How to (almost) get away with fraud?

Subhash Chandra Goenka is many things.

He’s a media mogul who set up Zee — India’s first private TV channel in 1992. He was a Member of Parliament who dipped his toes in the world of politics. He is a philanthropist who helps the less fortunate.

But now…he’s also allegedly a fraudster!

At least that’s what the Securities and Exchange Board of India (SEBI) thinks.

So, what damning evidence have they found to support their claim? In today’s Finshots, we dive into what they’ve revealed in their interim order. Fair warning, it’s a long Friday read.

The Story

The story begins in November 2019. Subhash Chandra’s Essel Group was going through some turmoil. The Group had a lot of business interests. But one business in particular was turning out to be quite bothersome — infrastructure. Their infra division (including 7 entities) had to borrow a lot of money to keep building stuff and was neck-deep in debt.

So when they borrowed money from Yes Bank, the bank asked for some guarantee. It wanted some assurance that Essel would pay back the loan.

So Subhash Chandra found the answer in another group entity - Zee Entertainment. He stepped in and said, “Here’s ₹200 crores in a fixed deposit. It’s from Zee Entertainment which we own. If the other companies default, you can take the money and do as you please.”

On the face of it, there’s nothing really wrong with this. Subhash Chandra is using money from a sister entity (Zee) to help the infra companies borrow money. But the problem is that Zee Entertainment is also a listed company. It’s answerable to its shareholders and the board. And apparently, Subhash Chandra didn’t seek the board's permission before he pledged the fixed deposit. Now you could put this down to some oversight. Some laxity on his part. But it still riled up a couple of independent directors who were on the board of Zee Entertainment. They resigned from their positions and shot off a complaint to SEBI. They said that Zee’s team was taking this oversight too casually.

Because here's the thing. Yes Bank simply used the fixed deposit to settle the dues from the infra companies. That money from Zee was gone. But if Essel Infra paid Zee back the ₹200 crores, everything would be alright, yes? Everything would've been fine.

So SEBI asked Zee if it had got the money back. And Zee said "Yes, we did. We got it way back in October 2019 itself." It showed SEBI a few receipts of 'Money received'.

Now that should’ve ended the matter. And SEBI should’ve quietly gone back to its office. But SEBI smelt something fishy. They wanted more proof. So they asked for the bank records of all the entities involved in this deal.

And let’s just say that the money trail they found was shocking.

So, when Zee said it had received its ‘dues’, well…it was kind of a lie. Here’s a sample of what actually transpired.

First, Zee took some money out of its coffers and paid an entity called Living Entertainment. These folks then transferred the money to Khubsoorat Infra. This infra company then moved this money to Sprit Infrapower & Multiventures. This entity then took the money and quietly sent it to Pan India Infraprojects. From here it was handed over to Essel Green Mobility. And finally, Essel Green Mobility transferred the money back to Zee.

Since there are multiple entities involved here who were all responsible for returning the 200 crores, we have taken the case of Essel Green Mobilty (one of the entities involved) to show how they returned their share of the money.

And the kicker? All these transfers took place in the span of just 1 day!

Basically, Zee didn’t get any money back. It lost the ₹200 crores it gave to Yes Bank as a guarantee. And then it took more money out of its pocket, routed it through multiple entities, made it seem like the infra companies paid it back and then declared that it didn’t suffer any losses.

It even left a note in its annual report for FY20 saying that the company had got back the money back. The audit committee gave this a clean chit too.

But as SEBI’s investigation shows, it all seems like a farce. The folks in charge at Zee Entertainment tried to pull the wool over the eyes of all their shareholders. Their board. And even tried to fool SEBI by claiming to have got the money back.

So you can imagine that SEBI isn’t pleased. And they didn’t mince words in its initial report too. They call it an “elaborate scheme orchestrated by the Promoter Family of Zee Limited.” And even said that it “appears as if it [Zee Limited] was used like a piggy bank by the Noticees [the promoters].”

But wait…the story isn’t over. Not yet.

See, if it was only Zee Entertainment, you might’ve passed it off as a one-off case. You might've said that the promoters made a mistake once. It's not that big of a deal. just forgive and move on.

But apparently, the rot runs deep. And in the report, SEBI mentions another connected case it investigated last month — The case of Shirpur Gold Refinery, a company that has been listed on the stock exchange since 1986. And which is controlled by Subhash Chandra’s two sons — Amit and Punit Goenka.

When SEBI started investigating a tip-off about issues at Shirpur in February 2021, they unearthed a level of fraud that was even more egregious than what happened at Zee.

Now this case is a bit complicated. So we’ve simplified and reduced the case to its bare essentials.

First things first. Shirpur borrowed around ₹400 crores from a few banks. It told the bankers that it needed money for its operations. But Shirpur actually didn’t use the money for itself. Instead, it handed over the cash to 3 other entities. One of which was called Altrarex Traders.

Now SEBI figured that Altrarex had connections to the Subhash Chandra family group. But, you could turn a blind eye to this deal for now. Maybe Altrarex wasn’t eligible for a bank borrowing and needed help. So Shirpur, simply decided to help out a ‘family’ entity. It handed over ₹240 crores to Altrarex. All Altrarex needed to do was generate some revenues for itself and use that to pay Shirpur back on time. Shirpur could then pay the banks and no one would be wiser as to what had taken place within the family. All would be fine with the world.

But of course that's not what happened.

