How to solve the US debt crisis!

If you’ve been hearing about the US debt ceiling crisis and wondering what on earth that is, fret not, in today’s Finshots we’ll break it down for you.

The Story

If you borrow money, you have to pay it back. It’s that simple. But if your income isn’t growing fast enough, you’ll be in a spot of bother. You’ll have to juggle your daily expenses along with repaying the principal and interest on your loans.

And sometimes, the only way out is to borrow more money just to repay the old loans. It can be a vicious cycle.

This can happen to countries too. That’s why the US has a rule in place to keep this sort of debt binge in check. The government has a hard stop on how much money it can borrow. This is called the ‘debt ceiling’. It’s a limit on borrowing more money just to meet some of its existing obligations — such as government salaries, pensions, and even the interest on current debt. The ceiling exists to prevent the country from going into that vicious cycle.

Which brings us to today.

See, the problem for the US is — they’re at the ceiling already. Which means they can’t borrow more money. They’ll have to hope that their tax revenues are good enough for now.

But if it isn’t…well, they’ll default on loans. And then, all hell would break loose. Because when a country defaults on debt, people stop trusting it. They’ll hesitate to lend more money. And if they do, they’ll demand sky-high interest rates as a precaution. It hurts the country’s finances even further.

People with mortgages will see their interest rates rise. They might have to shell out $130,000 more as payments. 3 million jobs could be lost. And the overall debt burden could rise by a staggering $850 billion. All this money could’ve been invested in improving healthcare or education. But alas… that won’t happen.

Sounds quite scary, no?

But hold on…before you run out screaming that the US is in the middle of a financial calamity, let’s put your mind at ease. We’re not there. Yet.

See, this isn’t the first time that the US is in the throes of such a crisis. In fact, and you won’t believe this, since 1978, they’ve actually tweaked this ceiling at least every 9 months! How else do you think the limit soared from $1 billion when it was first introduced in 1917 to a whopping $31.4 trillion now!

Basically, each time the US government was in danger of hitting this self-imposed ceiling, they simply modified it. So just remember that this matter everyone is fretting about is way more common than you think. Politicians typically bicker over it to prove a point. But they finally come to their senses and they’ll simply kick the debt can down the road. Because let’s face it, no one really wants to default, right? It would be pretty embarrassing for the US.

So the question really is — will this time be different?

Ah, the dreaded question. We don’t know. All we can say is that people seem to be a bit more worried than usual. Because the Presidential elections are looming next year. That means politicians are trying to one-up each other. And they may leave logic at the door.

For instance, right now the Republicans have agreed to an increase in the ceiling. But with strings attached. They want the Democrats (who’re in power) to promise to cut back on spending — on renewable energy and social welfare schemes for the poor. And the President is saying he won’t budge on his principles.

So we’ll have to wait and see what this comes to.

In the meantime, we decided to dig for some quirky solutions ourselves. You know, just in case the politicians behave like toddlers and throw a tantrum.

For starters, maybe the government can play around with a ‘premium bond’. See, Bloomberg’s Matt Levine pointed out a loophole in case there’s an impasse. A bond consists of two bits — the principal and the interest. And apparently, only the principal will be considered to be a part of this debt ceiling. Not the interest.

So let’s imagine that there is a debt ceiling of $100. Now the government can issue a $100 bond and promise to repay it within a year. It’ll pay an interest of 5% too. But once it does this, it has already hit that ceiling. It can’t borrow more.

But say it wants to borrow $200 without breaching the $100 limit. What can it do? Well, maybe it can do something really crazy. It can issue a ‘premium bond’ and say, “Look, we’ll sell you a $100 bond. But we’ll give you an interest of 110%! At the end of the year, we’ll give you $210 back.”

So in effect, the face value of the bond is $100. Interest $110. That’s the structure.

But the government will only sell it to you for $200. So technically they haven’t breached the limit because the debt ceiling only counts the face value of the bond and not the sum that investors pay to acquire the bond. And the government can laugh its way to the bank and use the additional $100 to repay existing debt.

Also, they can keep doing this every time they’re close to reaching the limit. The debt ceiling becomes irrelevant.

Yes we know, it sounds insane and too far-fetched to happen. But who knows, right? The world’s a crazy place sometimes. Remember when oil prices went into negative territory in 2020?

The other gimmick is a magical $1 trillion coin!

Yup, there’s another loophole here. See, the US government’s hands are tied by prevailing law when issuing money. This includes paper money as well as coins such as gold, silver, and even copper.

But, the law missed including platinum!

That means, Joe Biden can simply ask the US Treasury which handles all these money matters to mint the coin — a $1 trillion one made of platinum. And deposit it with the central bank. And they can borrow money against that if they want to. Poof! The debt ceiling problem is solved!

Also, you don’t need to have $1 trillion worth of platinum to mint the coin. It could just be a commemorative coin made from platinum that carries the $1 trillion denomination. In theory, this could solve the problem temporarily. Because sooner or later, they’ll hit the limit again. The only problem is that this will make the US look pretty bad. It’s like the government coming in and printing new money. Technically that’s the Fed’s job (the US Central Bank). And if investors get the sense that the government is meddling in this very sacred process, they may be wary of investing in the country altogether. That would only make a bad situation even worse.

So in summary, there are 3 ways to solve the US debt ceiling crisis.

- Increase the debt limit.

- Issue premium bonds.

- Mint the damn $1 trillion coin.

There, problem solved!

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

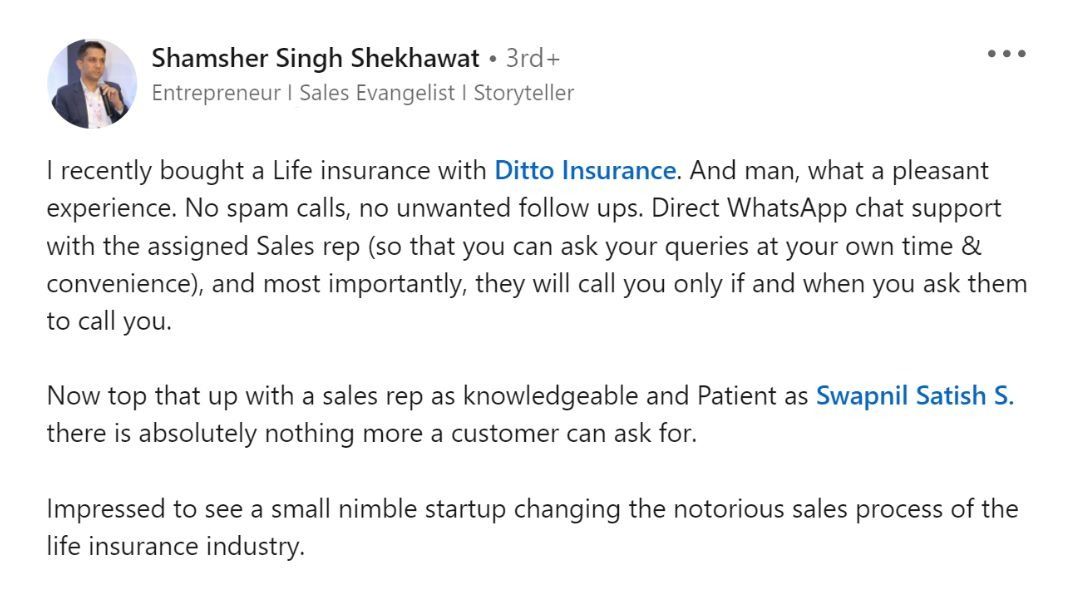

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here