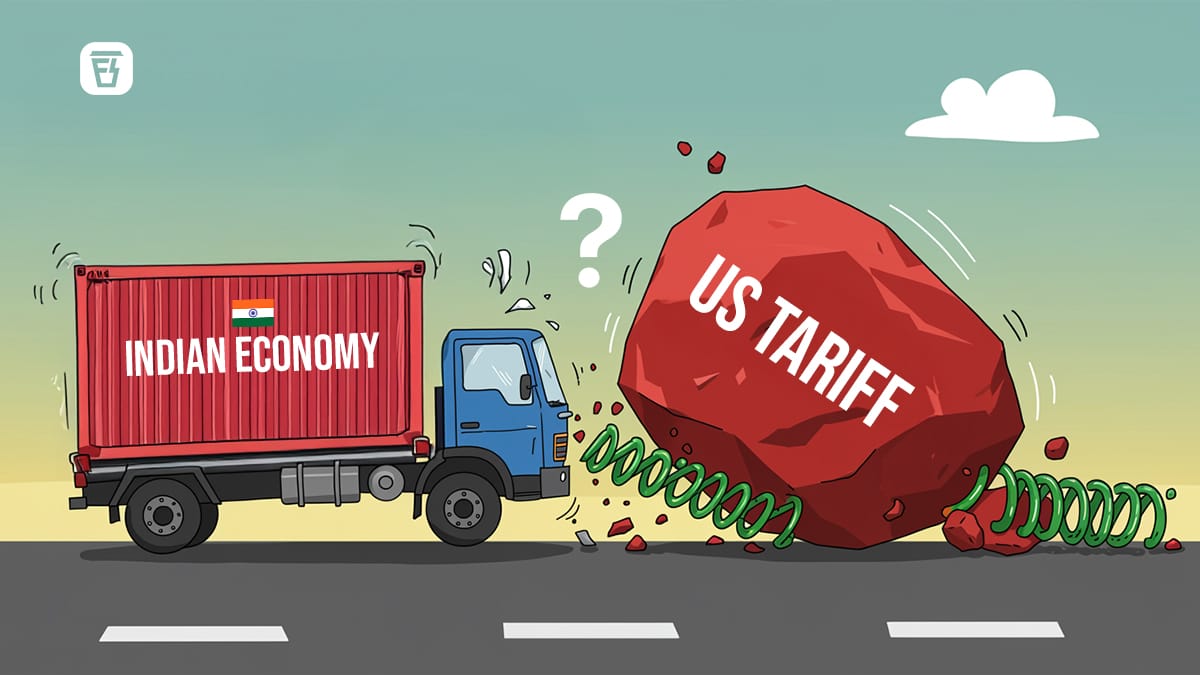

Can GST reforms be a shield against US tariffs?

In today’s Finshots, we tell you everything we know about the latest discussion on GST reforms and how they might help soften the impact of US tariffs on India.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Ever since the new financial year kicked off in April 2025, uncertainty has been hanging over India’s economy. And there are no prizes for guessing why.

US President Donald Trump has been on a mission to “make trade fair again”. And his favourite tool?

Reciprocal tariffs.

In simple terms, if he thinks India is charging American products high import duties, he wants to slap equally high duties on Indian goods entering the US.

And India has found itself squarely in his crosshairs. For months, trade talks have looked like a Bollywood drama with endless twists, turns and cliffhangers. Will tariffs come? Will they be delayed?

But now the suspense is over.

By the 27th of August, nearly everything India exports to the US will face a hefty 50% tariff. The only exceptions for now are pharmaceuticals, electronics and semiconductors, energy products and critical minerals. But even that’s shaky because Trump has made it clear that he wants more iPhones and generic drugs made in America.

And this is no small problem. Because you see, exports are one of India’s important economic engines. Out of the $434 billion worth of goods India exported last year, $87 billion went to the US. That’s about 2.5% of India’s GDP. Now, imagine what would happen with a 50% tariff wall on that flow.

Moody’s Analytics has already run the numbers, and the math doesn’t look pretty. It estimates that tariffs at this scale could knock 0.7% off India’s annual GDP growth. So if the expectation was for the economy to grow at 8.5% before the 2024 elections, it may now limp at around 7.8% till 2028.

That may not be catastrophic, but it’s not the dream run India was hoping for either. Which is why experts like Gaurav Ganguly from Moody’s say that India needs to make its economy more resilient.

And maybe, just maybe, the government was already thinking along those lines. Because this Independence Day, the Prime Minister unveiled a counter-punch in the form of a $50 billion stimulus package.

