hit an EU sanction wall

In today’s Finshots, we tell you how a new wave of EU sanctions on Russian oil might jeopardise India’s billion-dollar oil game.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

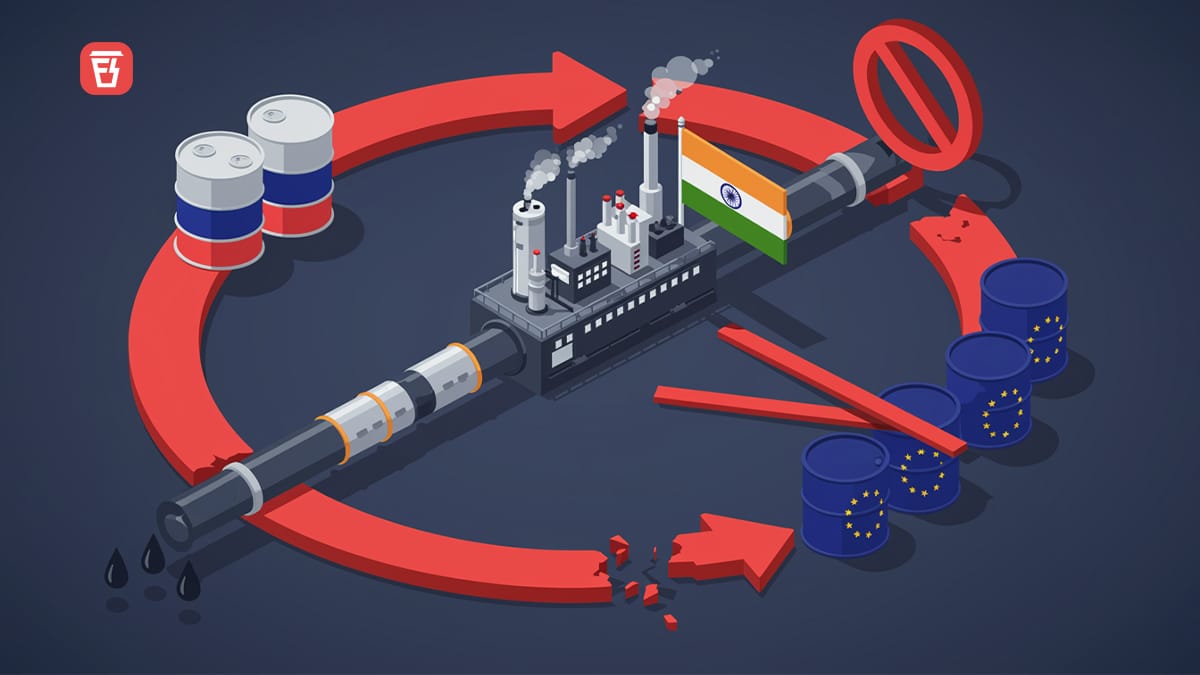

Every country has its own oil playbook. The US drills, Saudi Arabia controls supply, China hoards. And for a while, India did something else entirely. It arbitraged. Indian refineries bought discounted Russian crude oil (or the oil the West didn’t want) and turned it into diesel and jet fuel the West desperately needed. Basically, we refined, repackaged and resold it. It was smart and surprisingly legal. There were no embargoes on refiners or restrictions on where Europe sourced its fuel. And this way, we made $15 billion in fuel exports to Europe last year.

But the European Union (EU) now wants to shut the system that made it work. Its 18th sanctions package bans the import of any petroleum product made from Russian crude, regardless of where it’s processed. Here’s an excerpt from the press release:

The new measures focus on five building blocks: cutting Russia's energy revenues, hitting Russia's banking sector, further weakening its military-industrial complex, strengthening anti-circumvention measures….

Sidenote: A “shadow fleet” or “dark vessels” refers to oil tankers that secretly transport sanctioned crude. They operate with obscure ownership, flags of convenience and deceptive routes to dodge scrutiny.

This change forces India to rethink not just where it buys oil, but how it builds energy strategy.

Allow us to explain…

When Russia invaded Ukraine, the world split into energy blocs. The West imposed sanctions on oil and Russia started offering discounts. And India, which imports over 85% of its oil, took the pragmatic path at the time. We went from sourcing just 2% of crude from Russia to 40% in under a year! Even now, it hovers around 30%.

Why? Because a $3–$5 discount per barrel quickly turns into billions in savings. And we didn’t just consume that oil. We refined it, exported it and Europe (especially countries like the Netherlands, Spain and Romania) became major customers. No one asked too many questions. As long as the barrels didn’t come directly from Russia, the trade survived on ambiguity.

But now, the EU isn’t just targeting Russian revenue. It’s cracking down on circumvention.

So what does this mean for India?

For starters, refineries like Reliance Industries and Nayara lose a top dollar customer. If Europe stops buying fuels, where do they send the barrels? Sure, they can redirect some of it to Asia or Africa, but margins there are thinner. Freight costs rise and traders take a bigger cut. So the volume that went directly into premium-paying European markets could get rerouted through costlier, more complex paths.

