Hard truths about India’s population

In today’s Finshots, we talk about India’s much-vaunted demographic dividend.

The Story

We’re now the most populous country in the world! We have overtaken China and we have 1.429 billion people. Or at least, that’s what the UN says.

But this milestone gives us something to talk about — the demographic dividend. Because irrespective of whether we’ve overtaken China or not, there is one key thing about India’s population — We have a super young population with a median age of 28.4 years and that means we have a very large population that’s of working age. In fact, by 2030, 69% of the total population is expected to fall into this category. And in absolute terms, it will total 1.04 billion people.

That’s the demographic dividend!

Because with more people in the workforce, we can have increased economic growth and higher savings and investments. And we’ve seen this play out in other countries in the past. For instance, Japan in the 1960s, Korea in the 1980s, and China in the 1990s…all of them capitalised on the young population and supercharged their growth. On the other, countries in Latin America didn’t quite reap the benefits of their young population. Their growth rate remained anaemic.

And this boils down primarily to two things — education and employment. It’s something that India will have to grapple with too.

Let’s start with the education dilemma. How often have we heard people say that while the country churns out engineers, only a few of them have the skillsets that actually make them employable?

Well, according to a study by talent assessment firm Wheebox, 50% of all graduates are unemployable. Sure, this was their analysis after running a test for only around 375,000 students. So maybe we can’t simply extrapolate it entirely. But we’ve all heard the stories. And we know there’s at least some semblance of truth to this.

One reason why this could be happening is that we have a bunch of private colleges in India that do the bare minimum to keep their racket going. Sample this from the Indian Express in 2020.

AICTE Chairman Anil Sahasrabudhe said the root problem is the large number of private and deemed universities which are not under the purview of AICTE. “The qualifying criteria were probably relaxed to increase the gross enrollment ratio, cater to increased demand, but no one followed up to check if the institutes were eventually following rules,” he said. Unlike engineering institutes whose intake is monitored by the apex body, there is no limit on private universities and deemed universities offering BTech courses.

That means we’ll simply end up having a young population armed with these ‘worthless’ degrees. And that’s not going to help our growth in any way.

Also, a report by the Confederation of Indian Industry (CII) revealed something quite shocking. A puny 3% of our workforce consists of formally skilled workers. This number is 24% in China.

Now the thing is, we can’t really improve the quality of our workforce unless we hit our promise of spending more on education across the spectrum. See, one of the targets set by the government is to spend at least 6% of the GDP on education. But for a long time, it has been stuck at just under 3%.

This could mean we’re squandering our demographic dividend.

Maybe that feeds into our unemployment problem too.

The International Labour Organization (ILO) says that the unemployment rate for those with either a bachelor’s degree or higher is a staggering 15% in India. Maybe part of this is due to the unemployability of worthless degrees.

But remember, we expect this to be the segment that forms India’s middle class and drives consumption in the country. We hope they’ll land high-paying jobs and spend money on discretionary purchases and push the consumption economy forward. But if this segment is stuck in a rut, it’s a bit of a bummer. The Pew Survey says that the middle-income Chinese population that lives on $10–50 a day totals nearly 800 million. On the other hand, in India, this accounts for only 121 million people.

The Indian consumption story we hear about often will be left wanting.

There’s even an issue with low-skilled jobs. Numbers indicate that in the past few years, more people have actually gone back to jobs in agriculture. Despite wages stagnating even here. And creating 93 million jobs in the next 25 years in manufacturing to make ourselves a powerhouse isn’t going to be easy,

Oh, and there’s one more thing. There’s actually a very important third piece in all this — women. Or rather, the participation of half our population in the labour force. The unfortunate reality is that in the past decade, women have actually dropped out of the job market. The proportion of working women has fallen from 26% to 19%.

And while women contribute to 40% of China’s GDP, it’s just 17% in India’s case.

But it’s not all gloom and doom of course. Many things have gone in our favour over the past couple of decades. We’re now the fifth-largest economy in the world and we’ve left behind our colonial masters. We took over the presidency of the G20 this year. We’re attracting foreign manufacturers such as Apple to set up shop in India to push manufacturing. We’re focusing on infrastructure building as a means to create more jobs. We’ve become a power in our own right.

But in order to truly capitalize on the opportunity that this demographic dividend is offering us, we may have to do a lot more. Because before you know it, the fertility rate drops, people get older and the ratio skews in the opposite direction. We’ll find ourselves in the same position as Japan from the 1990s or China of today. We need to prepare ourselves for that. And we have the next 30 years to do so.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

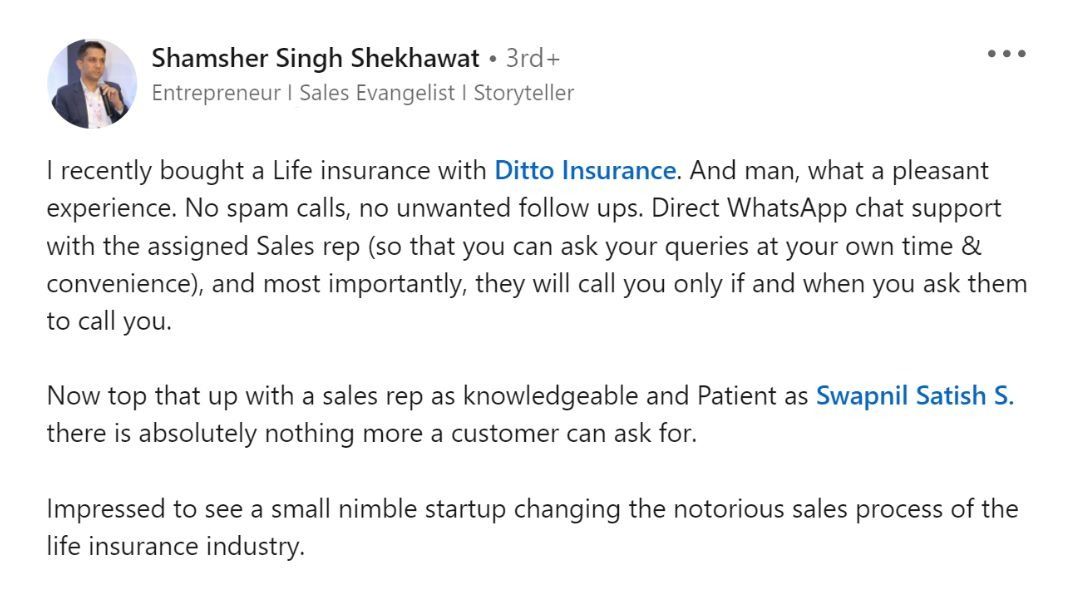

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here