Altrarex defaulted on the loan. And if it couldn't pay Shirpur back the money, this essentially meant Shirpur couldn’t return the money to the banks either. Shirpur defaulted too.

Now Altrarex had other creditors that had lent it money. And one of those creditors was a company called Ekmart. When Altrarex defaulted, Ekmart decided to drag it to bankruptcy court. It wanted to recover its ₹50 crores from Altratrex.

At this point, Shirpur should’ve put its hands up. It should’ve said that Altrarex owed it some money too. It should’ve tried to recover that money to pay the banks. But, Shirpur made no such fuss. It stayed away from the proceedings.

Now this wasn’t a wise move because it meant that even if the bankruptcy court found a way to liquidate Altrarex’s assets, Shirpur wouldn’t get any money from the process. Simply because it chose not to ask for it.

Weird.

But wait, it gets weirder.

Ekmart, the company that sued Altrarex? Well, that company was owned by folks in the Subhash Chandra family too. So basically, Shirpur, which was owned by Subhash Chandra’s family didn’t want its money back. But Ekmart, which was also indirectly owned by the family did?

We told you things were getting weird!

So, what on earth is happening here, you ask?

Well, it seems that there was a rather nefarious plan in motion here.

See, once the bankruptcy court declared Altrarex insolvent, liquidated its assets and paid Ekmart, the company can basically shut shop. And the money it borrowed from Shirpur can be written off. It will just vanish into thin air.

Or maybe not. Because we actually do know where it vanished.

You see, Altrarex didn’t keep that ₹240 crores for itself. It actually transferred the money to some intermediary companies and it finally wound up at a company called Jayneer Infrapower.

Now here’s something we didn’t tell you. And we promise this is the last surprise. When we told you that Amit and Punit Goenka owned Shirpur, we forgot to mention that the sons actually owned Shirpur via a company called Jayneer Infrapower!

So basically, Shirpur borrowed money from banks, used a long-winded route to avoid returning it, and sent the money back into the pockets of its promoters — the Subhash Chandra family!

Ingenious!

Anyway, there’s one thing you should know. Subhash Chandra hasn’t been officially named in this Shirpur Gold Refinery case. He’s only been served a notice in the first case involving Zee that we told you about. But his son Punit Goenka has his foot in both pies — Shirpur and Zee. And that unfortunately could pose a problem for another deal that has been in the works for a while.

We’re talking about the mega merger between Sony and Zee that was announced in 2021.

Because one part of the deal was that Subhash Chandra’s son Punit Goenka would continue to lead operations in the merged entity. But if SEBI’s contention is that Punit Goenka should be barred from any management positions, he can’t be part of this merger anymore. Also, if he is being accused of financial fraud, you can bet that Sony’s not going to be happy. They’ll probably be worried about other skeletons lurking in his closet. And they might want to reconsider everything about the merger.

Also, SEBI themselves are sowing the seeds of doubt. They’re asking whether the permissions given by the various authorities for the merger should be reconsidered. It is financial fraud after all.

Anyway, you can bet that Subhash Chandra’s family will appeal SEBI’s order. But all we can say is that irrespective of the outcome of that, it has already been quite a steep fall from the top for the Subhash Chandra family.

Until then…

Don't forget to share this article on WhatsApp, Linkedin, and Twitter.

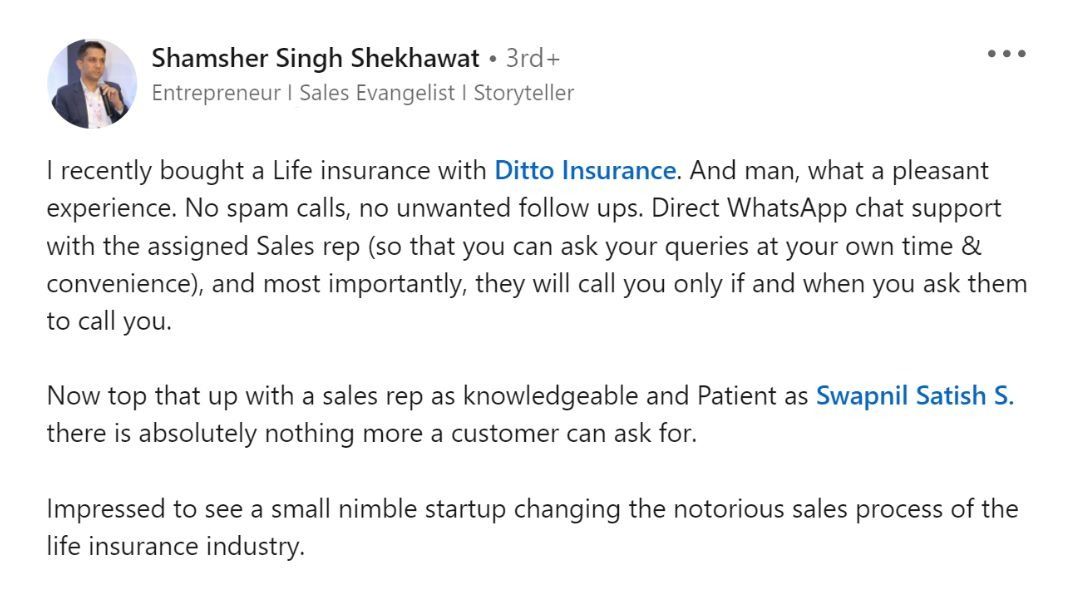

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here