Sunny Side Up 🍳: Coin ATMs, denim dreams and dairy distress

Hey folks!

If you’re a regular bus commuter, you’ve probably fought with the conductor for change at least at some point in time. Sure, Bengaluru seems to have an e-ticketing system for a few local routes now. But ‘change illa’ or ‘chutta nahi hai’ (no change) is a common problem in smaller markets or when Uber or Ola auto drivers force you to pay in cash no?

Once, I even angrily shoved 31 ₹1 coins in an auto driver’s palms when he cried about change. I wonder why it didn’t cheer him up or why I was carrying all of that in the first place. But anyway, the RBI has a solution to our unchanging change problems.

In its latest monetary policy decision, RBI Governor Shaktikanta Das announced that the central bank will run a QR code-based coin vending machine pilot in 12 cities. All you’ve got to do is use your phone to withdraw coins while the amount gets debited from your bank account.

And although this sounds like the RBI has heard the common folks’ troubles, that isn’t really why it’s coming up with this system. In reality, the RBI has lots of coins in its kitty and these clunky things need a lot of storage space. Also, while some parts of India have a lot of coins, others face a coin drought.

So, they thought “Why not come up with a clever way to make everyone happy?” But you tell us, on a scale of 1–10, how excited are you about this idea?

Here’s a soundtrack to put you in the mood 🎵

Tuta Pull Waha by Deepak Rathore Project

Hat tip to our reader Shivangi Sharma for this lovely recommendation.

Are we good to go now?

A couple of things caught our eye this week 👀

Levi’s’ Indian dream

If by the end of 2023, you end up seeing more Indians in denim, then here’s the reasoning behind it.

Denim maker Levi Strauss & Co. sees India as a great playing field to expand its denim sales. And supposedly it’s scaling up its investment in Indian stores and innovating its products. The reason?

Global recession fears. With inflation and energy prices shooting up in other major economies, a pair of jeans could be the last thing on the western buyer’s shopping list.

That’s quite opportunistic because the Indian denim market is smoothly growing at 8 to 9% a year and could explode into an enormous ₹92,000 crore market by 2028. And if you’re wondering why, it’s because the Indian denim industry was quick to bounce back from the pandemic and is outperforming global denim growth.

Another factor is that Indians of all ages (young folks mostly) and body types are embracing the ever-comfy and long-lasting denim.

The proof lies in the fact that India currently has over 50 denim fabric mills in the organised sector. That’s about 60% more than a decade ago. We also have the second largest installed annual capacity (of over 1,600 million metres) to produce denim fabric in the world after China.

Besides more fabric mills also means more employment opportunities no?

But there are pain points too. See, denim production can pollute and squeeze out natural resources. For instance, denim dyes release a lot of harmful chemicals into the environment. Also, if you remember our story on fast fashion (The Fashion Destruction) you know that it takes about 3,800 litres of water to make a pair of jeans.

So if Levi’s and other denim makers who may follow suit find ways to expand more sustainably ― like recycling old denim or innovating their production processes then the growth in the denim industry could be a win-win for everyone.

PS: If you’re watching the Border-Gavaskar Trophy (that’s the name for the cricket test series between India and Australia), you’ll notice that the Indian cricket team has a new sponsor logo on their jersey — Killer. You now, the one famous for jeans. They’re playing to the denim gallery for sure.

***

Why are milk prices skyrocketing?

Your cappuccinos and lattes are becoming pricier.

Amul, last week, announced another milk price hike of ₹3 per litre. Not just Amul. Other popular names like Nandini and Mother Dairy have also gone the same route. And although this is Amul’s first rate hike this year, they hiked prices at least 3 times in 2022. It’s a 17% jump in the past year and a half.

Why? You ask.

Well, you could blame production costs.

Take packaging. Packing plastic film has become 7–8% more expensive over the past year. Then there’s feed prices. Cattle rearing demands a lot of fodder. Stuff like rice bran cakes, corn and soy feed. Last October, extreme weather conditions destroyed crops, taking fodder inflation up to a 9-year high!

To tackle this, states that had excess production of paddy straw like Punjab agreed to transport it to places like Kerala. See, Punjab and Haryana prefer burning their straw because it is high in silica content that can harm cattle. But that isn’t good for the environment. So, recent studies have found ways to treat and make it consumable for milk-producing animals.

That could cut down environmentally hazardous stubble burning and help distribute fodder to ailing states. But it still won’t solve the fodder inflation crisis because of the increased costs of treatment and logistics.

The result?

Milk prices are spiralling like there’s no tomorrow.

Looks like we’ve all got to get used to black coffees and green teas. Because this could just be the beginning of the great milk price rise.

Also, to all our vegetarian buddies:

Translation: In a few days, paneer will sell in tiny little pouches at the jewellery stores.

