India’s diamond woes

In today’s Finshots, we explain what ails India’s diamond industry

The Story

If you own a diamond, chances are that it has an India connection. Yup, even if you bought it from Belgium or Dubai.

You see, 14 out of 15 diamonds set in jewellery worldwide are cut and polished in India. And that makes us a world leader. In 2021, we exported a massive $26 billion worth of diamonds all across the world.

But things have been slowing down of late. Our gross diamond exports have declined by ~10% in FY23 over the previous year. We’re down to $22 billion now. And the industry is worried because cut and polished diamonds made up nearly 62% of the total gems and jewellery exports last year.

And guess who gets hurt the most when this happens…

Surat!

This city in Gujarat forms the heart of the Indian diamond industry. It employs over 8 lakh people and has a virtual monopoly in the diamond cutting and polishing trade. But right now, these processing units are working at only 70% of their capacity. And 20,000 employees have already been laid off.

Now before we get into what’s going on, aren’t you curious about how India became this diamond-exporting behemoth?

Well, the thing is, we aren’t big on the mining department. Sure, the earliest diamonds were first discovered in the riverbeds of Golconda or modern-day Hyderabad over 4,000 years ago. And for a long time, India was synonymous with diamonds. But we don’t seem to have massive mines to compete with the rest of the world anymore. In fact, we have just one mechanised mine in a town called Panna in Madhya Pradesh.

And the other diamond reserves that we have are located in ecologically sensitive areas. We can’t employ mechanised mining here effectively.

But our history with diamonds meant that we could capitalize in other ways. And by that, we mean the cutting and polishing bit. Now the reason why we became successful is simple — low cost of labour. See, if the US spends $100 per carat to cut a diamond, India can do it at 10% of the cost. And not only do we have cheap labour but also skilled ones who can work with the smallest of diamonds. Since small diamonds require a lot of labour, the abundance and costs of employing such workers have helped India monopolize the industry i.e. cut and polished diamonds under 1 carat.

And Surat emerged as the hub. Thanks to the efforts of a couple of enterprising brothers ― the Mavjivanwalas who decided to set up shop in the early 1900s. While the trade slowly picked up, a seismic shift happened when Gujaratis decided to immigrate to a famous diamond trading hub in Europe in the 1960s. We’re talking about Antwerp in Belgium. Once there, these Indian immigrant folks weaved their way into the diamond business. But instead of using local labour, they opted to use cheap family labour back at home. They sent the diamonds to Surat for polishing.

And that’s how it all began.

So, why is the shine fading now, you ask?

Well, it could be just a temporary blip caused by a couple of things.

For starters, people in the US and China seem to be tightening their belts. They’re cutting back on buying diamonds. And when our two biggest export destinations stutter, it hurts our diamond industry.

Now this is quite cyclical. You’ll see a rise and fall in demand every few years. And when the situation improves, the fortunes of India’s diamond industry come roaring back as well.

But there’s something else too this time around–Russia. See, at least 30% of our rough diamonds come from Russia. We’re quite dependent on them. But when Russia decided to invade Ukraine, this threw a wrench in our plans. No one wanted diamonds that originated in Russia. Countries wanted to place sanctions and cripple the country’s economy. Russia was cut off from the dollar banking system that the world relied on.

The result?

Since April 2022, our imports of rough diamonds from Russia dropped by 40%.

But wait…couldn’t we have worked around this and used the rupee to settle trades?

Well, it seems like the Russians didn’t want the rupee either. And that left India’s diamantaires in a bit of a pickle. They simply couldn’t source enough stones for their needs.

The only saving grace was that the supply wasn’t completely choked off. Because even if the world didn’t want to be seen associating with Russian diamonds, they couldn’t just do away with it entirely.

Why?

Because it’s really difficult to trace the origins of these diamonds.

You see, at the start of the supply chain, diamonds get a certificate that stamps their origins. This is to prevent the so-called blood diamonds from entering the system. But after that, once the stones from various parts of the world come to be processed in places like Surat, everything gets mixed together. The diamond takes on a ‘mixed origin’ documentation. That means once a polished diamond is ready to be set into jewellery, it’s quite hard to pinpoint whether it had roots in Russia.

