Could tempered glass be India’s next billion-dollar market?

In today’s Finshots, we tell you about the hidden business of tempered glass and why India might finally have a shot at turning it into a serious industry.

But just a heads up before we dive in. The Urban Company IPO opens today, and we actually wrote a explainer story about it yesterday. But thanks to a tech glitch the email never reached you. No worries though, you can catch the full story here.

Also, here’s a quick, exciting announcement:

Catch Nithin Kamath (Zerodha & Rainmatter), Vaibhav Domkundwar (Better Capital), and Shrehith Karkera (Ditto and Finshots) live this Saturday at the Grand Finale of Pitch Perfect 2025!

Save the date: Saturday, Sept 13 | 2-5 PM | Bengaluru

They'll be talking all things startups, where the fintech industry is headed, and what it takes to build and back some of India's most trusted startups.

We're offering 10 exclusive passes for Finshots readers! Secure your spot today.🎟️

And with that out of the way, let's get onto today’s story, shall we?

The Story

The tale begins around 1660 with “Prince Rupert’s drops”.

These teardrop-shaped glass beads, made by dripping molten glass into cold water, were oddities of their time. The fat end could take hammer blows without shattering. But if you so much as nicked the thin tail, the whole thing exploded into dust. Nobody knew why they behaved that way, but they hinted at something extraordinary — cool glass fast enough, and you could trap invisible stresses inside it that made it absurdly strong and shockingly fragile.

Centuries later, those experiments found a new life. When Apple was designing the first iPhone, Steve Jobs hated the plastic screens. So he went to Corning, the glassmaker that had once experimented with “chemically strengthened glass” and then shelved it. Apple pushed them to revive it. And out came Gorilla Glass we know today. Suddenly, tempered glass wasn’t just a curiosity — it became the invisible window of the digital age.

Now, if you’ve read this far, you’re probably wondering — how is tempered glass actually made today?

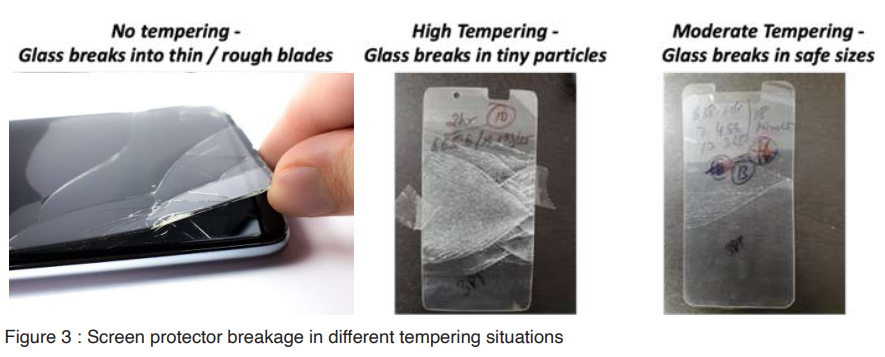

Well, the key step is chemical strengthening. Dipping the glass in molten potassium salt replaces smaller sodium ions with larger potassium ones at the surface. That creates compressive stress and makes the glass resistant to cracks. Add coatings and adhesives, and you get protectors that can last almost like Gorilla Glass itself. But if done poorly, you get soda-lime knockoffs that chip and peel in weeks.

So yeah, the science behind it is elegant. But the business of tempered glass in India is not so much. In fact, it barely exists.

“Wait, then what’s that screen protector on my phone?”, you ask. Well, odds are it was imported or pushed through the grey market.

As the Confederation of All India Traders (CAIT) points out, India, the world’s second-largest smartphone market, will need nearly 40 crore tempered glass protectors annually by 2025, worth about ₹20,000 crores. But over 90% of this demand is met by low-cost imports, leaving the domestic industry unorganised and inconsistent in quality. That’s a massive missed opportunity.

And then there’s the grey market we spoke of. On paper, India imported ₹7,300 crore worth of “glass and glassware” in FY24. But buried in customs data are small shipments under “HS codes” meant for mirrors or other glass. These parcels, sometimes worth just a few thousand rupees, aren’t declared as “screen protectors”. They’re cut in backrooms, dressed up with stickers and sold at kiosks.

A 2019 customs alert even flagged that tempered glass consignments from China and Hong Kong were routinely misclassified and undervalued. It’s a neat way to dodge duties. So the government loses revenue, legitimate brands lose share, and the grey bazaar thrives. The alert added that “similar goods are being imported from various ports and the aforesaid undervaluation is resulting into loss of revenue to the Government exchequer.”

So while the official imports of tempered glass sourced from China rose from ₹2,200 crores in January 2024 to ₹4,000 crores as of January 2025, the real number is likely far higher once you count all the misdeclared shipments.

And at the end of this chain sit the kiosks. They buy these screens at ₹15–₹30 a piece, sell at ₹99–₹149, and pocket good margins. They control the installation, the upsell and the consumer’s trust.

