India’s new CPI explained

In today’s Finshots, we explain why the government has changed how we see inflation in India.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Every year, we’re told about the consumer inflation rate, and on paper it doesn’t look all that high. Yet for people actually paying bills, buying groceries, and going about their daily lives, it often feels like their wallets are getting lighter year after year.

Rents keep rising, school fees rarely stay the same as last year, healthcare costs don’t come down, and small monthly expenses quietly pile up.

This disconnect isn’t just psychological. It’s structural. Inflation isn’t simply about prices going up; it’s about which prices matter more than others. So when the government says that inflation is X%, that number is built using the Consumer Price Index, or CPI. In simple terms, CPI is a weighted average of what households spend their money on. The more a household spends on a category, the more price changes in that category are meant to influence the final inflation number.

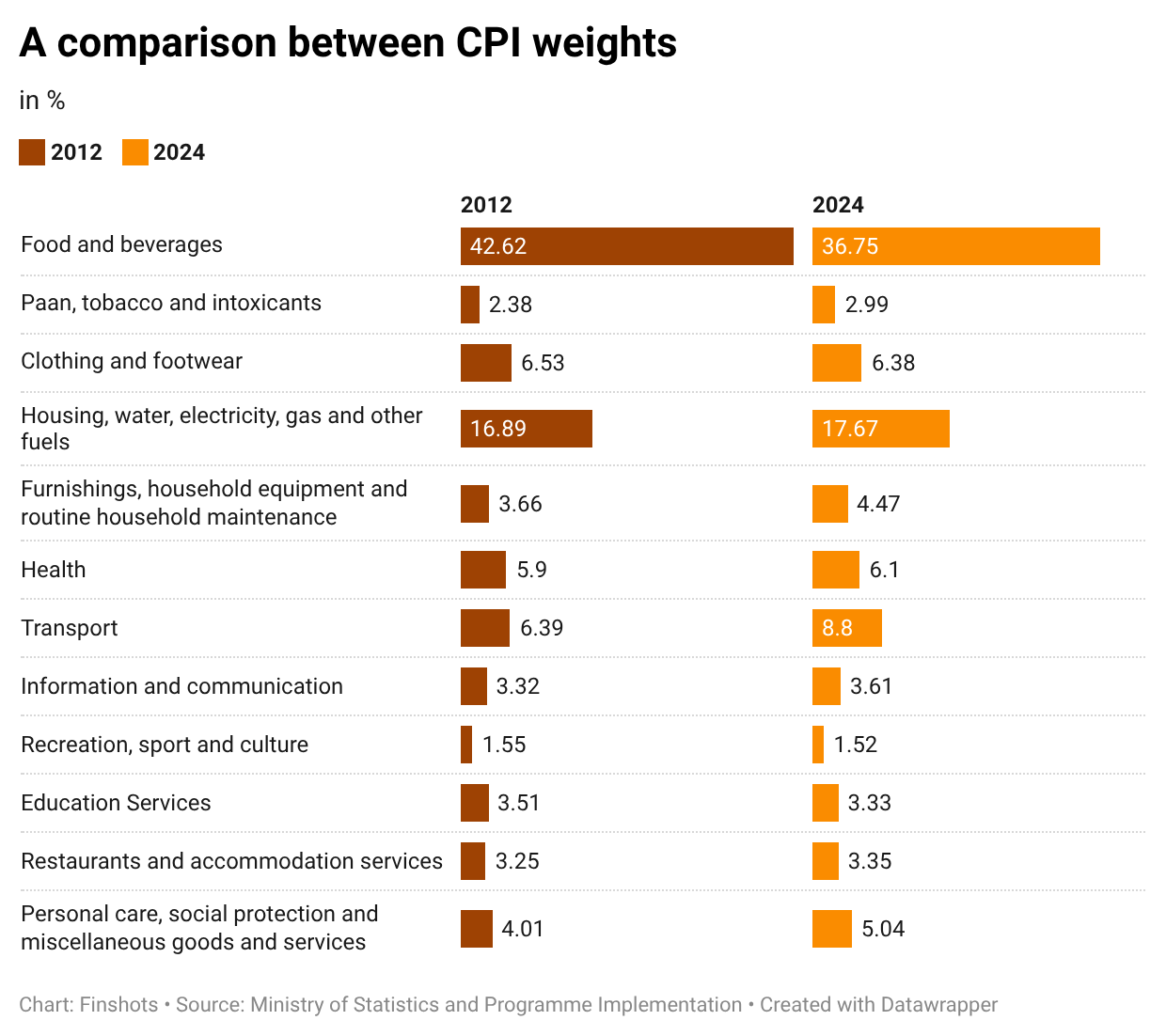

But here’s the thing. For years, India measured inflation using a framework anchored to spending habits from 2012. Back then, food took up a much larger share of household budgets, items like DVD players and second-hand clothing were still relevant, and services played a much smaller role.

Over the past decade, that balance has shifted sharply. Households now spend far more on rent, transport, education, healthcare, and a growing list of services that barely existed earlier. But inflation measurement continued to reflect the structure of the 2012 economy.