But the Western world is still trying. They’re figuring out ways to trace the origins of Russian diamonds so that they can pull the plug on this part of the trade too. They’re even trying to convince Belgium, which runs the world’s largest diamond trading hub in Antwerp to join forces too.

And if it does come down to this, it could result in some more issues for Surat’s diamantaires.

The only hope is that these sanctions will mostly affect large diamonds over 1 carat. So, our expertise with smaller stones might still save Surat’s diamond industry. We’ll have to wait and see how it all unfolds.

Until then…

PS: India’s also going full tilt on creating lab-grown diamonds. And that could provide some relief although industry observers are still sceptical. We wrote about it a few months ago and if you haven’t read it yet, check it out here.

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

Term life insurance prices are rising!

A prominent insurer is looking to increase their term insurance rates in the next few weeks.

For some context: when you buy a term life product, you pay a small fee every year to protect your downside. And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones.

The best part? When you buy early, you can lock in your premiums to ensure they're not affected by any future rate hikes.

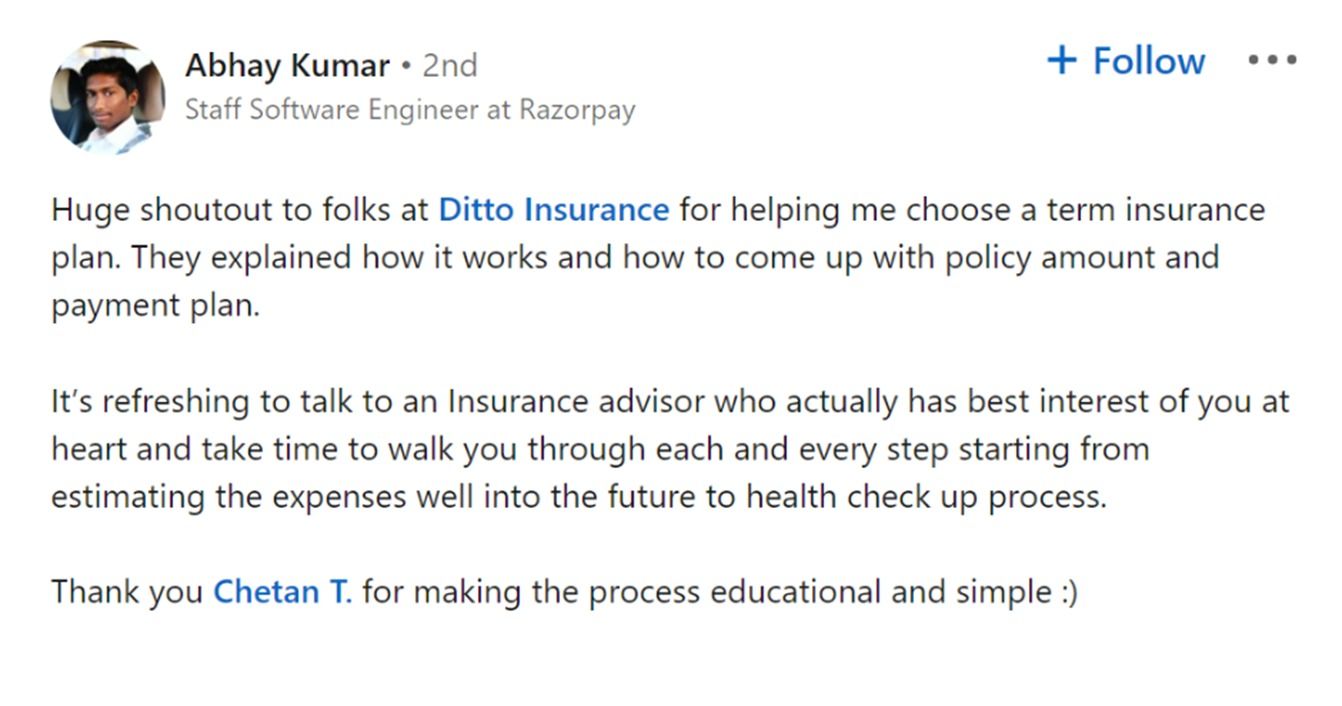

So, if you've been thinking of buying a term plan, now might be the best time to act on it. And to help you in the process, you can rely on our advisory team at Ditto.

Head to our website by clicking on the link here

Click on “Book a FREE call”

Select Term Insurance

Choose the date & time as per your convenience and RELAX!