Globally though, the business looks very different. By 2024, screen protectors were a $55 billion market on track to hit $95 billion by 2030. And while tempered glass was the top growing category, it wasn’t dominated by kiosks but by organized, branded players. Just look at Belkin, an American consumer electronics company. It turned a $2 sheet into a $39.95 Apple Store service, where the real value wasn’t just the glass, but bubble-free installation jigs and Apple’s trust.

In short, while India’s tempered glass story is still stuck in kiosks and grey markets, elsewhere it has already been transformed into a premium service business. Which makes you wonder, “Why isn’t India playing the same game?”

Because until this year, there wasn’t even a rulebook.

Those flashy “9H hardness” stickers you see on cover packaging? They come from a crude pencil test. Scratch glass with a 9H pencil (a hard grade of graphite), and if no mark appears, voilà, “9H certified!” In other words, it sounded scientific, but it meant nothing. A kiosk’s word was all you had, and grey channels were faster, cheaper, and more liquid than any formal brand.

But that’s changed, thanks to the Bureau of Indian Standards (BIS).

In March, it published “IS 19348:2025”, or the world’s first dedicated standard for screen protectors. It lays down tests for optical clarity, surface stress, adhesion, edge finishing. It even demands fog-marking (the maker’s ID etched on the glass) and a license you can verify on the BIS CARE app.

And supply is waking up too. Just days ago, India inaugurated its first tempered-glass factory in Noida — a ₹870-crore collaboration between Optiemus and Corning under the RhinoTech brand. Sure it’s not the whole mountain — tens of millions of pieces a year by FY27 against outgrowing demand — but it’s the first time standards and domestic capacity showed up together.

But before we get too excited, there are a few heavy odds.

SKU chaos is brutal. In Q2 2025 alone, India shipped nearly 4 crore phones across dozens of models, each needing unique cutouts. Miss the timing or lose even 10% in yields, and margins vanish. Working capital is another trap. In the US, retailers like Best Buy or Apple pay brands in 60–70 days. In India, kiosks deal only in cash-and-carry. Fast, liquid, and nearly impossible to dislodge.

Enforcement is shaky as well. Unless “IS 19348” is backed by a Quality Control Order (QCO) at ports, uncertified imports will keep slipping through. And kiosks? They earn their fattest cut on cheap sheets. Unless certified glass pays them more and reduces complaints, they have no reason to switch.

And finally, there’s consumer behaviour. Most buyers still see protectors as something to replace every couple of months or years. Convincing them to pay a premium could be an uphill task. Especially since you can’t control the scale as setting up a proper tempering line can cost ₹200–₹300 crore. For smaller players, importing and branding remains cheaper, but again, that market is already crowded.

So what’s the way out?

For starters, the opportunity is real and the market is too big to ignore. Add the export potential, customs duty as well as GST, and it’s a genuine billion-dollar play.

But it’ll take more than one factory or one standard to unlock it. The government must enforce BIS rules at ports. Brands need to step up with warranties, recycling, and consumer education. Kiosks must be incentivized to recommend certified glass. Do that, and the transformation could look a lot like ISI marks for helmets or hallmarks for gold. Once consumers learn to trust a fog-mark, it becomes shorthand for safety.

And the global playbook shows it can work. Consumers abroad already pay 20–30x the base cost when they trust the brand and installation. If India builds that same mix of trust, supply, and scale, the ₹20,000 crore could grow far beyond regional markets.

So yeah, now you know the story of the glass that guards your screens. And the irony is that tempered glass is made to shatter under stress… but maybe that very fragility could be India’s strongest business opportunity yet.

Until then…

If this story helped you understand how the tempered glass and screen protector business works, don’t forget to share it with your friends, family or even strangers on WhatsApp, LinkedIn and X.

🚨 ATTENTION: FINSHOTS FAMILY 🚨

Insurance Masterclass Series: No More GST on Your Premiums

Yes, you read that right - from 22nd September, GST will no longer be applied to insurance premiums.

What does this mean for you?

- A big shift in how insurance is priced and purchased.

- An opportunity to make a more informed decision - if you wait.

That’s why our advice is simple:

🚫 Don’t buy insurance before 22nd September.

✅ Instead, use this time to understand which plan truly fits your family’s needs so you’re ready to act smart when GST is gone.

To guide you, we’ve designed this exclusive 2-day masterclass series:

Registering will give you access to both Masterclasses:

1️⃣ Health Insurance Masterclass

📅 Saturday, 13th September

⏰ Time: 11:00 AM - 12:30 PM

✔️ How to choose health insurance that truly protects your family

✔️ Smart strategies for handling medical costs

✔️ Mistakes to avoid when buying health insurance

✔️ Getting maximum value from your policy

2️⃣ Life Insurance Masterclass

📅 Date: Sunday, 14th September

⏰ Time: 11:00 AM - 12:30 PM

✔️ How to secure your family’s future without overspending

✔️ Term, ULIP, or Endowment - what works best for you?

✔️ Why timing matters when you buy insurance

✔️ The costly traps of mixing insurance with investments

Live Q&A - Get Your Questions Answered by an Expert in both webinars.

Limited slots: only 300 seats for this series! Secure your spot today and prepare to make your move after GST is removed!