Think of it as a three-part strategy. First up, semiconductor factories get support to strengthen India’s tech backbone. Next, there’s an employment boost — ₹1 lakh crore has been allocated, with newly employed youth getting a one-time ₹15,000 support (under certain conditions, of course). The scheme hopes to benefit 3 crore young Indians. And finally, the big one — GST (Goods and Services Tax) reforms, maybe the most ambitious of them all.

The idea is simple. If exports are hit, make goods cheaper, help small and medium industries breathe easier. Basically, put more money in people’s pockets and crank up domestic demand.

But here’s the real question. Can GST reforms actually balance the tariff blow?

Well, maybe.

India’s GST, especially on goods is a bit of a maze right now. We’ve got four major slabs: 5%, 12%, 18% and 28%. And it’s actually messy because taxation doesn’t just depend on the product itself, but also on how it’s packaged or branded. Take something as simple as popcorn. If you buy it loose at a roadside stall, you pay 5% GST. If it’s a branded retail packet, that jumps to 12%. And if it’s caramelised or flavoured popcorn at a cinema, you’re looking at 18%. The result is confusion for businesses, tax leakages, endless litigation for tax authorities and crores of rupees locked up in disputes.

The new GST reform plan tries to fix this. Instead of four slabs, there’ll mostly just be two — 5% and 18%. And goods currently under 12% and 28% will be pushed into either of these two buckets. That means less confusion, fewer disputes, more affordable goods and higher consumption. And consumption is crucial because over 60% of India’s GDP comes from people and businesses spending money. In fact, estimates suggest these GST cuts could boost nominal GDP growth by 0.6% — enough to soften the tariff hit.

Sure, the government could lose around ₹1 lakh crore a year or about 0.4% of GDP, if it scraps the 12% and 28% GST slabs. But here’s the thing. The 18% slab already brings in over 65% of all GST collections. So even if the higher slabs are removed, a boost in household consumption could help cover that shortfall.

And not to forget, the reforms also bring in a new 40% GST on so-called “sin goods” — stuff like pan masala, gutkha, tobacco, luxury cars, SUVs and even online gaming. That should also help cover some of the shortfall.

On the face of it, this sounds like a neat solution. Tariffs hurt exports, GST cuts lift consumption and the economy balances itself out.

But here’s the catch. Think of it this way. If your jewellery in a bank locker gets stolen during a robbery, the bank might reimburse you with 100 times the locker rent. That’s compensation, sure. But it’s not the same as getting back your grandmother’s necklace, no?

That’s the difference between GDP cushioning and industry-level pain.

Because while India’s economy as a whole may stay steady, the industries directly hit by tariffs like textiles, gems and jewellery, leather, marine products, chemicals and auto components are still in deep trouble.

Take gems and jewellery, for instance. The US is India’s biggest buyer, and suddenly 30% of that global trade is at risk. Or look at textiles and leather, dominated by small and medium enterprises. They can’t absorb the extra costs because that could wipe out their margins, and if they raise prices, US buyers will simply shift to Vietnam or Bangladesh, where tariffs are much lower.

The result is cancelled orders, factory shutdowns, workers losing jobs, families unable to repay loans they took to expand their small businesses and banks obviously not keen on giving them extra time or writing off their loans.

And let’s be honest. More people buying cheaper TVs, fridges, small cars or scooters because of lower GST at home doesn’t put money back in the hands of small exporters who stitch garments, cut diamonds, craft leather goods or weave carpets. That gap is very real.

So, what’s the workaround, you ask?

Well, one option is to find new buyers in economies like China or the EU, for the stuff we currently ship to the US. Because while it’s true that the US is the world’s biggest economy, it actually makes up just about 10% of global trade in goods. That means there’s a much bigger world out there, and as supply chains shift and trade routes get reshuffled, other countries will find ways to bypass the US. India has to be part of that rerouting too.

Now, the government is trying to cushion the blow a little like suspending import duties on cotton to make life easier for garment makers. But it doesn’t solve the bigger problem of shrinking exports, job losses in small industries and lost access to the US market.

So yeah, unless American policy changes or we successfully carve out new export destinations, the pain isn’t going anywhere.

And until then, trade talks may be our only glimmer of hope.

Don’t forget to share this story on WhatsApp, LinkedIn and X.

Myth Alert: I'm Too Young to Buy Life Insurance!

The other day, one of our founders was chatting with a friend who thought life insurance was something you buy in your 40s. He was shocked that it was still a widely held belief.

Fact: Life Insurance acts as a safety net for your family. The younger you are, the cheaper it is. And the best part? Once you buy it, the premium remains unchanged no matter how old you get.

Unsure where to begin or need help picking the right plan? Book a FREE consultation with Ditto's IRDAI-Certified advisors today.