Source: Tenor

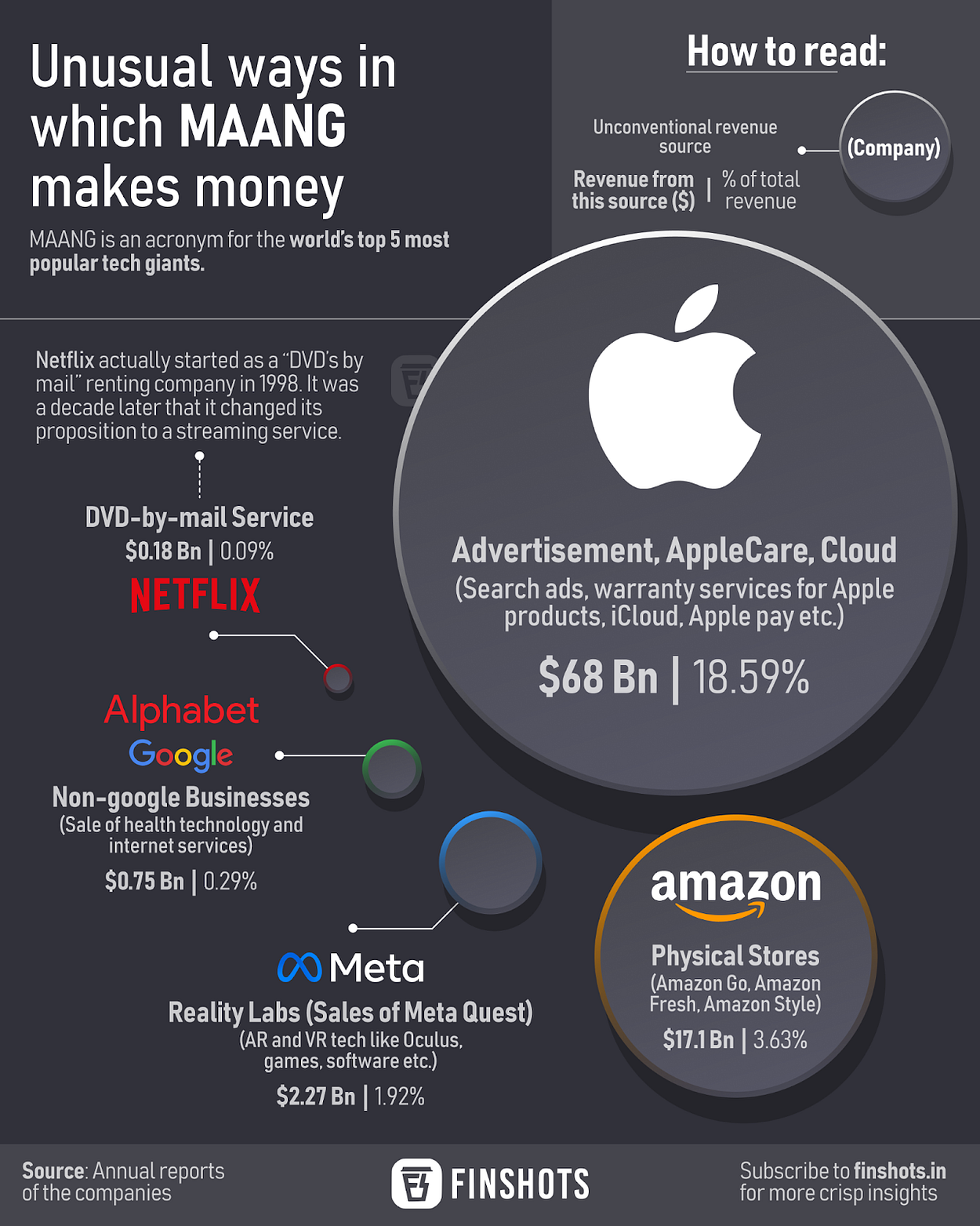

Infographic 📊

Money tips 💰

Junk food finance

Don’t the weekends just take your junk food cravings to a different level?

We get it. And that’s why we thought ― Why not explain finance using junk food as a prop?

Let’s start with risks ― the trans fats of the financial world. Look, anything that’s deep-fried carries trans fats. Think potato chips. You’ve got trans fats in them and boy, they’re addictive. That’s why you can’t stop with just a few. You always want more.

Risks look a lot like this. If your stocks are doing well because the markets are smiling, you could be lured to pour in more money, instead of diversifying in other stuff like liquid funds or buying gold.

And just like how trans fatty foods are irresistible, risks can be too. Because they’re both hidden. You’ll only see them when the tide turns. The trans fats of the financial world could be bad for your financial health.

Next, we have hidden fees in financial products ― the added sugars of the financial world. Now, you know sugar can affect your weight if you don’t know where to draw the line. But you don’t realise how much added sugar or artificial sweeteners you indirectly consume through those “healthy” oatmeal cookies and diet colas.

Hidden fees can be the same. That no-cost EMI you used to buy your new phone? It doesn’t really come without interest you know. So do many other financial products like credit cards and mutual funds.

And that’s why it’s always wise to look out for hidden charges before you buy.

Last on the list, let’s talk about the empty calories of the financial world. Any guess what this could be?

We’re talking about swayed investments, the ones you make because the news recommends them or because companies decorate their future performance. They may not be making any progress in the right direction, but they might tell you otherwise. It’s like indulging on that piece of cake that isn’t adding any nutritional value.

And that’s why you need to do some analysis before you park your money there because you were swayed by what someone said.

And now that we’ve told you how to avoid junk foods, we also think you should know how important it is to realise these things early on to avoid repercussions in the future. A lot like realising how important it is to insure yourself and your family early on in life so that your financial planning doesn’t come a full circle.

And if you need any help figuring out health or life insurance for yourself, just talk to our fabulous advisors at Ditto Insurance (Yup, that’s us)!

1. Go to Ditto’s website — Link here

2. Click on “Chat with us”

3. Enter your query, and RELAX!

Our advisors will take it from there!

And with this guide to junk food finance, we think you’ll be good to go. What say you?

Readers Recommend 🗒️

What the Health | A Netflix Documentary

We received this amazing recommendation from our reader Meraj Aman. Thanks bud!

A follow-up to the 2014 Leonardo DiCaprio-backed documentary Cowspiracy: The Sustainability Secret, this film reviews the health impact of consuming meat, fish, eggs and dairy products, questions the vile practices of leading health and pharmaceutical organisations and also roots for plant-based diets.

A well-synced suggestion for a time when dairy prices are rising, don’t you think?

***

That’s all folks!

Don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: morning@finshots.in).

Until next Sunday…

You can share this edition on WhatsApp, LinkedIn and Twitter