As consumption patterns evolved, the framework didn’t keep pace. That’s also why inflation often felt understated. Food prices may have cooled and pulled the headline inflation down, even as rent, school fees, and medical bills continued to rise steadily in the background. So yeah, inflation wasn’t being misreported. It just wasn’t fully reflecting today’s spending reality.

Now to be fair, measuring inflation is no easy feat. Consumption patterns change faster than statistical systems do. But over time, the mismatch became too large to ignore. Which is why the old inflation framework itself had to be replaced.

That replacement arrived in early 2026.

In February, India began publishing inflation data using a new CPI series built on 2024 consumption patterns. This means 2024 is now the base year for measuring inflation, replacing 2012 as a reference point.

But what does a base year mean and why does it matter?

Well, base years matter because they define what “normal” spending looks like. Inflation is always measured relative to this base. If the base reflects an outdated economy, inflation starts telling an outdated story. By anchoring CPI to the Household Consumption Expenditure Survey of 2023–24, India is now measuring price changes against how households actually spend today, not how they spent more than a decade ago.

In simpler terms, the new CPI doesn’t just track how prices are changing. It tracks how prices are changing for the things that now make up everyday life.

That shift is also visible in the consumption basket itself. Outdated items from a bygone era such as VCRs, DVD players, cassettes, tape recorders, and second-hand clothing were removed. In their place came expenses that relate to modern households: streaming services, rural housing, value-added dairy products, digital storage devices, babysitters, and other services.

The basket also became broader. The number of goods items increased from 259 to 308, while services expanded from 40 to 50 items, pushing the total basket from 299 to 358. But updating the basket is only part of the story. What really determines how inflation behaves is weights or how much importance each category carries in the final number.

Under the older framework, food dominated inflation because it accounted for a much larger share of household spending. But today, households spend relatively less on food and more on housing, transport, healthcare, education, and services. The new CPI reflects this shift by rebalancing weights using the latest expenditure data, changing which price movements influence inflation the most.

One of the most consequential and least discussed changes in the new CPI, though, is India’s shift to the COICOP-2018 classification system. Earlier, inflation was measured using just six broad consumption groups, many of which bundled very different expenses together. But under the new framework, CPI is organised into 12 clearly defined divisions, following international standards used by most major economies.

Sidebar: COICOP sounds complicated, but the idea behind it is simple. It stands for Classification of Individual Consumption According to Purpose — which is a long way of saying, let’s organise spending by what people actually pay for. Rent stays with rent. Hospital bills stay with healthcare. School fees stay with education. This is how most countries measure inflation.

And this isn’t simply a cosmetic change. Instead of burying services inside broad categories, it gives clear visibility to specific expenses. If a category meaningfully eats into household income, it now has a distinct place in the inflation calculation. For regular households, this means recurring monthly costs such as rent, school fees, or hospital bills are harder to statistically dilute.

There’s also a quiet global importance. For years, international institutions struggled to compare India’s inflation with the rest of the world because the underlying classification didn’t match the rest of the world. By adopting COICOP, India is now measuring inflation using the same framework as other major economies. So comparisons become cleaner.

The simplest way to think about COICOP is that it changes which prices are taken seriously. Inflation may never perfectly match every household’s experience, but the new framework brings it closer to real life. And when inflation is measured more honestly, policy responses — from interest rates to cost-of-living adjustments, stand a better chance of landing where they matter most.

Now what changed isn’t just what people spend on, but how and where they do it. We’re talking about online and retail. Sure, the old CPI had price data collected from the on-ground visits to the markets but it was limited. But CPI today is built by combining market visits with digital tools, online prices, and official records, to reflect how people actually shop and pay, not how they used to earlier.

That’s how it works theoretically.

But what does this actually mean for the inflation number you see every month?

Inflation may start behaving a little differently. Sudden spikes in food prices may not swing the headline number as wildly as before, while slow, steady increases in rent, healthcare, education, and services will matter more. Inflation might feel less jumpy month to month but more familiar. Seen through this new approach, India’s latest inflation readings are 2.73% in rural areas and 2.77% in urban ones.

That still doesn’t mean inflation will perfectly match everyone’s wallet. It probably never can. A household paying school fees and rent will experience inflation very differently from one spending more on groceries or fuel.

But what has changed is how we measure it. By updating the base year, refreshing the basket, rebalancing weights, adopting global standards, and modernising how prices are tracked, India has rebuilt the way it measures inflation to reflect everyday life.

So the next time you hear that inflation is “under control” but your expenses say otherwise, remember that prices didn’t suddenly change overnight. But the way we measure them finally has.

Until then…

If this story helped you understand how inflation is calculated, share it with a friend, family member or even strangers on WhatsApp, LinkedIn and X.

Before you go…

A quick note for our NRI readers!

If you’re living abroad, there’s a good chance you’re overpaying for life insurance.

Indian term insurance can often be way cheaper than policies in the US, UK, or Singapore. But eligibility rules, medical tests abroad, rider restrictions, and claim settlement in INR can get complicated fast.

So we put together a practical, no-fluff guide on Term Insurance for NRIs in India covering premiums, documentation, underwriting, and what really happens during a claim.

If you earn abroad but your family depends on India, this is worth 5 minutes.