EaseMyTrip’s ups and downs, Gold > Treasuries, Mahindra’s SUV rise and more…

In this week’s wrapup, we look at how Mahindra became India’s 2nd biggest carmaker, how private hospitals are driving revenues from cancer care, why central banks are holding more gold than US Treasuries, why Kraft Heinz wants to to split into two companies a decade after the merger and an explainer on Trump Media’s bid to hoard a cryptocurrency.

And in this week’s Markets Edition, we dive into why EaseMyTrip’s stock price has been nosediving for a while now. Click here to read the full story.

With that out of the way, let’s recap what we wrote this week.

How Mahindra became India’s 2nd biggest carmaker

For decades, India was a hatchback country, and Maruti and Hyundai ruled while SUVs looked like niche toys.

But the tide has turned in the last few years. Compact SUVs became aspirational yet affordable, taxes favoured them, and Mahindra was already positioned as an SUV-first company. And in February, it even leapfrogged Hyundai to grab the No. 2 spot in overall sales.

But this wasn’t just luck. It was a story of matching strategy to market shifts, focusing on what customers want, and executing on scale and efficiency in a deeply competitive industry.

And to know how Mahindra did this, you can check out our Monday newsletter here.

Why cancer care is becoming private hospitals’ biggest driver

Cancer is one of India’s fastest-growing health crises with over 15 lakh new cases last year alone. But public infrastructure is buckling under shortages of equipment, doctors, and funding.

Private hospitals, meanwhile, have spotted the gap and are investing in high-end machines, luring top oncologists, and packaging treatments under one roof.

That’s why oncology is now Max Healthcare’s single biggest specialty, and Fortis has doubled down too.

But what does this say about the future of healthcare in India? And what can be done about it?

That’s what we explore in our Tuesday’s story.

Gold is the new treasury?

For the first time in 30 years, central banks are holding more gold than US Treasuries.

The trigger? Rising inflation that erodes bond returns, the fear of sanctions, and a mountain of US debt that looks shakier by the day. Even India’s RBI has pulled back 100 tonnes from overseas vaults.

All of this changes a few things for the markets as well as investors. And if the very people who mint money are hedging with gold, what should the rest of us take away from that?

We broke it down in our Wednesday’s story here.

Kraft Heinz wants to press ‘undo’

When Warren Buffett and 3G Capital stitched together Kraft and Heinz in 2015, it was supposed to be a food empire blending cheese and ketchup into a $90 billion powerhouse.

Instead, the company bled market share, underinvested in its brands, and missed shifting consumer tastes.

Now, nearly a decade later, Kraft Heinz wants to split back into two and it’s spending $300 million just on the undo.

But will this fix the mess or simply mark the end of a failed experiment?

You can read our Thursday’s explainer here to know more.

Trump Media wants to corner a cryptocurrency called Cronos!

Donald Trump’s media company just announced a $6.4 billion plan to hoard nearly a fifth of all Cronos tokens and run a validator node. The pitch? Treat it like a corporate “digital asset treasury.”

But here’s the thing. Unlike Bitcoin or Ethereum, Cronos’s fortunes are tied tightly to Crypto.com’s ecosystem, raising big questions on risk and reward for Trump’s crypto ambitions.

And the bigger question is: Can you really monopolise a blockchain and still keep it alive?

We unpack it all in Friday’s newsletter.

Finshots Weekly Quiz 🧠

Here’s your chance to win some exclusive Finshots merch. All you have to do is click 👉🏽 this link, answer all the questions correctly by 12 noon on September 12th (Friday) and tune in to our Sunday newsletter aka Sunny Side Up next week to check if you got lucky.

That’s it from us this week. Have a great weekend!

Liked this wrapup?

Don’t forget to share it on WhatsApp, LinkedIn and X.

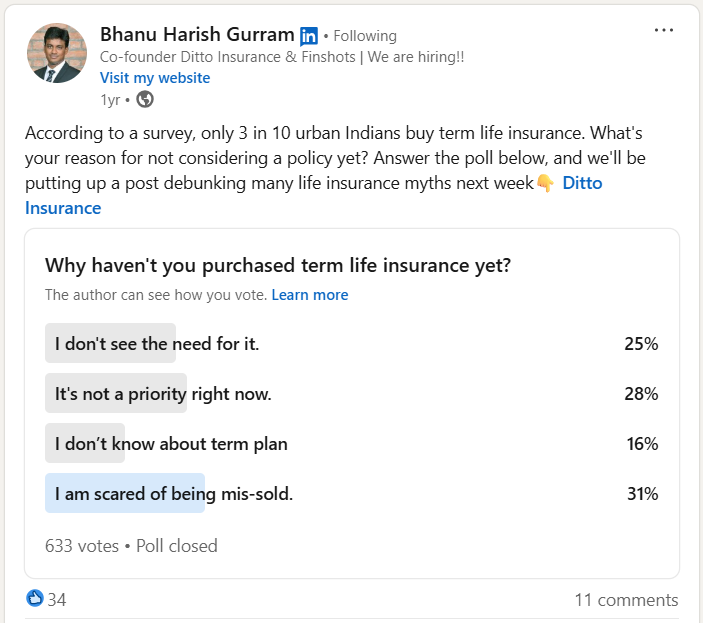

Our Co-founder Asked People Why They Avoid Term Insurance. The Top Reason? Right Here. 👇

31% said their biggest fear is being mis-sold. Many worry that agents may push costly plans or add confusing extras without full transparency.

That's a valid concern. After all, how can you trust something you don’t completely understand?

That’s why Ditto, a product of Finshots, has pioneered India’s #1 Spam-Free insurance platform. Our IRDAI-Certified advisors offer honest advice and help you find the right plan. Book a FREE consultation today.