Reliance Industries is a good example. It’s a major refiner exporting diesel to Europe. And it did this by inking a 10 year deal with Rosneft to buy over 5 lakh barrels per day of Russian crude at a discount. That oil powered a $15 billion diesel export engine. But if those barrels can’t flow to Europe anymore, the advantage starts fading.

Then there’s Nayara. It’s India’s second-largest buyer of Russian oil and a major exporter of diesel to Europe. Unlike Reliance, Nayara doesn’t have the luxury of other business arms to buffer the impact. If sanctions bite deeper, it could be forced to scale down exports or focus on India’s tightly-regulated domestic market, where margins are thinner. Plus, Rosneft has a stake in Nayara which it wants to sell to RIL. But all that’s imperiled by the sanctions for the time being.

Multiply these effects across small traders and other public refiners and the ripple effect becomes a wave.

Then we have the economy side of things.

The fallout of these sanctions for India is said to be in billions of dollars annually. But these fuel exports weren't just corporate profit as they also helped India balance its current account and cushion the impact of rising crude prices without slashing fuel taxes. Now, with Russian discounts shrinking and sourcing costs rising, our oil import bill climbs. The trade deficit widens and inflation math gets messier.

Because diesel fuels everything from trucks to tractors. When refiners lose their margins, they’ll try to delay price hikes. But eventually, the cost trickles down at the fuel pump or into the fiscal deficit (if the government chooses to subsidize it).

So yeah, inflation might not spike overnight, but it starts simmering.

But then you’re probably wondering “If India’s out, where will the EU get its oil and diesel from?”

Well, ironically, it may still end up buying Russian oil.

Not directly, of course. But from someone who buys Russian oil, refines it elsewhere, slaps a new label on it and sells it to the EU at a higher cost. Middlemen find ways. Arbitrage finds cracks. Europe might pat itself on the back for cutting India off, but if it ends up paying more for the same fuel via a more complex route, it’s not much of a win.

You see, whoever has oil has the cards. Russia has it and it’s selling it at a discount. That makes the economics very favourable for the nation. India was a good place to get reasonably priced oil for the EU. But even if you remove India, Russia could still reshuffle its crude through other countries which can then route it to the EU. And Indian refiners could plug themselves somewhere in this chain again for an opportunity, although the margins may suppress.

In fact, it just means higher costs, longer routes and possibly higher inflation for the EU.

Perhaps that’s why this story isn’t fully playing out yet. You see, the sanctions on diesel don’t kick in until January. So there’s still time for refiners, traders and policymakers to reshuffle a lot that’s at stake.

Nevertheless, the clock’s ticking. So what’s India’s way out, you ask?

One option is adaptation. Refiners may continue to import Russian crude, but segregate their output. Like Russian oil for domestic sales or Asian exports, while using oil from some other nation for Europe. That’s possible, but not seamless. It means more operational complexity and more exposure to freight and blending risks. Another is diversification. India already sources crude from 40 countries today, up from 27. That’s a hedge against disruption. But the cost is that most of these crude oil are benchmark-priced (or market priced), unlike the Russian deal that was opportunistic and discounted.

And there’s also the long, strategic game: reduce oil dependence altogether. India is already investing in electric mobility, green hydrogen and solar infrastructure and every oil shock accelerates that push. But that takes time. Until then, we remain exposed to every foreign policy shift, every war, every price shock.

To be fair, India’s not sitting idle. We’re ramping up domestic oil exploration. Sure, that’s a move that clashes with our green goals but helps plug energy gaps. And to India’s credit, we’ve already met our climate targets under the Paris agreement ahead of schedule.

But maybe the real lesson here is that arbitrage, by nature and especially in oil, is temporary. It thrives on loopholes, grey zones and timing. And eventually, someone always closes the gap like the EU did.

So while India’s oil strategy worked brilliantly, it was always a trade, not a plan.

Now the challenge isn’t just about rerouting barrels or finding new buyers. It’s about building capacity, diversified supply channels and gaining pricing power. Because in a world where oil can be a weapon, relying on discounts and imports is a fragile defence.

So the question isn’t how long we can stretch the arbitrage but how quickly we can break free from the grip of foreign oil. Can India do it? In a few years or a decade? You tell us!

Until then…

Don’t forget to share this story on WhatsApp, LinkedIn and X.

Myth Alert: I'm Too Young to Buy Life Insurance!

The other day, one of our founders was chatting with a friend who thought life insurance was something you buy in your 40s. He was shocked that it was still a widely held belief.

Fact: Life Insurance acts as a safety net for your family. The younger you are, the cheaper it is. And the best part? Once you buy it, the premium remains unchanged no matter how old you get.

Unsure where to begin or need help picking the right plan? Book a FREE consultation with Ditto's IRDAI-Certified advisors today.