How reliant is the Indian pharma industry on China?

In today’s Finshots, we tell you why the world’s pharmacy still needs China’s chemistry and what India can do to catch up.

But before we begin, if you like stories that make business and finance actually make sense, then hit subscribe by clicking here. If you’re already a subscriber (or reading this on the app), just scroll down – today's story's a good one.

The Story

India loves to call itself the pharmacy of the world. And that’s not without reason. We make and export generic drugs to over 200 countries. But beneath this success story lies an uncomfortable truth. That the pharmacy depends on another supplier for its raw materials. Yup, because India does make the pills, but it doesn’t make enough of the ingredients that make those pills work.

Those ingredients are called APIs, or Active Pharmaceutical Ingredients, which are the core chemicals that give a drug its therapeutic effect. And to make those APIs, you need something called Key Starting Materials (KSMs) which are the high-quality raw inputs used in the earliest stages of production. So think of APIs as the cake and KSMs as the flour and butter that go into baking it.

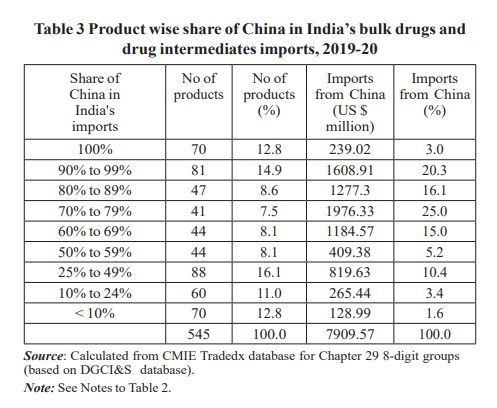

For many critical APIs or KSMs, our import dependence is 60–70% on China, and in some cases, that number is close to100%.

Now, this dependency wasn’t built overnight. It’s the result of decades of economic drift. Back in the 1980s, India produced most of its APIs domestically. But over time, environmental regulations, high energy costs, and the rise of cheaper Chinese imports made many plants simply unviable. So by the early 2000s, it was logically more profitable to focus on formulations or the so called ‘finished drugs’ than making the chemistry behind them. And that’s how Indian manufacturers quietly outsourced that part of the chain to China.

And honestly, for a while, no one noticed until the pandemic hit. When Chinese factories shut down, prices of common APIs like paracetamol and azithromycin spiked overnight. The supply chain froze, production slowed, and the world’s pharmacy discovered it didn’t control its own shelves.

Which brings up the question: what did we do, or are doing, to address this bottleneck?

Well, the government’s response has been to roll out a ₹7,000 crore Production Linked Incentive (PLI) scheme to rebuild domestic API capacity. And as a part of this, it approved building three Bulk Drug Parks in Gujarat, Andhra Pradesh, and Himachal Pradesh – and pushed companies to restart manufacturing of certain compounds or fermentation-based antibiotics. Take, for instance, Aurobindo Pharma. They recently commissioned a ₹2,400 crore plant to produce Penicillin G – an antibiotic used to treat a wide range of bacterial infections.

Similarly, several companies, such as Alkem Labs and Sun Pharma, have started producing clavulanic acid, the primary ingredient in Augmentin, another antibiotic.

In just the last 2 years, since the start of the PLI scheme, we’ve had close to ₹3,000 crore worth of investments from various companies to start producing APIs and KSMs.

But was this enough to cease the dependence on China?

Well, not really. And let me explain why.

China has been a leader in this segment for the last few decades. Which means that it has achieved economies of scale i.e. having the know-how to produce these items economically and at a large scale.

But how did China get to this scale, you ask?

By treating pharmaceuticals as a strategic industry as far back as the 1990s and into the 2000s. It offered cheap land, reliable utilities, low-interest loans, and export-linked tax incentives to drug manufacturers. And gradually, thousands of small and mid-sized API producers sprouted across provinces like Jiangsu, Zhejiang, and Shandong.

However, the real turning point came when China integrated environmental compliance into its supply chains. This was when many Western countries scaled back bulk drug production due to concerns about pollution, and China filled that gap by building dedicated chemical parks with centralized waste treatment. It also built an ecosystem where KSM producers, intermediate processors, and API manufacturers operated in close proximity, so logistics costs can be slashed drastically.

But China’s rise wasn’t just about policy. It was also about resources.

You see, many of the ingredients used in pharmaceutical chemistry rely on certain minerals and specialty chemicals. These elements are used in everything from catalysts in fermentation to the purification of compounds. They are essential for producing high-purity APIs on a large scale. And China holds a near-monopoly on that front. It controls roughly 60–70% of global rare earth mining and has a near-monopoly on its processing. This means that apart from having cheaper access to these materials, Chinese manufacturers also have an almost guaranteed access to processed specialty chemicals and minerals.

This kind of policy makes it very unstable to open a pharmaceutical manufacturing facility outside of China and to maintain continuous access to the raw ingredients needed to produce APIs at a competitive price.

Apart from policy and raw material, China has another advantage: labour. As per a World Bank study, if a typical Western API company has an average wage index of 100, this index is as low as 8 for a Chinese company and 10 for an Indian company. This means that if a Western company pays its workers ₹100 for a certain amount of work, a Chinese company would only pay about ₹8, and an Indian company would pay about ₹10 for the same job.

And lastly, there’s just one more advantage where China really takes the home run. And that is infrastructure. Since industrial clusters in China integrate chemicals, solvents, utilities, and waste treatment… the API plants can buy cheap steam, power, and intermediates next door. All while India’s units face higher input costs and patchy utilities despite progress in the new parks.

So, there you have it:

- Public policy,

- Rare earth minerals,

- Labour, and

- Infrastructure.

In a nutshell, these four factors are why China has built a thriving API manufacturing industry. You could say that they mastered the chemistry, the scale, and the economics that make the drug industry stick. India, meanwhile, mastered the branding and distribution that took it to the world.

We excel at finished medicine, but at the most energy and capital-intensive stages like fermentation and key intermediates, we ceded ground decades ago. And rebuilding that lost chain takes time. It needs reliability and scale, the kind that can’t be faked with pilot runs or short-term subsidies. And it needs trust. Because global buyers, especially in the US and EU, now demand stricter traceability, cleaner production, and consistent quality – all the things that can raise costs just as Chinese suppliers discount to defend their share.

Still, India has a shot worth fighting.

It doesn’t need to replace China entirely. But just reduce its vulnerability by delivering on low-cost utility drugs from the bulk-drug parks we spoke of above. Plus, if big formulations sign multi-year purchase deals, and if we double down on high-import-risk APIs like antibiotics and vitamins, we could build an ecosystem where chemistry becomes as much our strength as formulations once did.

Moreover, we can also prioritise fermentation and high-import-risk molecules under PLI, while encouraging domestic intermediates to cut Chinese feedstock dependence. And lastly, enforce quality and build traceability to win premium buyers.

Done well, these can help de-risk the chokepoints that we face today and anchor a resilient base that lets ‘the world’s pharmacy’ stand on more of its own raw materials. And maybe that’s the real test for India’s chemical and pharma future. What do you think?

Until then…

Sharing is caring. If you found this story useful, please do consider telling your friends about it. All you have to do is send it on WhatsApp, LinkedIn, or X and ask them to subscribe! :)

75% of Indians are NOT covered by Life Insurance!

Don’t be a part of the herd — take the first step and lead the way.

A term life insurance plan offers a crucial safety net for your loved ones, ensuring they’ll be financially supported even in your absence.

Book a FREE call with Ditto to learn more about term life insurance and find the best plan for you and your family.